MBRF to fold BRFs Middle East assets into Saudi Arabia joint venture – Just-food.com

Published on: 2025-10-28

Intelligence Report: MBRF to fold BRFs Middle East assets into Saudi Arabia joint venture – Just-food.com

1. BLUF (Bottom Line Up Front)

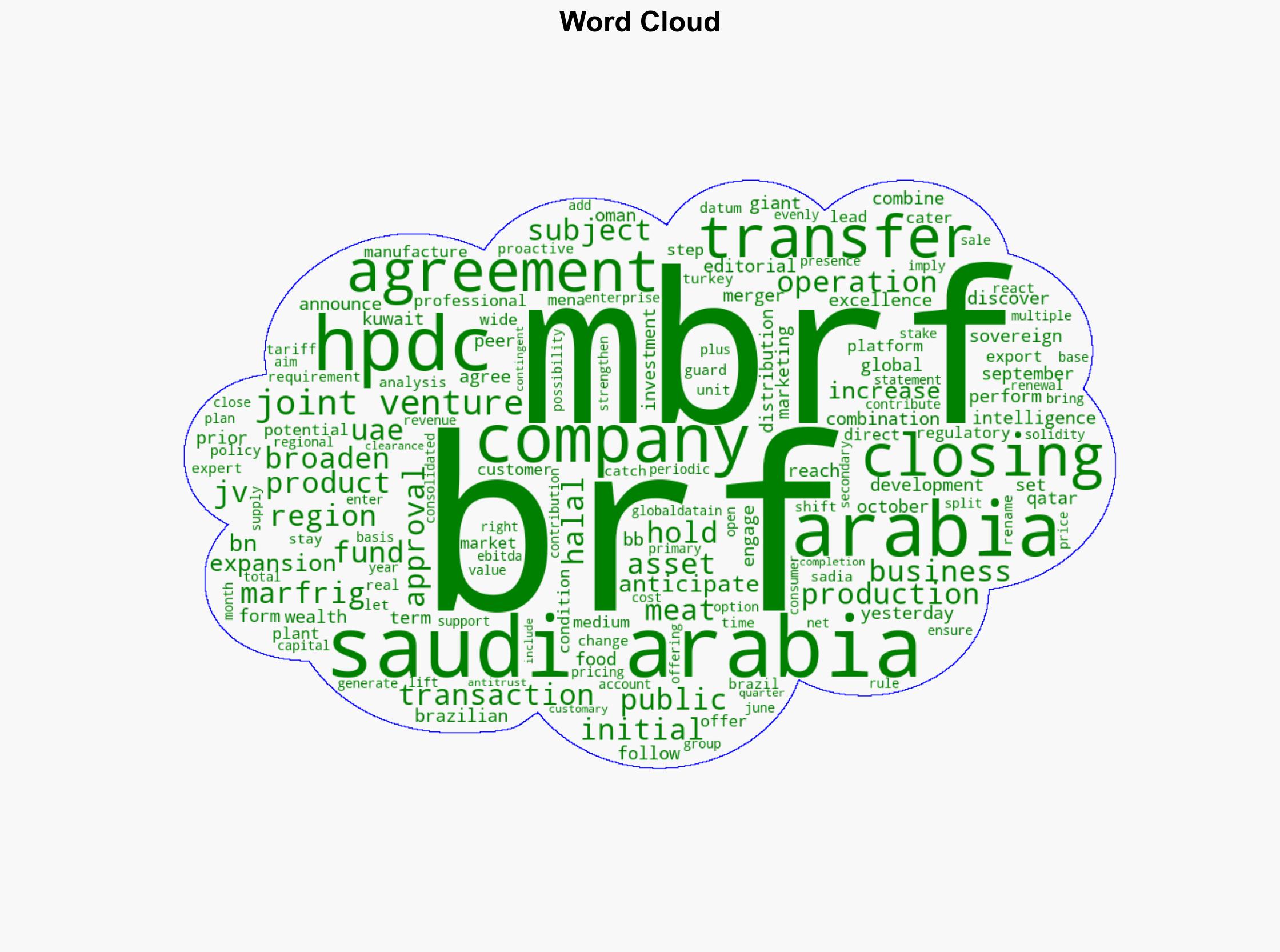

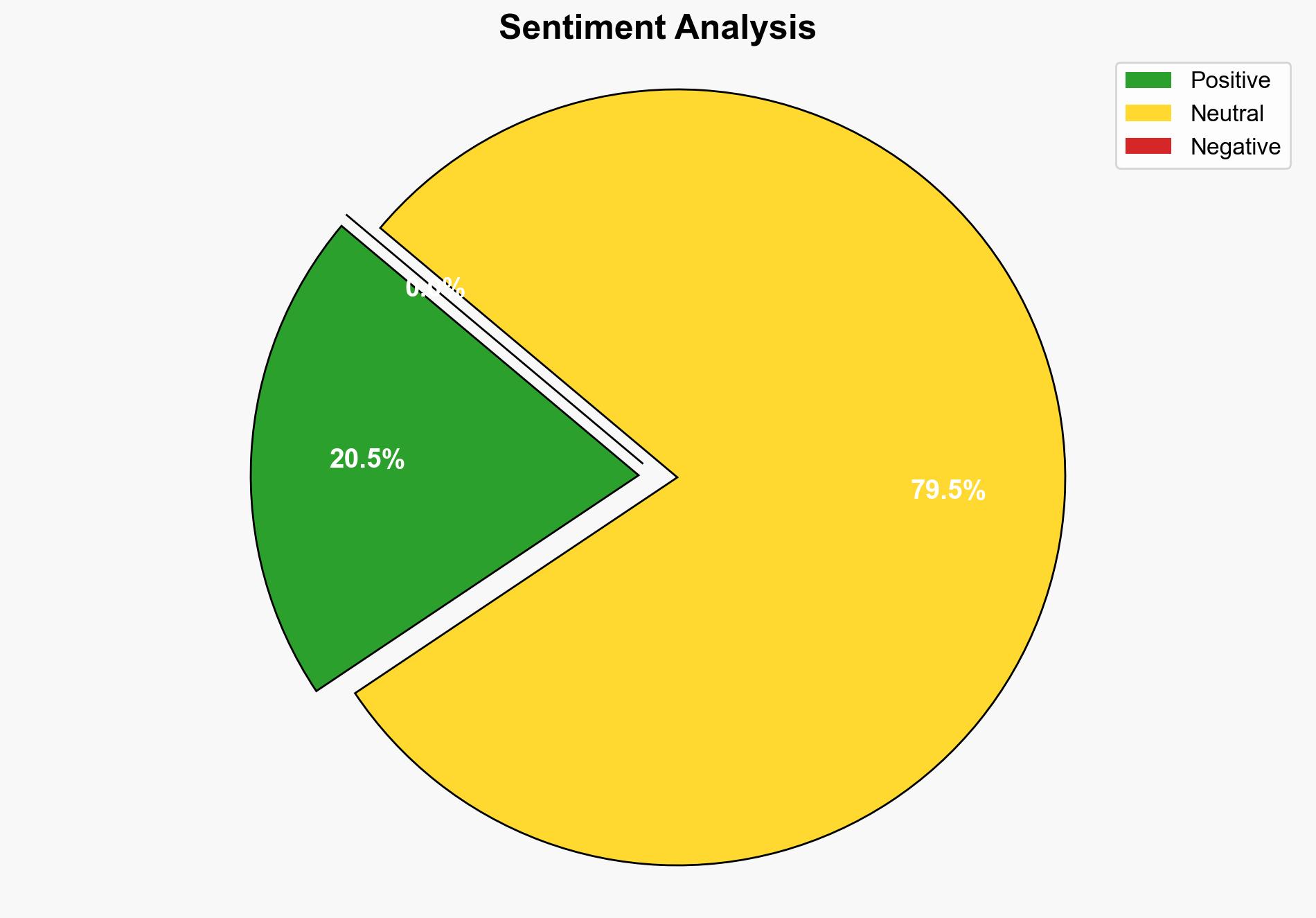

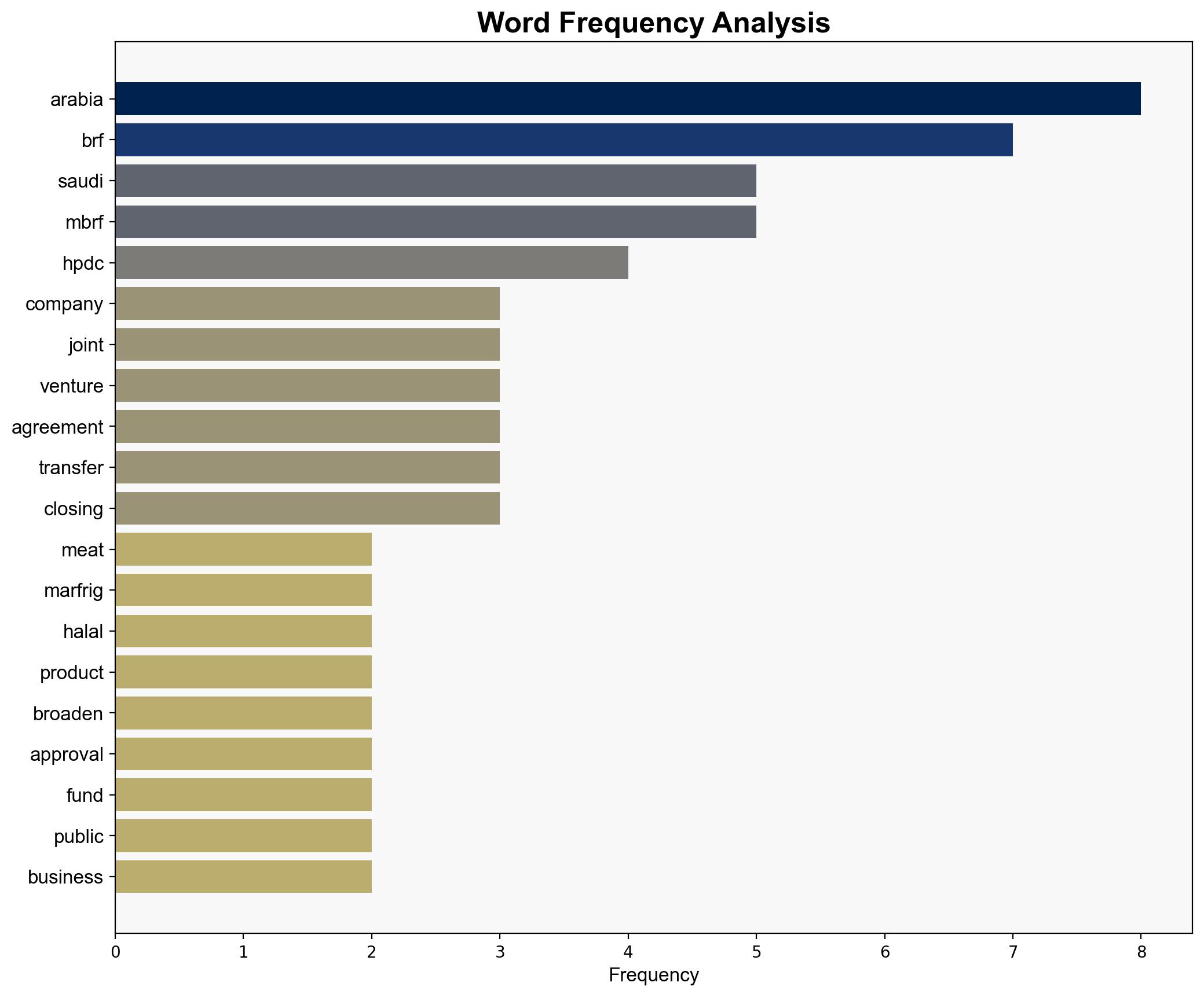

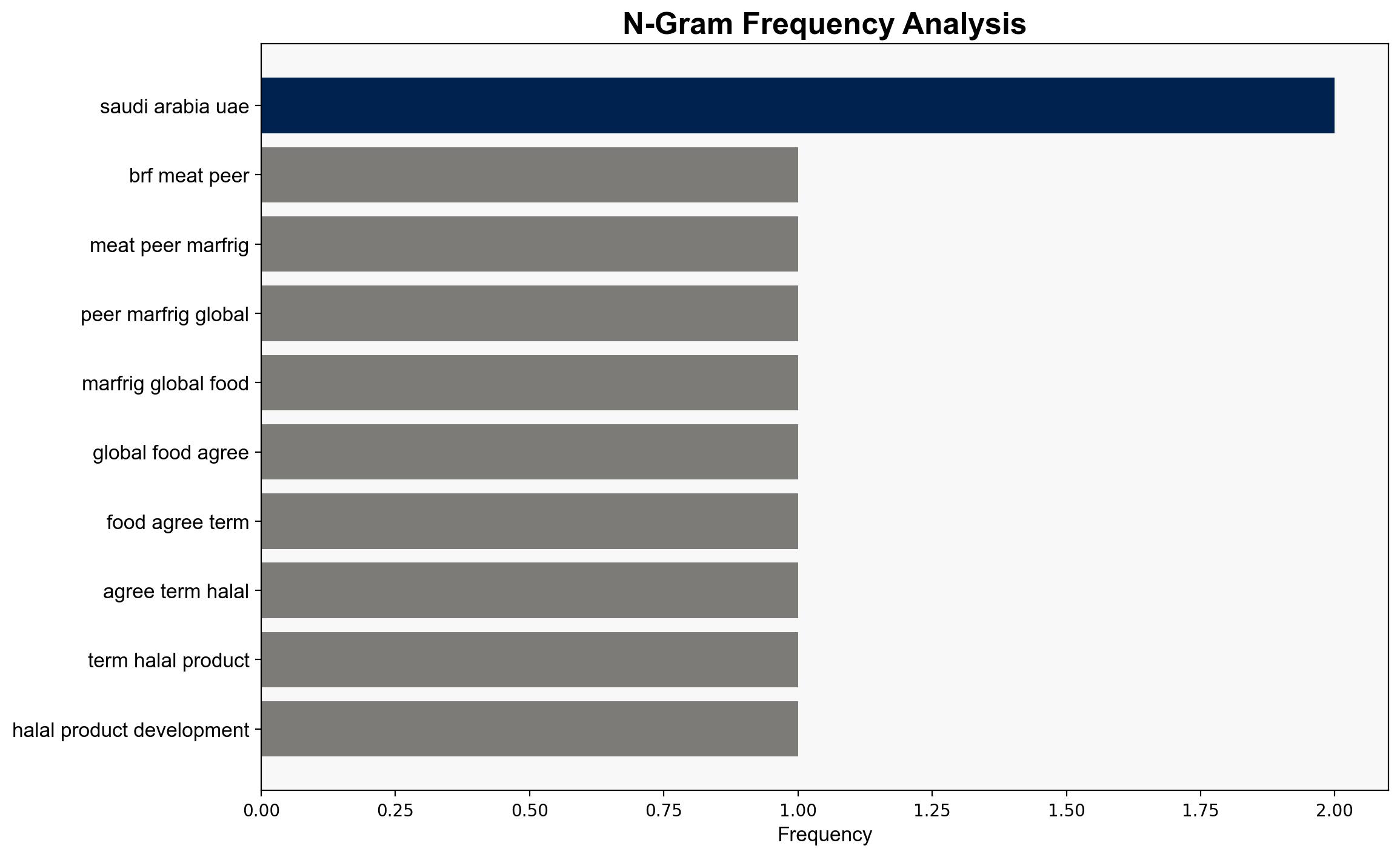

The strategic move by MBRF to integrate BRF’s Middle East assets into a joint venture with Saudi Arabia’s Public Investment Fund (PIF) is likely aimed at strengthening regional market presence and optimizing operational efficiencies. The most supported hypothesis suggests this is a strategic alignment to capitalize on the growing demand for halal products in the MENA region. Confidence level: Moderate. Recommended action: Monitor regulatory approvals and market reactions to anticipate potential shifts in regional market dynamics.

2. Competing Hypotheses

1. **Hypothesis A**: The joint venture is primarily a strategic move to enhance BRF’s market share in the MENA region by leveraging Saudi Arabia’s economic influence and the PIF’s resources.

2. **Hypothesis B**: The joint venture is a defensive maneuver to mitigate risks associated with geopolitical instability and regulatory changes in the Middle East, ensuring business continuity and asset protection.

Using ACH 2.0, Hypothesis A is better supported due to the explicit mention of expansion goals and the strategic importance of the halal market. Hypothesis B lacks direct evidence but remains plausible given the region’s volatility.

3. Key Assumptions and Red Flags

– **Assumptions**: The success of the joint venture assumes stable geopolitical conditions and regulatory environments in the MENA region.

– **Red Flags**: Potential over-reliance on Saudi Arabia’s economic stability and political climate. Lack of detailed financial terms and operational plans could indicate underlying uncertainties.

– **Blind Spots**: Limited information on competitive responses from other regional players and potential impacts of international trade policies.

4. Implications and Strategic Risks

– **Economic**: Potential for increased market share and revenue growth in the halal sector. However, economic dependencies on Saudi policies could pose risks.

– **Geopolitical**: The joint venture may be influenced by shifting alliances and regional tensions, impacting operational stability.

– **Regulatory**: Compliance with local and international trade regulations is crucial; any misalignment could lead to operational disruptions.

5. Recommendations and Outlook

- Conduct a thorough risk assessment of geopolitical and regulatory environments in the MENA region.

- Develop contingency plans for potential shifts in Saudi economic policies or regional instability.

- Scenario Projections:

- Best Case: Successful integration and market expansion, leading to increased profitability and market dominance.

- Worst Case: Regulatory hurdles and geopolitical tensions disrupt operations, leading to financial losses.

- Most Likely: Gradual market penetration with moderate revenue growth, contingent on stable regional conditions.

6. Key Individuals and Entities

– MBRF

– BRF

– Public Investment Fund (PIF)

– Halal Product Development Company (HPDC)

– Marfrig Global Foods

7. Thematic Tags

national security threats, regional focus, economic strategy, geopolitical risk, market expansion