US stocks drift near their record heights as PayPal rallies and Royal Caribbean falls – Boston Herald

Published on: 2025-10-28

Intelligence Report: US stocks drift near their record heights as PayPal rallies and Royal Caribbean falls – Boston Herald

1. BLUF (Bottom Line Up Front)

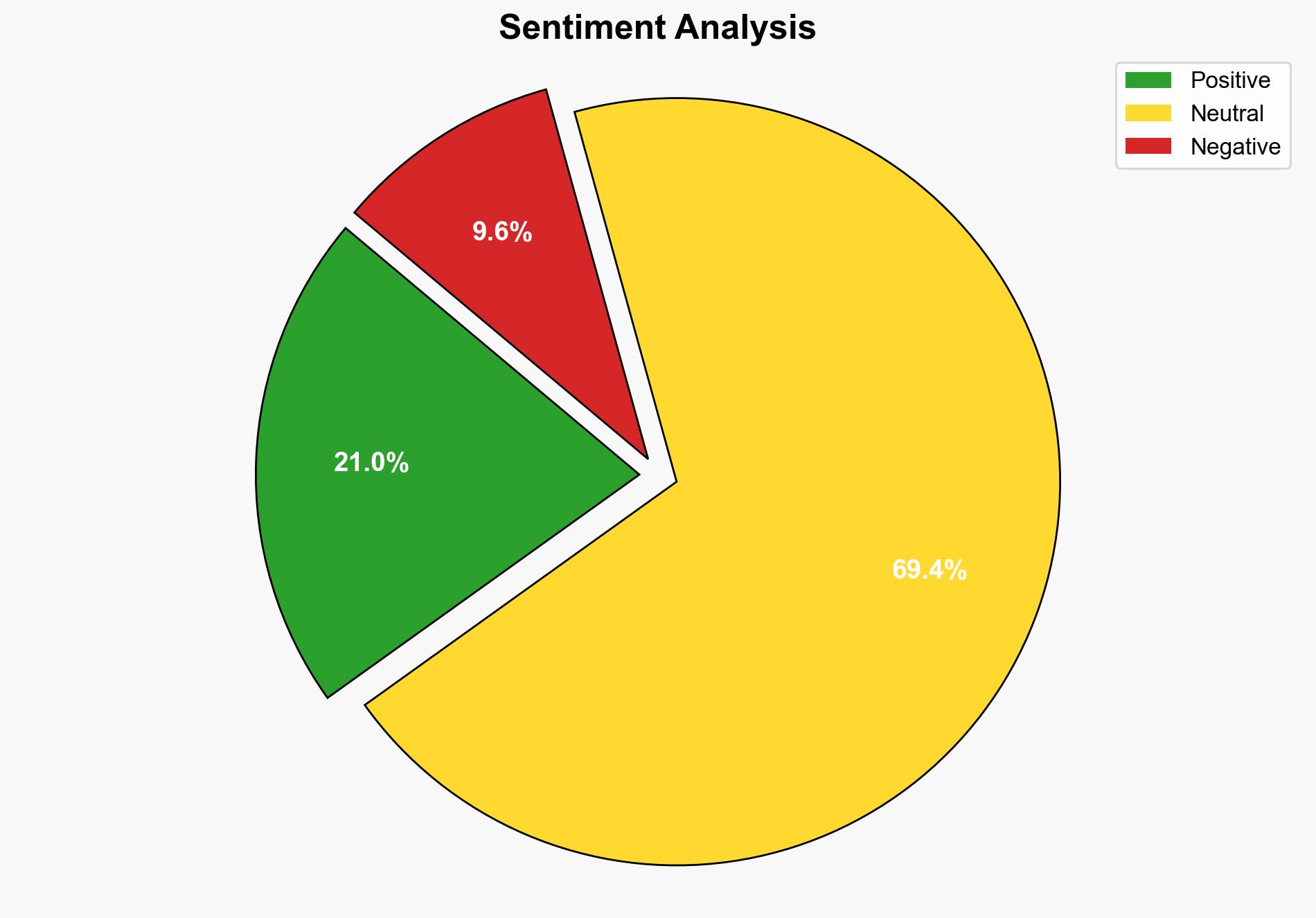

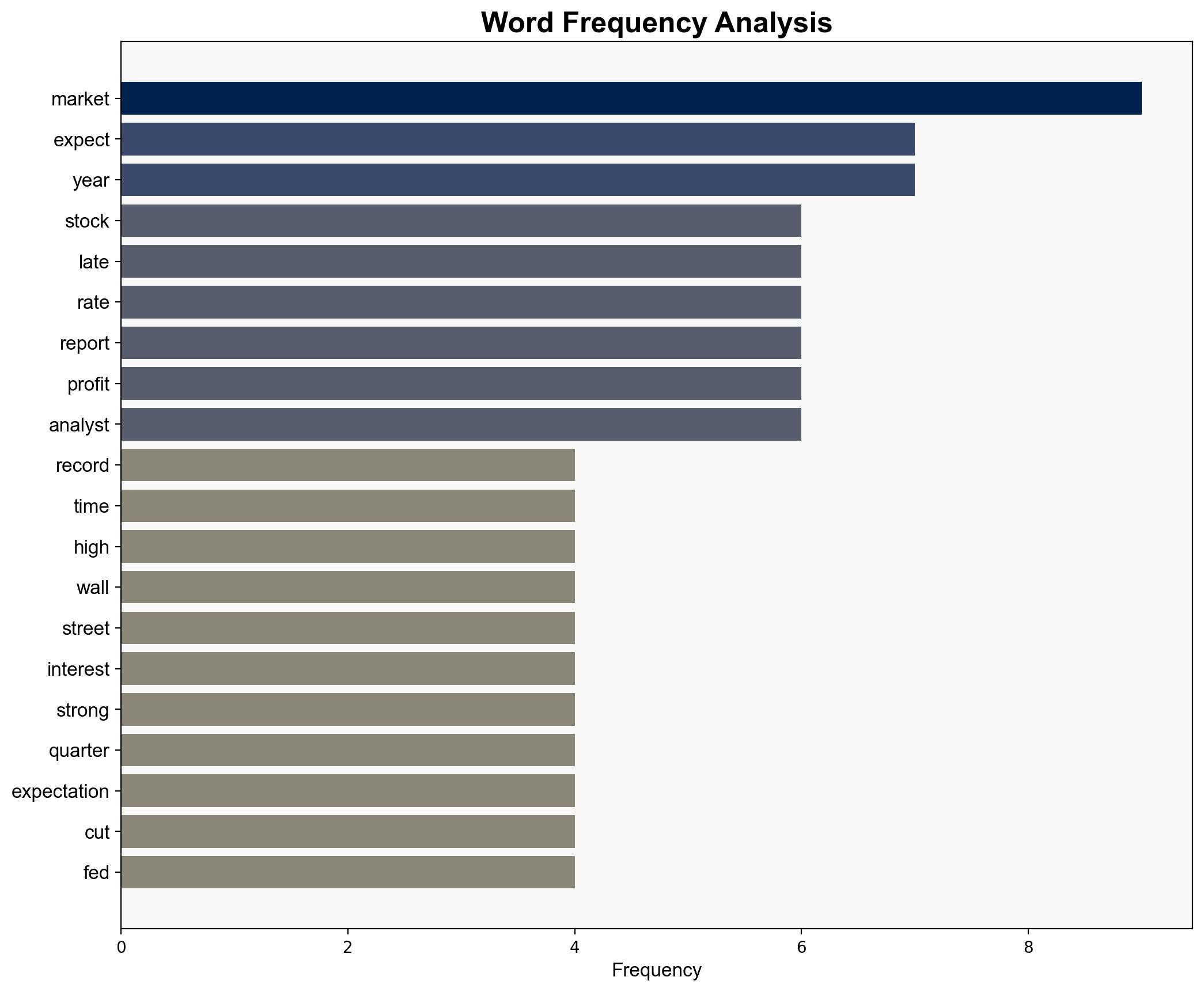

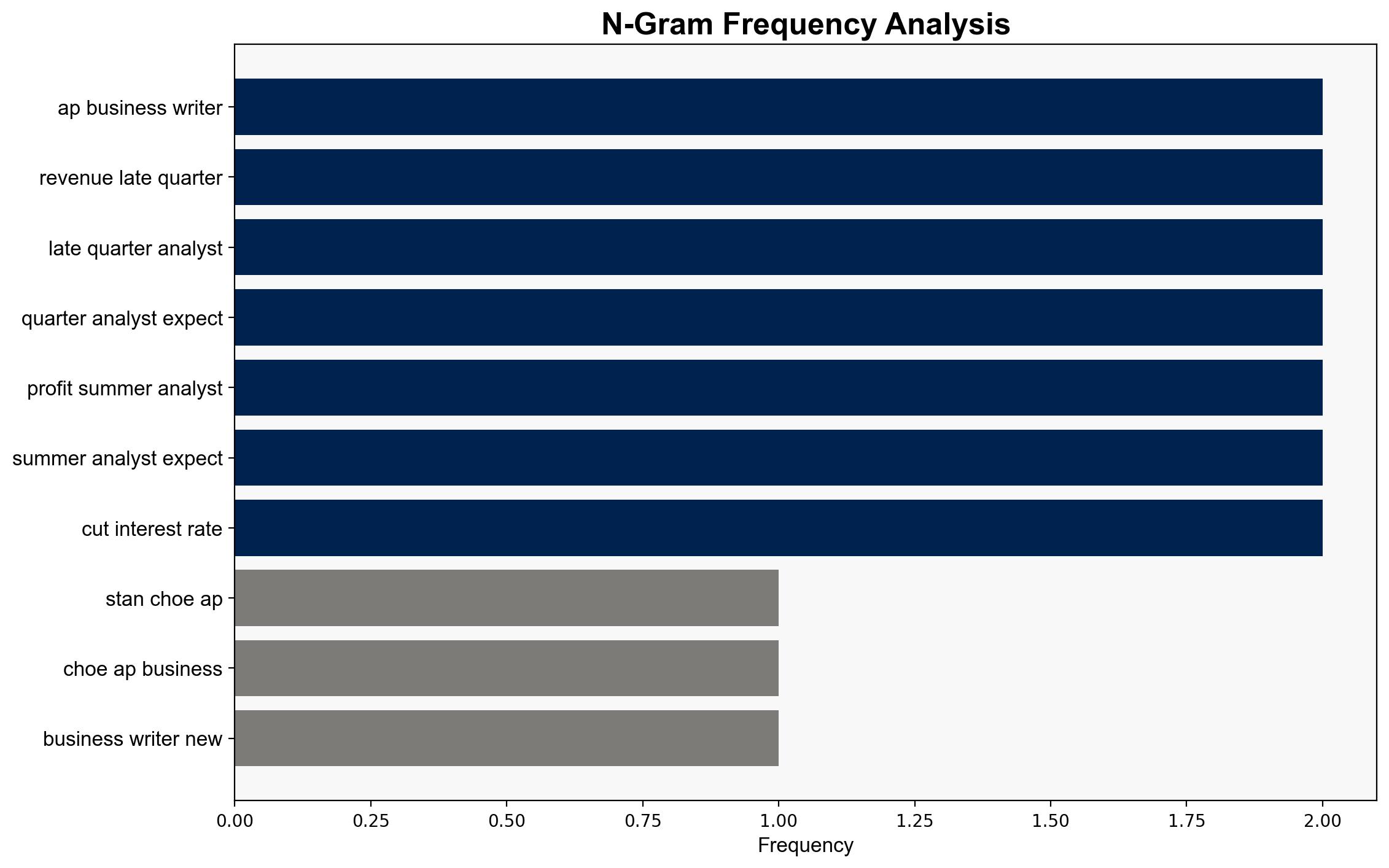

The current stock market dynamics reflect a mixed sentiment driven by corporate earnings reports and anticipation of Federal Reserve actions. The most supported hypothesis is that market fluctuations are primarily influenced by corporate earnings and Federal Reserve interest rate decisions. Confidence level: Moderate. Recommended action: Monitor Federal Reserve announcements and corporate earnings closely to anticipate market movements.

2. Competing Hypotheses

– **Hypothesis A**: The stock market’s current state is primarily influenced by corporate earnings reports, with significant movements tied to companies like PayPal and Royal Caribbean.

– **Hypothesis B**: The anticipation of Federal Reserve interest rate decisions is the primary driver of current market behavior, overshadowing individual corporate performance.

Using ACH 2.0, Hypothesis A is better supported due to the immediate impact of earnings reports on stock prices, as evidenced by PayPal’s rally and Royal Caribbean’s decline. Hypothesis B is plausible but less supported as the Fed’s decision is still pending and its impact speculative.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that corporate earnings reports are accurately reflecting company performance and that the Federal Reserve’s actions will align with market expectations.

– **Red Flags**: Potential overreliance on anticipated Federal Reserve actions could lead to market volatility if expectations are not met. Additionally, geopolitical factors, such as US-China relations, could disrupt market stability.

4. Implications and Strategic Risks

The market’s sensitivity to earnings reports and Federal Reserve decisions suggests a volatile environment. A misalignment between Fed actions and market expectations could lead to significant market corrections. Additionally, geopolitical tensions, particularly between the US and China, pose a risk to economic stability and investor confidence.

5. Recommendations and Outlook

- Monitor Federal Reserve announcements closely and prepare for potential market volatility following their decisions.

- Encourage diversification of investment portfolios to mitigate risks associated with individual corporate performance.

- Scenario-based projections:

- Best: Fed cuts rates, aligning with market expectations, leading to a rally.

- Worst: Fed maintains rates, causing a market downturn due to unmet expectations.

- Most Likely: Fed cuts rates modestly, resulting in a mixed market response.

6. Key Individuals and Entities

– Donald Trump

– Xi Jinping

– Jerome Powell

– PayPal

– Royal Caribbean

– Federal Reserve

7. Thematic Tags

economic stability, market volatility, Federal Reserve, corporate earnings, US-China relations