The market is complacent about new Russia oil sanctions These ones are serious – Livemint

Published on: 2025-10-29

Intelligence Report: The market is complacent about new Russia oil sanctions These ones are serious – Livemint

1. BLUF (Bottom Line Up Front)

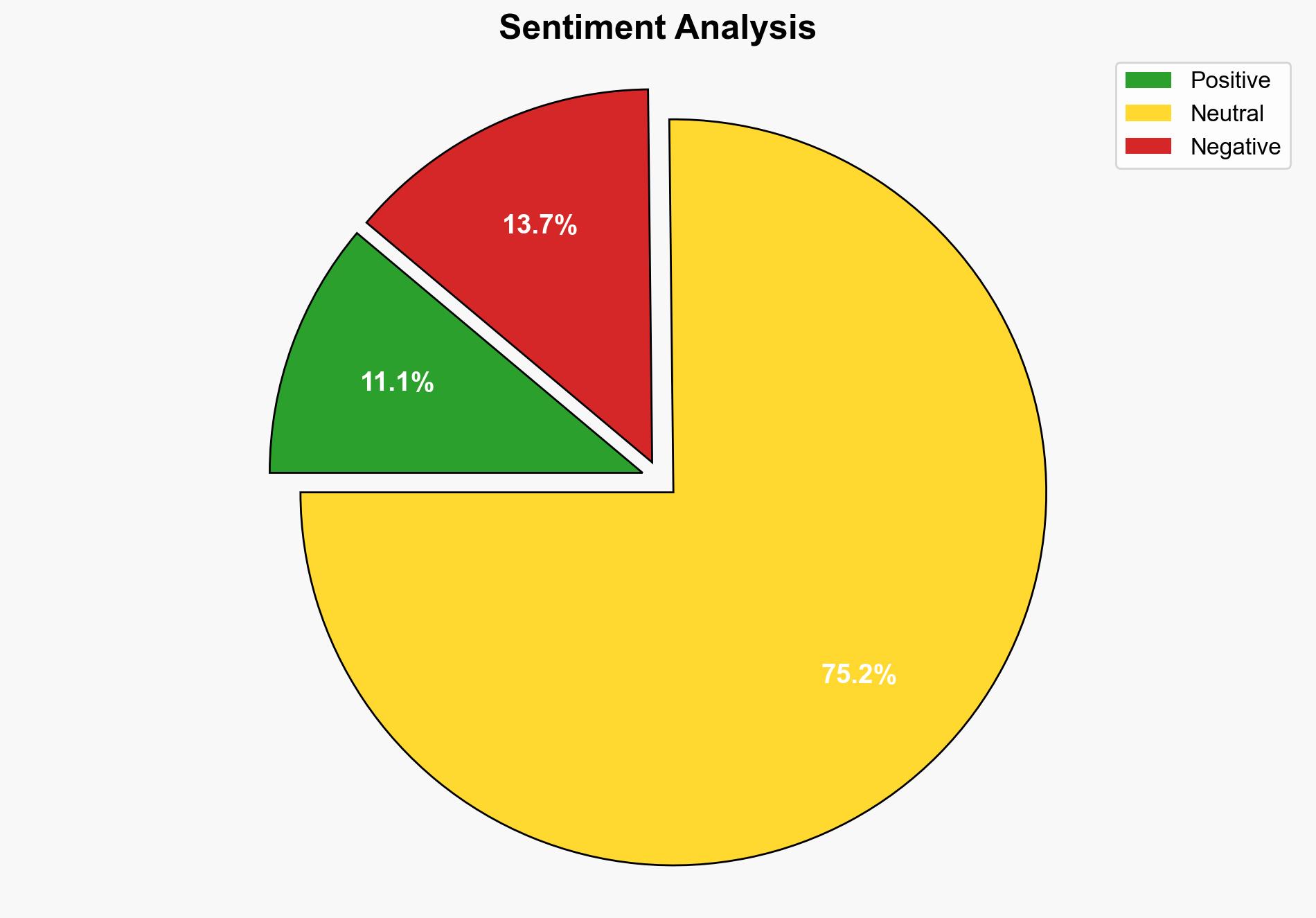

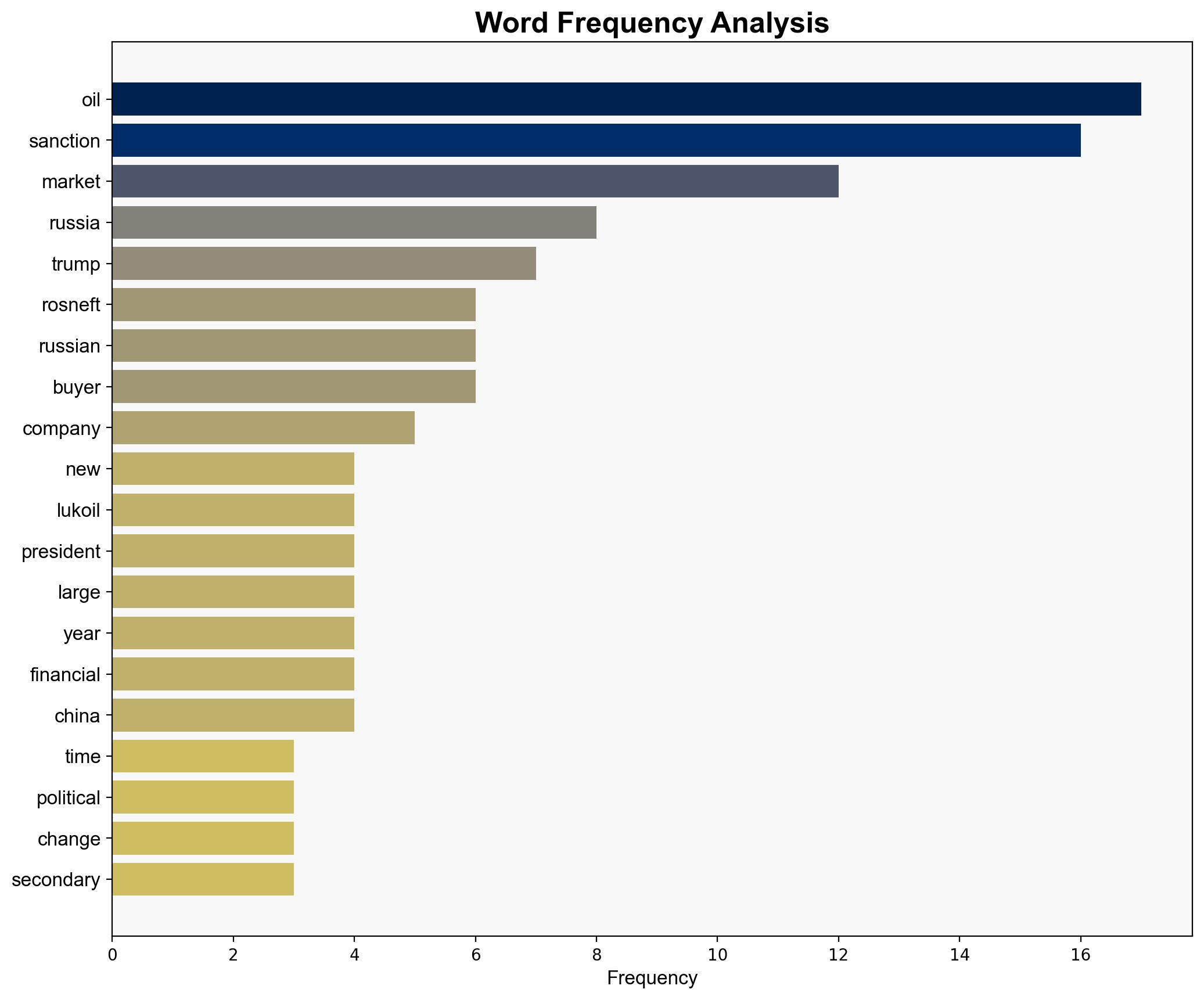

The market’s current complacency regarding new Russian oil sanctions may be misplaced. The most supported hypothesis is that these sanctions will have a significant impact on Russian oil exports, particularly affecting companies like Rosneft and Lukoil, due to their extensive international operations. Confidence level: Moderate. Recommended action: Monitor compliance and enforcement mechanisms closely, particularly in key markets like India and China, to assess the real impact of sanctions.

2. Competing Hypotheses

1. **Hypothesis A**: The new sanctions on Russian oil companies will be effective in significantly reducing Russian oil exports, as they target major players like Rosneft and Lukoil and threaten secondary sanctions on their business partners.

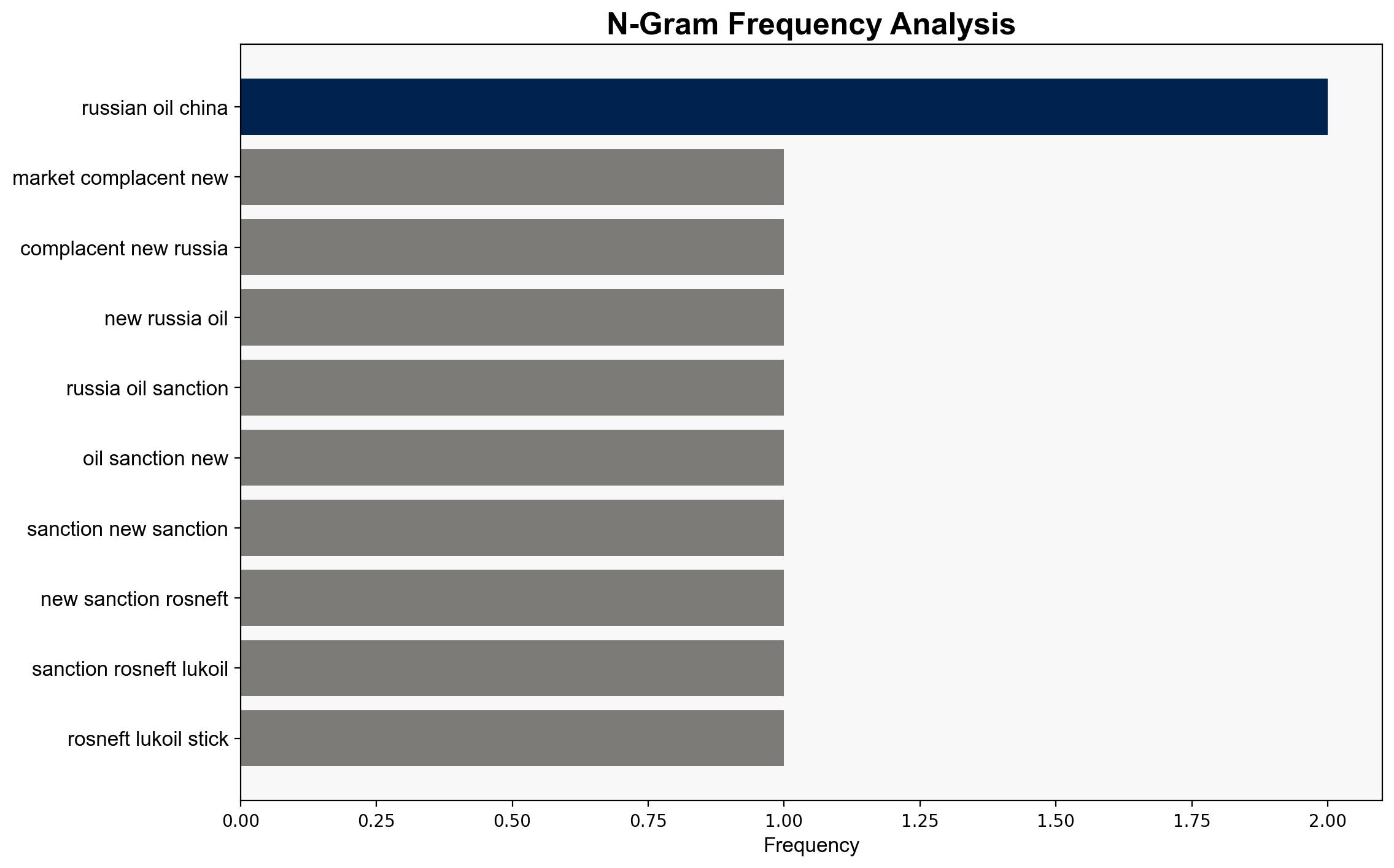

2. **Hypothesis B**: The sanctions will have limited impact due to market skepticism, historical ineffectiveness of similar measures, and the ability of Russian oil companies to find alternative buyers, particularly in China and India.

Using ACH 2.0, Hypothesis A is better supported due to the specific targeting of financial assets and the threat of secondary sanctions, which could deter international partners from engaging with sanctioned entities.

3. Key Assumptions and Red Flags

– **Assumptions**:

– The U.S. Treasury will enforce secondary sanctions effectively.

– Major buyers like India and China will comply with sanctions.

– **Red Flags**:

– Historical ineffectiveness of similar sanctions.

– Potential for China and India to circumvent sanctions through alternative financial systems.

– Lack of immediate market reaction could indicate underestimation of sanctions’ impact.

4. Implications and Strategic Risks

– **Economic**: Disruption in Russian oil exports could lead to increased global oil prices, affecting economies dependent on oil imports.

– **Geopolitical**: Strained relations between sanctioning countries and Russia could escalate, potentially leading to retaliatory measures.

– **Cyber**: Increased risk of cyber retaliation from Russia against sanctioning countries.

– **Psychological**: Market confidence could be shaken if sanctions prove more effective than anticipated, leading to volatility.

5. Recommendations and Outlook

- Enhance monitoring of compliance in key markets, particularly India and China, to assess the real impact of sanctions.

- Prepare contingency plans for potential retaliatory actions by Russia, including cyber threats.

- Scenario Projections:

- Best Case: Sanctions lead to significant reduction in Russian oil exports, strengthening global sanction regimes.

- Worst Case: Sanctions are circumvented, leading to minimal impact and emboldening Russia.

- Most Likely: Partial compliance with sanctions, leading to moderate disruption in Russian oil exports.

6. Key Individuals and Entities

– Rosneft

– Lukoil

– Donald Trump

– Vladimir Putin

– Indian refining giant Reliance Industries

– Chinese national oil companies

7. Thematic Tags

national security threats, economic sanctions, geopolitical strategy, energy markets