Sponsor’s message Webinar Financial Crime Outlook 2026 What are the Key Trends across KYC AML and Fraud Applications – Finextra

Published on: 2025-10-30

Intelligence Report: Sponsor’s message Webinar Financial Crime Outlook 2026 What are the Key Trends across KYC AML and Fraud Applications – Finextra

1. BLUF (Bottom Line Up Front)

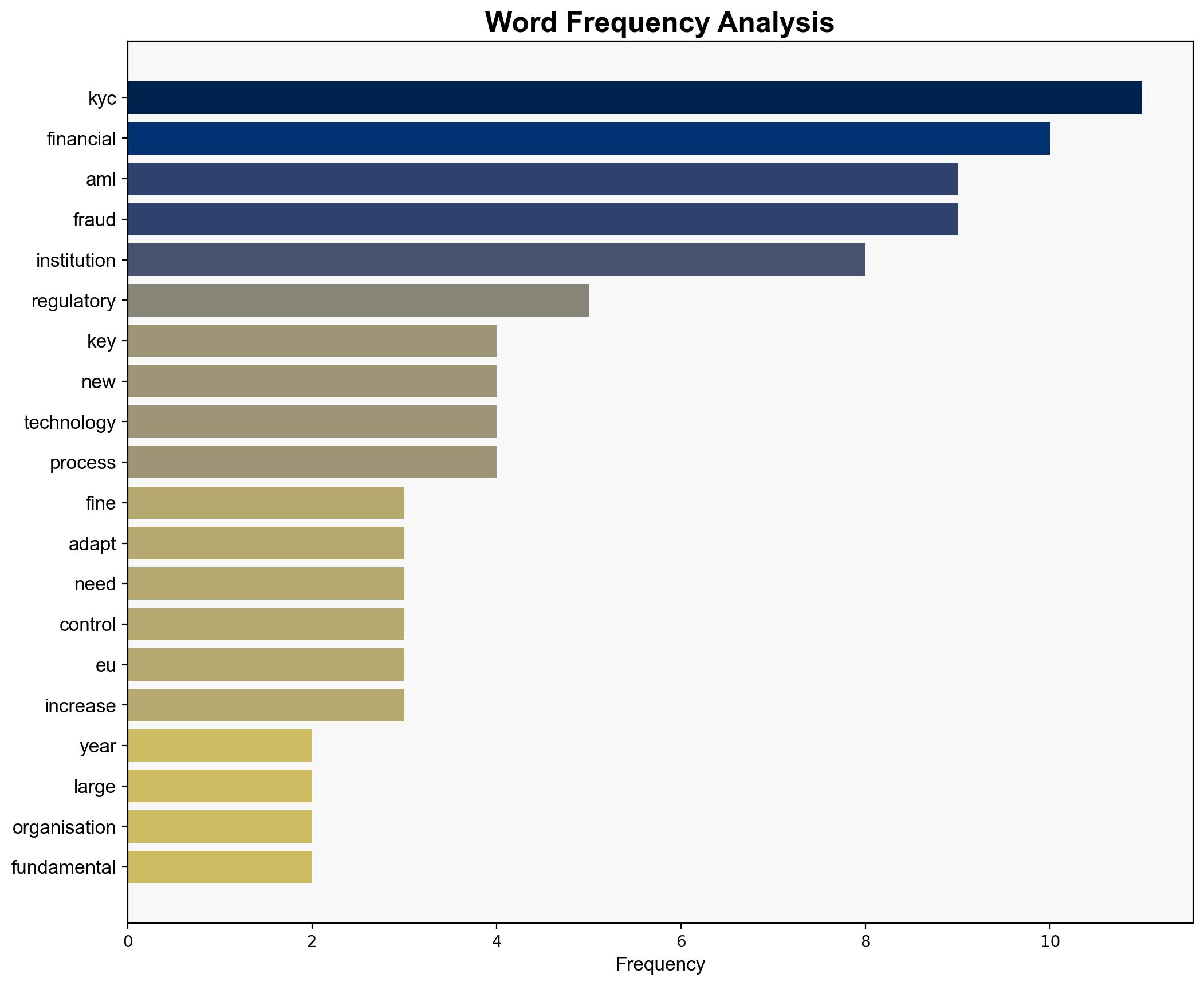

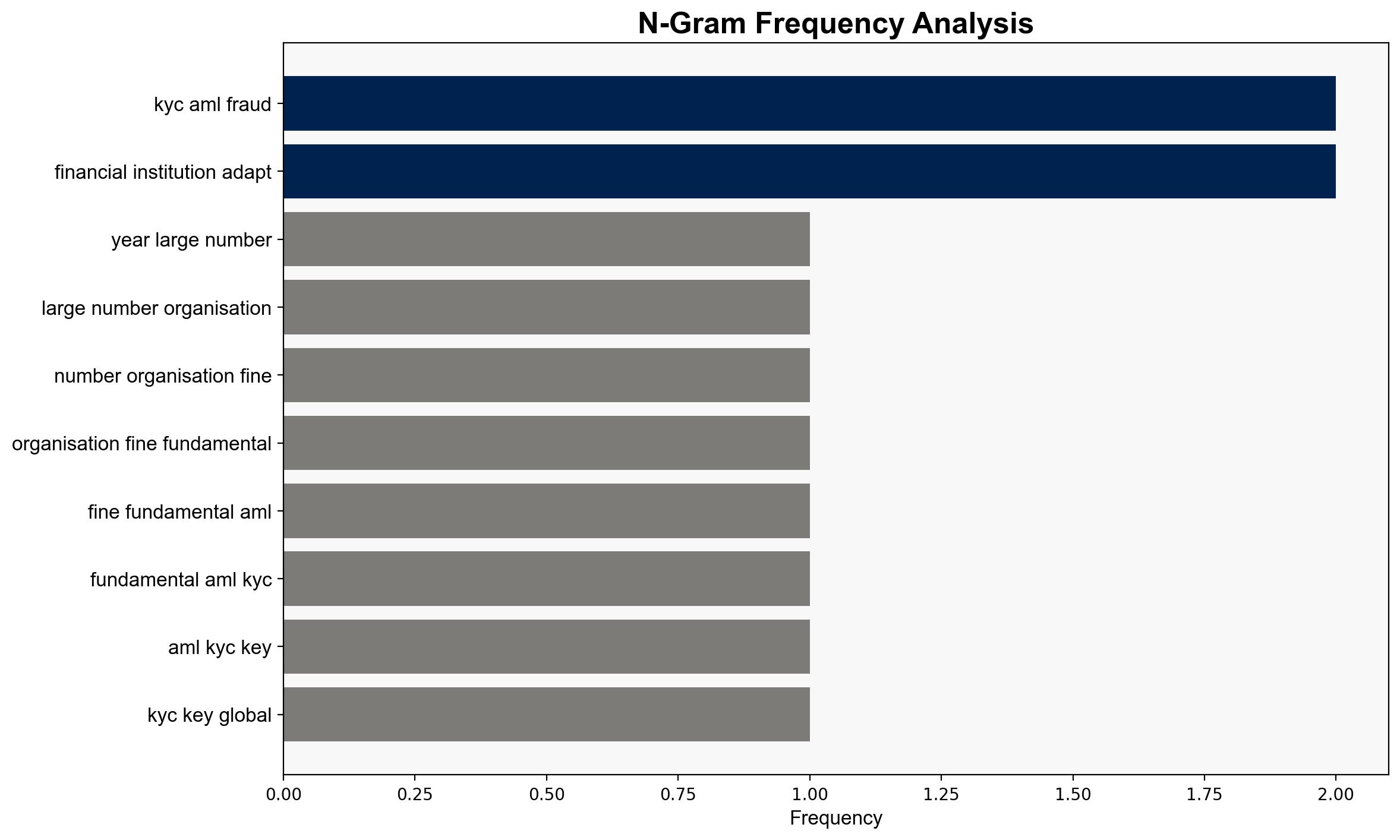

The most supported hypothesis is that financial institutions will increasingly rely on advanced AI tools and data-sharing systems to enhance KYC and AML processes in response to evolving regulatory demands and sophisticated fraud tactics. Confidence level: Moderate. Recommended action: Financial institutions should prioritize investment in AI and data integration technologies to strengthen compliance and fraud prevention capabilities.

2. Competing Hypotheses

Hypothesis 1: Financial institutions will successfully adapt to new regulatory requirements and sophisticated fraud tactics by leveraging AI tools and data-sharing systems, leading to enhanced KYC and AML processes.

Hypothesis 2: Despite the availability of advanced technologies, financial institutions will struggle to keep pace with regulatory changes and sophisticated fraud tactics due to cost pressures and integration challenges, resulting in continued vulnerabilities.

3. Key Assumptions and Red Flags

Assumptions:

– AI and data-sharing technologies can be effectively integrated into existing KYC and AML systems.

– Regulatory bodies will provide clear guidelines that facilitate compliance.

Red Flags:

– Potential over-reliance on technology without adequate human oversight.

– Inconsistent data quality across institutions could hinder effective data sharing.

– Rapid regulatory changes may outpace institutions’ ability to adapt.

4. Implications and Strategic Risks

The integration of AI and data-sharing systems could significantly enhance fraud detection and compliance, reducing financial crime risks. However, failure to adapt could lead to increased fines and reputational damage. Economic implications include potential cost savings from streamlined processes, while cyber risks may escalate if data-sharing systems are not adequately secured. Geopolitical tensions could arise if regulatory harmonization efforts are perceived as uneven or unfair.

5. Recommendations and Outlook

- Invest in AI and data integration technologies to enhance KYC and AML capabilities.

- Establish cross-industry consortiums to improve data-sharing standards and practices.

- Scenario Projections:

- Best Case: Seamless integration of AI tools leads to significant reductions in financial crime and enhanced compliance.

- Worst Case: Integration challenges and regulatory non-compliance result in increased fines and reputational damage.

- Most Likely: Gradual improvements in compliance and fraud prevention as institutions adapt to new technologies and regulations.

6. Key Individuals and Entities

Barclay, Klarna, Monzo

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus