Lukoil to Sell Foreign Assets to Gunvor After US Sanctions – gcaptain.com

Published on: 2025-10-31

Intelligence Report: Lukoil to Sell Foreign Assets to Gunvor After US Sanctions – gcaptain.com

1. BLUF (Bottom Line Up Front)

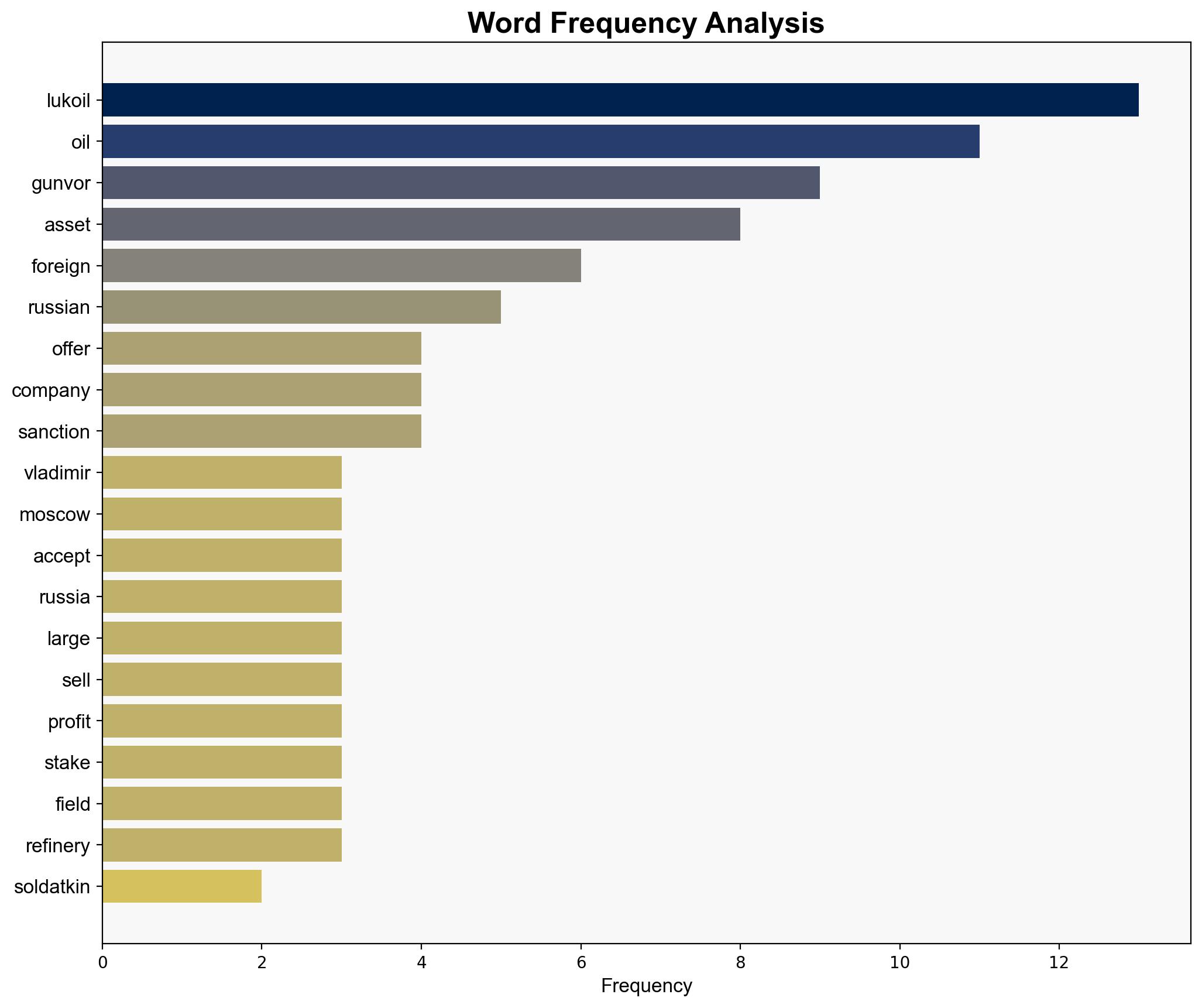

Lukoil’s decision to sell its foreign assets to Gunvor is a strategic maneuver likely influenced by recent US sanctions. The most supported hypothesis is that Lukoil aims to mitigate the impact of these sanctions while maintaining a degree of operational continuity through Gunvor, a company with historical ties to Russian interests. Confidence in this hypothesis is moderate, given the complexity of international sanctions and the opaque nature of corporate negotiations. Recommended action includes monitoring the transaction’s progress and assessing potential shifts in global oil market dynamics.

2. Competing Hypotheses

1. **Hypothesis A**: Lukoil is selling its foreign assets to Gunvor primarily to circumvent US sanctions, leveraging Gunvor’s international presence and historical ties to Russian interests to maintain influence in global markets.

2. **Hypothesis B**: Lukoil’s asset sale is a strategic divestment unrelated to sanctions, aimed at consolidating its operations and focusing on more profitable or strategically important ventures within Russia.

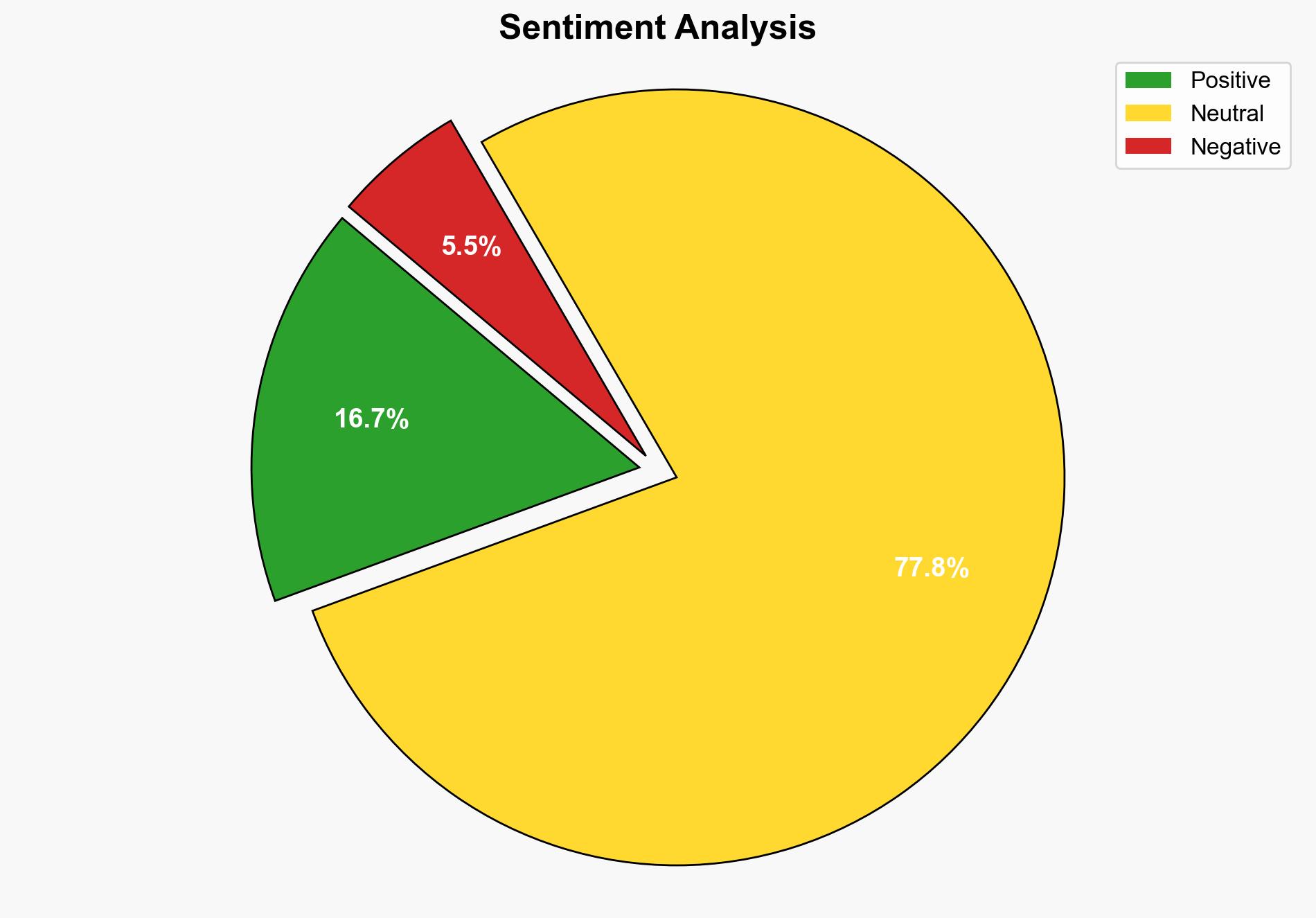

Using Analysis of Competing Hypotheses (ACH), Hypothesis A is better supported due to the timing of the sale following the imposition of sanctions and Gunvor’s historical involvement with Russian oil trades.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that Gunvor’s acquisition will not face significant regulatory hurdles, and that the transaction is primarily driven by sanctions rather than internal strategic shifts.

– **Red Flags**: The historical connection between Gunvor and Russian political figures could attract further scrutiny or sanctions. Additionally, the lack of detailed terms in the transaction raises questions about the true nature of the deal.

4. Implications and Strategic Risks

This transaction could lead to a reshaping of alliances within the global oil market, potentially increasing Gunvor’s influence. There is a risk of further sanctions targeting Gunvor, which could destabilize related markets. Economically, this move might affect oil prices and supply chains, particularly in regions dependent on Lukoil’s assets.

5. Recommendations and Outlook

- Monitor regulatory responses and potential sanctions against Gunvor to anticipate market disruptions.

- Engage with international partners to assess the broader impact on energy security and market stability.

- Scenario Projections:

- Best Case: The transaction proceeds smoothly, with minimal market disruption and no additional sanctions.

- Worst Case: Additional sanctions are imposed on Gunvor, leading to significant market instability and geopolitical tensions.

- Most Likely: The transaction faces regulatory scrutiny but proceeds, with moderate market adjustments.

6. Key Individuals and Entities

– Vladimir Soldatkin

– Oksana Kobzeva

– Gunvor

– Lukoil

– Gennady Timchenko

7. Thematic Tags

national security threats, economic sanctions, global oil market, geopolitical strategy