WSJ talks easing housing prices as Trump continues to ship out illegals – Americanthinker.com

Published on: 2025-10-31

Intelligence Report: WSJ talks easing housing prices as Trump continues to ship out illegals – Americanthinker.com

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that the easing of housing prices is primarily due to a combination of decreased demand from reduced immigration and increased remote work, rather than solely due to policy changes under the Trump administration. Confidence level: Moderate. Recommended action: Monitor housing market trends and immigration policies to assess long-term impacts on the economy.

2. Competing Hypotheses

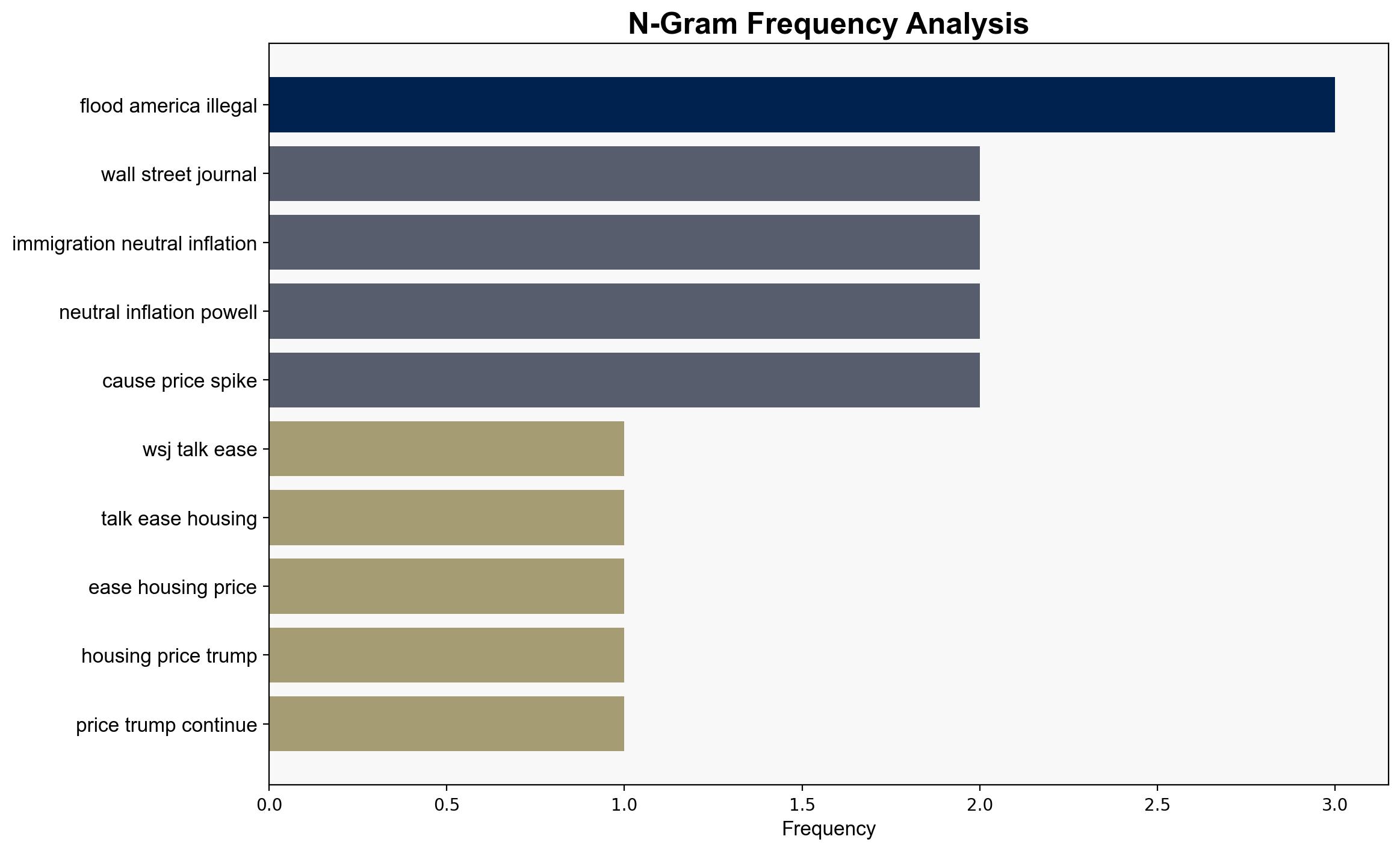

1. **Hypothesis A**: The easing of housing prices is primarily due to Trump’s immigration policies, which have reduced the influx of illegal immigrants, thereby decreasing demand for housing.

2. **Hypothesis B**: The easing of housing prices is due to a combination of factors, including reduced immigration, increased remote work, and broader economic conditions unrelated to specific immigration policies.

Using ACH 2.0, Hypothesis B is better supported as it considers multiple factors influencing housing prices, including remote work trends and economic conditions, rather than attributing changes solely to immigration policies.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes a direct and significant impact of immigration policy on housing demand. Hypothesis B assumes a multifactorial influence on housing prices.

– **Red Flags**: Potential bias in attributing housing price changes solely to immigration policy. Lack of comprehensive data on the relative impact of remote work and economic conditions.

– **Blind Spots**: The analysis may overlook other economic factors such as interest rates and housing supply changes.

4. Implications and Strategic Risks

– **Economic Implications**: A continued decrease in housing demand could stabilize or reduce housing prices, impacting the real estate market and related sectors.

– **Geopolitical Risks**: Changes in immigration policy could affect international relations and domestic political dynamics.

– **Cascading Threats**: Economic instability could lead to broader financial challenges, affecting consumer confidence and spending.

5. Recommendations and Outlook

- Monitor housing market trends and immigration policies to assess long-term impacts on the economy.

- Scenario Projections:

- **Best Case**: Stabilization of housing prices with balanced demand and supply.

- **Worst Case**: Economic downturn due to significant drops in housing demand and related sectors.

- **Most Likely**: Gradual adjustment of the housing market with moderate price stabilization.

6. Key Individuals and Entities

– Jerome Powell

– Donald Trump

– Joe Biden

7. Thematic Tags

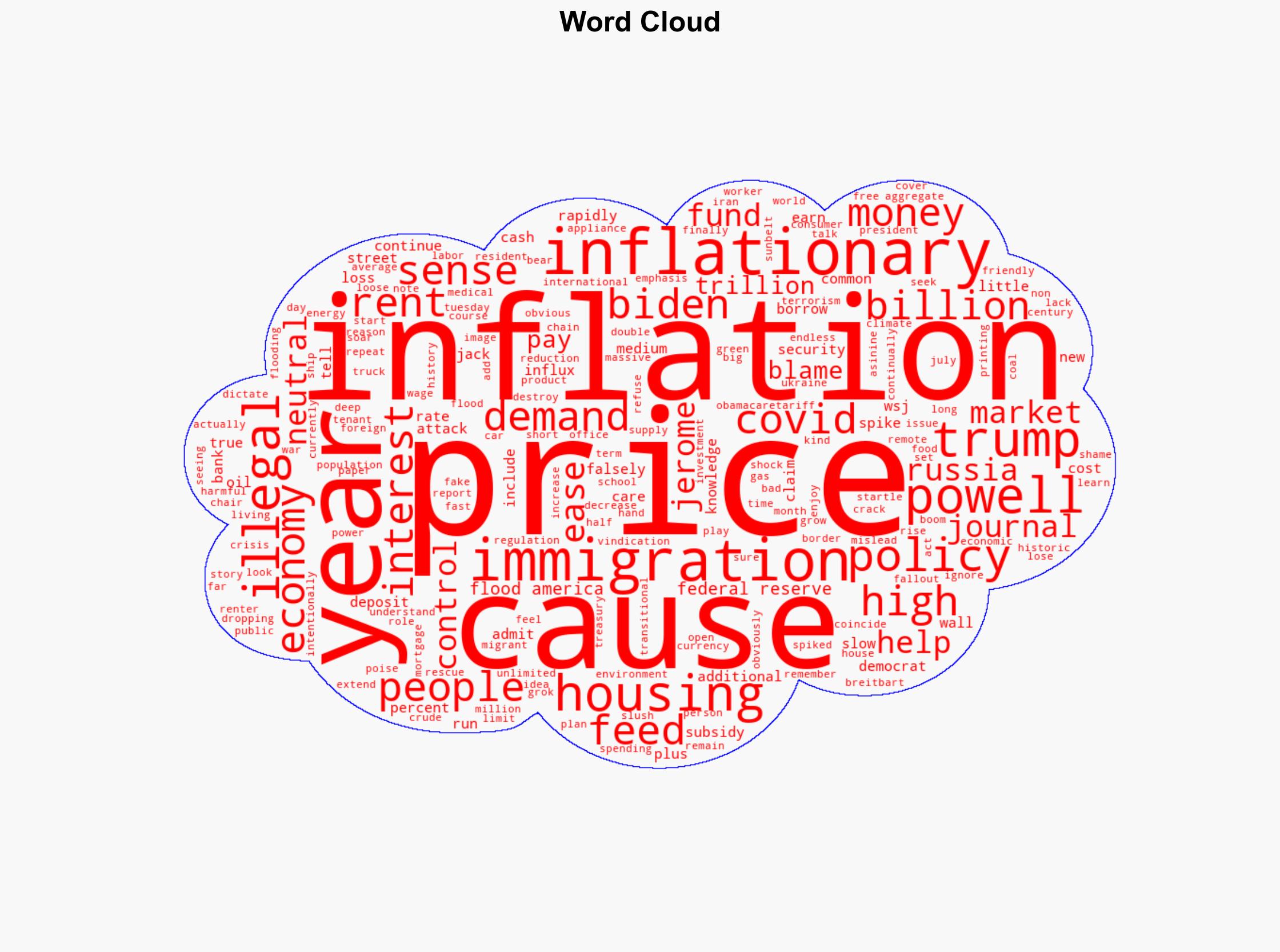

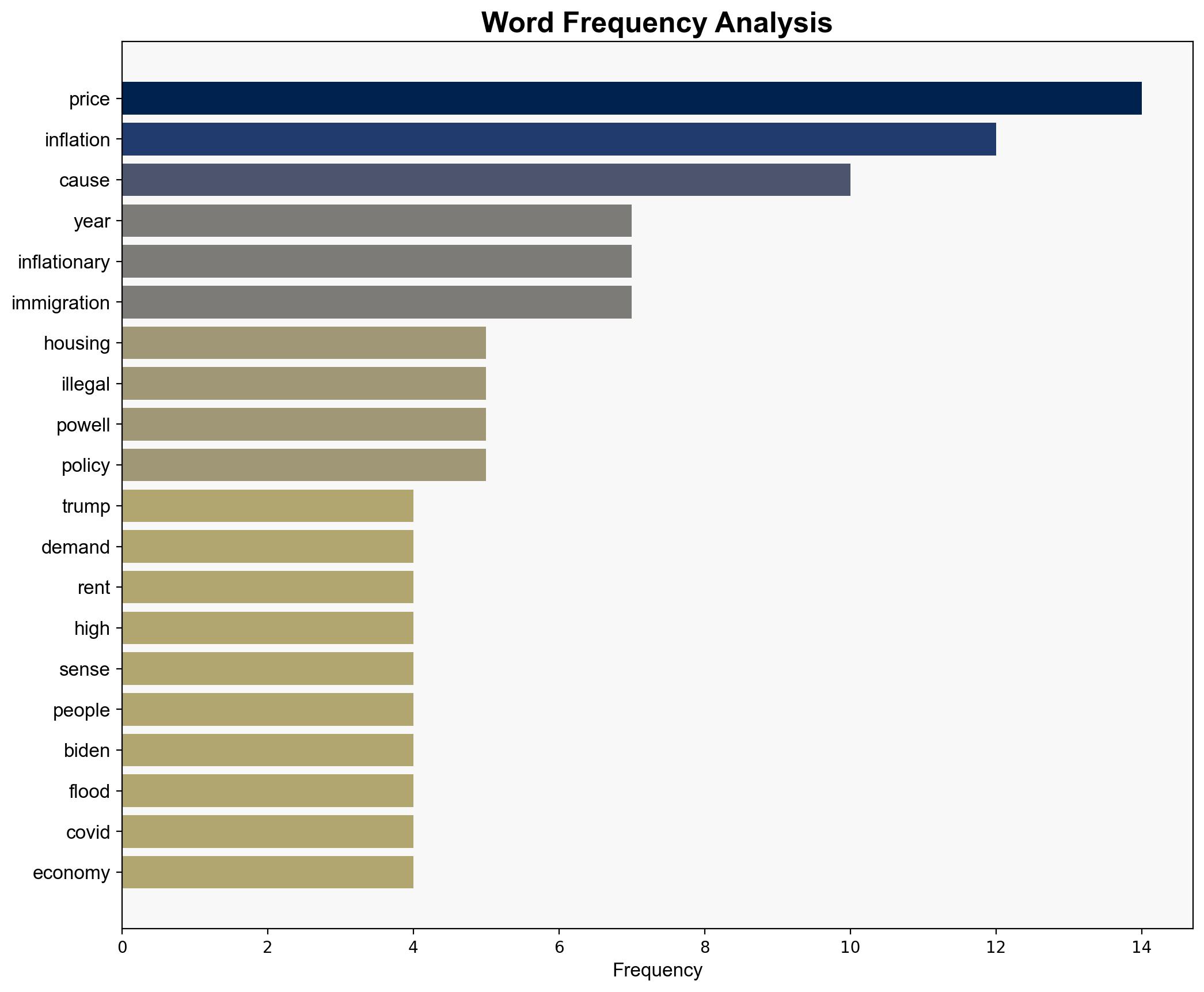

national security threats, economic stability, immigration policy, housing market trends