Lexington Trust Services stopped from doing business after DIA finds lax money-laundering protocols – New Zealand Herald

Published on: 2025-10-31

Intelligence Report: Lexington Trust Services stopped from doing business after DIA finds lax money-laundering protocols – New Zealand Herald

1. BLUF (Bottom Line Up Front)

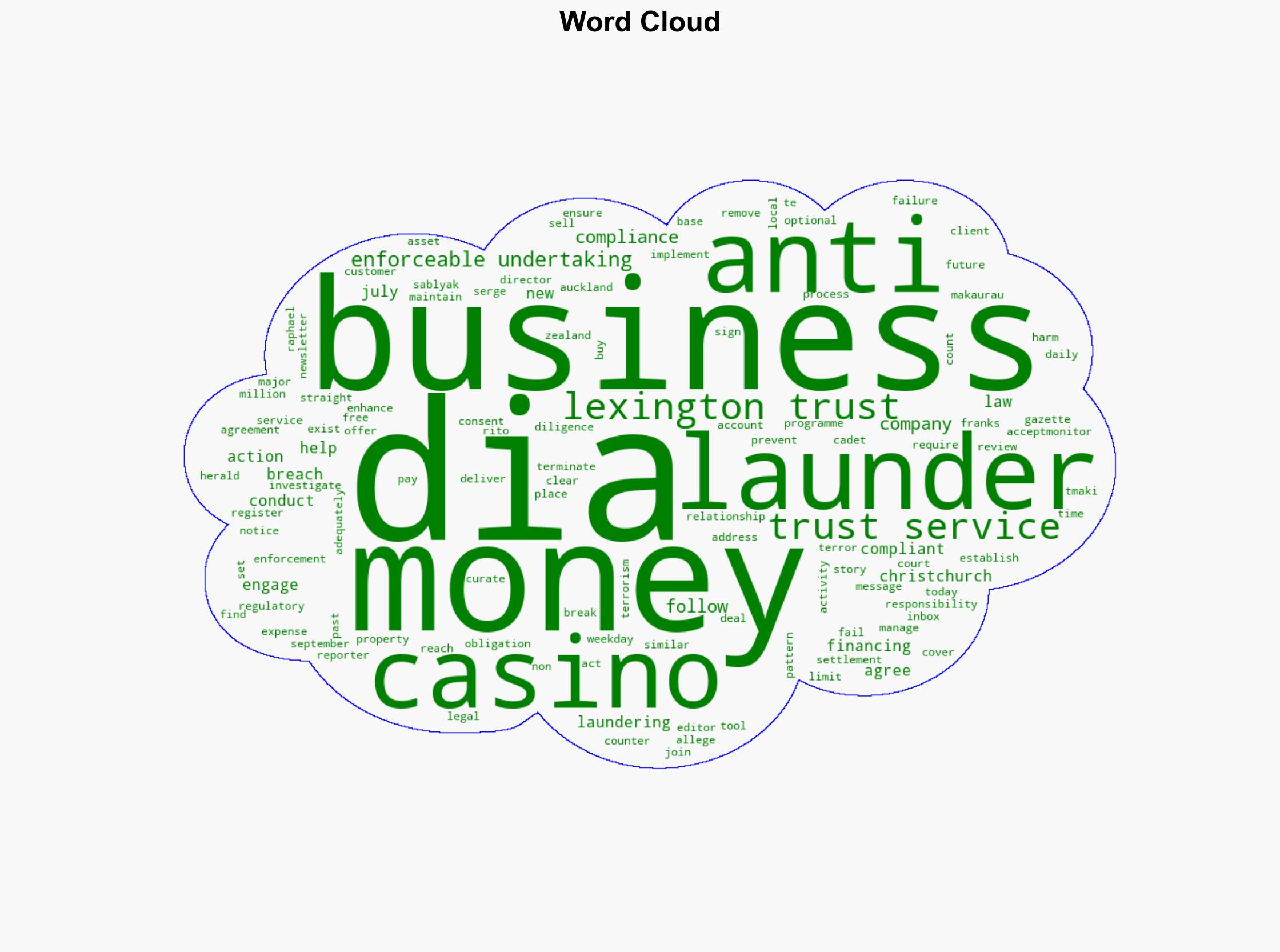

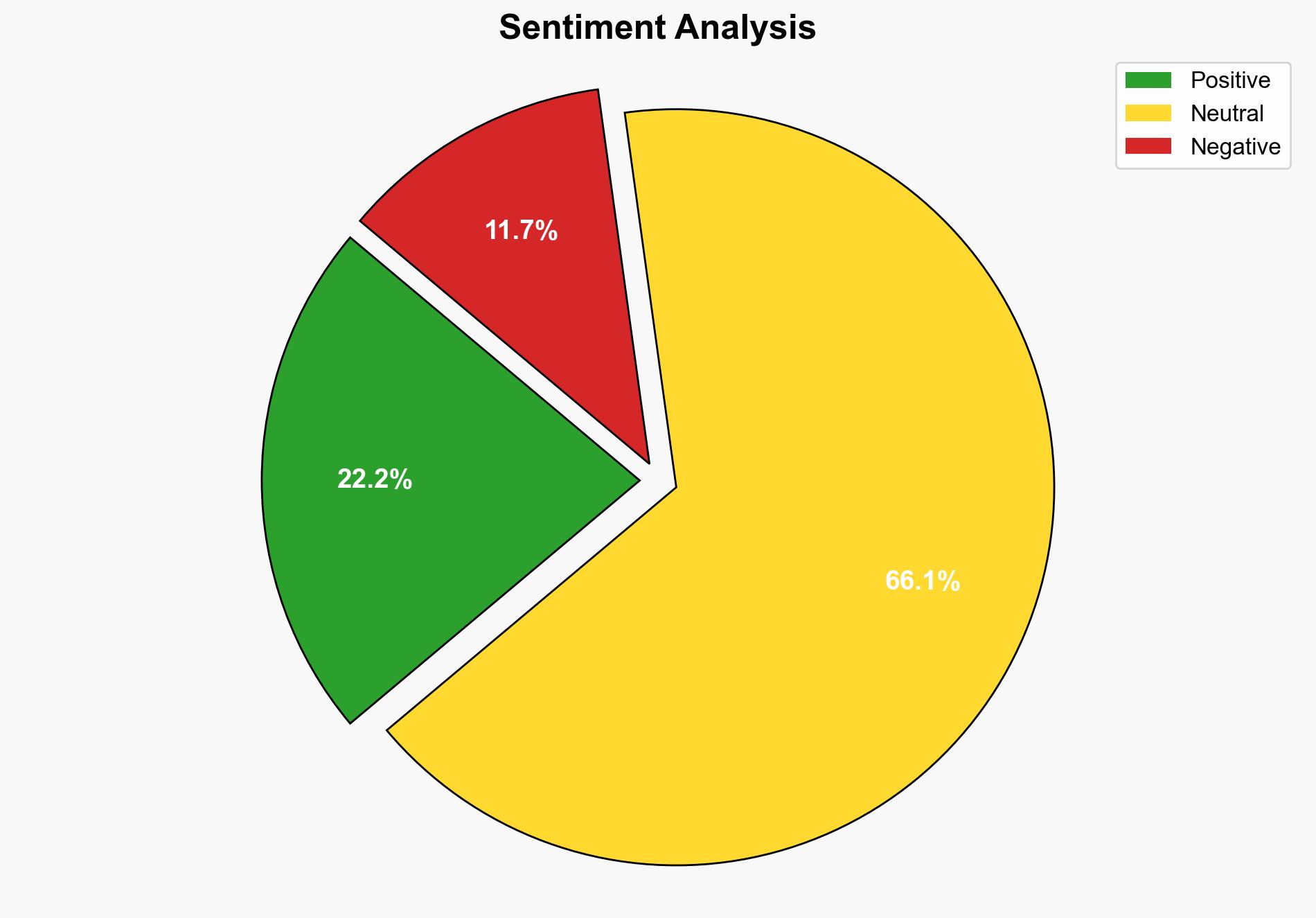

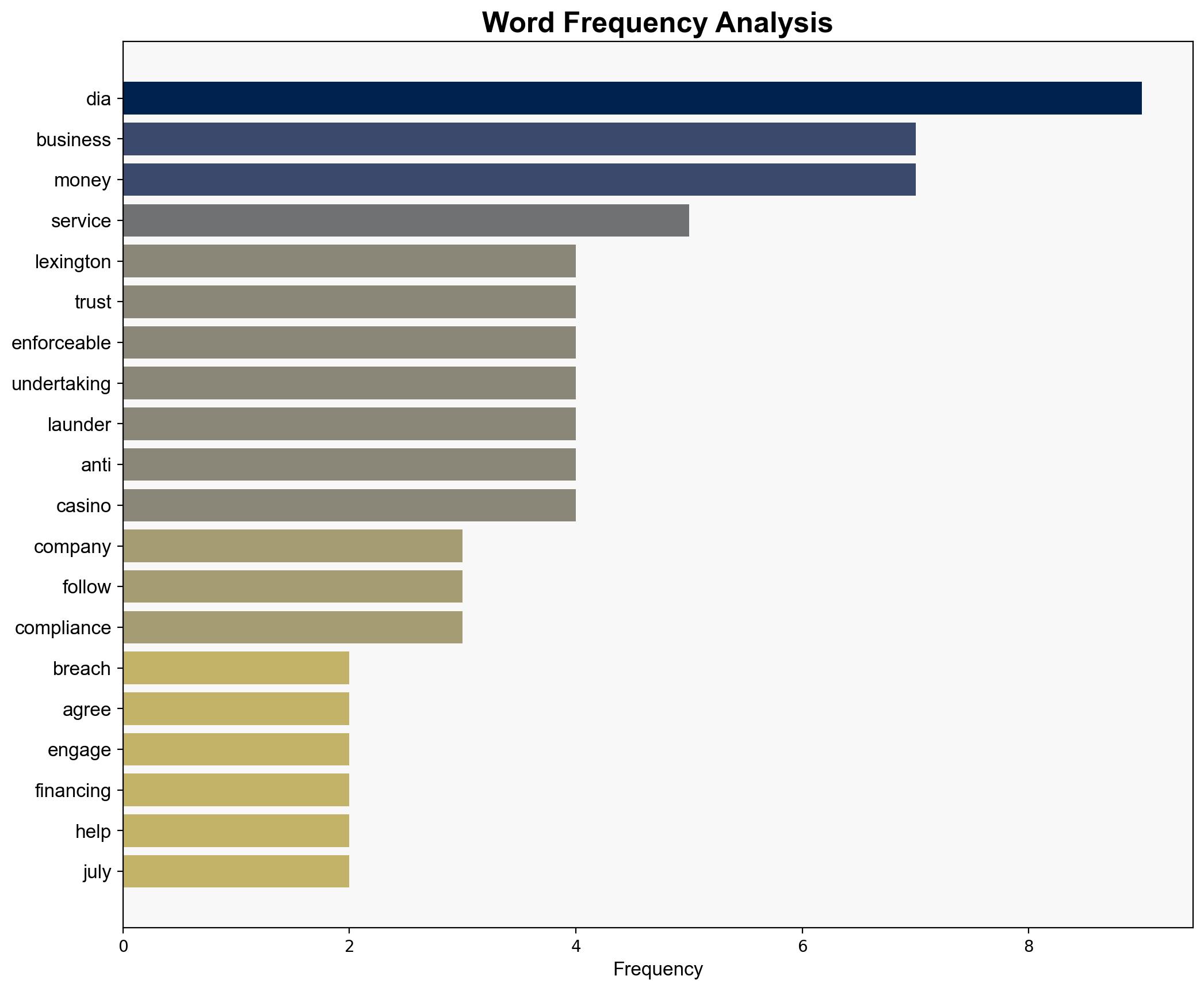

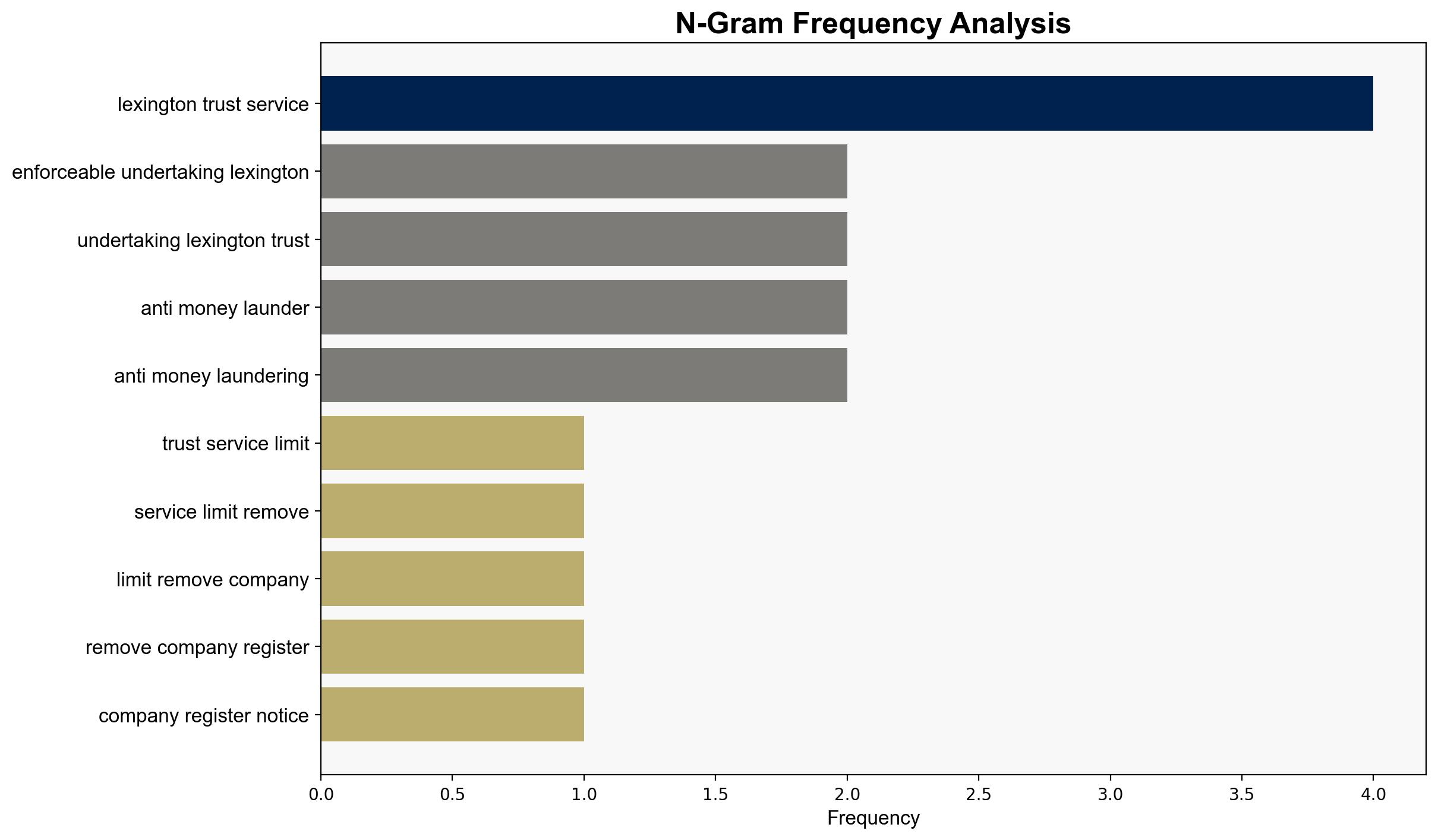

The Department of Internal Affairs (DIA) has enforced a halt on Lexington Trust Services due to inadequate anti-money laundering protocols. The most supported hypothesis suggests systemic non-compliance within Lexington Trust Services, potentially indicating broader regulatory challenges in the financial sector. Confidence level: Moderate. Recommended action: Strengthen regulatory oversight and conduct comprehensive audits across similar entities.

2. Competing Hypotheses

1. **Systemic Non-Compliance Hypothesis**: Lexington Trust Services has a pervasive culture of non-compliance with anti-money laundering regulations, possibly reflecting broader sectoral issues.

2. **Isolated Incident Hypothesis**: The enforcement action against Lexington Trust Services is an isolated case of oversight failure, not indicative of wider systemic issues.

Using Analysis of Competing Hypotheses (ACH), the systemic non-compliance hypothesis is better supported by the DIA’s ongoing investigations and previous similar cases, such as Christchurch Casino’s settlement for anti-money laundering failures.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the DIA’s findings are comprehensive and indicative of true compliance failures. Another assumption is that similar entities may share comparable compliance challenges.

– **Red Flags**: The lack of detailed evidence on the specific breaches by Lexington Trust Services raises questions about the depth of non-compliance. The absence of information on corrective measures taken by Lexington Trust Services is also concerning.

4. Implications and Strategic Risks

The enforcement action against Lexington Trust Services could signal increased regulatory scrutiny across the financial sector, potentially leading to economic implications for non-compliant entities. There is a risk of reputational damage to New Zealand’s financial sector, which could deter foreign investment. Additionally, if systemic, these compliance failures could be exploited by malicious actors for money laundering or financing terrorism.

5. Recommendations and Outlook

- Conduct sector-wide audits to identify and rectify compliance gaps.

- Enhance training programs for financial institutions on anti-money laundering protocols.

- Scenario Projections:

- Best: Rapid compliance improvements across the sector, restoring confidence.

- Worst: Widespread non-compliance leading to international sanctions.

- Most Likely: Incremental improvements with ongoing regulatory challenges.

6. Key Individuals and Entities

– Serge Sablyak

– Raphael Franks

– Lexington Trust Services

– Christchurch Casino

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus