Are Wall Street Analysts Bullish on Hewlett Packard Enterprise Stock – Barchart.com

Published on: 2025-10-31

Intelligence Report: Are Wall Street Analysts Bullish on Hewlett Packard Enterprise Stock – Barchart.com

1. BLUF (Bottom Line Up Front)

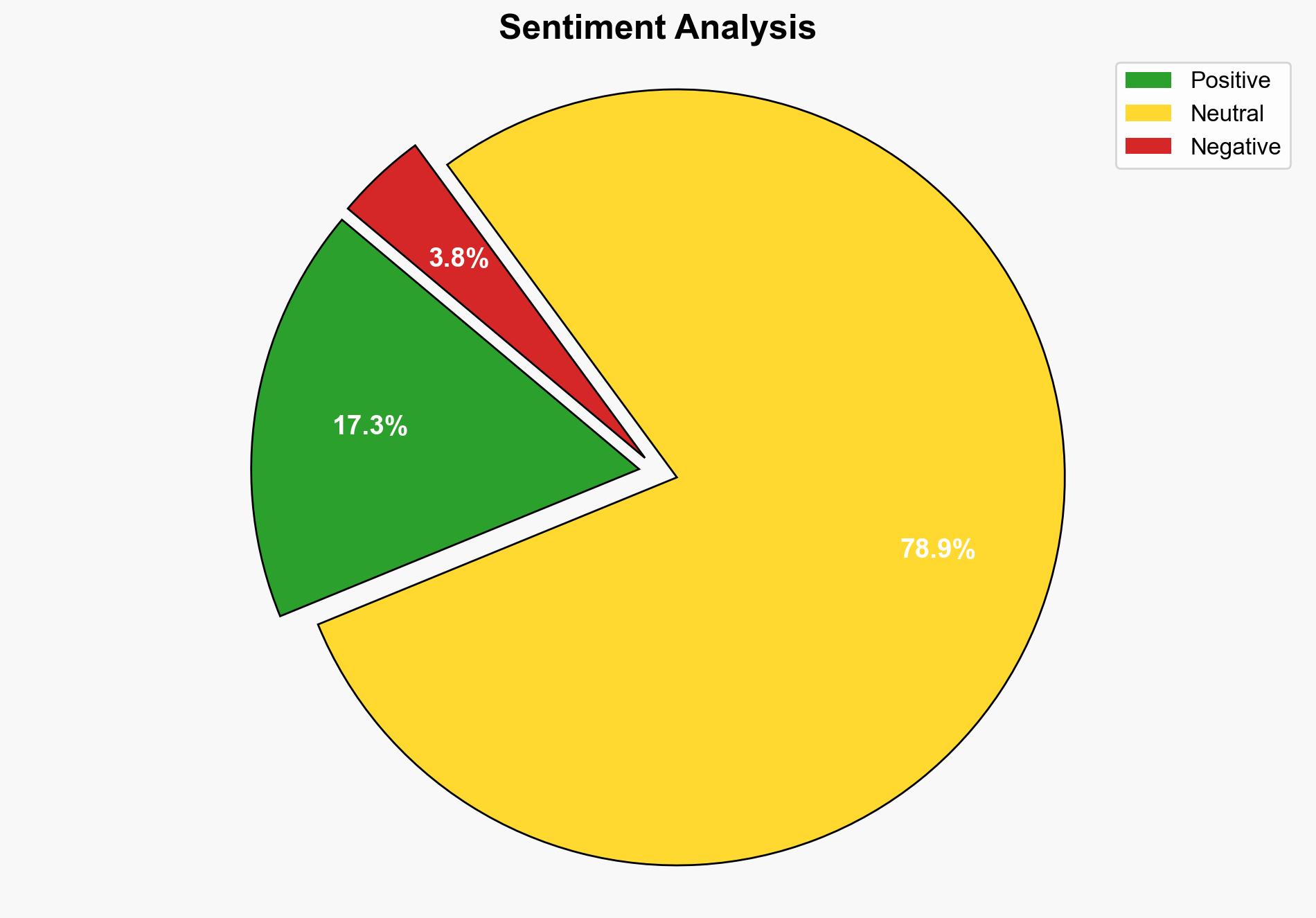

The most supported hypothesis is that Wall Street analysts have a cautiously optimistic outlook on Hewlett Packard Enterprise (HPE) stock, with a moderate buy consensus. This report uses the Analysis of Competing Hypotheses (ACH) 2.0 to evaluate the evidence. Confidence level: Moderate. Recommended action: Monitor HPE’s fiscal performance and strategic initiatives closely for shifts in analyst sentiment.

2. Competing Hypotheses

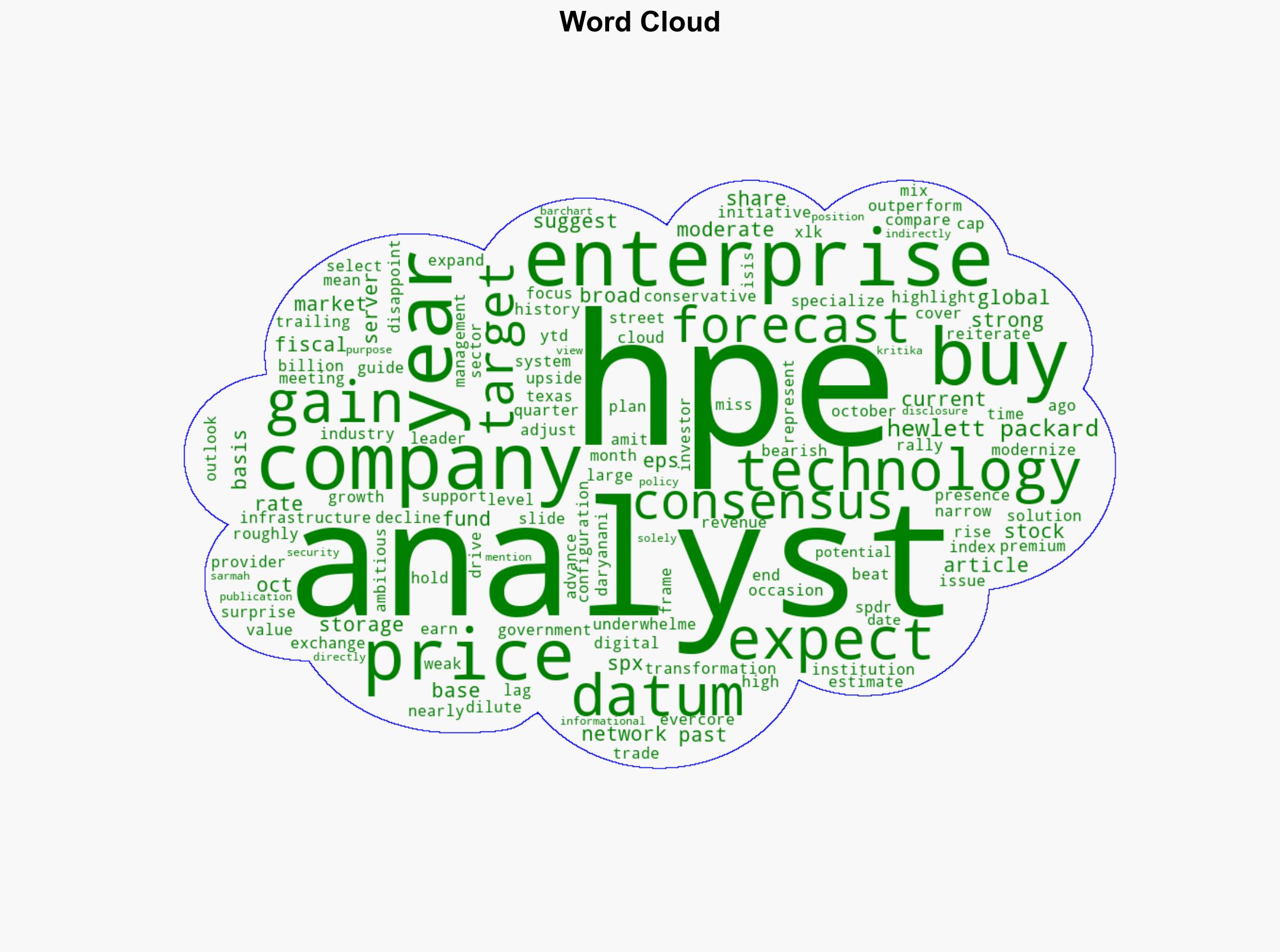

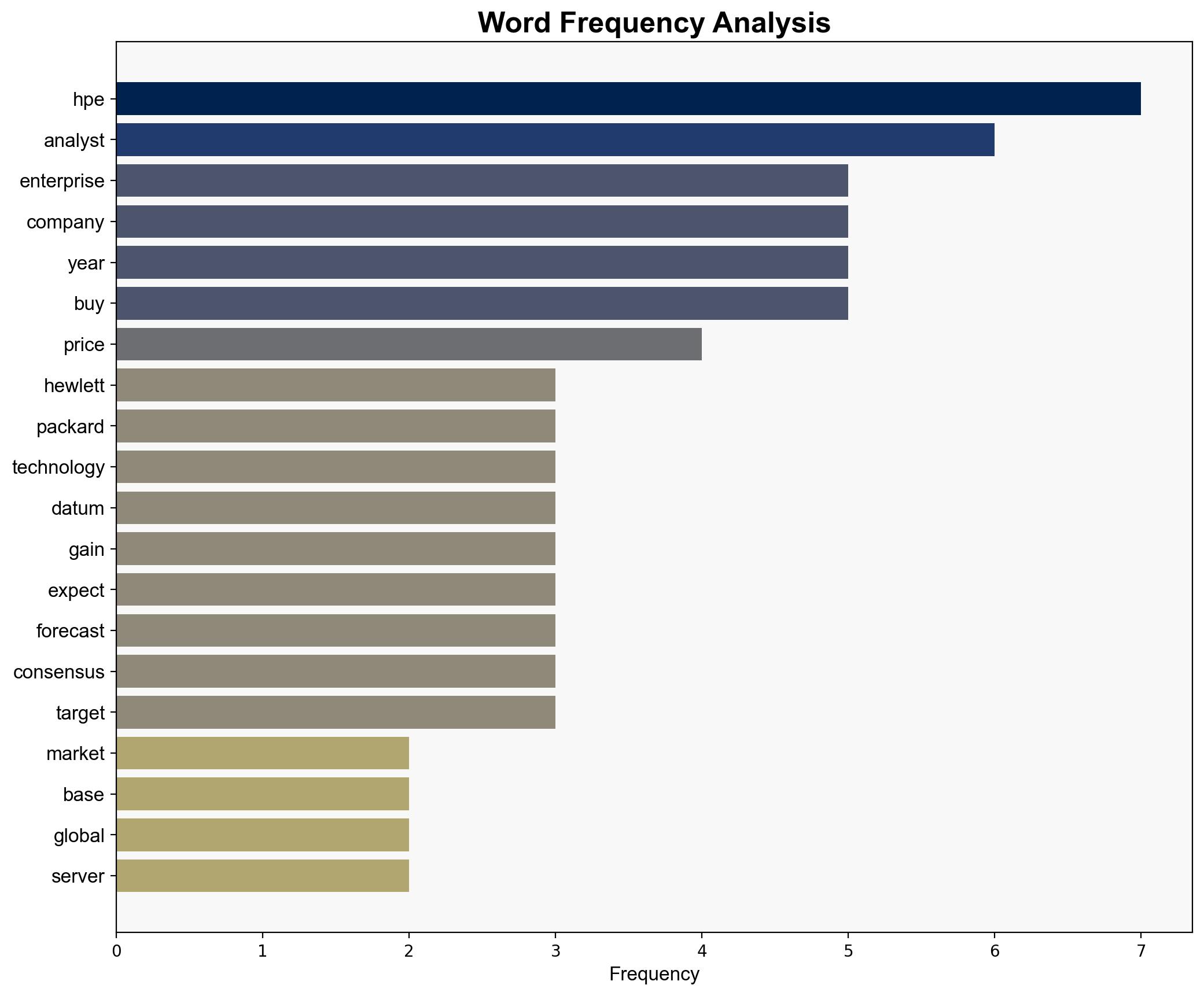

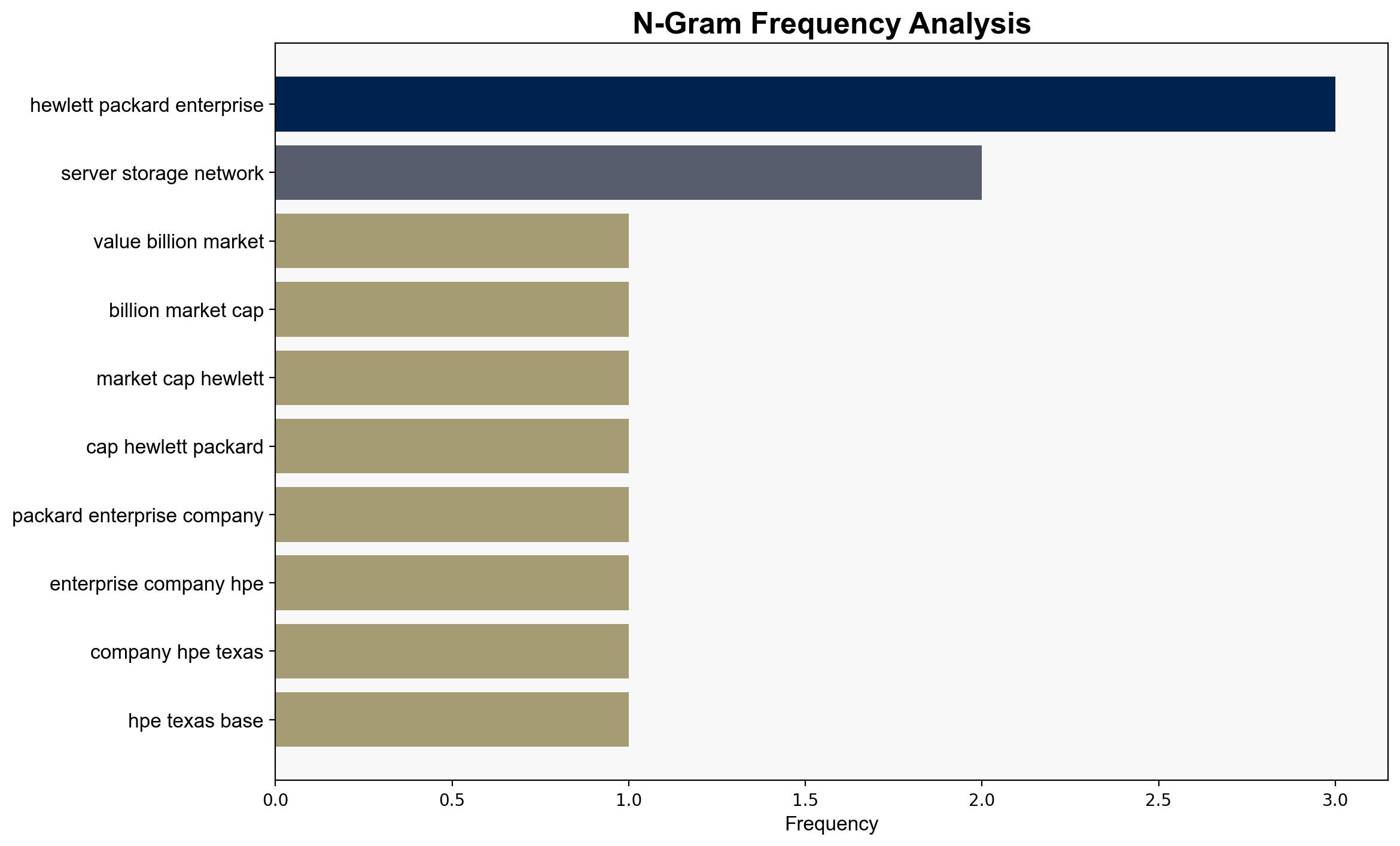

– **Hypothesis 1**: Analysts are bullish on HPE, expecting strong future performance due to strategic expansion in server, storage, and network sectors.

– **Hypothesis 2**: Analysts are cautiously optimistic, with moderate buy ratings reflecting concerns over HPE’s conservative revenue growth forecasts and mixed earnings history.

Using ACH 2.0, Hypothesis 2 is better supported. The moderate buy consensus and recent analyst disappointment over fiscal outlooks suggest a tempered optimism rather than outright bullishness.

3. Key Assumptions and Red Flags

– **Assumptions**: Analysts assume HPE’s strategic initiatives will eventually translate into improved financial performance. They also assume that market conditions will remain favorable for technology stocks.

– **Red Flags**: The discrepancy between HPE’s forecasts and analyst expectations could indicate potential overestimation of HPE’s market capabilities. The shift from strong buy to moderate buy suggests evolving sentiment that requires monitoring.

4. Implications and Strategic Risks

– **Economic Risks**: If HPE fails to meet its conservative forecasts, it could lead to a decline in stock value and investor confidence.

– **Geopolitical Risks**: Global economic instability could impact HPE’s international operations and revenue.

– **Psychological Risks**: Continued mixed earnings reports may erode investor trust and lead to increased stock volatility.

5. Recommendations and Outlook

- Monitor HPE’s quarterly earnings and strategic announcements for signs of deviation from forecasts.

- Consider scenario-based investments:

- Best Case: HPE exceeds expectations, leading to stock appreciation.

- Worst Case: HPE underperforms, causing a decline in stock value.

- Most Likely: HPE meets conservative forecasts, maintaining current stock levels.

- Engage with analysts to understand shifts in sentiment and underlying reasons.

6. Key Individuals and Entities

– Amit Daryanani (Evercore ISI)

– Kritika Sarmah (Publication Author)

7. Thematic Tags

economic analysis, stock market trends, technology sector, investment strategy