Wall Street Analyst Warns That Nvidia Is Facing Serious Trouble – Futurism

Published on: 2025-10-31

Intelligence Report: Wall Street Analyst Warns That Nvidia Is Facing Serious Trouble – Futurism

1. BLUF (Bottom Line Up Front)

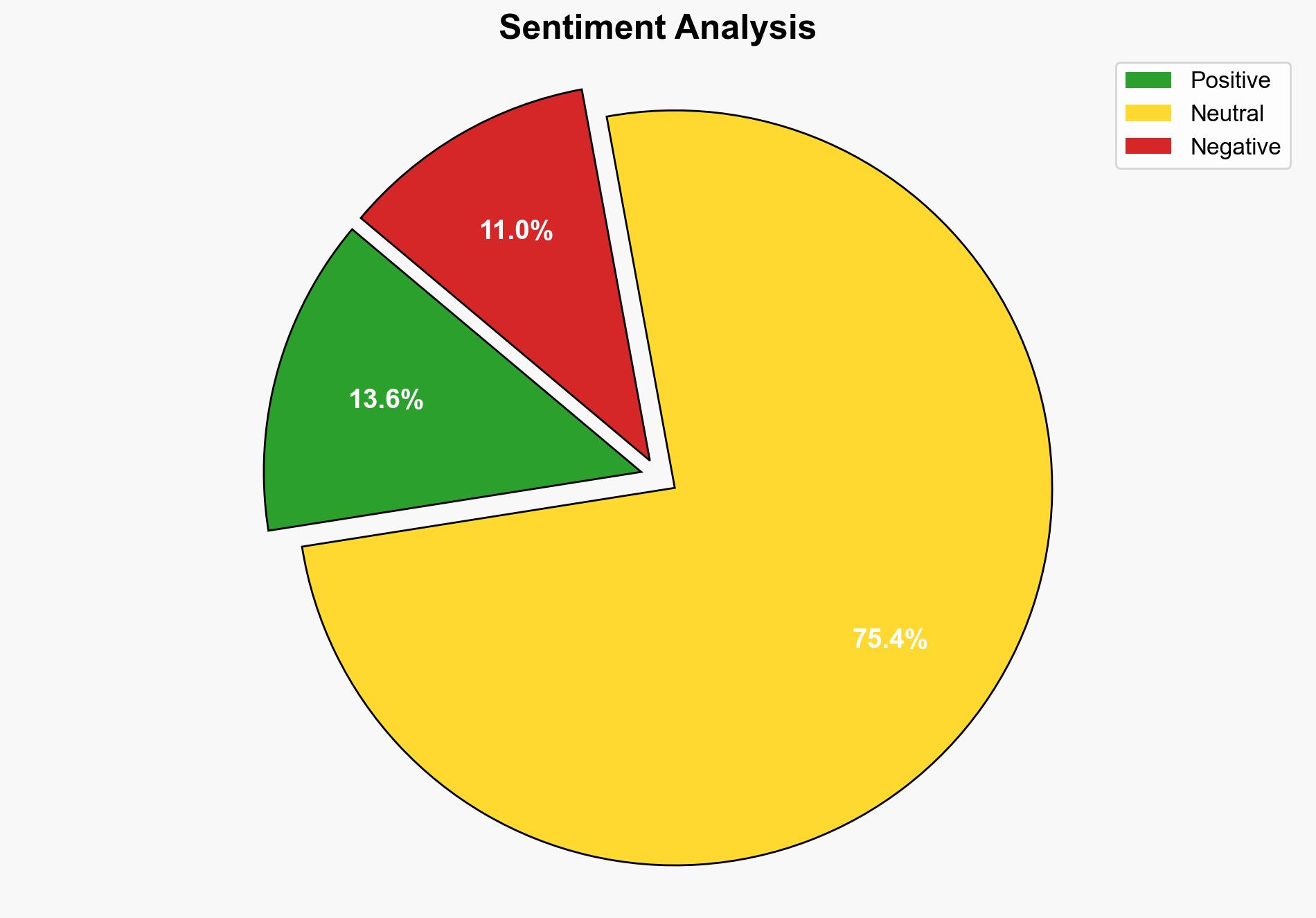

Nvidia is potentially overvalued due to an AI-driven investment bubble, posing significant financial risks. The most supported hypothesis suggests that current AI investments are unsustainable, leading to a potential market correction. Confidence level: Moderate. Recommended action: Monitor Nvidia’s financial health and AI market trends closely to anticipate market shifts.

2. Competing Hypotheses

Hypothesis 1: Nvidia’s stock is overvalued due to an AI investment bubble, which will lead to a market correction as AI spending decreases.

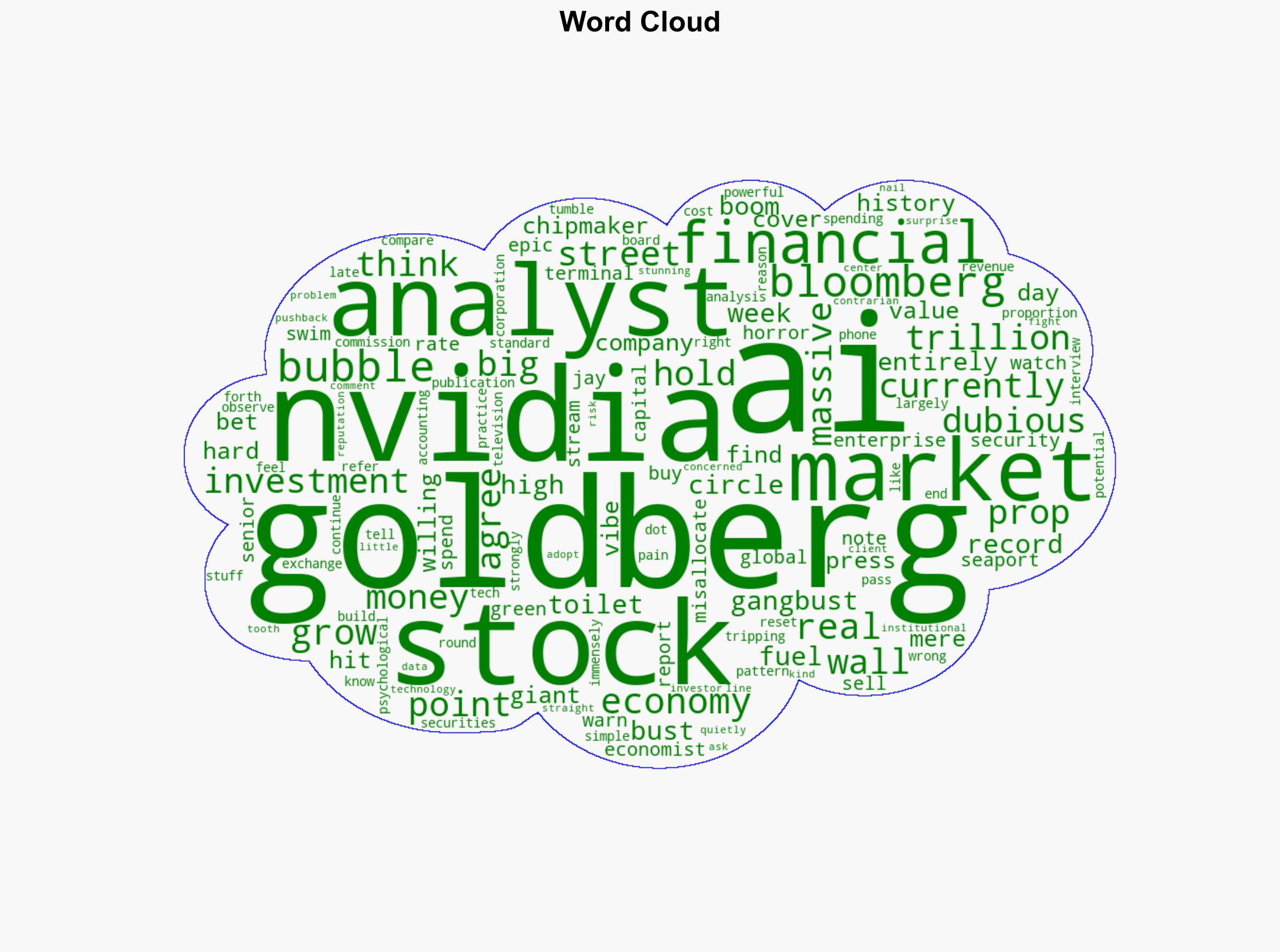

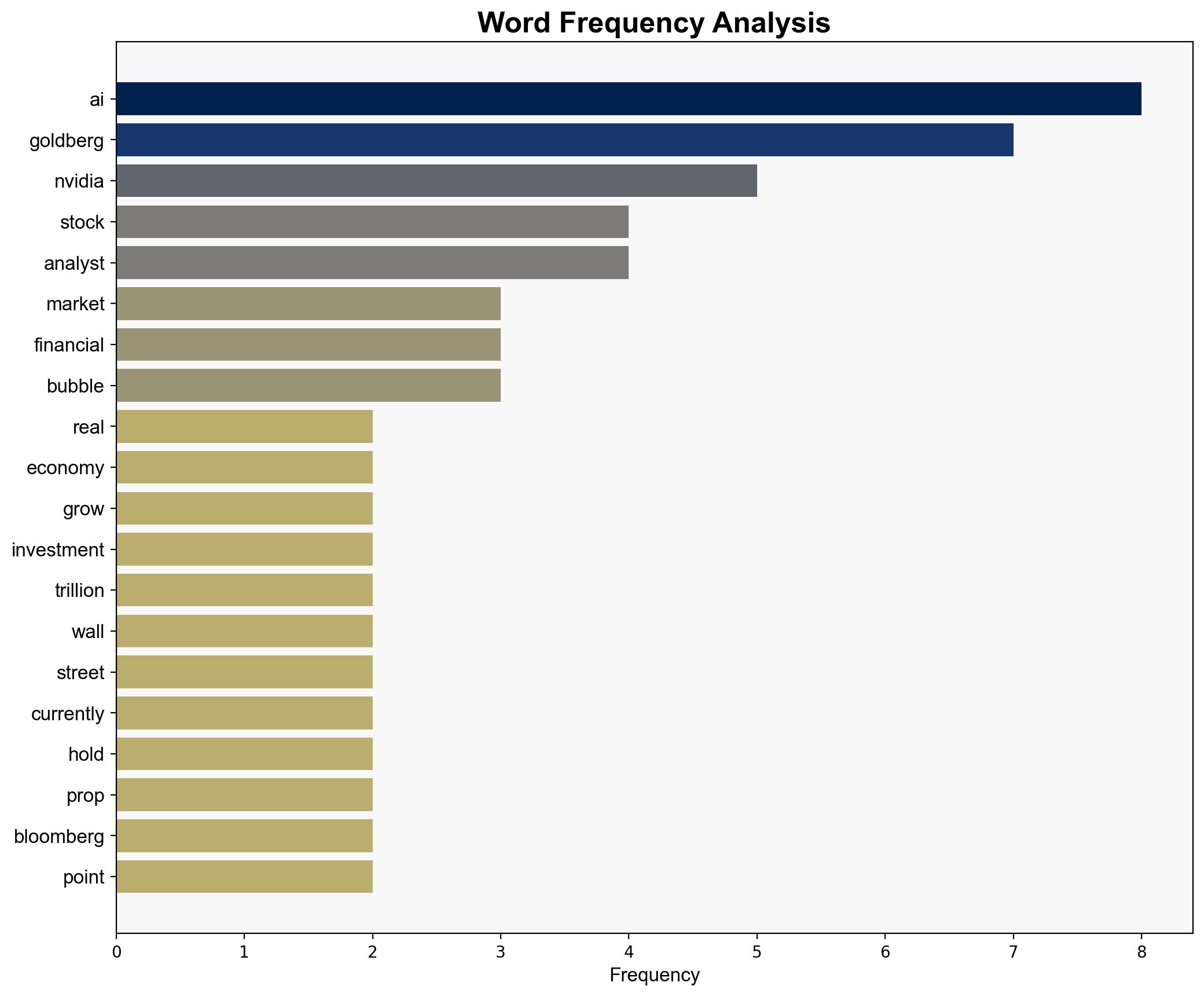

– Supported by analyst Jay Goldberg’s warnings of misallocated capital and historical parallels to past investment bubbles.

Hypothesis 2: Nvidia’s valuation is justified by the long-term potential of AI technology, and current market fluctuations are temporary.

– Supported by the ongoing demand for AI technology and Nvidia’s position as a leading chipmaker.

Using Bayesian Scenario Modeling, Hypothesis 1 is more likely given the evidence of historical investment bubbles and the analyst’s insights into current spending patterns.

3. Key Assumptions and Red Flags

– Assumption: AI spending will decrease significantly, impacting Nvidia’s valuation.

– Red Flag: Potential bias in Goldberg’s analysis as a contrarian view, which may not account for all market dynamics.

– Missing Data: Lack of comprehensive financial data on Nvidia’s AI-related revenue and costs.

4. Implications and Strategic Risks

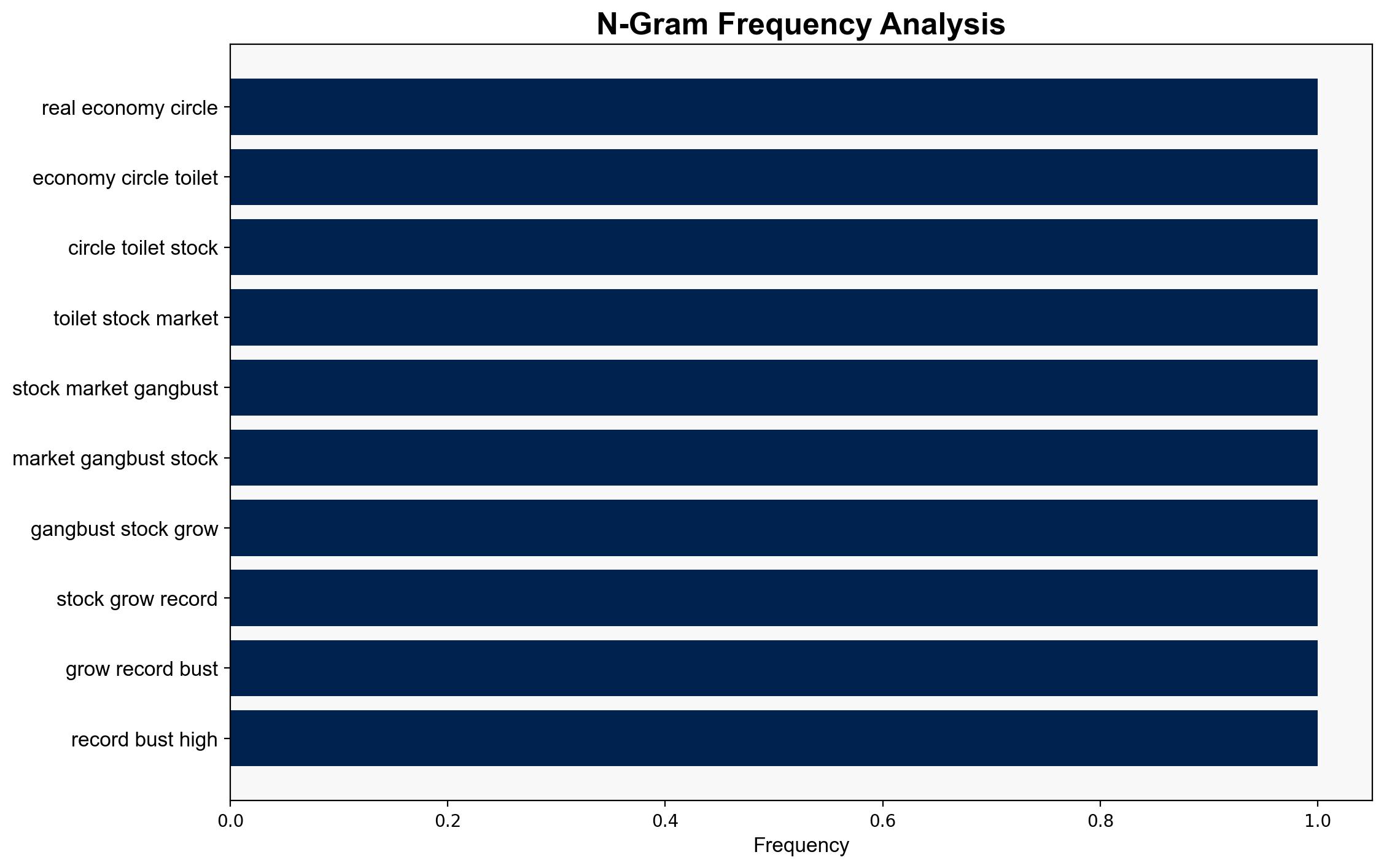

– Economic: A market correction could lead to broader financial instability, affecting tech stocks and investor confidence.

– Psychological: Investor panic could exacerbate market volatility.

– Geopolitical: Global reliance on AI technology could lead to international economic repercussions if the bubble bursts.

5. Recommendations and Outlook

- Monitor Nvidia’s financial disclosures and AI market trends to anticipate potential corrections.

- Engage with industry experts to validate or challenge current assumptions about AI investment sustainability.

- Scenario Projections:

- Best Case: AI market stabilizes, supporting Nvidia’s valuation.

- Worst Case: Significant market correction leads to a tech sector downturn.

- Most Likely: Gradual market adjustment with moderate impact on Nvidia.

6. Key Individuals and Entities

– Jay Goldberg

– Nvidia

– Bloomberg

7. Thematic Tags

economic stability, market analysis, technology investment, financial risk