Charting the Global Economy Fed Reins in Rate-Cut Expectations – Financial Post

Published on: 2025-11-01

Intelligence Report: Charting the Global Economy Fed Reins in Rate-Cut Expectations – Financial Post

1. BLUF (Bottom Line Up Front)

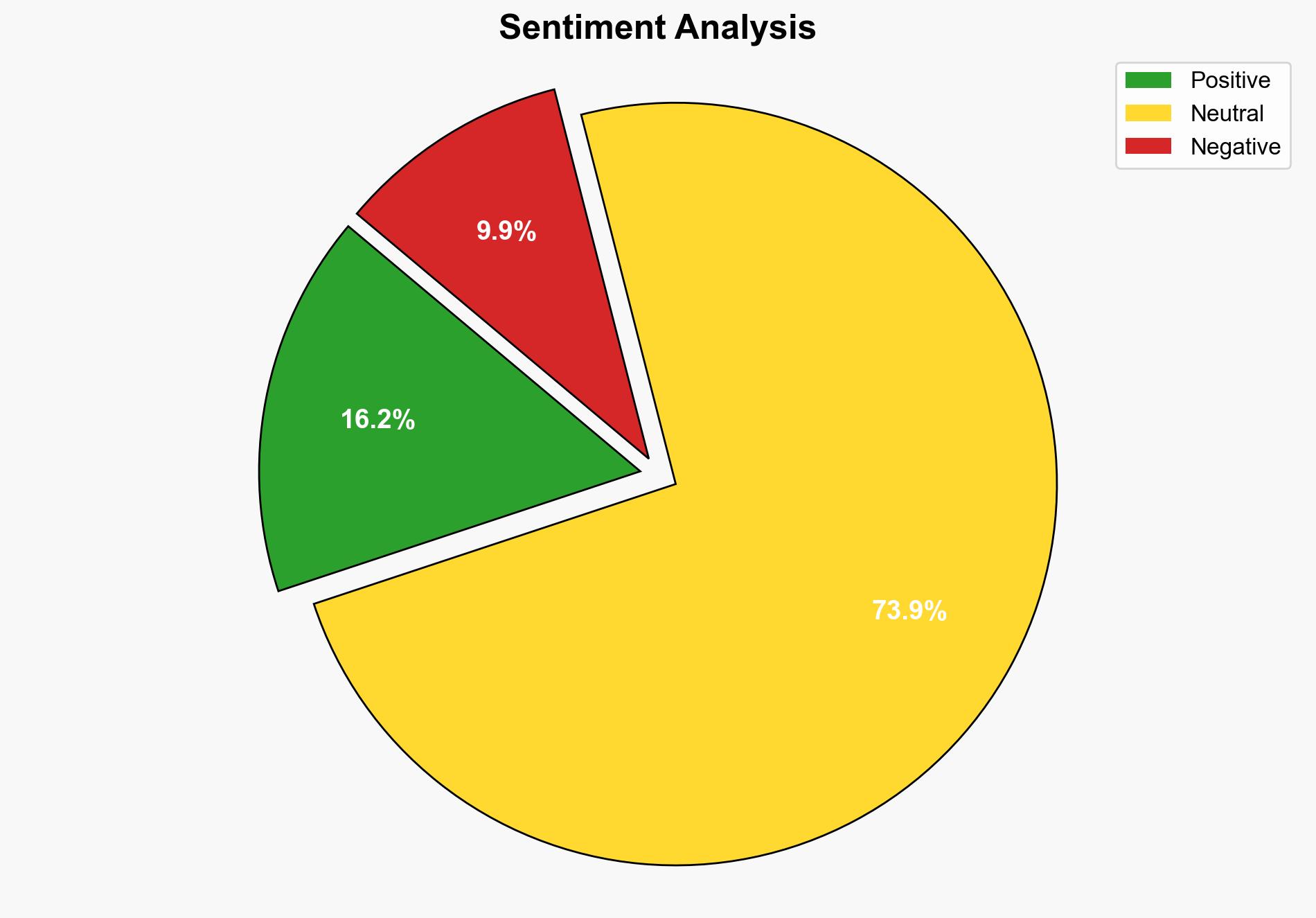

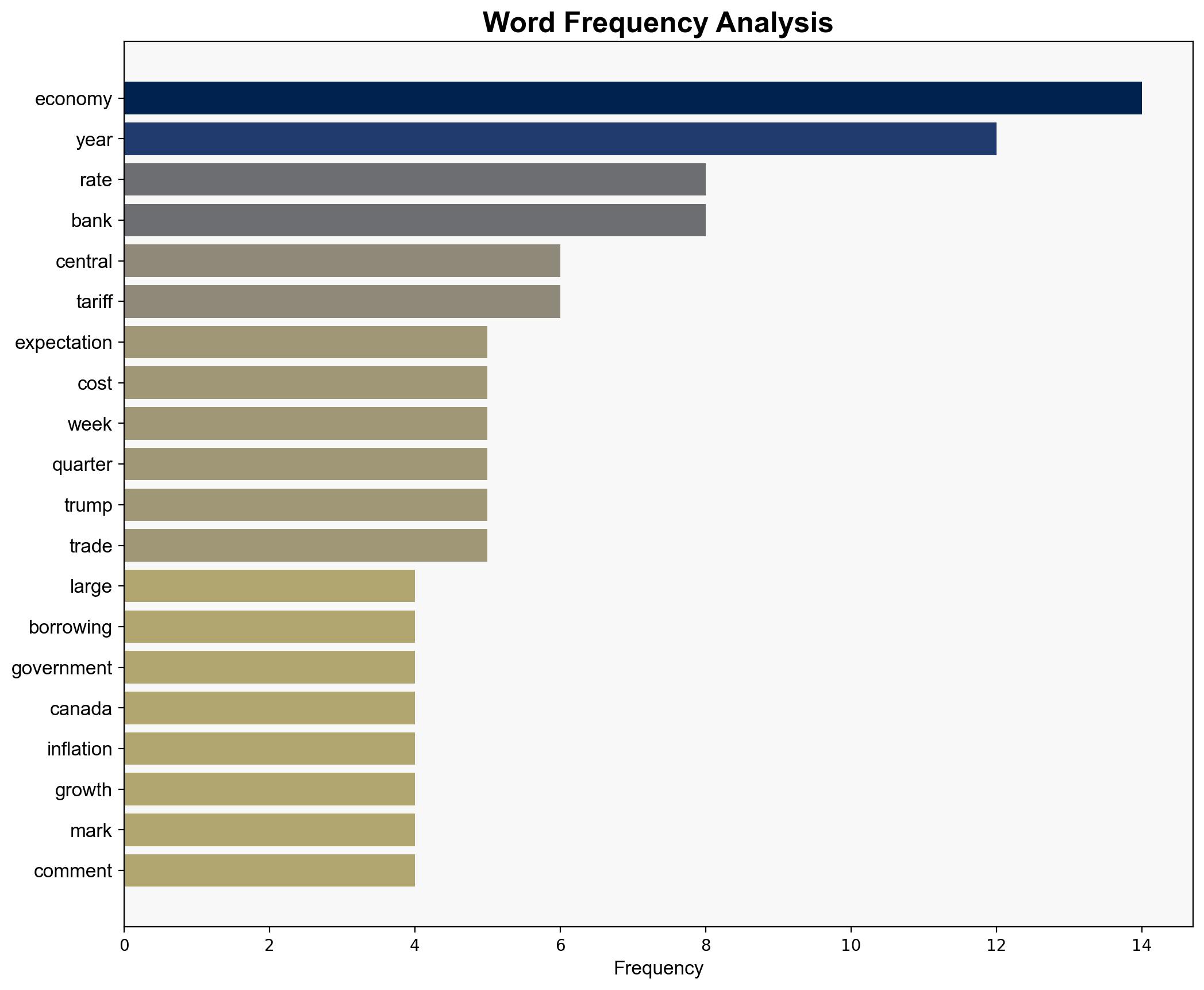

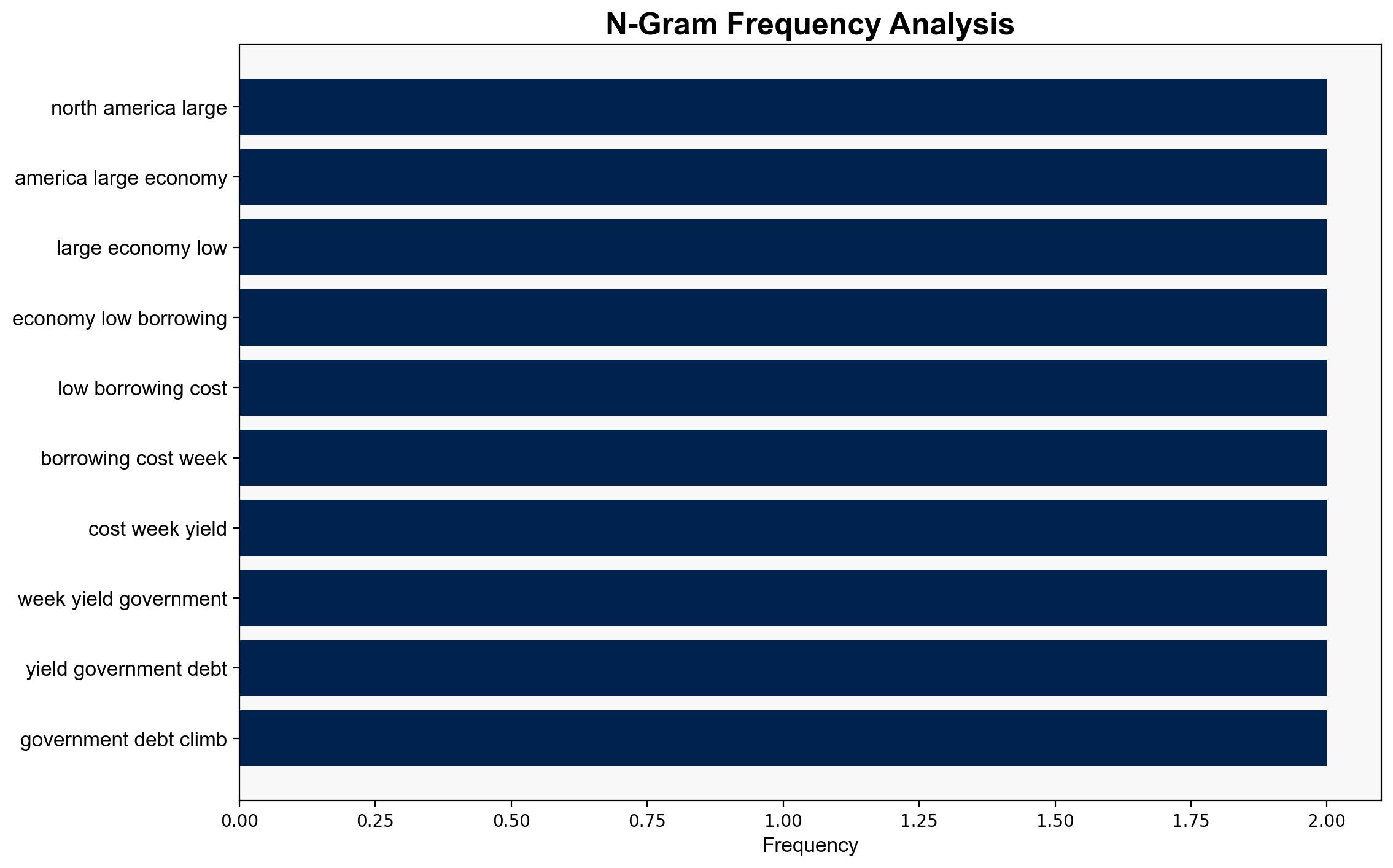

The Federal Reserve and the Bank of Canada are signaling a shift away from rate cuts, suggesting a stabilization in monetary policy amid global economic uncertainties. The most supported hypothesis is that central banks aim to maintain current rates to manage inflation and economic growth. Confidence level: Moderate. Recommended action: Monitor central bank communications closely for any shifts in policy that could impact global markets.

2. Competing Hypotheses

– **Hypothesis 1**: Central banks, including the Federal Reserve and the Bank of Canada, are maintaining current interest rates to stabilize inflation and support moderate economic growth, avoiding further rate cuts.

– **Hypothesis 2**: Central banks are preparing for potential rate cuts in response to unforeseen economic downturns or geopolitical tensions, despite current indications of stability.

Using ACH 2.0, Hypothesis 1 is better supported by current data, as central banks have publicly indicated a preference for maintaining rates barring significant economic changes.

3. Key Assumptions and Red Flags

– **Assumptions**: Central banks have accurate forecasts of economic conditions and inflation trends. The global economic environment remains relatively stable without major disruptions.

– **Red Flags**: Potential underestimation of geopolitical risks, such as trade tensions or regional conflicts, which could necessitate a policy shift. Lack of detailed data on the impact of emerging technologies and AI on economic growth.

4. Implications and Strategic Risks

– **Economic Risks**: A sudden economic downturn or geopolitical event could force central banks to reverse their stance, impacting global markets.

– **Geopolitical Risks**: Trade tensions, particularly involving the U.S., Canada, and China, could escalate, affecting economic stability.

– **Technological Risks**: The rapid advancement of AI and its impact on traditional economic drivers could lead to unforeseen economic shifts.

5. Recommendations and Outlook

- Monitor central bank announcements and economic indicators closely for early signs of policy shifts.

- Prepare for scenario-based responses:

- Best Case: Continued economic growth with stable interest rates.

- Worst Case: Economic downturn necessitating emergency rate cuts.

- Most Likely: Gradual adjustments in policy in response to economic indicators.

- Enhance analysis of geopolitical developments that could impact economic policies.

6. Key Individuals and Entities

– Jerome Powell

– Christine Lagarde

– Doug Ford

– Donald Trump

7. Thematic Tags

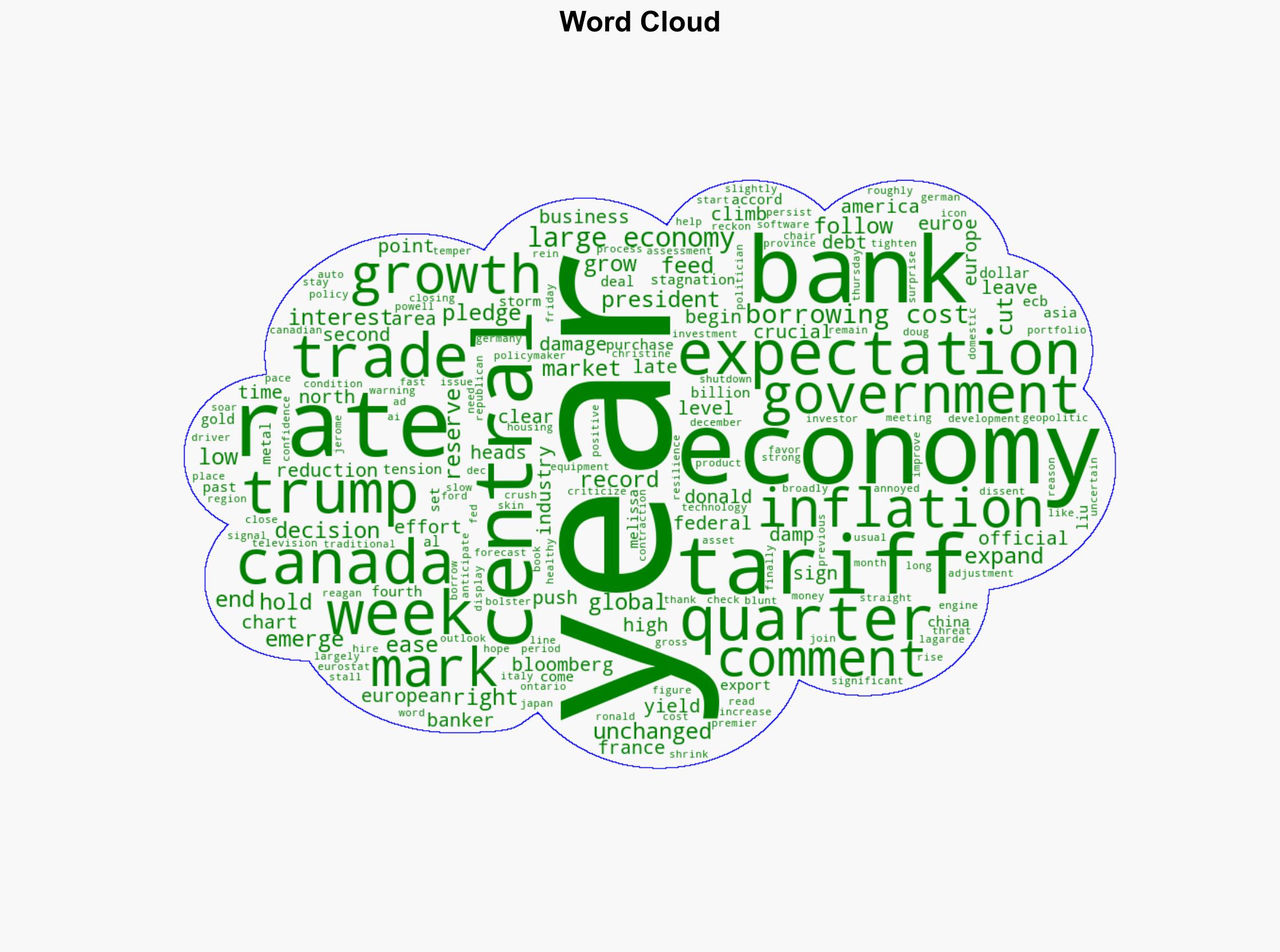

economic policy, central banks, inflation management, geopolitical risks, trade tensions