Bitcoin Fails to Rally on US-China Truce Whats Next for Price – BeInCrypto

Published on: 2025-11-03

Intelligence Report: Bitcoin Fails to Rally on US-China Truce Whats Next for Price – BeInCrypto

1. BLUF (Bottom Line Up Front)

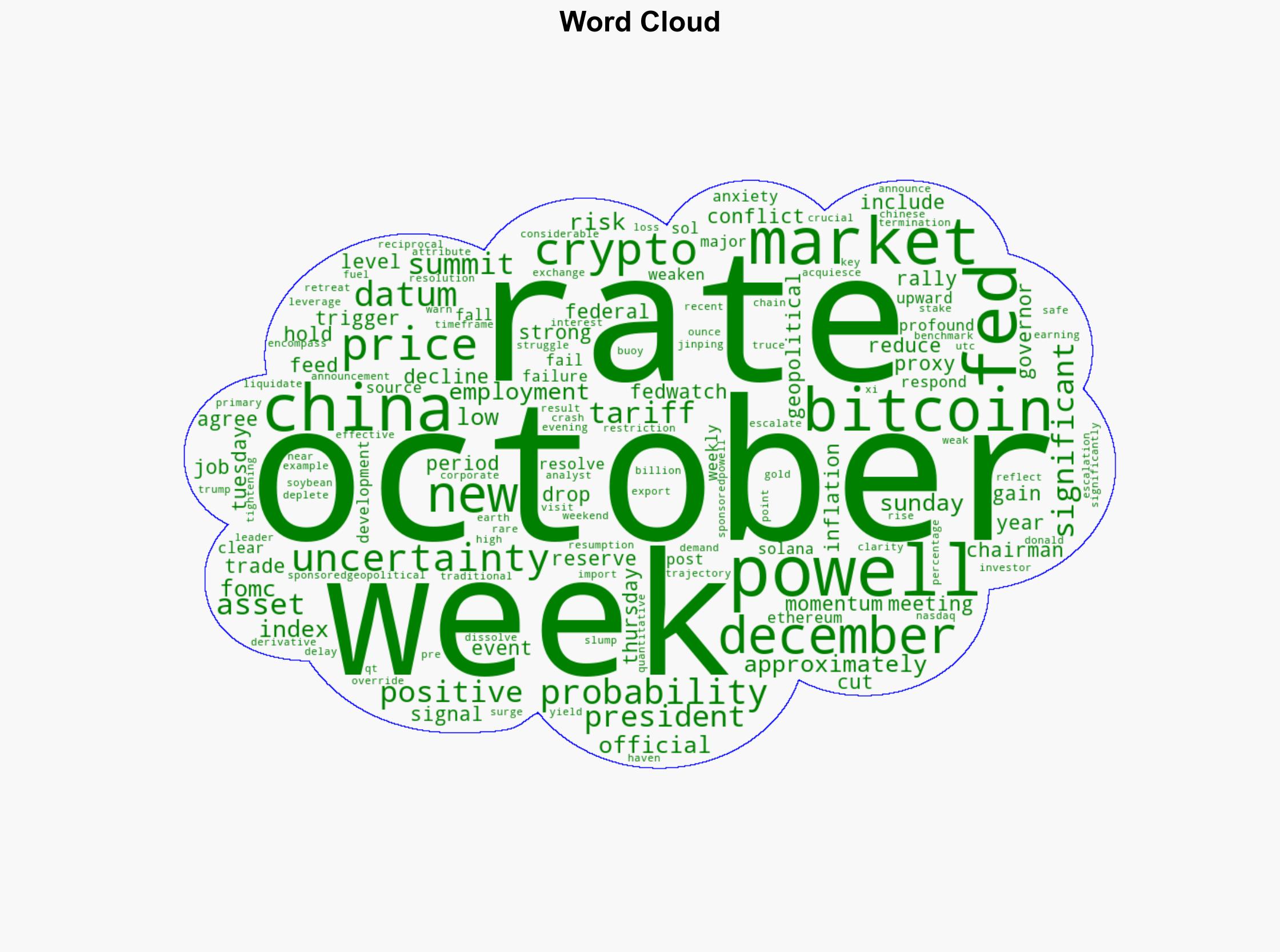

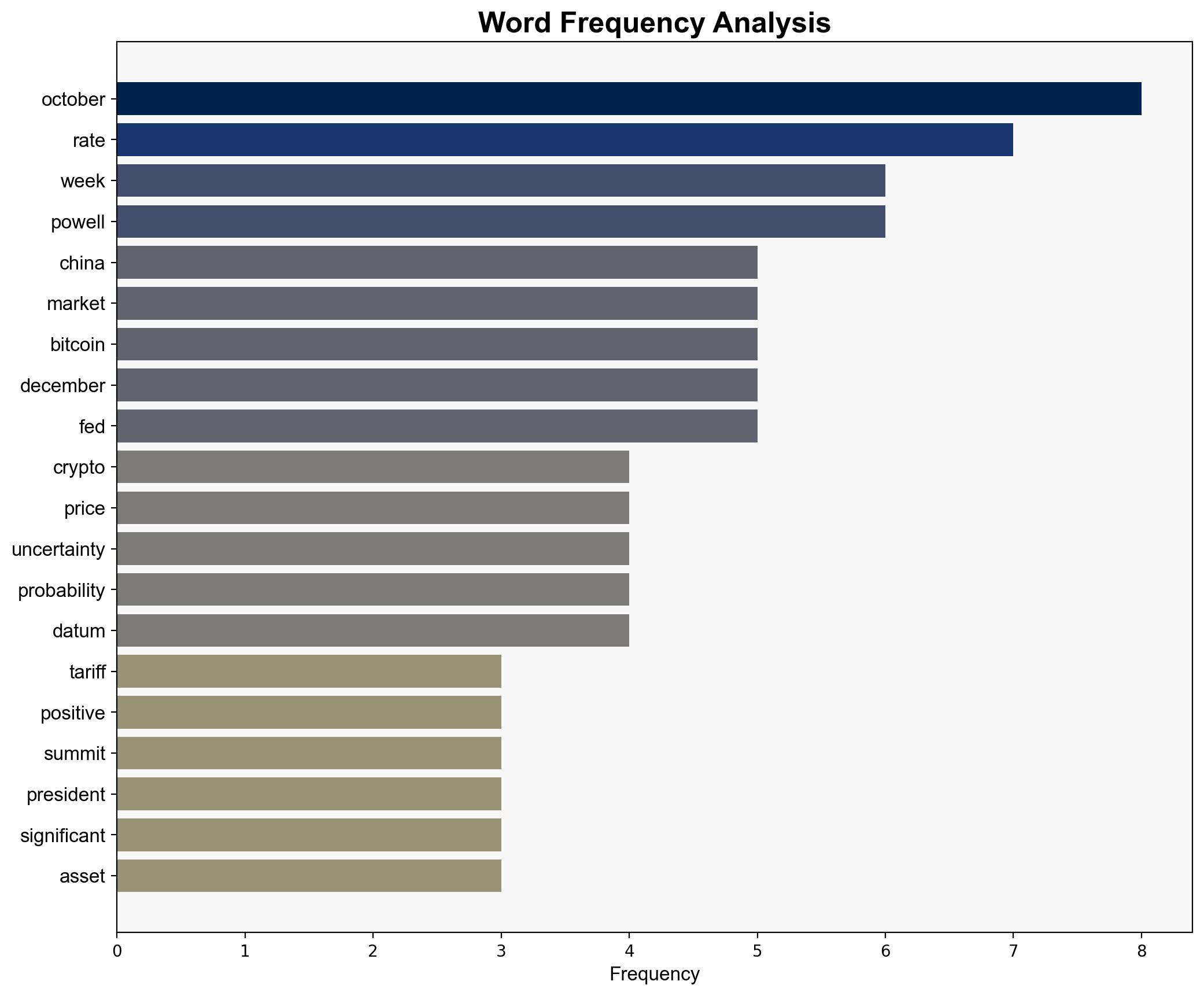

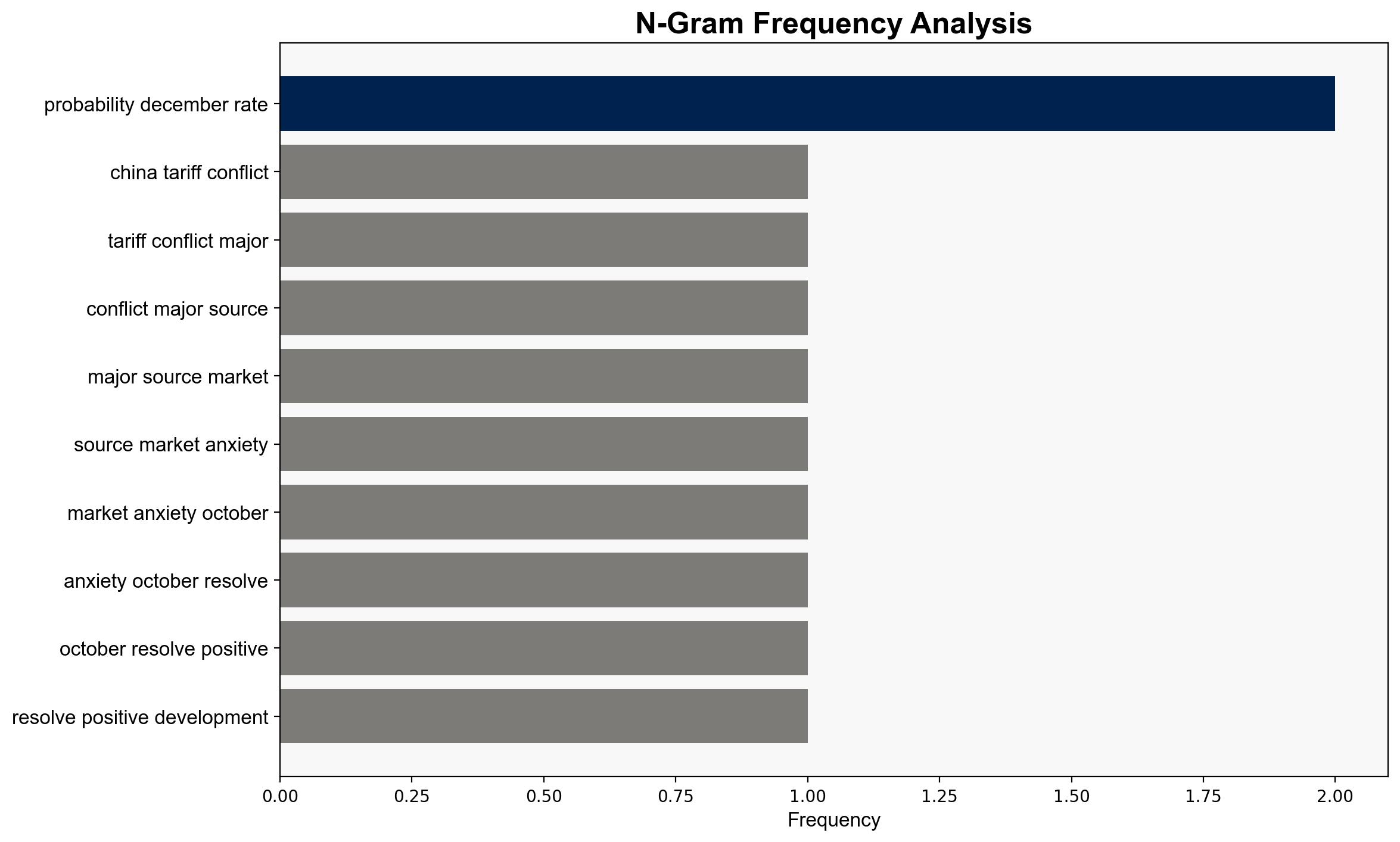

The most supported hypothesis is that Bitcoin’s failure to rally despite the US-China truce is primarily due to the Federal Reserve’s introduction of monetary policy uncertainty, which has overshadowed positive geopolitical developments. Confidence level: Moderate. Recommended action: Monitor Federal Reserve communications closely for clearer guidance on future monetary policy, as this will likely have a significant impact on Bitcoin and broader crypto market movements.

2. Competing Hypotheses

1. **Hypothesis A**: Bitcoin’s lack of rally is due to the overshadowing impact of Federal Reserve’s monetary policy uncertainty, which has introduced new risks that outweigh the positive effects of the US-China truce.

2. **Hypothesis B**: Bitcoin’s failure to rally is due to inherent weaknesses in the crypto market, such as loss of momentum and liquidation of leveraged positions, independent of external geopolitical or economic developments.

Using ACH 2.0, Hypothesis A is better supported as the introduction of monetary policy uncertainty by the Federal Reserve is a significant factor affecting risk assets, including Bitcoin. The timing of Bitcoin’s price drop aligns with Federal Reserve announcements, suggesting a strong correlation.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that Federal Reserve policy decisions have a direct and immediate impact on Bitcoin prices. Another assumption is that geopolitical developments like the US-China truce should inherently boost Bitcoin as a risk asset.

– **Red Flags**: The potential over-reliance on Federal Reserve actions as the sole driver of Bitcoin’s price movement could be misleading. Additionally, the assumption that Bitcoin should behave like traditional risk assets may not hold due to its unique market dynamics.

– **Blind Spots**: The analysis may overlook other macroeconomic factors, such as inflation data or employment figures, which could also influence Bitcoin prices.

4. Implications and Strategic Risks

The introduction of uncertainty by the Federal Reserve poses a strategic risk to the crypto market by potentially triggering volatility. If the Federal Reserve signals further rate cuts or holds, it could lead to significant shifts in investor sentiment. Additionally, the inherent volatility in the crypto market could exacerbate these effects, leading to rapid price swings.

5. Recommendations and Outlook

- Monitor Federal Reserve announcements and macroeconomic indicators closely to anticipate potential impacts on Bitcoin prices.

- Consider diversifying investments to mitigate risks associated with crypto market volatility.

- Scenario Projections:

- Best Case: Clear guidance from the Federal Reserve leads to a stabilization of Bitcoin prices and potential rally.

- Worst Case: Continued uncertainty from the Federal Reserve results in prolonged volatility and further declines in Bitcoin prices.

- Most Likely: Bitcoin prices remain volatile with short-term fluctuations driven by Federal Reserve communications and macroeconomic data releases.

6. Key Individuals and Entities

– Jerome Powell

– Raphael Bostic

– Lisa Cook

– Michelle Bowman

– Michael Barr

– Christopher Waller

7. Thematic Tags

national security threats, cybersecurity, counter-terrorism, regional focus