Locksley receives LoI from EXIM for Mojave project in California – Mining Technology

Published on: 2025-11-04

Intelligence Report: Locksley receives LoI from EXIM for Mojave project in California – Mining Technology

1. BLUF (Bottom Line Up Front)

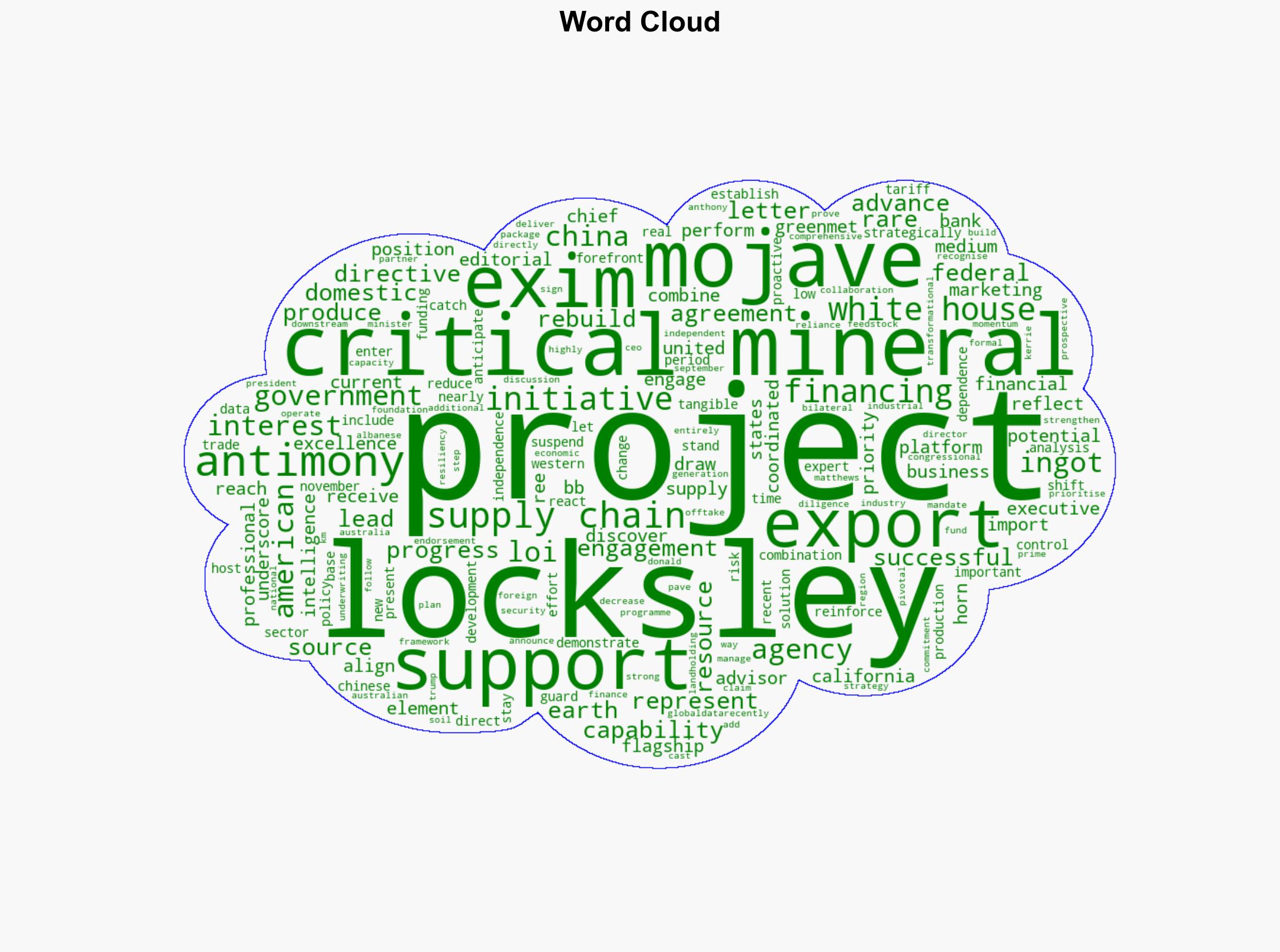

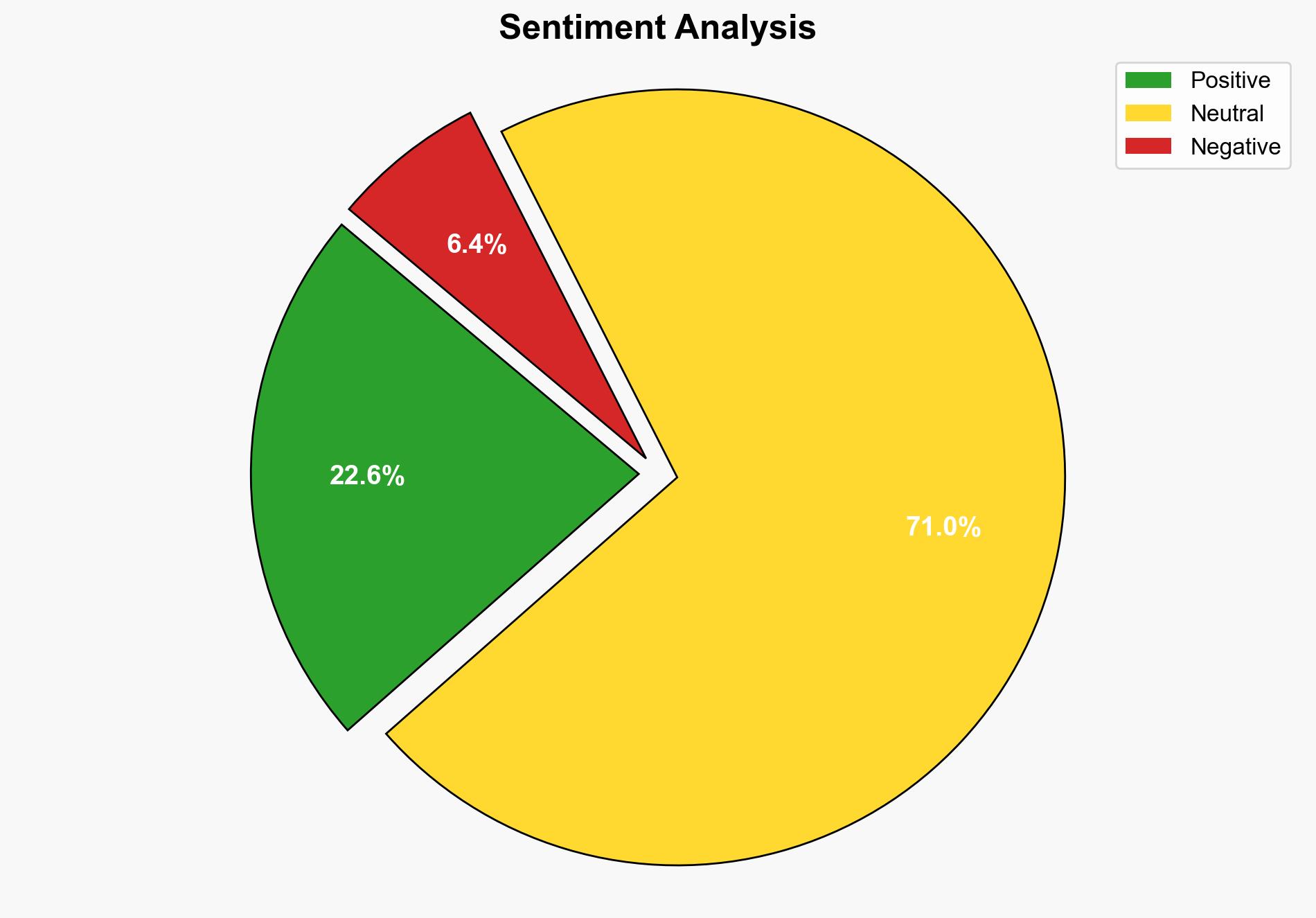

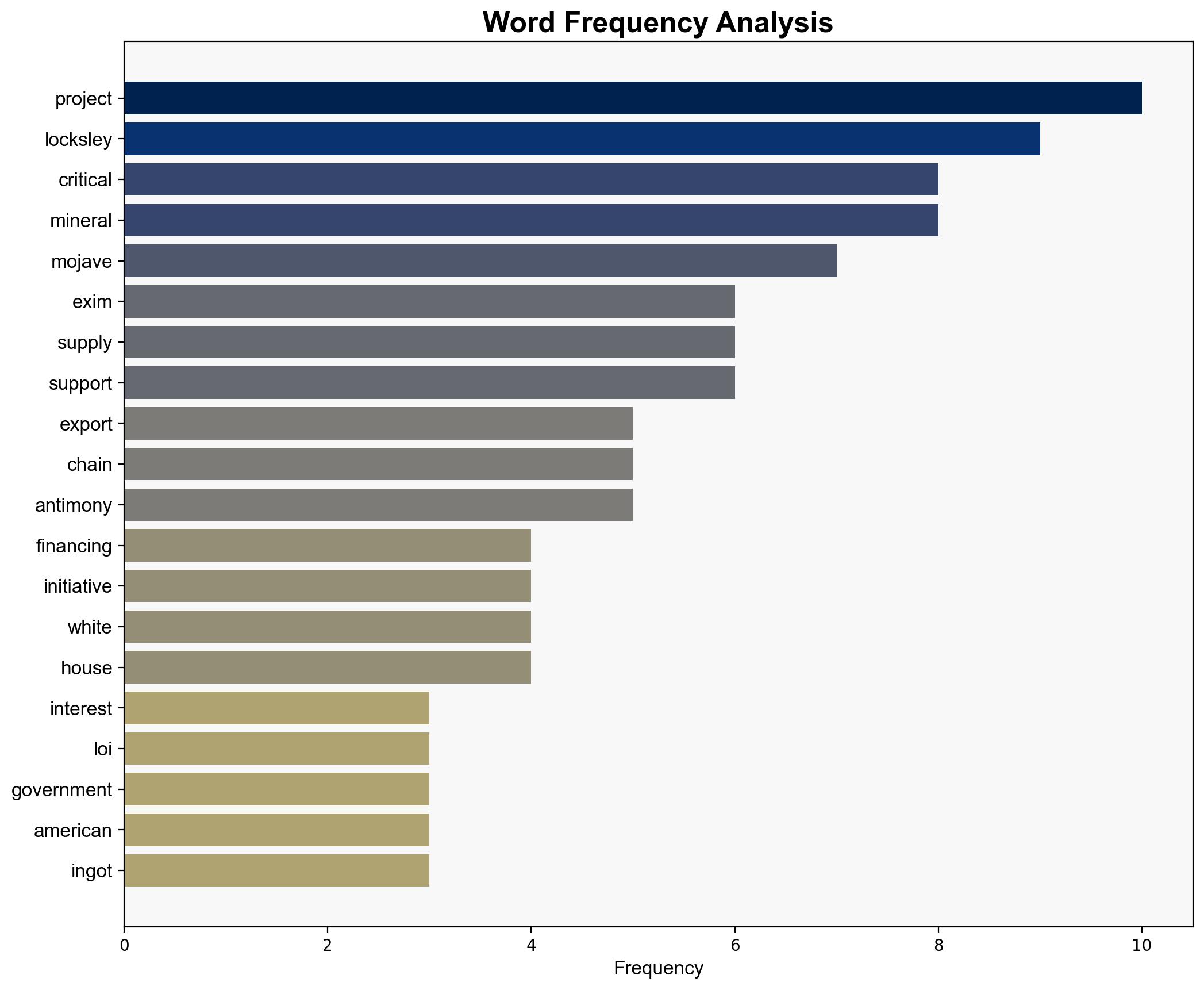

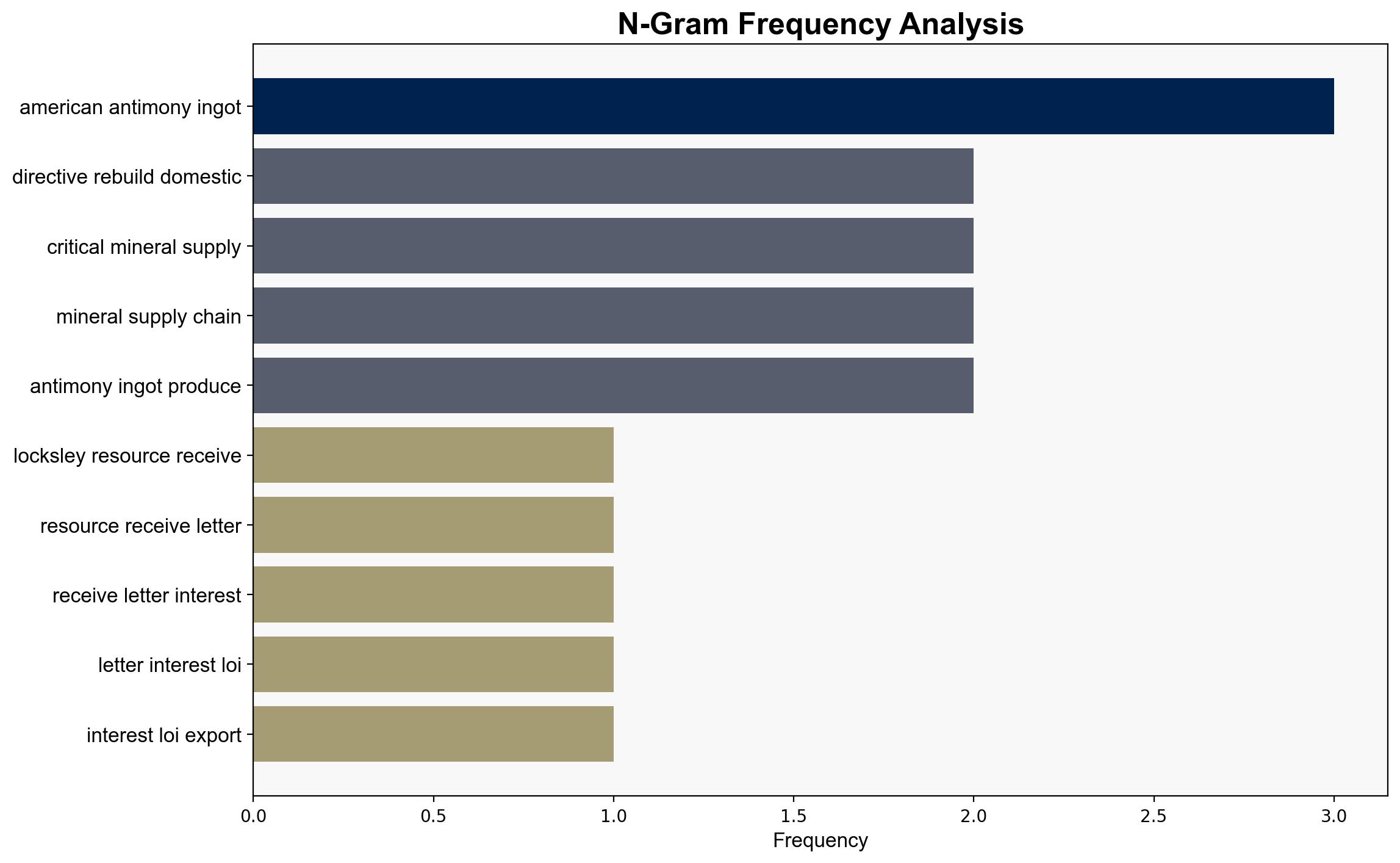

The most supported hypothesis is that the EXIM’s Letter of Interest (LoI) for Locksley’s Mojave project is a strategic move aligned with the White House’s directive to rebuild domestic supply chains for critical minerals, particularly antimony and rare earth elements (REEs). Confidence Level: High. Recommended action: Monitor the project’s progress and assess the impact on U.S. supply chain independence and geopolitical positioning.

2. Competing Hypotheses

1. **Hypothesis A**: The LoI from EXIM is primarily a strategic initiative to bolster U.S. domestic supply chains for critical minerals, reducing dependency on foreign sources, particularly China.

2. **Hypothesis B**: The LoI is more of a symbolic gesture, with limited immediate impact on the actual production and supply chain independence, serving primarily as a political statement rather than a substantive economic shift.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis A is better supported due to the alignment with broader government directives and recent geopolitical developments, such as China’s export control measures.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that EXIM’s involvement will lead to substantial financial backing and that the Mojave project will significantly impact the U.S. supply chain.

– **Red Flags**: The potential over-reliance on government support and the assumption that geopolitical tensions will not escalate further, affecting project feasibility.

– **Blind Spots**: Lack of detailed financial projections and timelines for the project’s completion and operationalization.

4. Implications and Strategic Risks

– **Economic**: Successful implementation could enhance U.S. economic resilience by reducing reliance on Chinese REEs.

– **Geopolitical**: Strengthening domestic supply chains may provoke countermeasures from China, potentially escalating trade tensions.

– **Cyber**: Increased attention on critical mineral projects may attract cyber threats targeting supply chain vulnerabilities.

– **Psychological**: Domestic confidence in U.S. industrial capabilities may rise, but failure to deliver could lead to skepticism about government initiatives.

5. Recommendations and Outlook

- **Mitigation**: Develop contingency plans for potential geopolitical escalations and cyber threats.

- **Exploitation**: Leverage the project to strengthen alliances with countries like Australia, enhancing bilateral cooperation on critical minerals.

- **Scenario Projections**:

– **Best Case**: Successful project completion leads to a robust domestic supply chain, reducing foreign dependency.

– **Worst Case**: Project delays or geopolitical tensions undermine the initiative, leading to increased reliance on foreign sources.

– **Most Likely**: Gradual progress with moderate impact on supply chain independence, contingent on sustained government support.

6. Key Individuals and Entities

– Kerrie Matthews

– EXIM (Export-Import Bank of the United States)

– Locksley Resources

– White House advisors on critical minerals

7. Thematic Tags

national security threats, supply chain resilience, critical minerals, geopolitical strategy