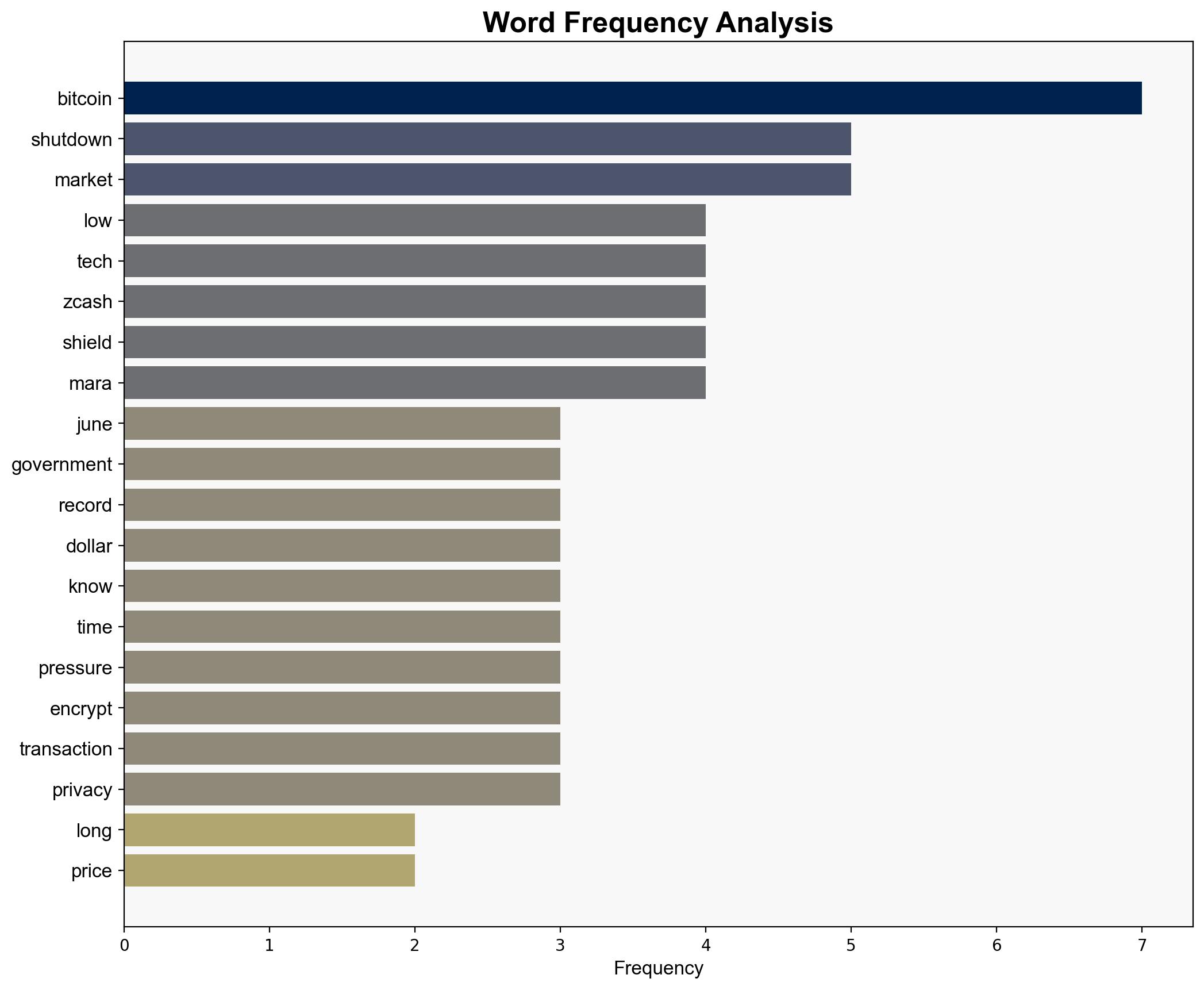

Bitcoin Nears Lowest Since June as US Government Shutdown Hits Joint Longest – CoinDesk

Published on: 2025-11-04

Intelligence Report: Bitcoin Nears Lowest Since June as US Government Shutdown Hits Joint Longest – CoinDesk

1. BLUF (Bottom Line Up Front)

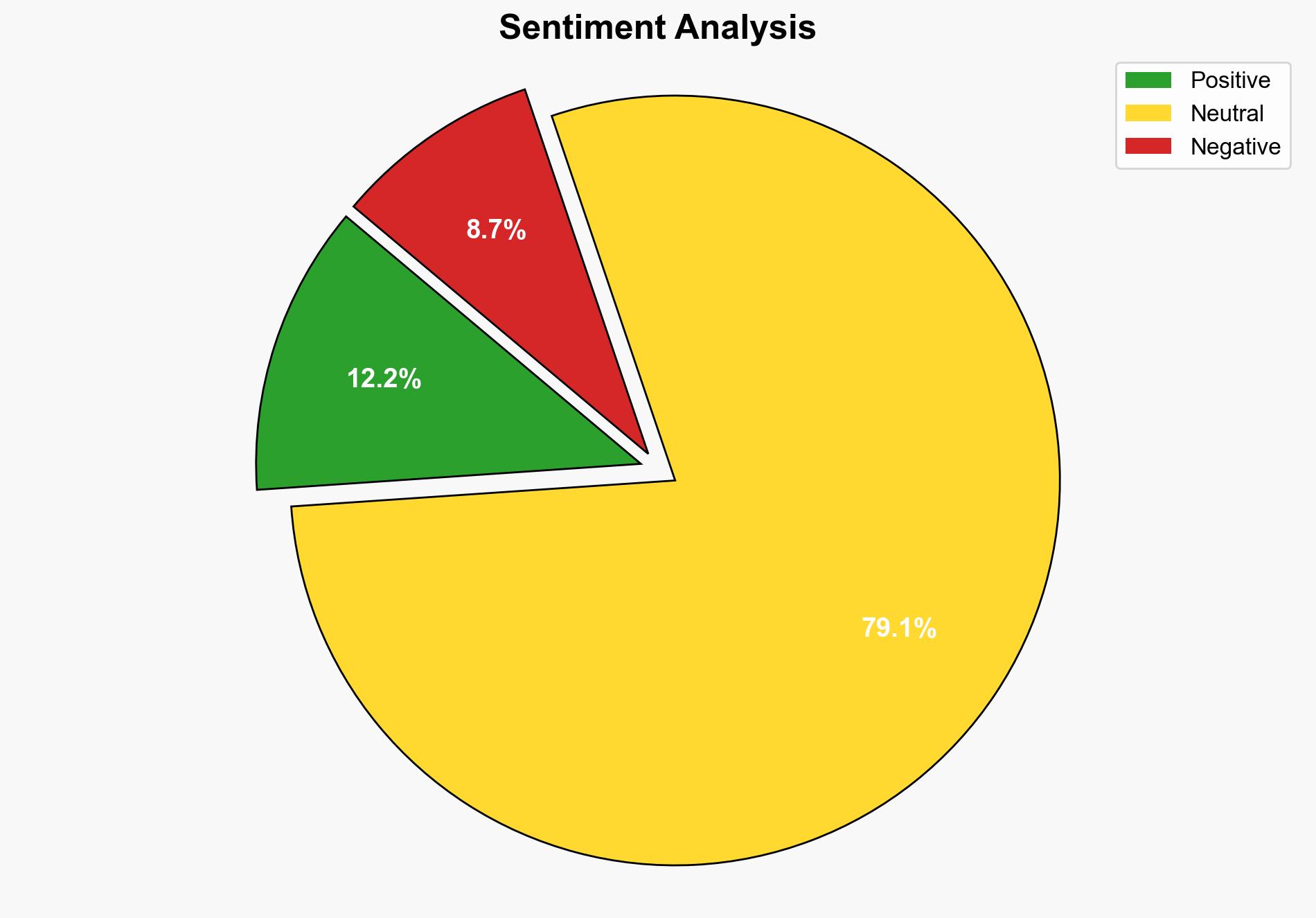

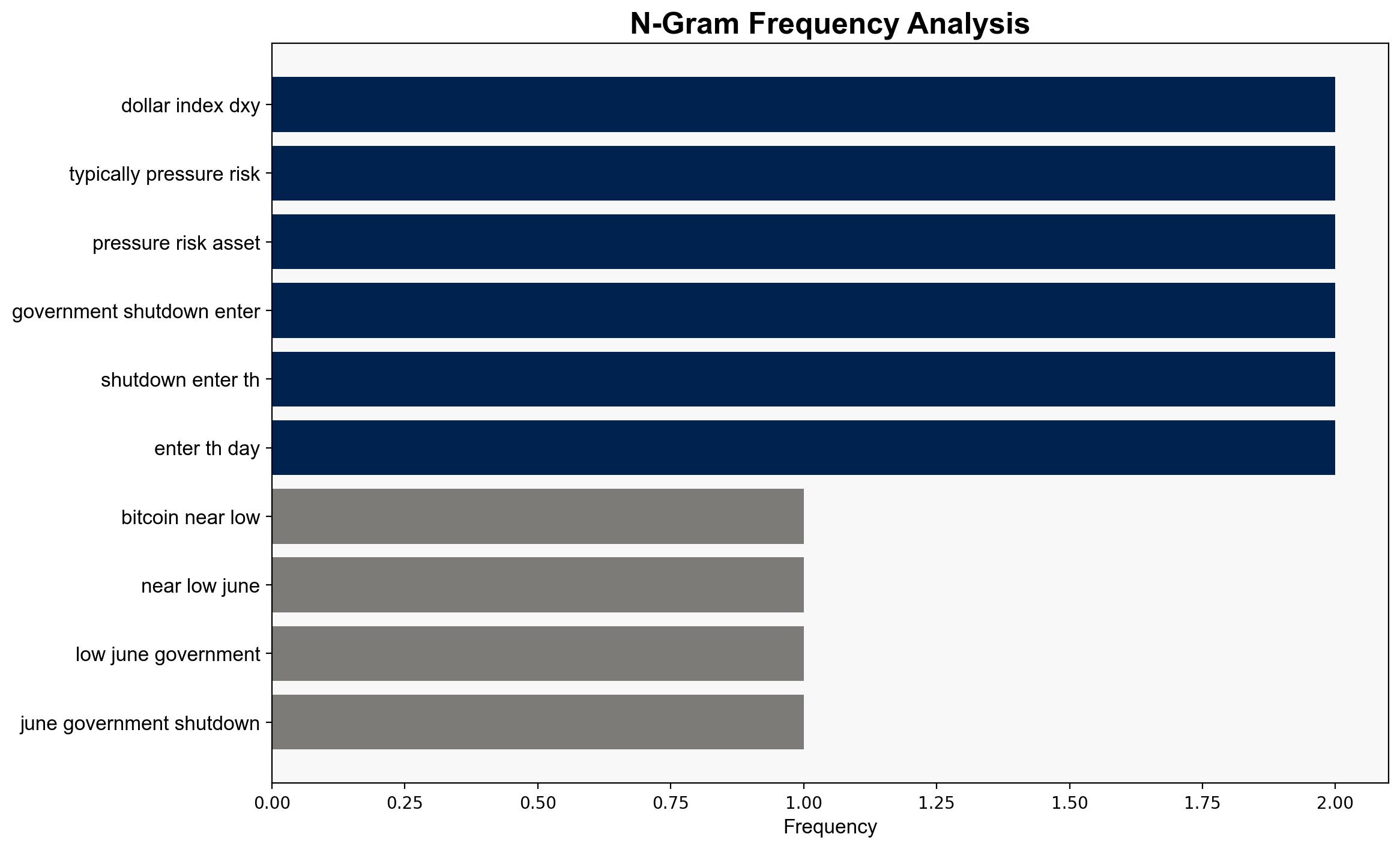

The analysis suggests that the prolonged U.S. government shutdown and the strengthening U.S. dollar are exerting downward pressure on Bitcoin prices. The hypothesis that the government shutdown will extend into mid-November, further impacting Bitcoin, is better supported. Confidence level: Moderate. Recommended action: Monitor Bitcoin and related markets closely for signs of further decline and potential buying opportunities if prices stabilize.

2. Competing Hypotheses

Hypothesis 1: The U.S. government shutdown and strengthening dollar are the primary drivers of Bitcoin’s price decline, with the shutdown likely to extend, exacerbating the situation.

Hypothesis 2: Bitcoin’s price decline is primarily driven by internal market factors and investor sentiment, with the government shutdown and dollar strength playing a secondary role.

3. Key Assumptions and Red Flags

Assumptions: Hypothesis 1 assumes a direct correlation between the government shutdown, dollar strength, and Bitcoin prices. Hypothesis 2 assumes that internal market dynamics are the dominant factors influencing Bitcoin.

Red Flags: The potential for cognitive bias in attributing Bitcoin’s decline solely to external factors like the government shutdown. Lack of detailed data on investor sentiment and internal market dynamics.

4. Implications and Strategic Risks

The prolonged government shutdown could lead to increased market volatility, affecting not only Bitcoin but also broader financial markets. A continued decline in Bitcoin prices may impact investor confidence in cryptocurrencies, leading to a potential sell-off. Geopolitical tensions, such as those with Iran, could further destabilize markets.

5. Recommendations and Outlook

- Monitor developments in the U.S. government shutdown closely, as its resolution or extension will significantly impact market dynamics.

- Consider potential buying opportunities if Bitcoin prices stabilize or show signs of recovery.

- Scenario Projections:

- Best Case: Government shutdown resolves quickly, Bitcoin stabilizes, and investor confidence returns.

- Worst Case: Shutdown extends, Bitcoin prices continue to fall, leading to broader market instability.

- Most Likely: Shutdown extends into mid-November, maintaining pressure on Bitcoin prices.

6. Key Individuals and Entities

Sean Bowe (Project Tachyon lead), Mara Holdings, Polymarket.

7. Thematic Tags

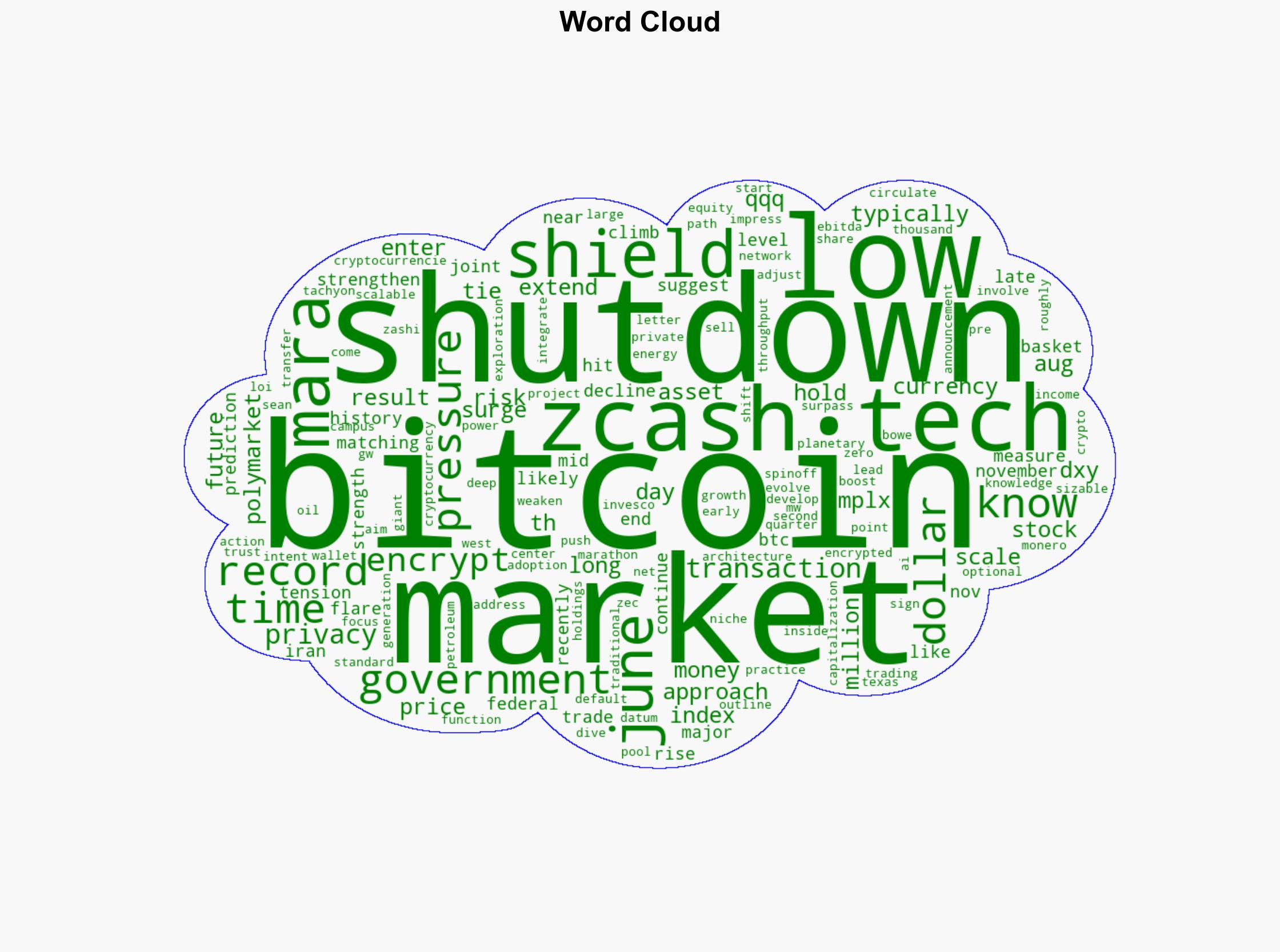

national security threats, cybersecurity, economic stability, cryptocurrency markets