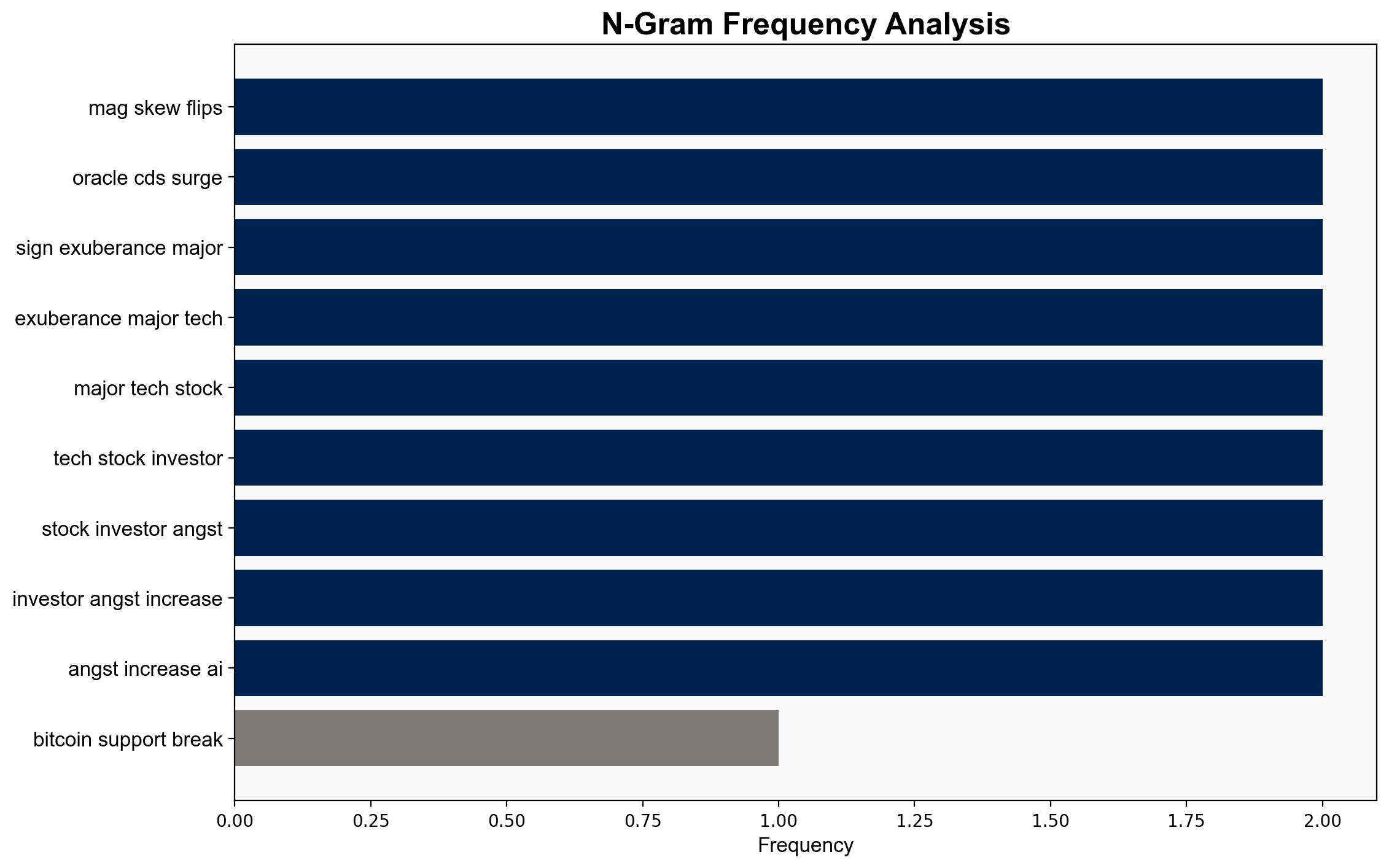

Bitcoins Last Support Before 100K Breaks as ‘Mag 7’ Skew Flips Oracle CDS Surges – CoinDesk

Published on: 2025-11-04

Intelligence Report: Bitcoins Last Support Before 100K Breaks as ‘Mag 7’ Skew Flips Oracle CDS Surges – CoinDesk

1. BLUF (Bottom Line Up Front)

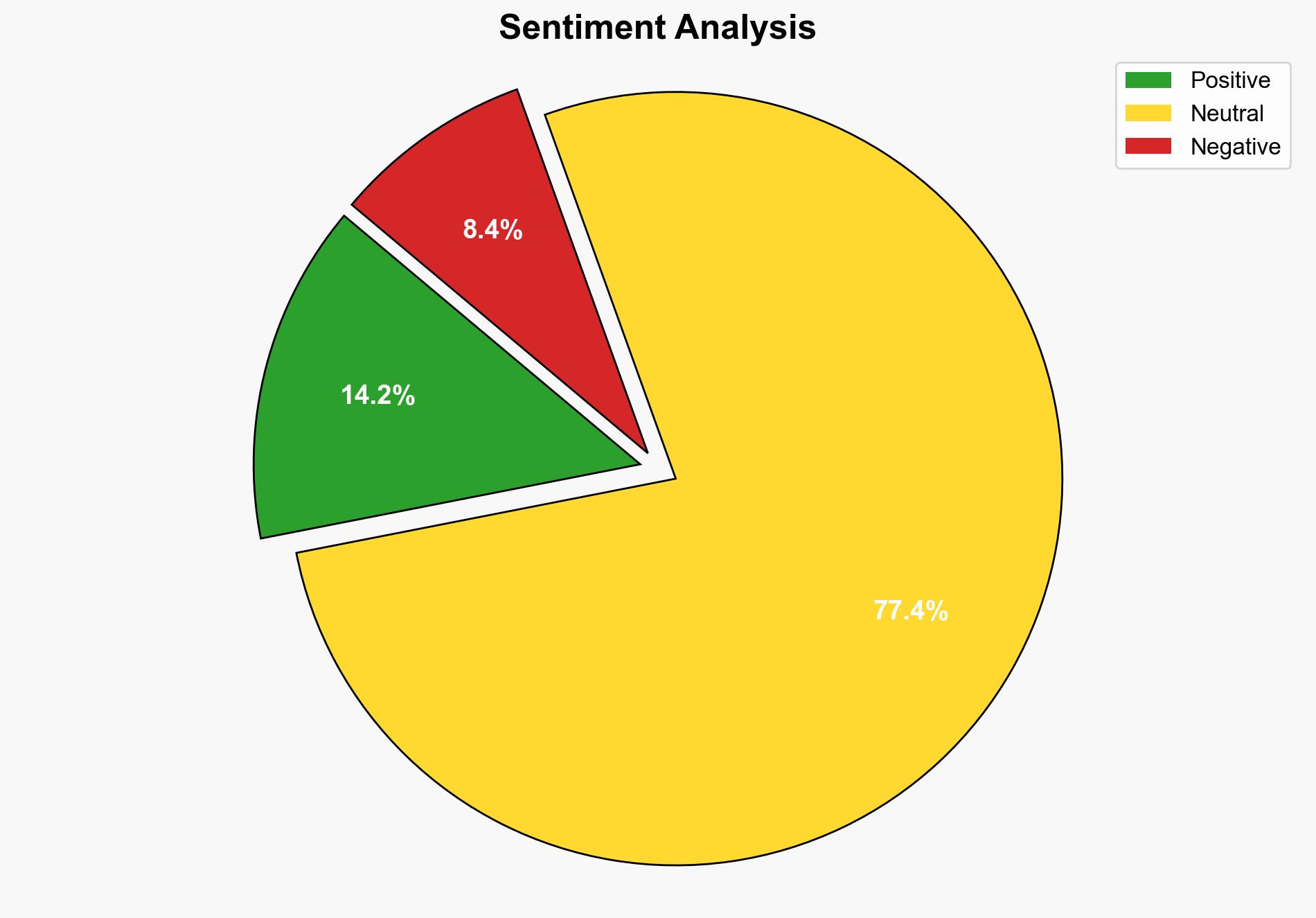

The strategic judgment indicates a moderate confidence level that Bitcoin’s current market behavior reflects a potential short-term consolidation phase rather than a sustained downturn. The hypothesis that Bitcoin will stabilize after a brief correction is better supported by the data. Recommended action includes monitoring market indicators closely for signs of stabilization or further decline, particularly in relation to tech stock performance and macroeconomic factors.

2. Competing Hypotheses

1. **Hypothesis 1**: Bitcoin’s breach of key support levels signals a deeper, sustained downturn driven by investor anxiety over tech stocks and macroeconomic pressures.

2. **Hypothesis 2**: The current market behavior represents a short-term consolidation phase, with Bitcoin likely to stabilize and potentially rebound after a brief correction, influenced by tech stock performance and AI investment trends.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 2 is better supported. The low skew readings historically align with short-term consolidation and reversal, suggesting a temporary market adjustment rather than a prolonged decline.

3. Key Assumptions and Red Flags

– **Assumptions**: It is assumed that the correlation between tech stock performance and Bitcoin is significant, and that AI investment trends will continue to influence market dynamics.

– **Red Flags**: Potential over-reliance on historical skew data as a predictive tool; lack of consideration for geopolitical events that could impact market sentiment.

– **Blind Spots**: Insufficient analysis of regulatory developments that could affect cryptocurrency markets.

4. Implications and Strategic Risks

– **Economic Risks**: A sustained downturn in Bitcoin could lead to broader market instability, affecting investor confidence in risk assets.

– **Cyber Risks**: Increased volatility may attract cyber threats targeting cryptocurrency exchanges and wallets.

– **Geopolitical Risks**: Global economic tensions, particularly involving major tech companies, could exacerbate market instability.

– **Psychological Risks**: Investor sentiment could shift rapidly, leading to panic selling or irrational exuberance.

5. Recommendations and Outlook

- Monitor tech stock performance and AI investment trends as leading indicators for Bitcoin’s market behavior.

- Prepare for scenario-based outcomes:

- **Best Case**: Bitcoin stabilizes and rebounds, driven by renewed investor confidence in tech stocks.

- **Worst Case**: Prolonged downturn leads to broader market instability and potential regulatory intervention.

- **Most Likely**: Short-term consolidation followed by stabilization, contingent on macroeconomic conditions.

- Enhance cybersecurity measures for cryptocurrency platforms to mitigate potential threats during periods of volatility.

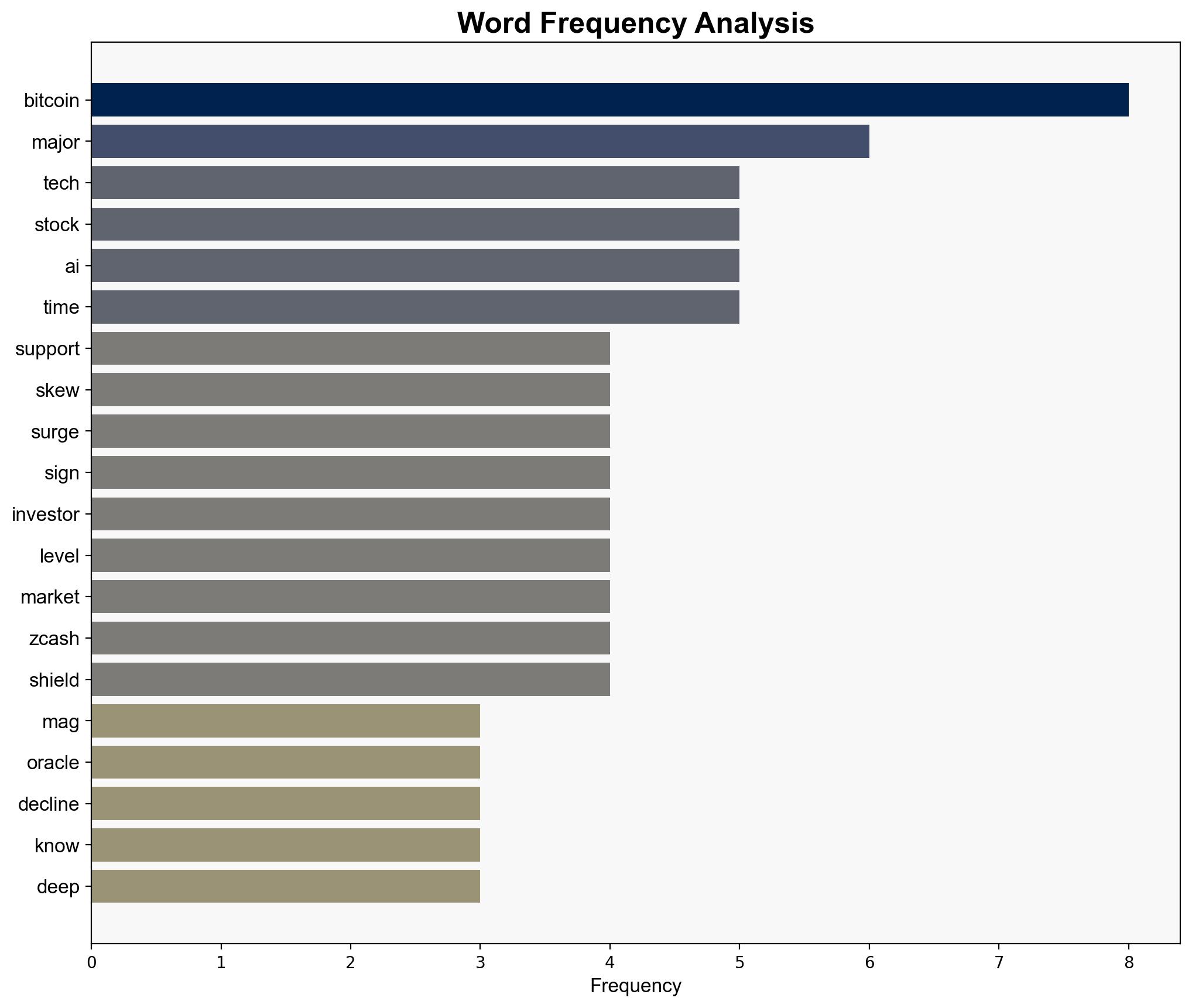

6. Key Individuals and Entities

– Markus Thielen

– Neil Sethi

– Oracle

– Zcash

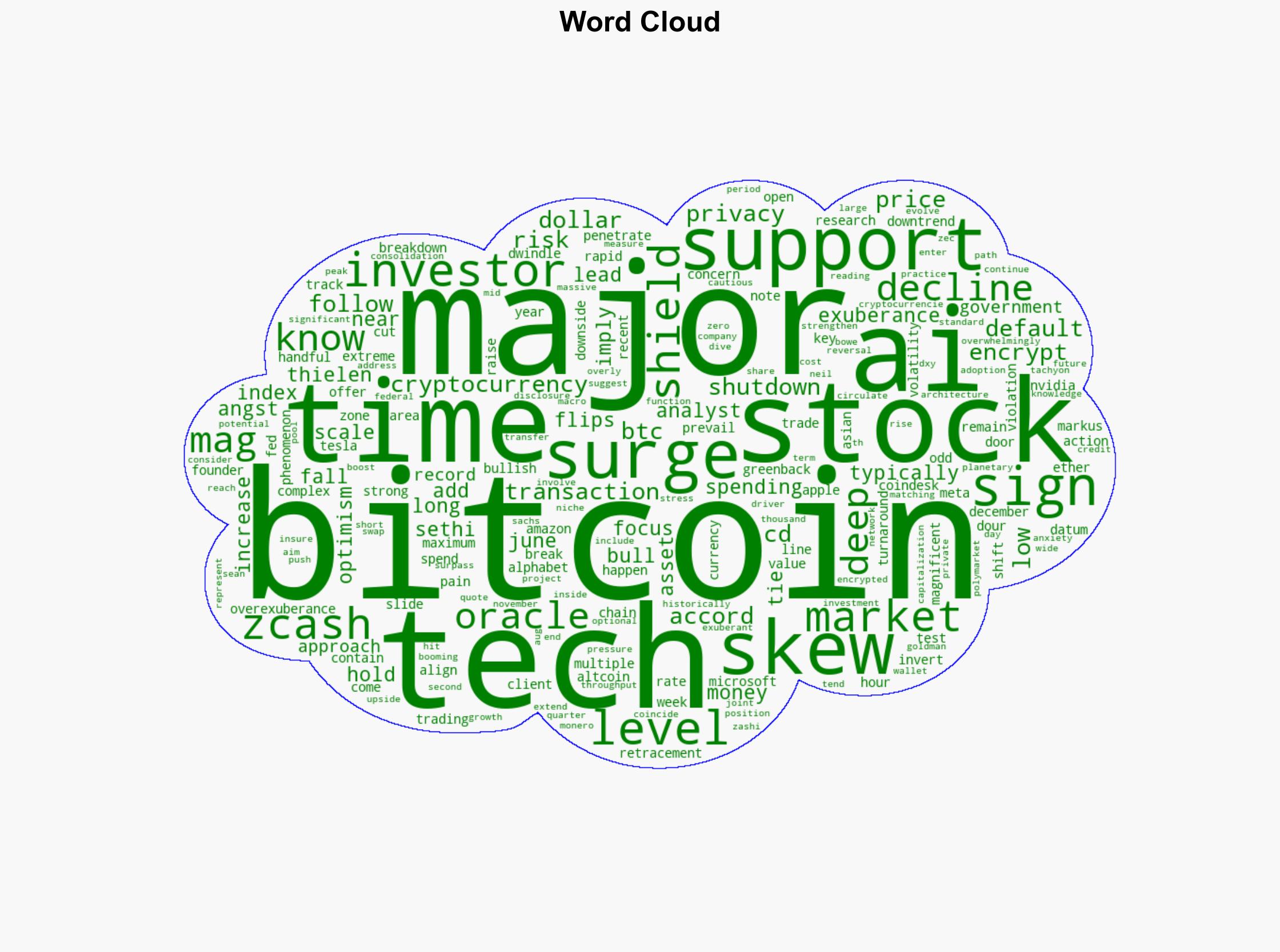

7. Thematic Tags

national security threats, cybersecurity, economic stability, cryptocurrency market dynamics