Indias biggest private equity fund 22 bn ChrysCapital fundraise opens to domestic LPs for first time – BusinessLine

Published on: 2025-11-05

Intelligence Report: Indias biggest private equity fund 22 bn ChrysCapital fundraise opens to domestic LPs for first time – BusinessLine

1. BLUF (Bottom Line Up Front)

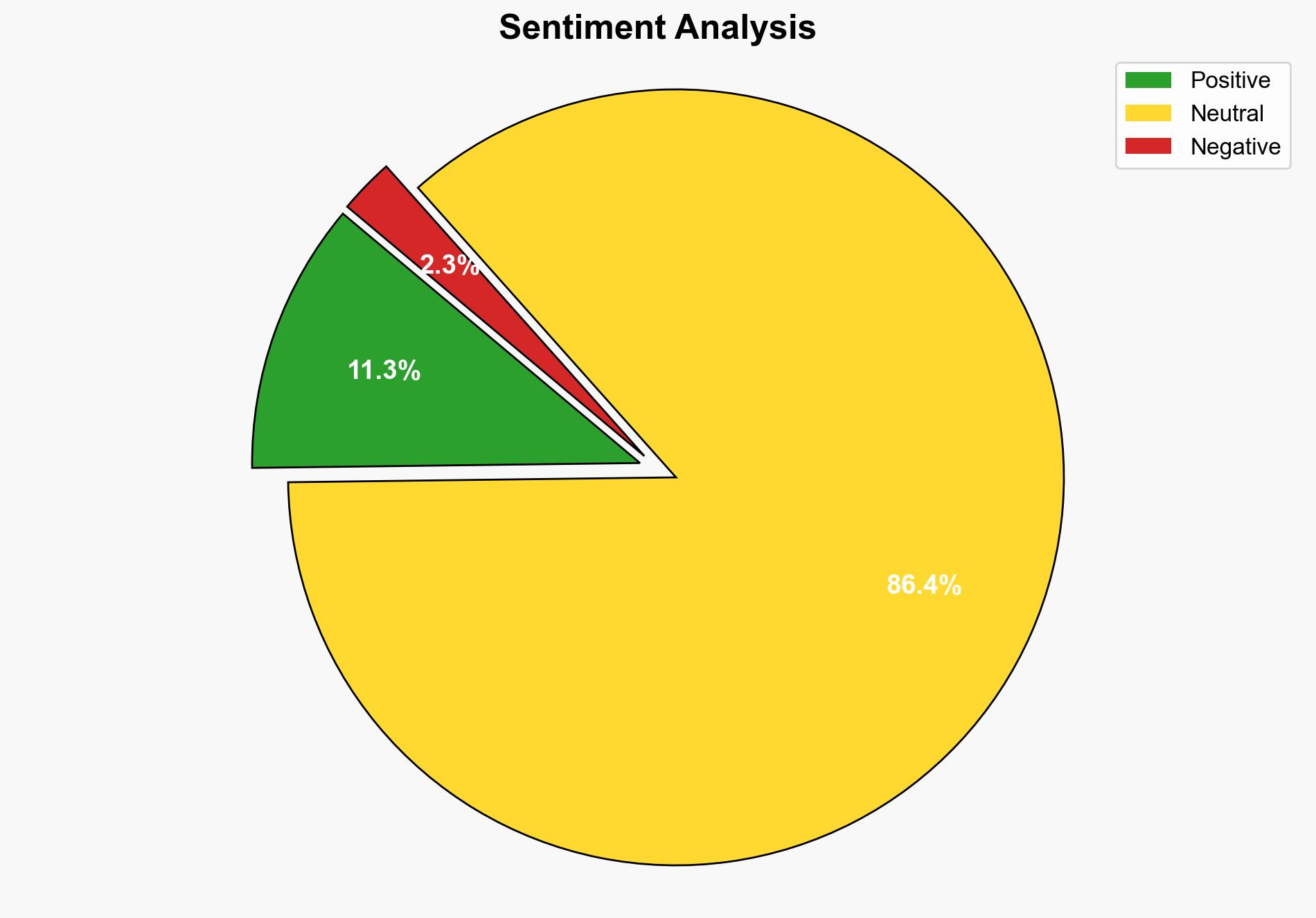

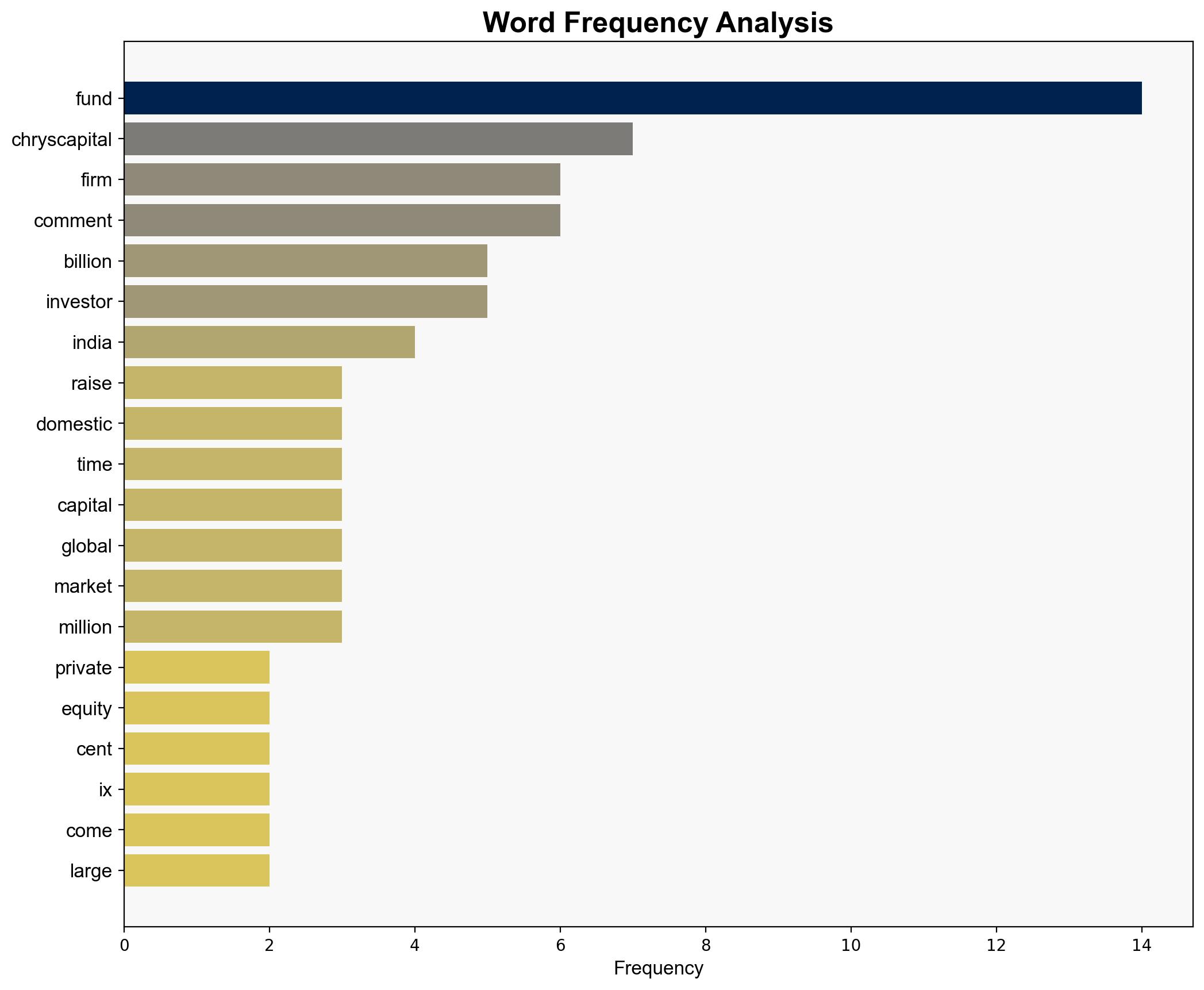

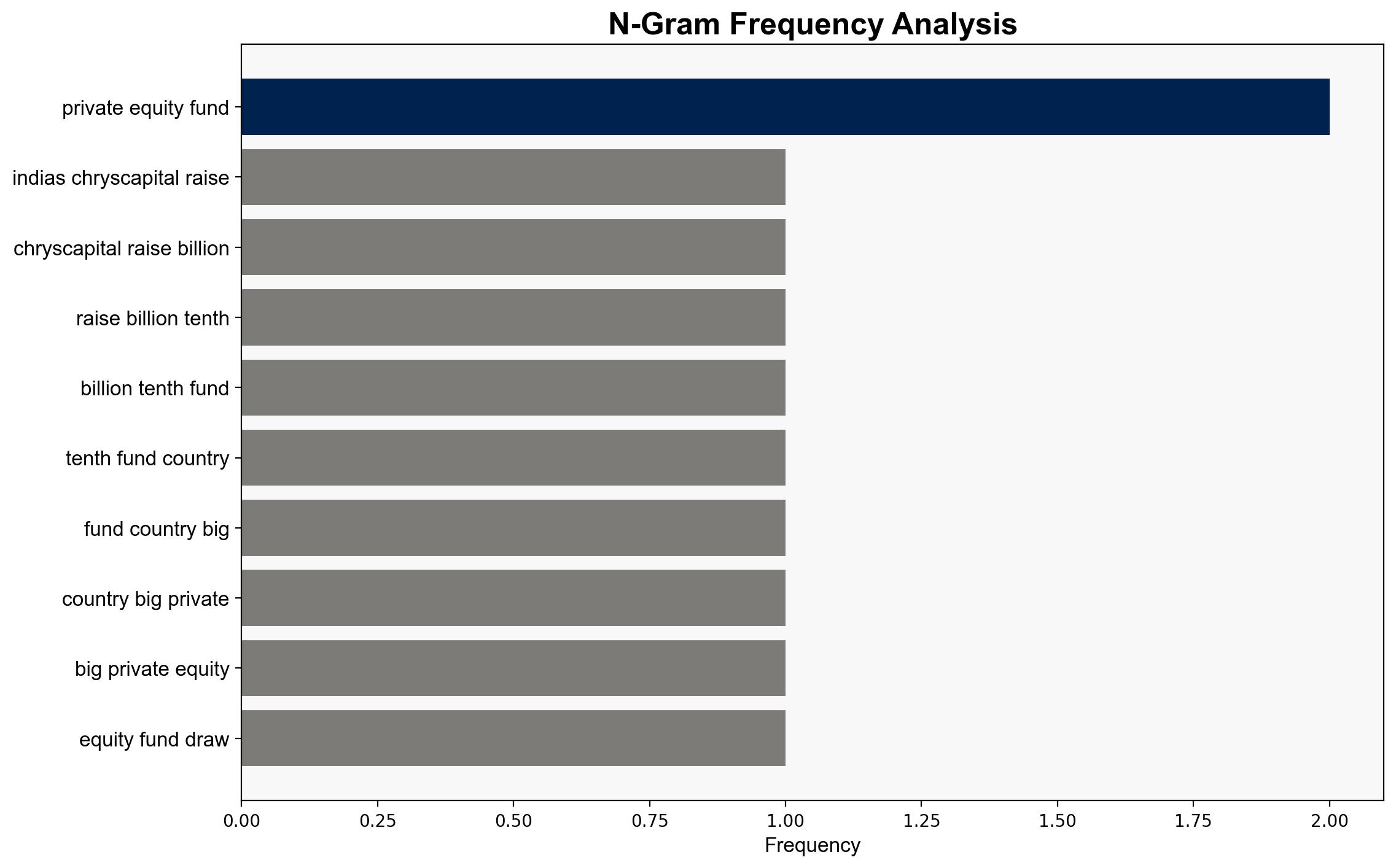

ChrysCapital’s decision to open its $22 billion fund to domestic limited partners (LPs) for the first time represents a strategic shift in India’s private equity landscape, potentially increasing domestic investment influence. The most supported hypothesis suggests this move is driven by a strategic response to global economic shifts and increased domestic wealth. Confidence level: Moderate. Recommended action: Monitor domestic LP engagement and its impact on India’s investment ecosystem.

2. Competing Hypotheses

Hypothesis 1: ChrysCapital’s decision to include domestic LPs is primarily driven by a strategic response to global economic uncertainties and the desire to diversify its investor base.

Hypothesis 2: The inclusion of domestic LPs is a tactical move to capitalize on the rising domestic wealth and growing interest in private equity within India.

Using ACH 2.0, Hypothesis 1 is more supported due to the broader context of global economic shifts and the need for diversified investment strategies. However, Hypothesis 2 remains plausible given the rapid increase in domestic wealth and investment interest.

3. Key Assumptions and Red Flags

Assumptions include the stability of global economic conditions and the continued growth of domestic wealth. Potential cognitive biases involve overestimating the impact of domestic LPs on the fund’s success. A red flag is the lack of detailed information on the specific terms offered to domestic LPs, which could indicate potential risks or hidden conditions.

4. Implications and Strategic Risks

This development could shift the balance of investment power within India, potentially leading to increased competition among domestic investors. There is a risk of over-reliance on domestic capital if global economic conditions worsen. Geopolitically, this move might attract more international attention to India’s investment market, impacting regional dynamics.

5. Recommendations and Outlook

- Monitor the performance and influence of domestic LPs in ChrysCapital’s fund to assess shifts in the investment landscape.

- Scenario-based projections:

- Best Case: Successful integration of domestic LPs leads to a more robust and diversified investment portfolio.

- Worst Case: Economic downturns lead to reduced returns, affecting domestic LP confidence.

- Most Likely: Gradual increase in domestic LP participation, stabilizing the fund’s investor base.

6. Key Individuals and Entities

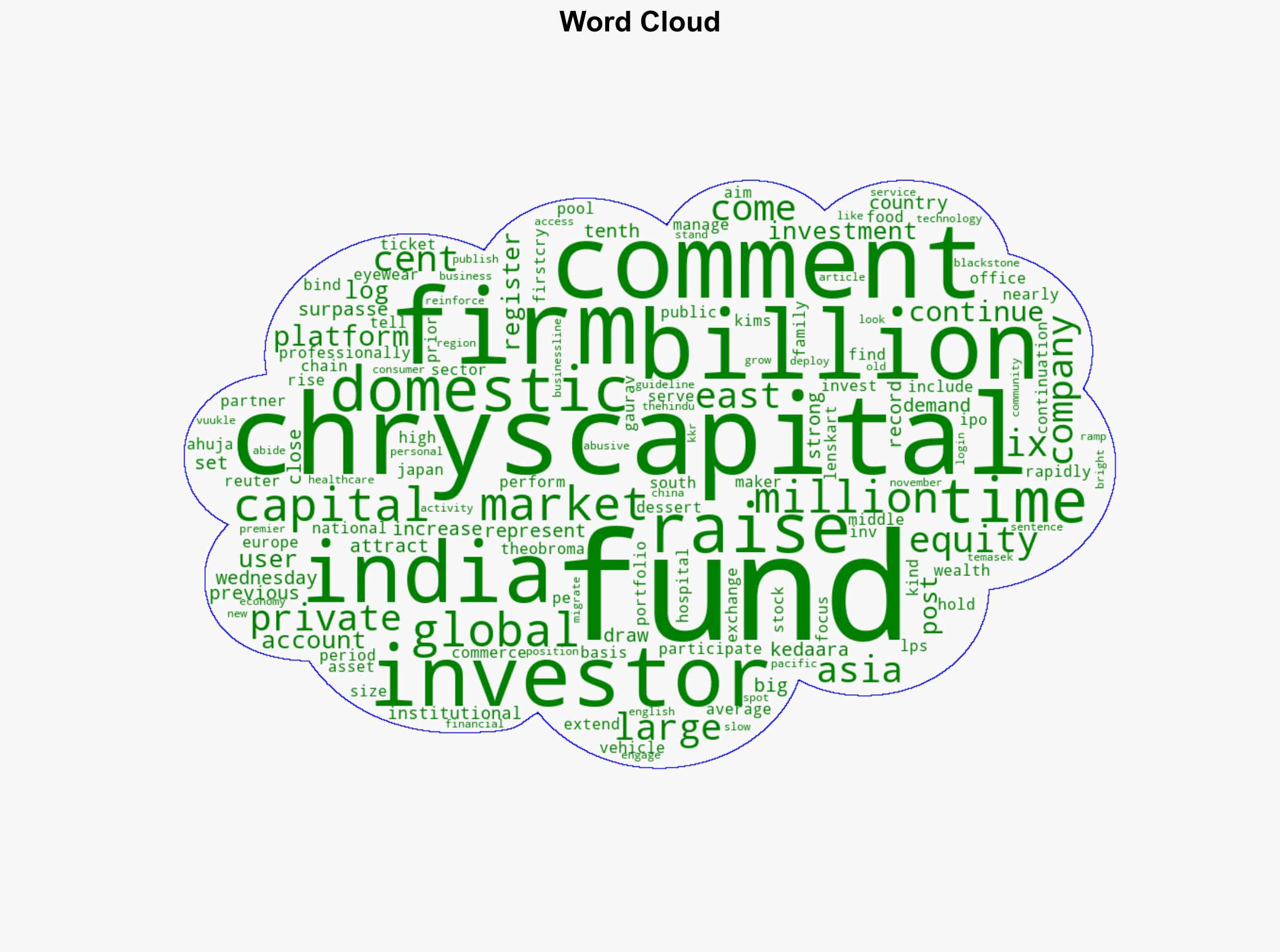

Gaurav Ahuja, ChrysCapital, Kedaara Capital, Theobroma, FirstCry, KIMS Hospital, Lenskart.

7. Thematic Tags

investment strategy, economic diversification, private equity, domestic investment, India market dynamics