Oil prices fall amid broader market selloff gains in US crude stockpiles – The Times of India

Published on: 2025-11-05

Intelligence Report: Oil prices fall amid broader market selloff gains in US crude stockpiles – The Times of India

1. BLUF (Bottom Line Up Front)

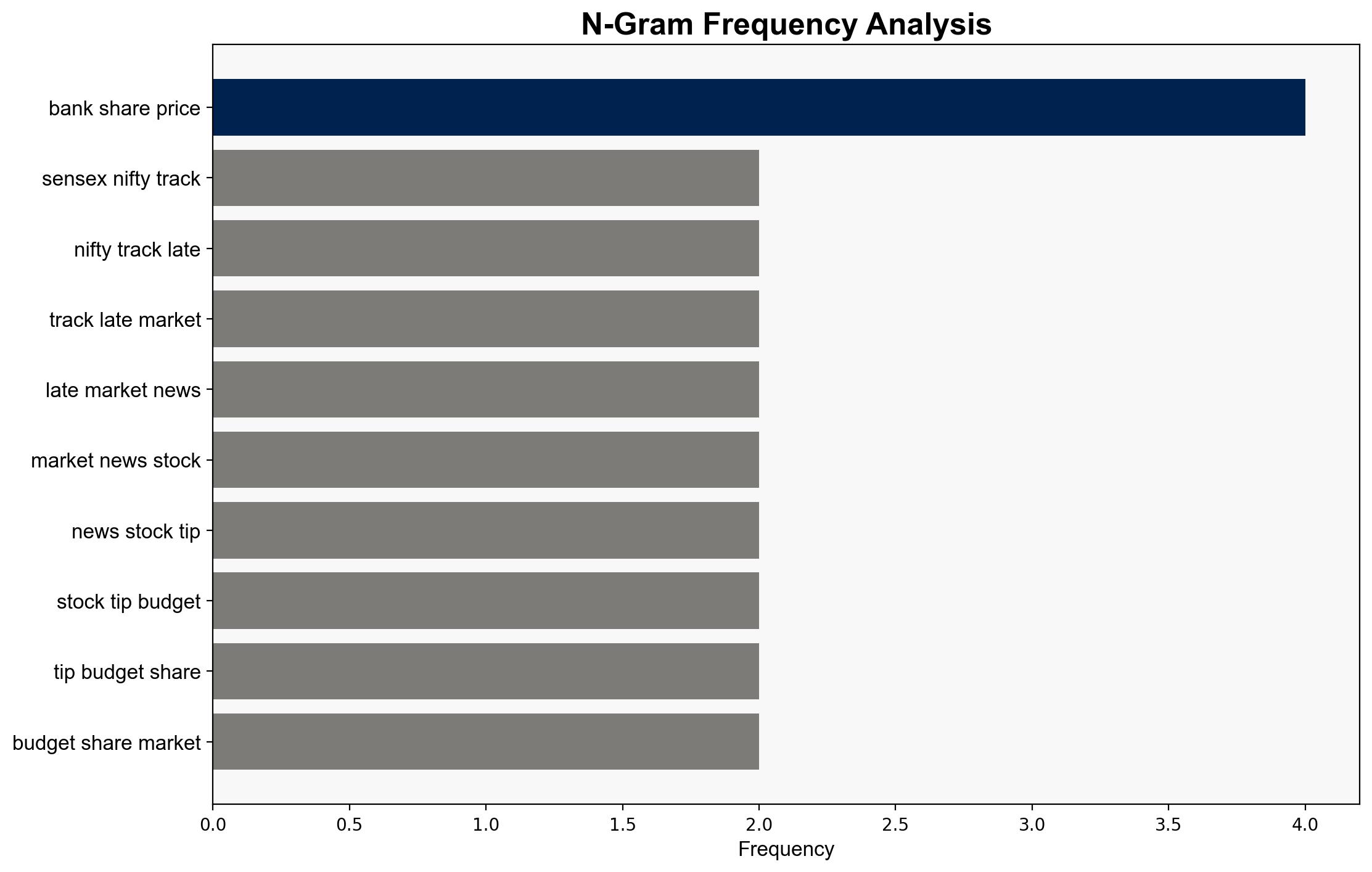

The most supported hypothesis is that the decline in oil prices is primarily driven by a combination of increased US crude stockpiles and a broader market selloff influenced by concerns over stock valuations and a strong US dollar. Confidence in this hypothesis is moderate, given the complexity of global oil markets and potential geopolitical influences. Recommended action includes monitoring OPEC’s production decisions and US economic indicators closely to anticipate further market movements.

2. Competing Hypotheses

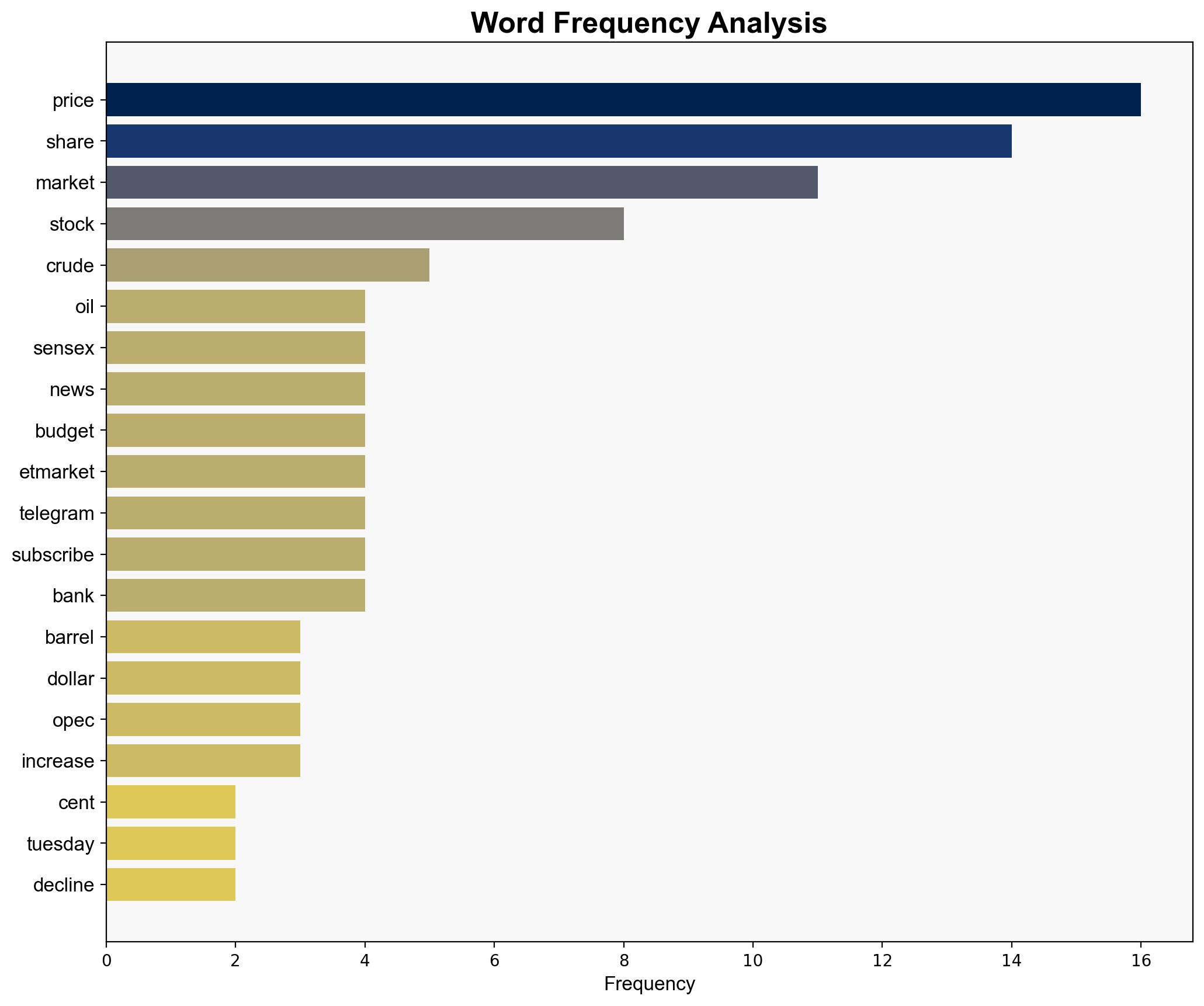

Hypothesis 1: The decline in oil prices is primarily due to increased US crude stockpiles and a strong US dollar, which makes oil more expensive for holders of other currencies, thereby reducing demand.

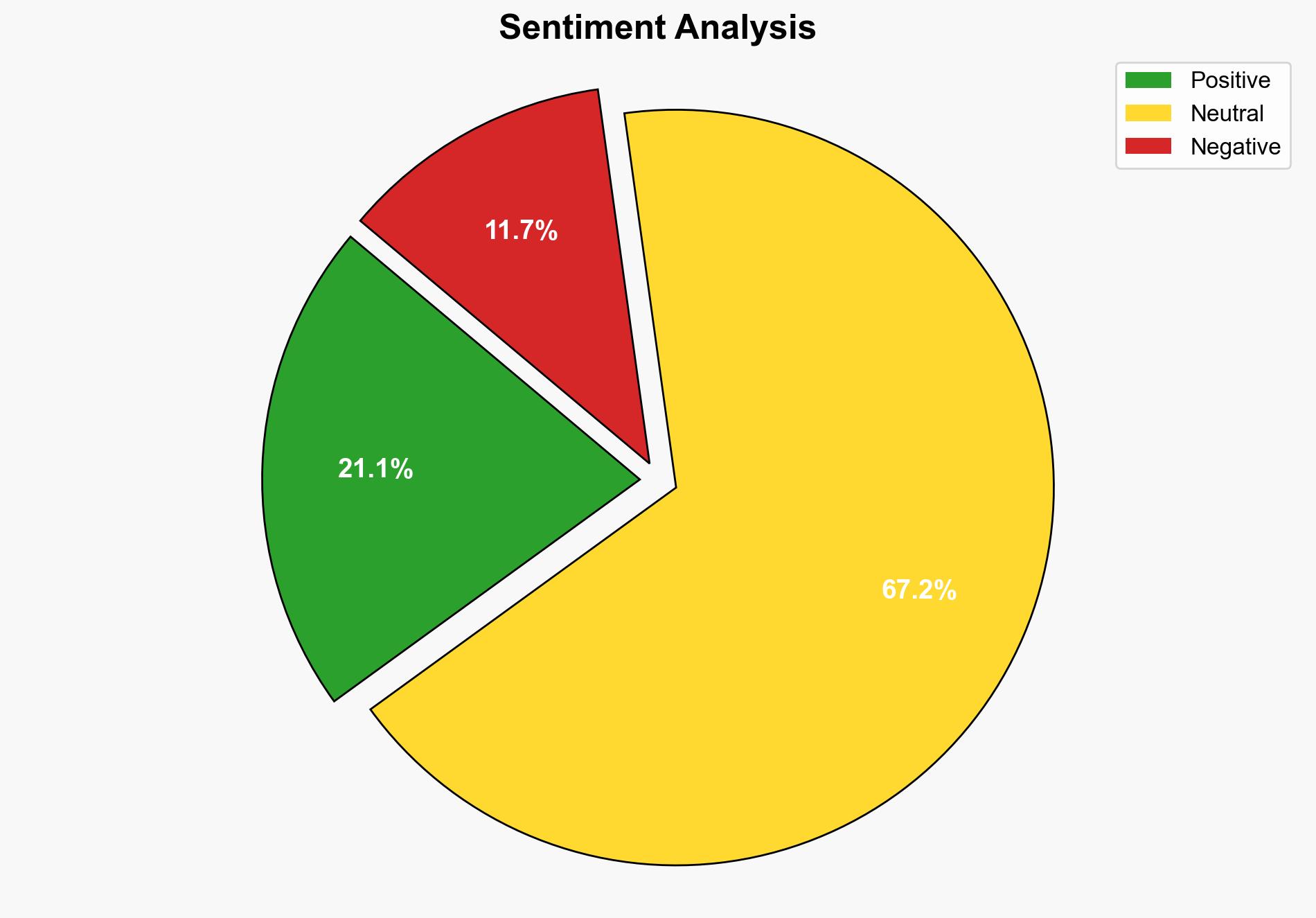

Hypothesis 2: The decline in oil prices is mainly driven by a broader market selloff, with investor sentiment negatively impacted by concerns over stock valuations and the potential economic impacts of artificial intelligence, leading to a shift towards safe-haven assets like the US dollar.

Structured Analytic Technique: Using ACH 2.0, Hypothesis 1 is better supported by the data, as the increase in US crude stockpiles is a direct and quantifiable factor affecting supply and demand dynamics. Hypothesis 2, while plausible, relies more on speculative investor sentiment and broader economic concerns.

3. Key Assumptions and Red Flags

Assumptions for Hypothesis 1 include the reliability of the American Petroleum Institute’s stockpile data and the continued strength of the US dollar. A red flag is the potential for geopolitical events to rapidly alter market dynamics, which is not accounted for in the current analysis. For Hypothesis 2, the assumption is that investor sentiment is significantly influenced by stock valuations and AI-related concerns, which may not be universally applicable.

4. Implications and Strategic Risks

The implications of continued oil price declines include potential economic strain on oil-exporting countries, which could lead to geopolitical instability. A strong US dollar could exacerbate trade imbalances and impact global economic growth. Strategic risks involve potential retaliatory actions by OPEC or other oil producers to stabilize prices, which could include production cuts or alliances with non-OPEC countries.

5. Recommendations and Outlook

- Monitor OPEC’s production strategies and US economic indicators closely to anticipate further market movements.

- Scenario-based projections:

- Best Case: Stabilization of oil prices through coordinated production adjustments by OPEC and allies.

- Worst Case: Escalation of geopolitical tensions leading to supply disruptions and further market volatility.

- Most Likely: Continued moderate fluctuations in oil prices driven by stockpile data and market sentiment.

6. Key Individuals and Entities

Tony Sycamore (IG Market Analyst), American Petroleum Institute, Organization of the Petroleum Exporting Countries (OPEC).

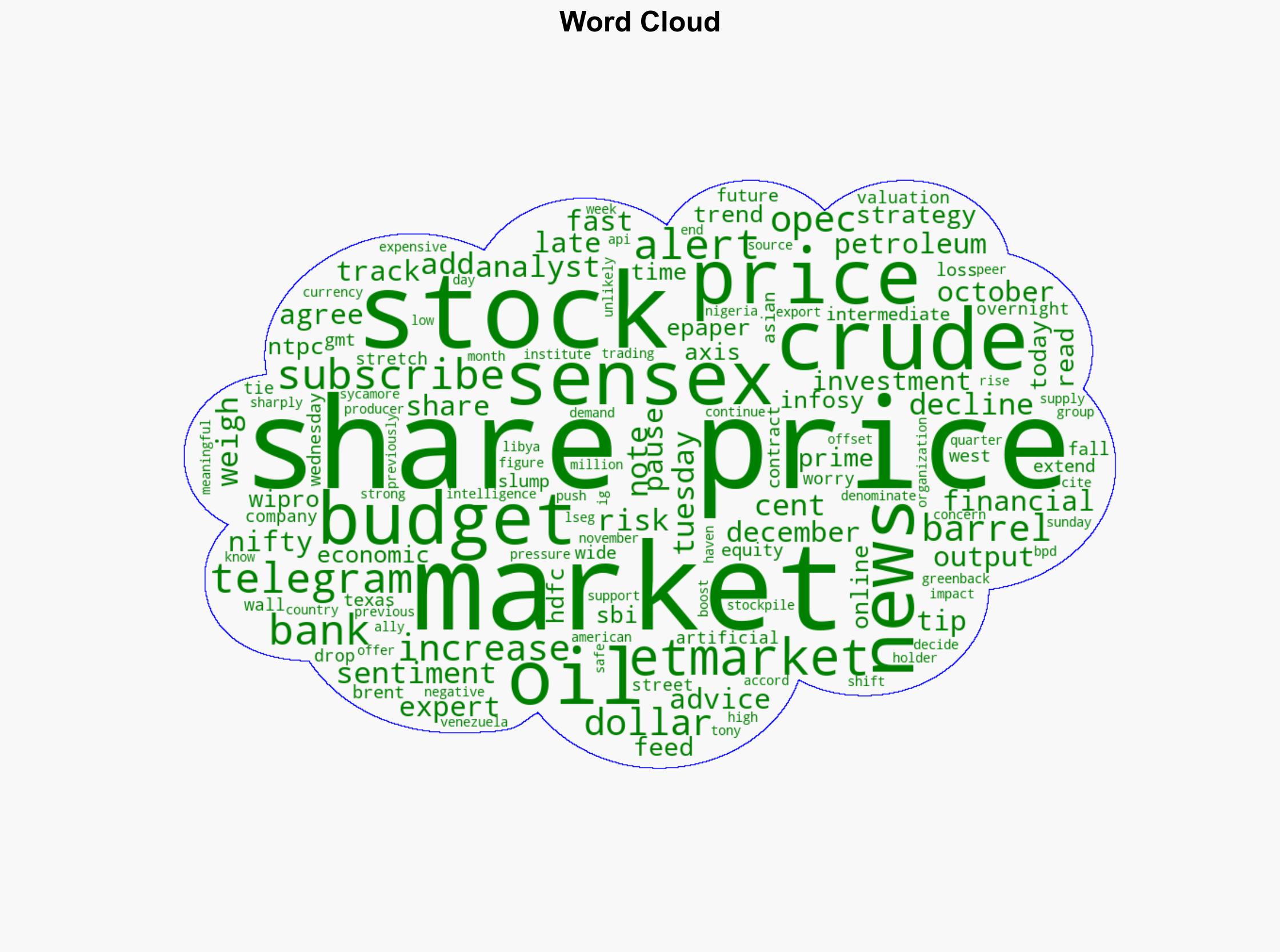

7. Thematic Tags

economic stability, market analysis, geopolitical strategy, energy security