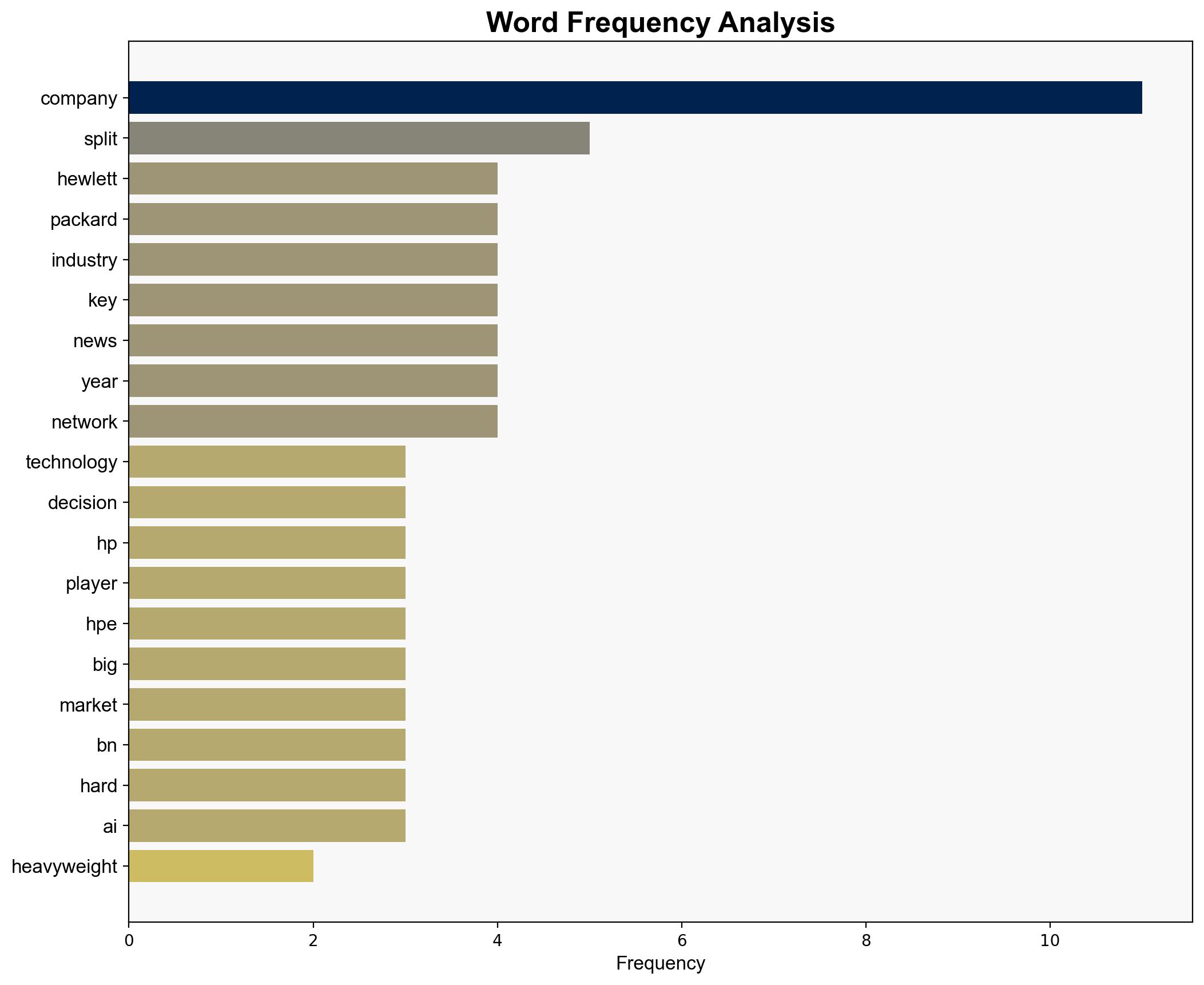

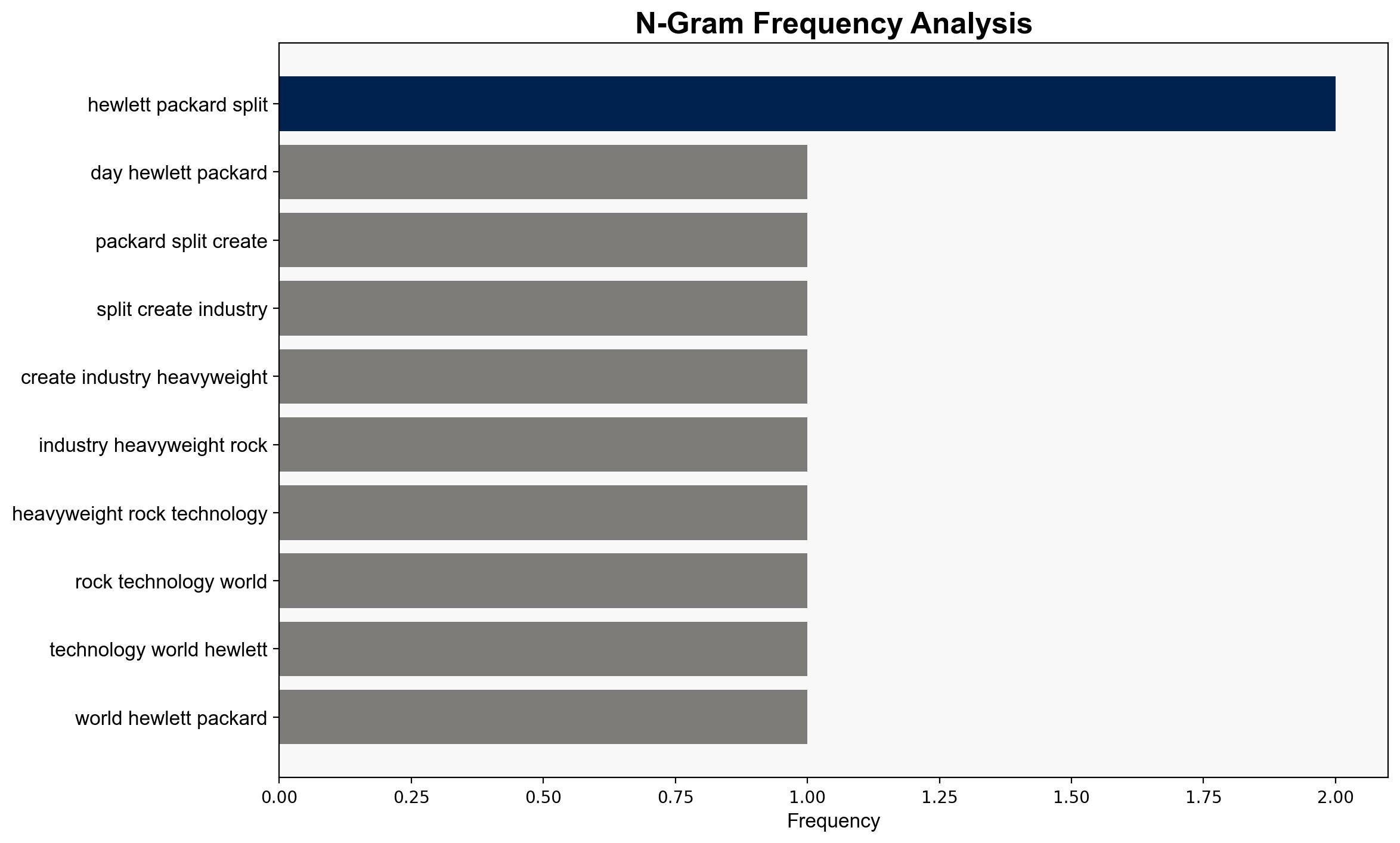

On this day in 2015 Hewlett Packard split – creating two industry heavyweights and rocking the technology world – TechRadar

Published on: 2025-11-05

Intelligence Report: On this day in 2015 Hewlett Packard split – creating two industry heavyweights and rocking the technology world – TechRadar

1. BLUF (Bottom Line Up Front)

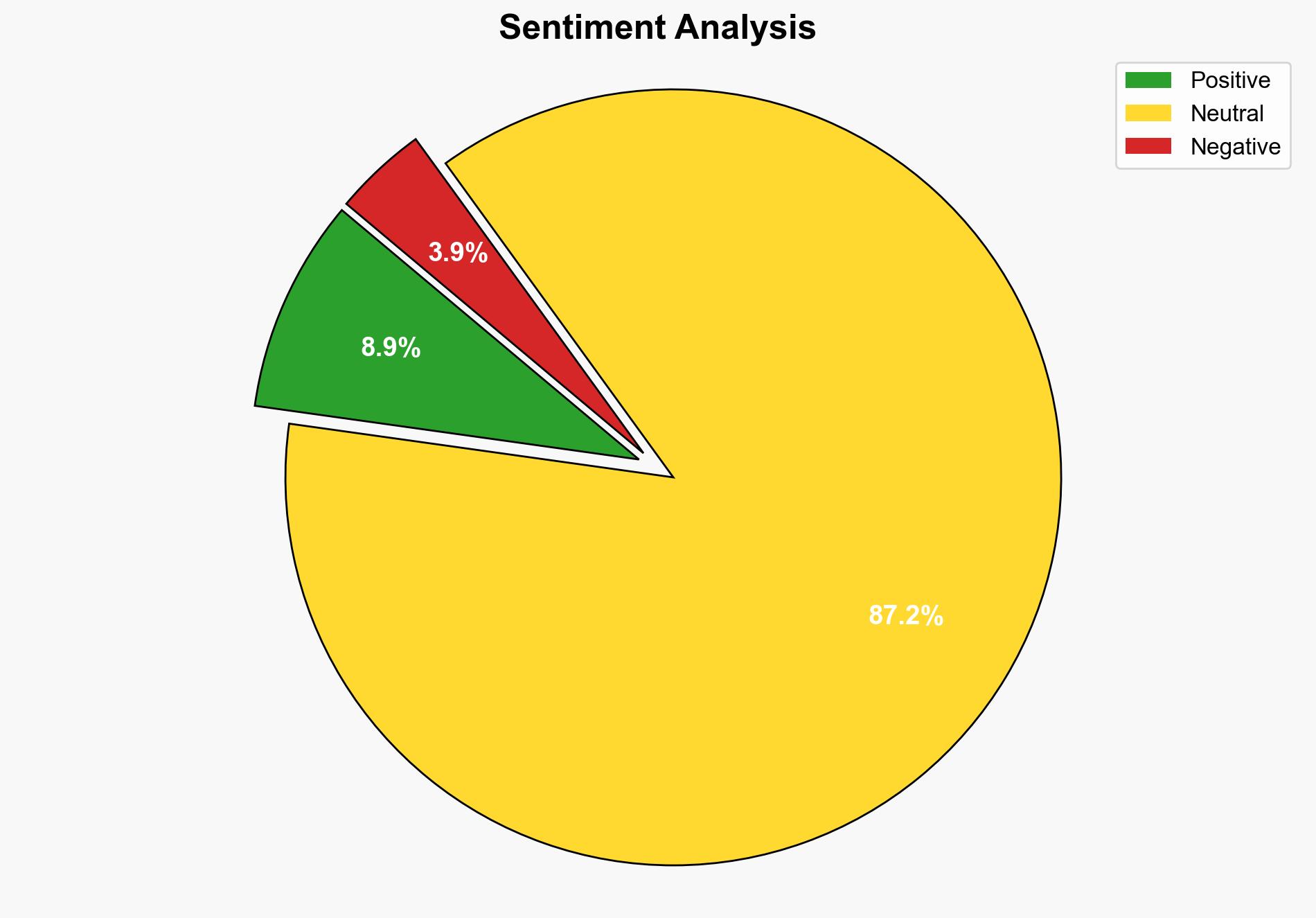

The strategic judgment indicates that Hewlett Packard’s split into two entities—HP Inc. and Hewlett Packard Enterprise (HPE)—was a successful strategic maneuver that allowed both entities to specialize and thrive in their respective markets. The hypothesis that the split enabled both companies to adapt more effectively to market changes is better supported. Confidence level: High. Recommended action: Monitor the ongoing strategic pivots of both companies, particularly in AI and cloud computing, to anticipate future market shifts.

2. Competing Hypotheses

1. **Hypothesis A**: The split allowed Hewlett Packard to become more agile and competitive, with HP Inc. focusing on consumer devices and HPE on enterprise solutions, leading to enhanced market positions for both.

2. **Hypothesis B**: The split was primarily a defensive move to manage declining market shares and internal inefficiencies, with limited long-term strategic benefits.

Using Bayesian Scenario Modeling, Hypothesis A is more supported due to the evidence of increased revenue and strategic acquisitions by HPE, and HP Inc.’s sustained market share in PC manufacturing.

3. Key Assumptions and Red Flags

– **Assumptions**: Both hypotheses assume that market agility and specialization are critical for success in the tech industry. There is an underlying assumption that the split was executed effectively without significant internal disruption.

– **Red Flags**: The analysis may overlook potential internal challenges post-split, such as cultural integration issues within acquired companies. The lack of detailed financial performance data for HP Inc. post-split is a blind spot.

4. Implications and Strategic Risks

The split has implications for market dynamics, with HPE’s focus on cloud and AI infrastructure positioning it against major players like Cisco and Dell. Strategic risks include potential over-reliance on AI-driven growth and vulnerability to rapid technological shifts. Economically, both companies must navigate competitive pressures and potential market saturation.

5. Recommendations and Outlook

- Continue monitoring HPE’s acquisitions and partnerships in AI and cloud computing to assess competitive positioning.

- Evaluate HP Inc.’s innovation strategies in consumer electronics to anticipate shifts in market leadership.

- Scenario-based projections:

- Best Case: Both companies leverage their specialized focus to dominate their respective markets.

- Worst Case: Market saturation and technological disruptions undermine growth, leading to financial instability.

- Most Likely: Continued moderate growth with strategic adjustments to maintain competitiveness.

6. Key Individuals and Entities

– Meg Whitman (former CEO during the split)

– Antonio Neri (current CEO of HPE)

– HP Inc.

– Hewlett Packard Enterprise (HPE)

7. Thematic Tags

technology strategy, corporate restructuring, market adaptation, AI and cloud computing, competitive analysis