Reliance preparing to stop crude imports from sanctioned Russian entities aims to preserve access to Western markets – The Times of India

Published on: 2025-11-05

Intelligence Report: Reliance Preparing to Stop Crude Imports from Sanctioned Russian Entities Aims to Preserve Access to Western Markets – The Times of India

1. BLUF (Bottom Line Up Front)

Reliance Industries is likely adjusting its crude import strategy to maintain access to Western markets amidst evolving sanctions on Russian oil. The most supported hypothesis is that Reliance is proactively reducing its dependency on Russian crude to avoid potential secondary sanctions and ensure compliance with international regulations. Confidence Level: Moderate. Recommended Action: Monitor Reliance’s import patterns and Western policy shifts to anticipate further strategic adjustments.

2. Competing Hypotheses

1. **Hypothesis A**: Reliance is reducing Russian crude imports primarily to comply with international sanctions and avoid secondary sanctions, thereby preserving its access to Western markets.

2. **Hypothesis B**: Reliance’s shift in crude sourcing is driven by market dynamics and cost considerations, with sanctions compliance being a secondary benefit.

Using ACH 2.0, Hypothesis A is better supported due to the explicit mention of sanctions compliance and the strategic importance of Western markets for Reliance’s business operations.

3. Key Assumptions and Red Flags

– **Assumptions**: Reliance’s decision-making is heavily influenced by international sanctions and market access considerations. The company has the flexibility to adjust its supply chain rapidly.

– **Red Flags**: Potential underestimation of Reliance’s ability to navigate sanctions through alternative legal mechanisms. Lack of detailed data on the cost implications of shifting crude sources.

– **Blind Spots**: The long-term impact of these shifts on Reliance’s supply chain stability and profitability is not fully explored.

4. Implications and Strategic Risks

– **Economic**: A shift away from Russian crude could increase costs if Middle Eastern and other sources are more expensive.

– **Geopolitical**: Aligning with Western sanctions may strain Reliance’s relations with Russian entities and potentially affect broader India-Russia relations.

– **Psychological**: Stakeholders may perceive Reliance’s actions as a commitment to Western alliances, influencing investor confidence and market perceptions.

5. Recommendations and Outlook

- Monitor policy developments in Western markets and adjust import strategies accordingly to mitigate risks of non-compliance.

- Explore diversification of crude sources to ensure supply chain resilience and cost-effectiveness.

- Scenario Projections:

- Best Case: Successful diversification leads to stable market access and cost management.

- Worst Case: Increased costs and geopolitical tensions with Russia impact profitability and market position.

- Most Likely: Gradual adjustment with manageable cost increases and maintained market access.

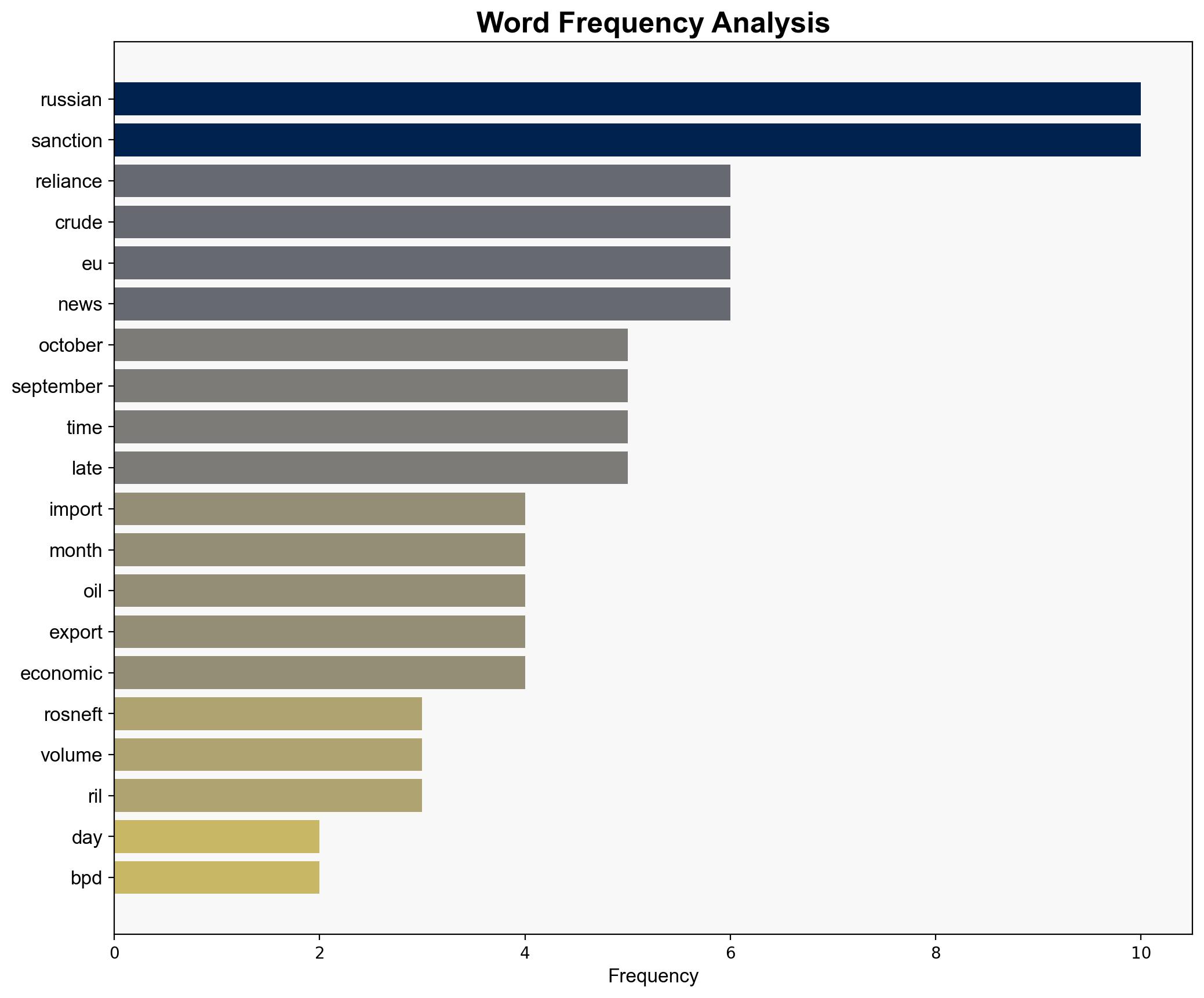

6. Key Individuals and Entities

– Reliance Industries

– Rosneft

– Nayara Energy

– European Union (EU)

7. Thematic Tags

national security threats, economic strategy, international sanctions, energy markets