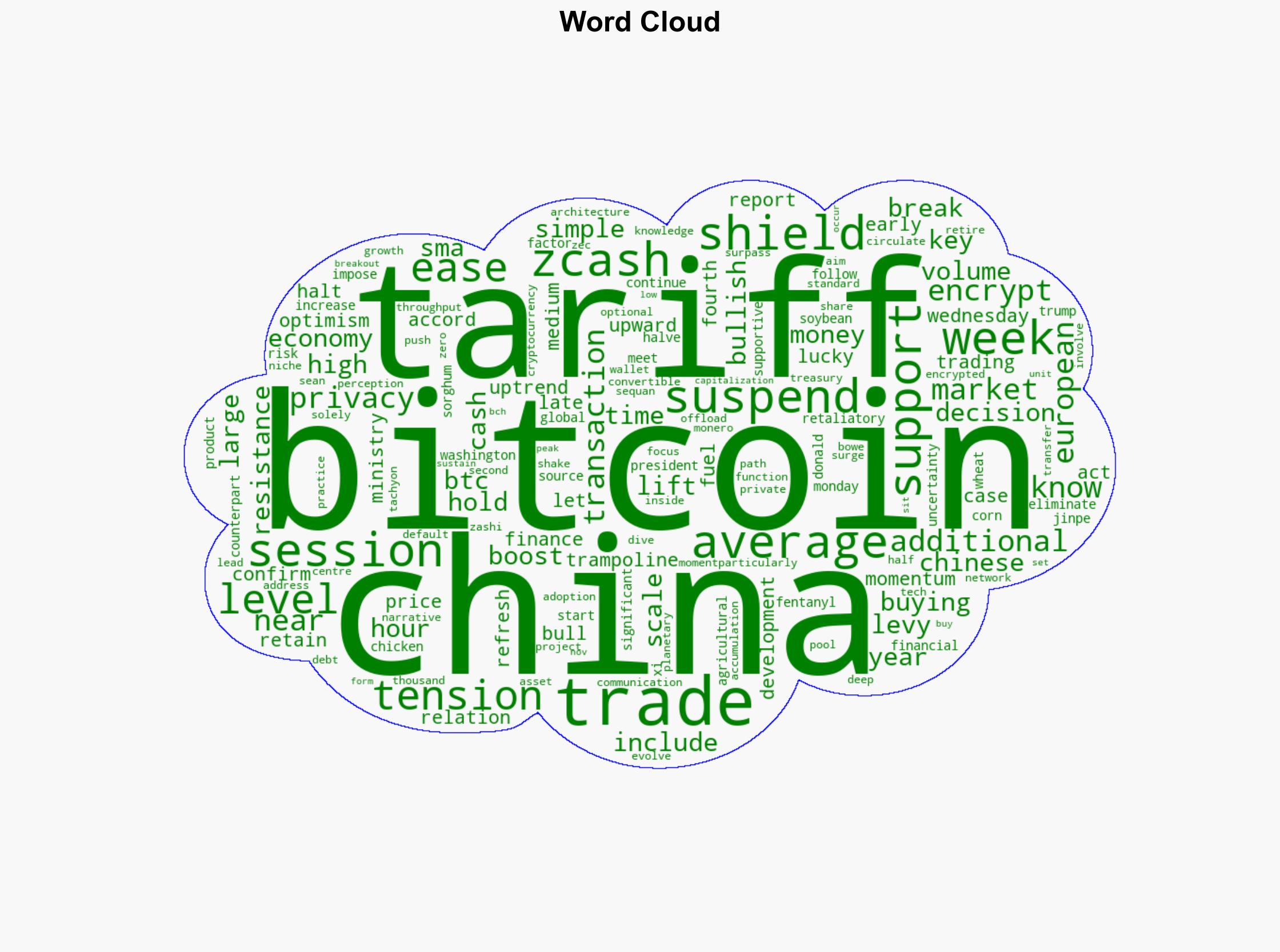

Bitcoin at Make or Break Level as China Suspends 24 Tariff on US Goods – CoinDesk

Published on: 2025-11-05

Intelligence Report: Bitcoin at Make or Break Level as China Suspends 24 Tariff on US Goods – CoinDesk

1. BLUF (Bottom Line Up Front)

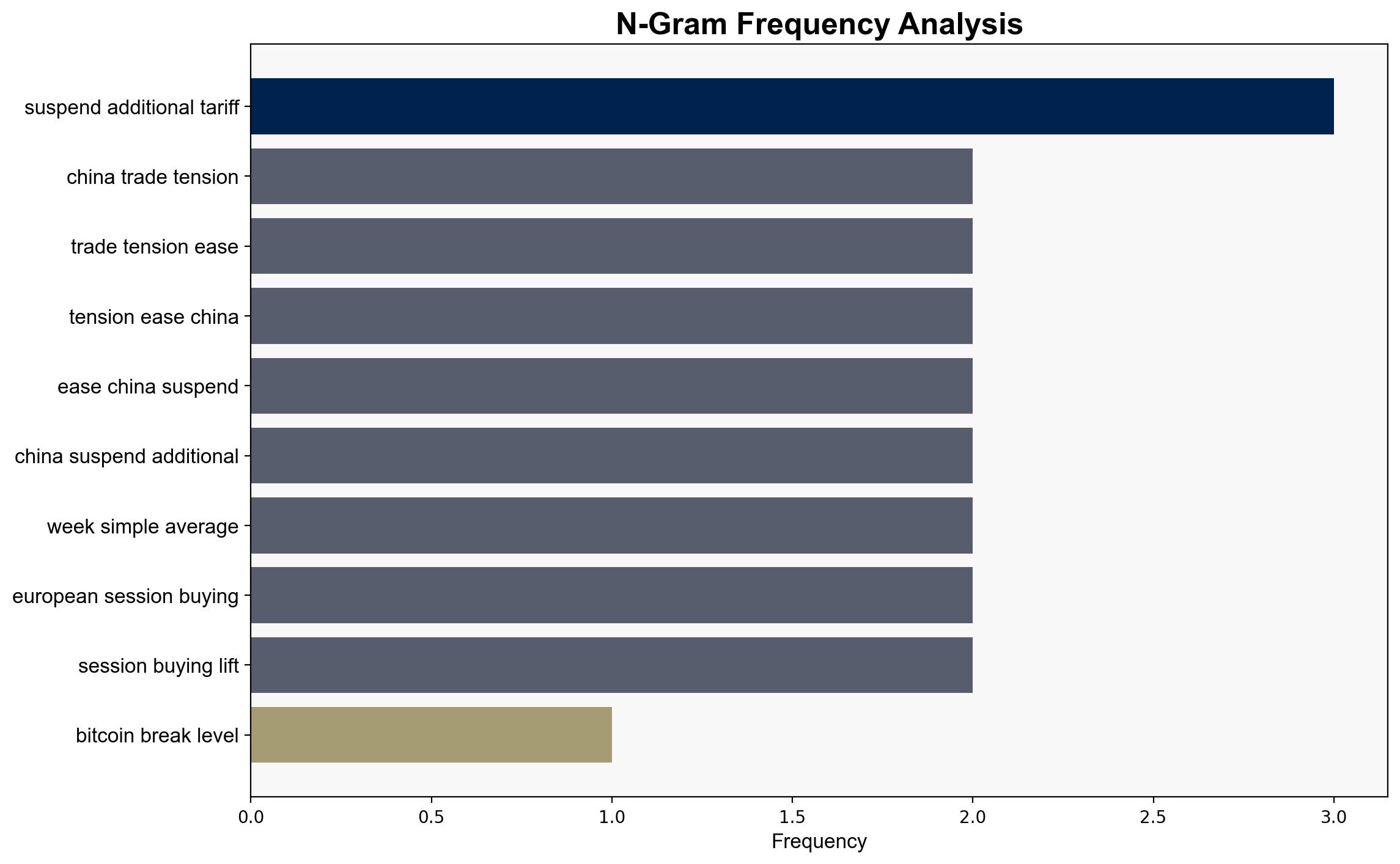

The suspension of tariffs by China is likely to ease trade tensions, potentially boosting market optimism and supporting Bitcoin’s bullish momentum. The most supported hypothesis suggests that this development will positively impact Bitcoin’s price, leveraging the current market conditions. Confidence Level: Moderate. Recommended action is to monitor Bitcoin’s price movements closely and consider strategic investments if bullish trends are confirmed.

2. Competing Hypotheses

1. **Hypothesis A**: The suspension of tariffs by China will lead to increased market optimism, positively influencing Bitcoin’s price and supporting a bullish trend.

2. **Hypothesis B**: Despite the suspension of tariffs, Bitcoin will not experience significant price movement due to other overriding market factors such as regulatory pressures or technological challenges.

Using ACH 2.0, Hypothesis A is better supported by the easing of trade tensions and the historical correlation between positive economic news and Bitcoin price increases. Hypothesis B lacks support as current data does not indicate significant negative factors outweighing the positive sentiment from the tariff suspension.

3. Key Assumptions and Red Flags

– **Assumptions**: The primary assumption is that easing trade tensions will directly translate to increased investor confidence and risk-taking behavior, benefiting Bitcoin.

– **Red Flags**: Potential regulatory actions against cryptocurrencies or unexpected geopolitical developments could negate the positive impact of tariff suspension.

– **Blind Spots**: The analysis may not fully account for the impact of internal Chinese economic policies or unforeseen technological disruptions in the cryptocurrency space.

4. Implications and Strategic Risks

– **Economic**: A boost in market optimism could lead to increased investments in Bitcoin and other cryptocurrencies, potentially driving up prices.

– **Geopolitical**: Continued easing of trade tensions between the US and China could stabilize global markets, but any reversal could lead to volatility.

– **Cyber**: Increased cryptocurrency activity may attract cyber threats targeting exchanges and individual investors.

– **Psychological**: Investor sentiment could shift quickly if positive developments are not sustained, leading to market volatility.

5. Recommendations and Outlook

- Monitor Bitcoin price trends and market sentiment closely to identify entry and exit points for investments.

- Prepare for potential regulatory changes by diversifying cryptocurrency portfolios and staying informed about policy developments.

- Scenario Projections:

- Best: Sustained bullish trend with Bitcoin breaking key resistance levels.

- Worst: Regulatory crackdowns or geopolitical tensions reverse positive sentiment, leading to a price drop.

- Most Likely: Moderate price increase as market adjusts to new trade dynamics.

6. Key Individuals and Entities

– Donald Trump

– Xi Jinping

– Ministry of Finance, China

7. Thematic Tags

national security threats, cybersecurity, economic stability, cryptocurrency market dynamics