The Energy Transition Is Achievable in Emerging Markets – Project Syndicate

Published on: 2025-11-05

Intelligence Report: The Energy Transition Is Achievable in Emerging Markets – Project Syndicate

1. BLUF (Bottom Line Up Front)

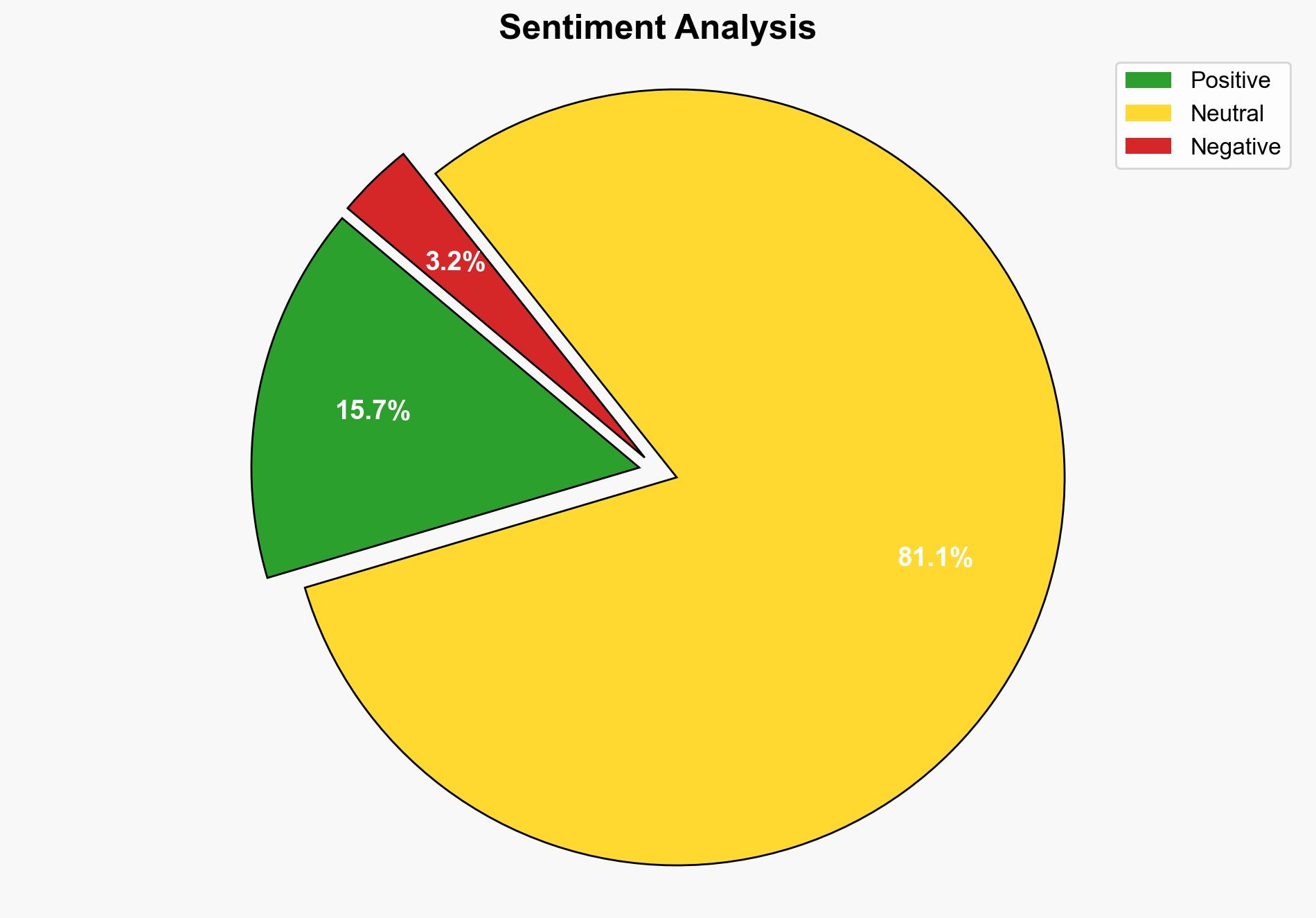

The energy transition in emerging markets is feasible but requires substantial climate finance and technological advancements. The most supported hypothesis is that with adequate investment and policy support, emerging markets can significantly increase their renewable energy capacity. Confidence level: Moderate. Recommended action: Encourage international financial institutions to increase climate finance allocations and support policy frameworks that facilitate renewable energy investments.

2. Competing Hypotheses

1. **Hypothesis A**: Emerging markets will successfully transition to renewable energy with sufficient climate finance and technological advancements.

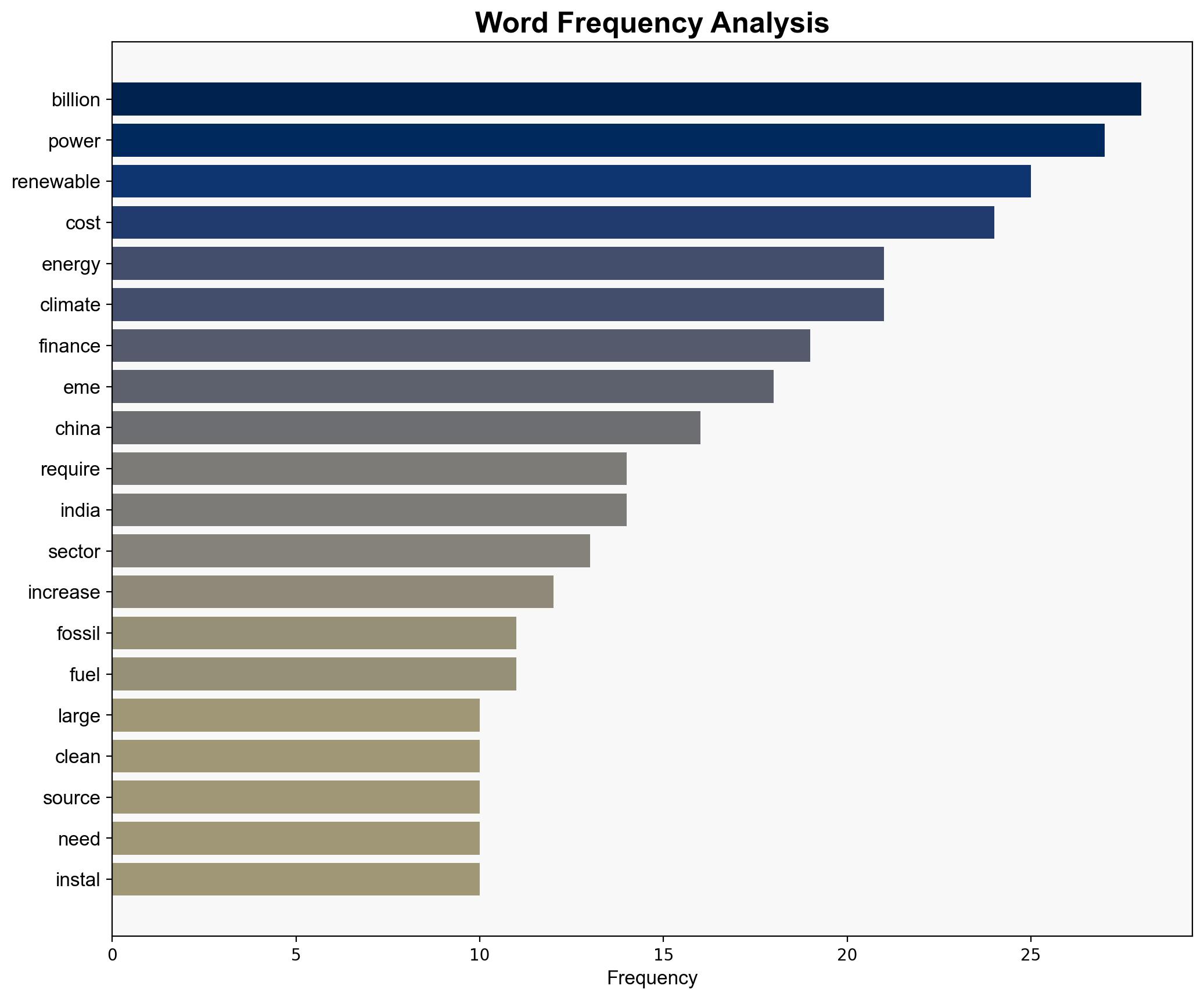

– Supported by the decreasing costs of renewable technologies and the significant investments already planned in countries like India and China.

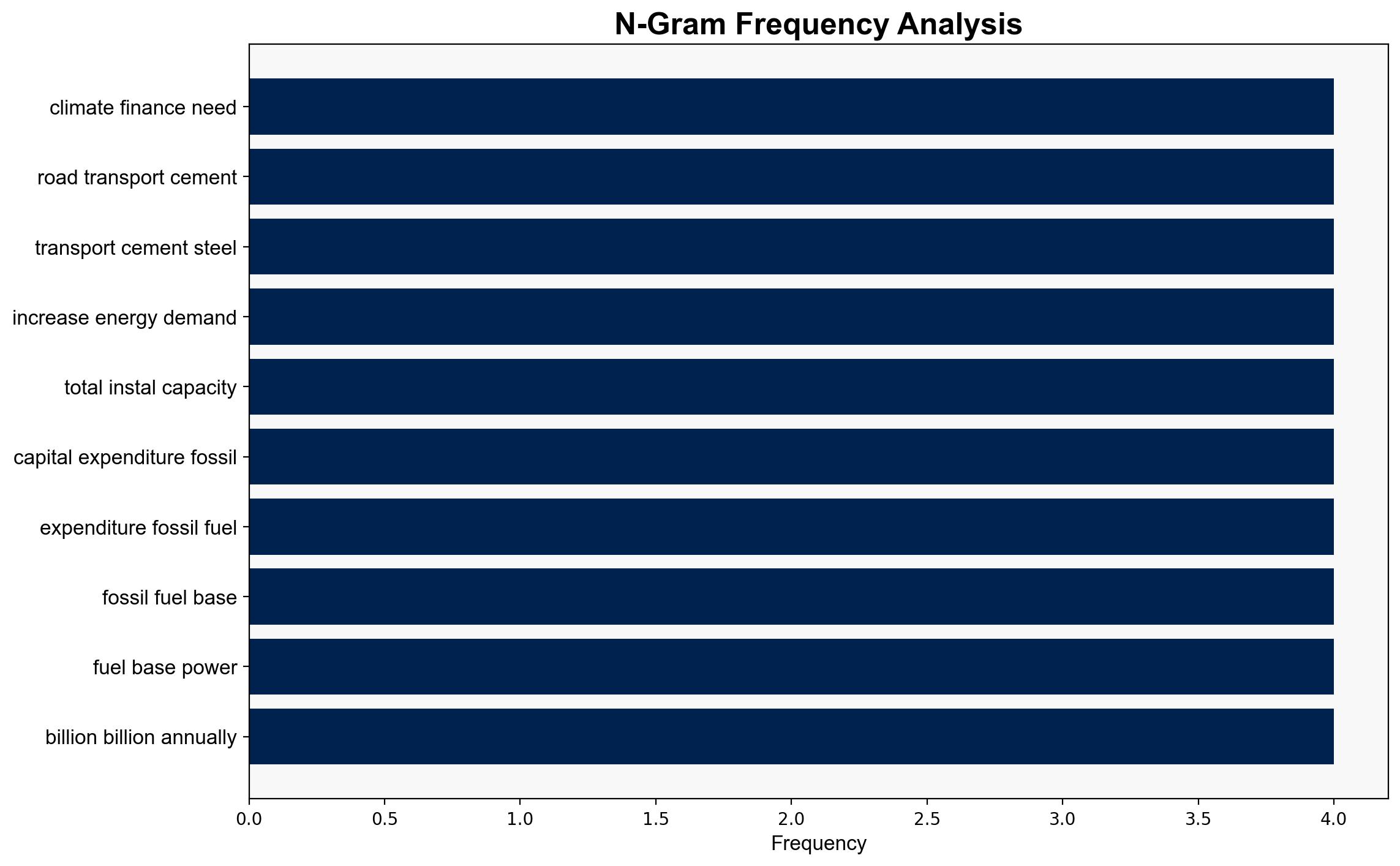

2. **Hypothesis B**: The transition will face significant delays due to financial, regulatory, and infrastructural challenges.

– Supported by the high upfront costs, regulatory hurdles, and the need for substantial grid adaptations.

Using ACH 2.0, Hypothesis A is better supported due to the global trend of decreasing renewable energy costs and existing commitments from major emerging markets.

3. Key Assumptions and Red Flags

– **Assumptions**:

– Technological advancements will continue to reduce costs.

– Political and economic stability will allow for sustained investment.

– **Red Flags**:

– Potential underestimation of the infrastructural changes needed.

– Over-reliance on projected cost reductions without accounting for possible supply chain disruptions.

– **Blind Spots**:

– Lack of detailed analysis on the impact of geopolitical tensions on energy supply chains.

– Insufficient consideration of potential resistance from entrenched fossil fuel interests.

4. Implications and Strategic Risks

– **Economic**: Successful transition could lead to economic growth and job creation in the renewable sector. However, failure could result in economic stagnation and increased energy costs.

– **Geopolitical**: Countries leading in renewable energy could gain strategic advantages, while those lagging may face increased energy dependency.

– **Cyber**: Increased reliance on digital infrastructure for energy management could heighten cybersecurity risks.

– **Psychological**: Public perception and acceptance of renewable energy initiatives are crucial for sustained policy support.

5. Recommendations and Outlook

- Encourage international collaboration to share best practices and technologies.

- Develop robust policy frameworks to streamline regulatory processes for renewable projects.

- Scenario Projections:

- **Best Case**: Rapid technological advancements and financial support lead to a successful transition by 2030.

- **Worst Case**: Geopolitical tensions and financial shortfalls delay transition efforts significantly.

- **Most Likely**: Gradual progress with periodic setbacks due to financial and regulatory challenges.

6. Key Individuals and Entities

– No specific individuals are mentioned in the source text. Key entities include international financial institutions, national governments of emerging markets, and major renewable energy companies.

7. Thematic Tags

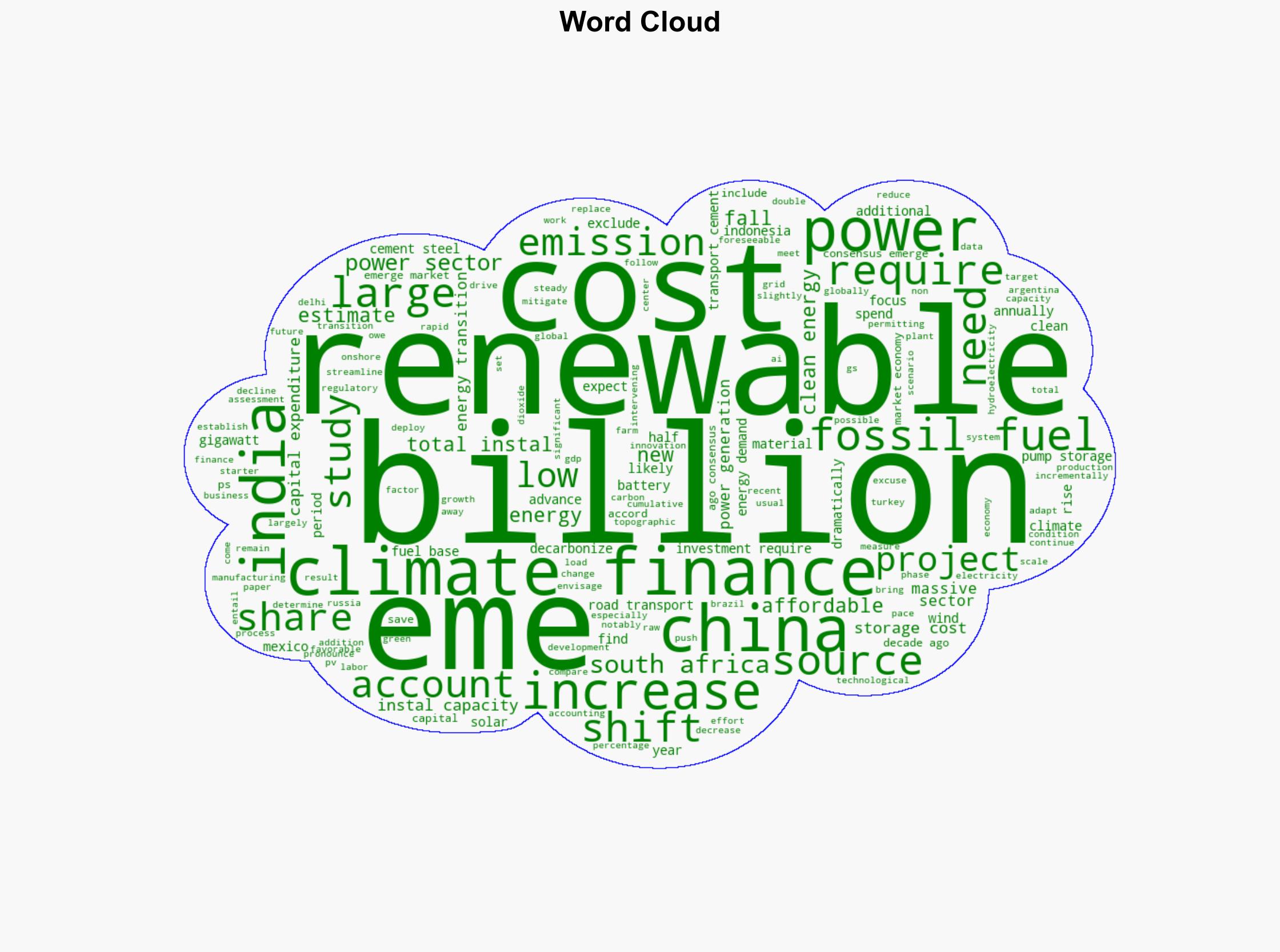

energy transition, climate finance, renewable energy, emerging markets, geopolitical strategy