Chinese autonomous driving firm Ponyai sees shares drop 12 in Hong Kong debut – CNBC

Published on: 2025-11-06

Intelligence Report: Chinese autonomous driving firm Ponyai sees shares drop 12% in Hong Kong debut – CNBC

1. BLUF (Bottom Line Up Front)

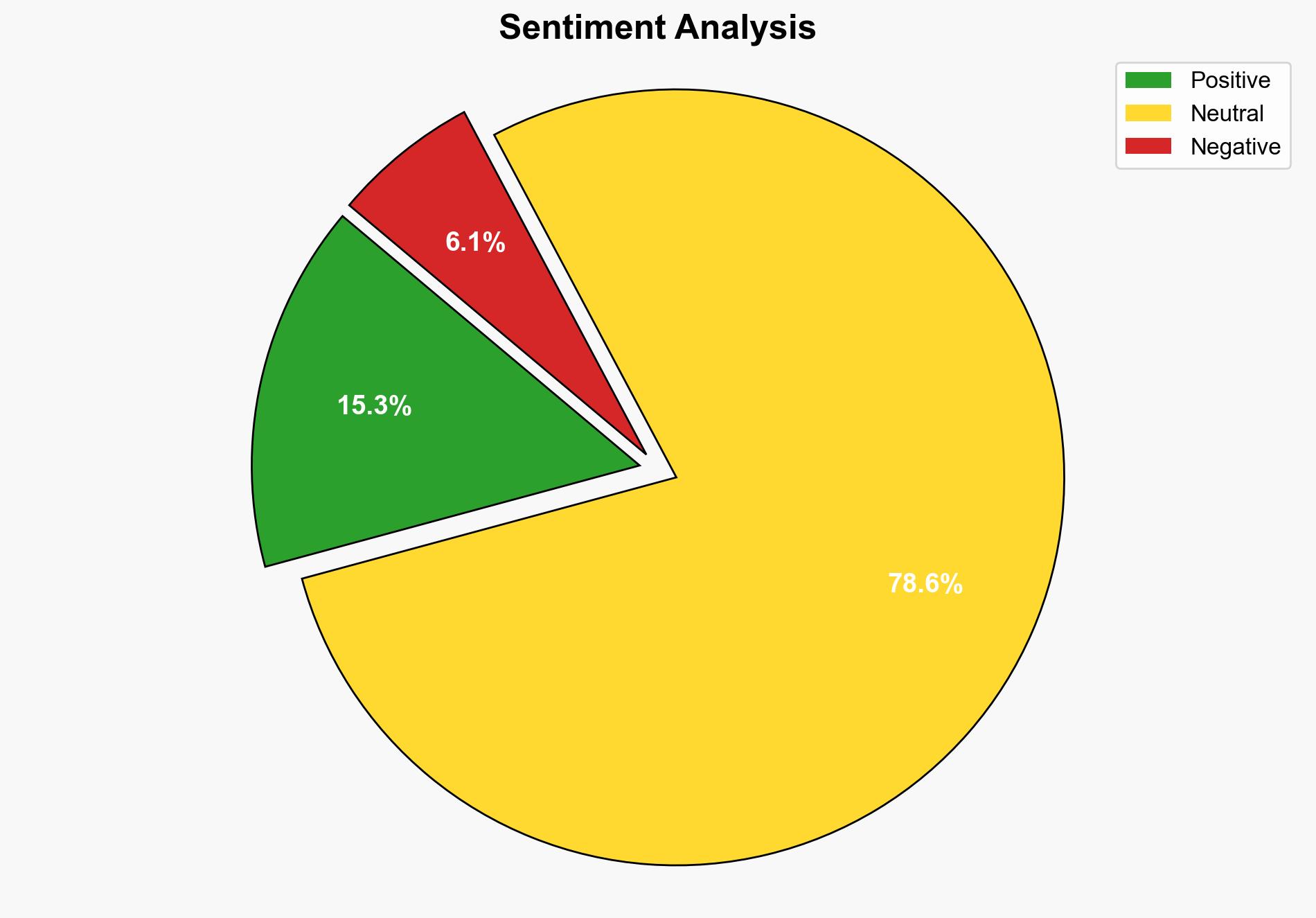

The most supported hypothesis is that Ponyai’s share drop is primarily due to market uncertainty and regulatory challenges in both domestic and international markets. Confidence level: Moderate. It is recommended to closely monitor regulatory developments and market sentiment, particularly in China and potential Western markets.

2. Competing Hypotheses

Hypothesis 1: The share drop is primarily due to market uncertainty and regulatory challenges, particularly in light of geopolitical tensions and the evolving regulatory landscape in China and abroad. This hypothesis is supported by the broader context of geopolitical tensions and regulatory scrutiny on Chinese technology firms.

Hypothesis 2: The share drop is largely a result of internal company issues, such as financial performance and miscommunication with investors. This is supported by reports of financial losses and allegations of misinformation regarding operational scale.

3. Key Assumptions and Red Flags

Assumptions:

– Hypothesis 1 assumes that external factors like regulatory changes and geopolitical tensions have a significant impact on investor confidence.

– Hypothesis 2 assumes that internal management and communication issues are the primary drivers of the share drop.

Red Flags:

– Inconsistent data regarding the number of cities in which WeRide operates.

– Potential bias in media reporting, possibly underestimating the impact of geopolitical factors.

4. Implications and Strategic Risks

The share drop could signal broader investor skepticism towards Chinese tech firms amid regulatory crackdowns and geopolitical tensions. This may lead to increased difficulty in accessing Western markets and capital. Additionally, internal mismanagement could exacerbate these challenges, leading to potential financial instability.

5. Recommendations and Outlook

- Monitor regulatory developments in China and potential Western markets to anticipate further impacts on market performance.

- Enhance transparency and communication with investors to rebuild confidence.

- Scenario-based projections:

- Best Case: Regulatory clarity and improved investor relations lead to a recovery in share price.

- Worst Case: Continued regulatory and geopolitical challenges result in sustained financial losses and market exit.

- Most Likely: Gradual recovery contingent on improved regulatory environment and strategic partnerships.

6. Key Individuals and Entities

– Tony Xu Han

– James Peng

– Li Xuan

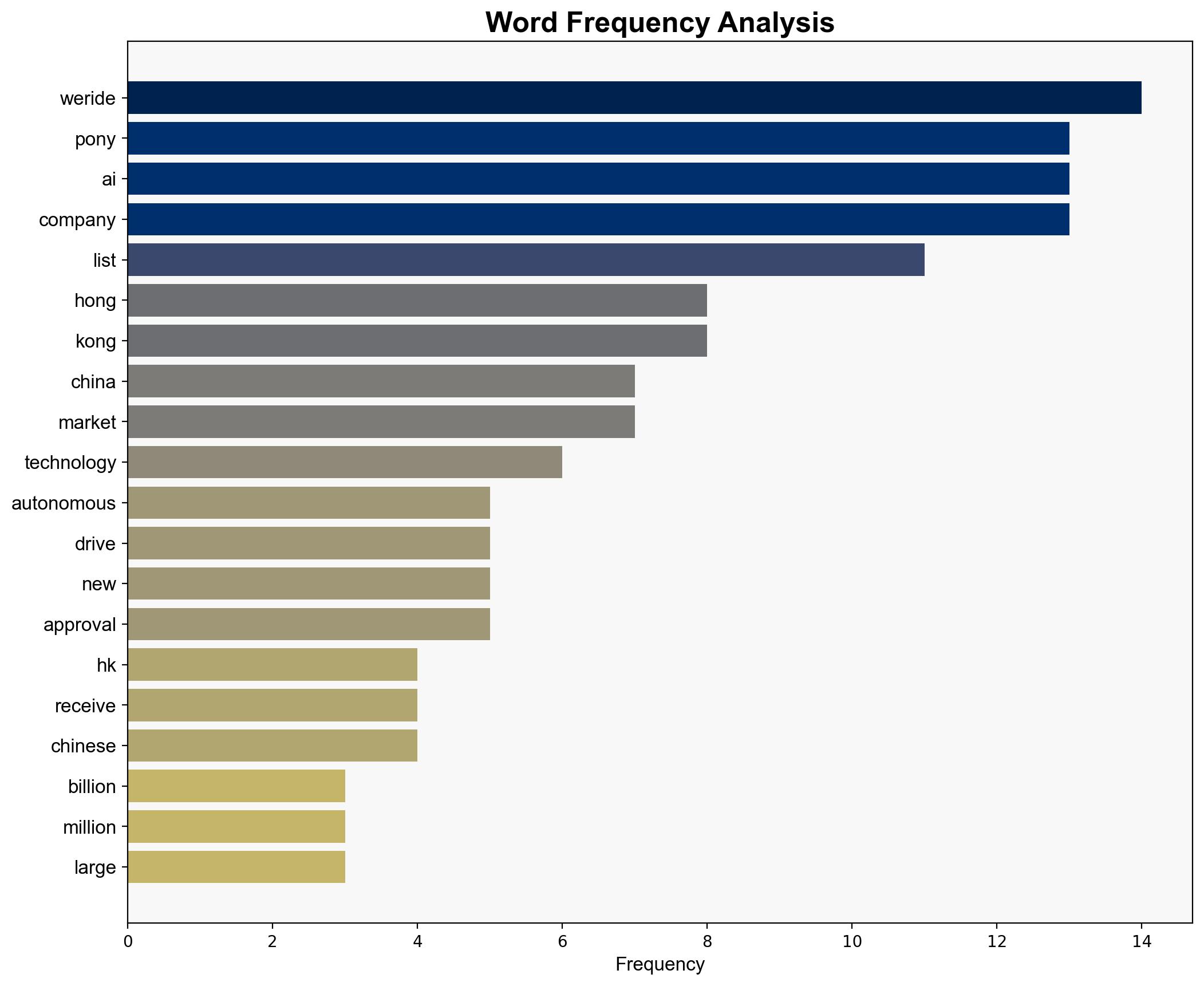

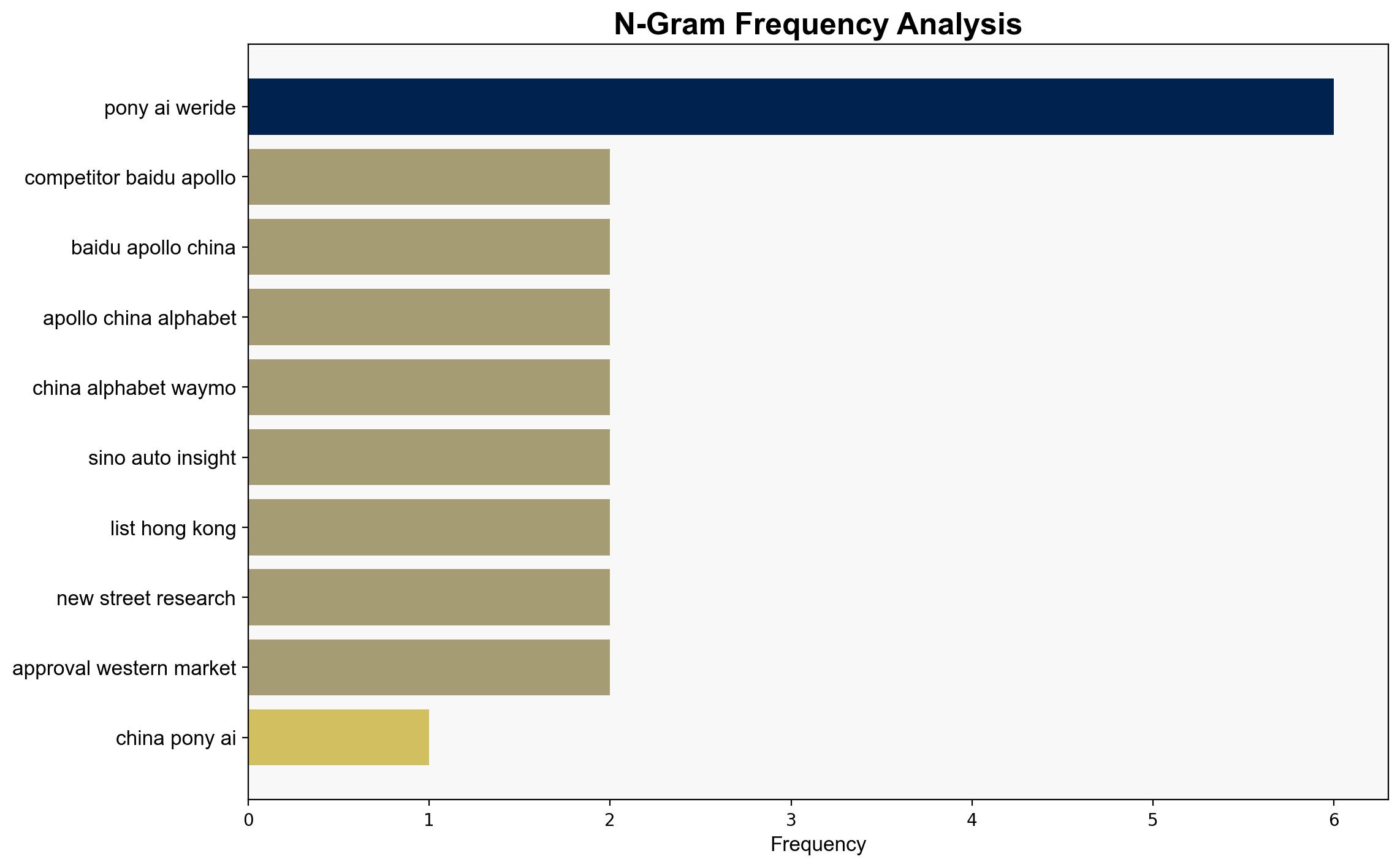

– Ponyai

– WeRide

– Baidu Apollo

– Waymo

– Uber

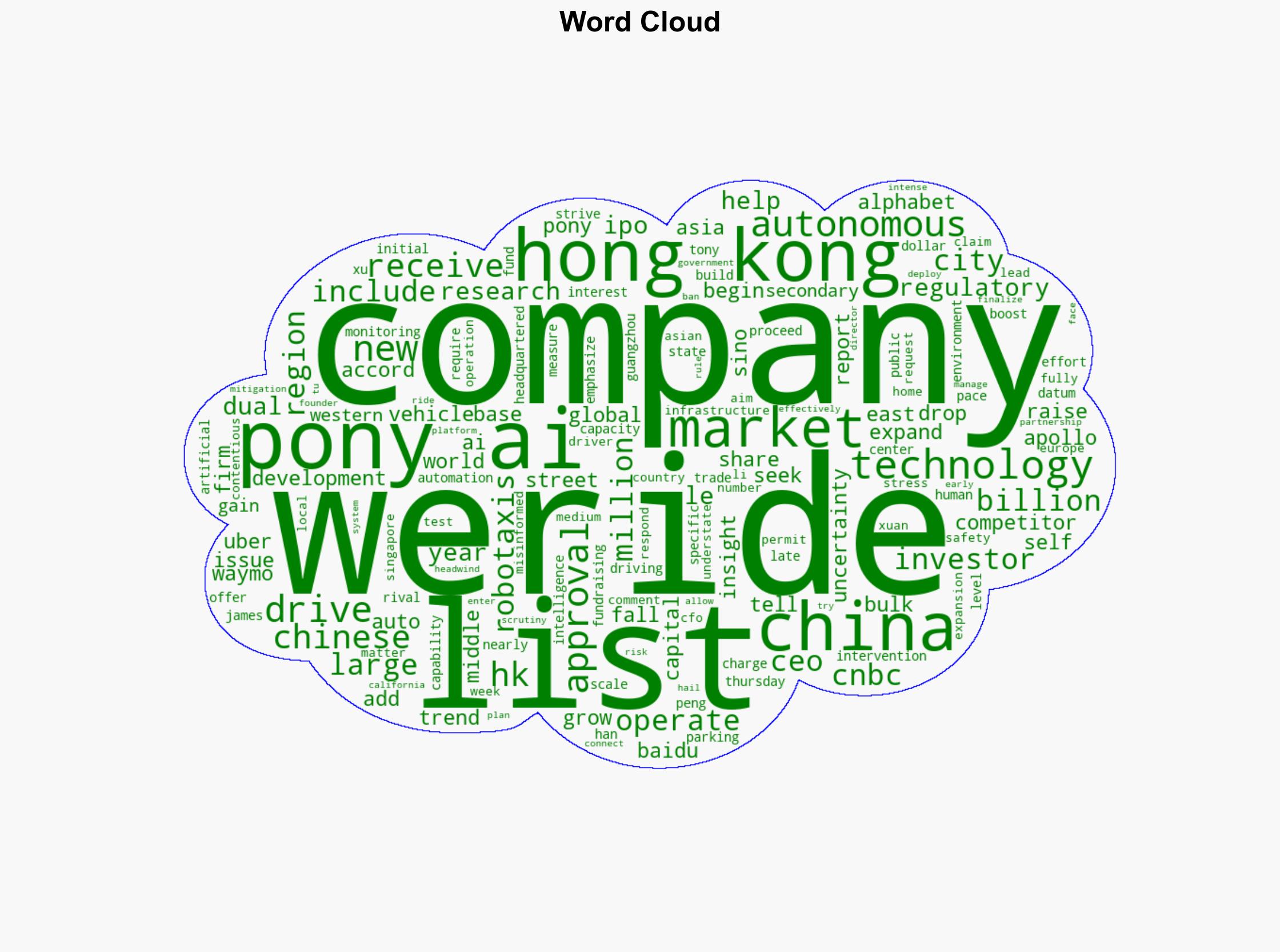

7. Thematic Tags

national security threats, regulatory challenges, market uncertainty, geopolitical tensions