Trumps report card is in a year after winning the election – The Sydney Morning Herald

Published on: 2025-11-06

Intelligence Report: Trumps report card is in a year after winning the election – The Sydney Morning Herald

1. BLUF (Bottom Line Up Front)

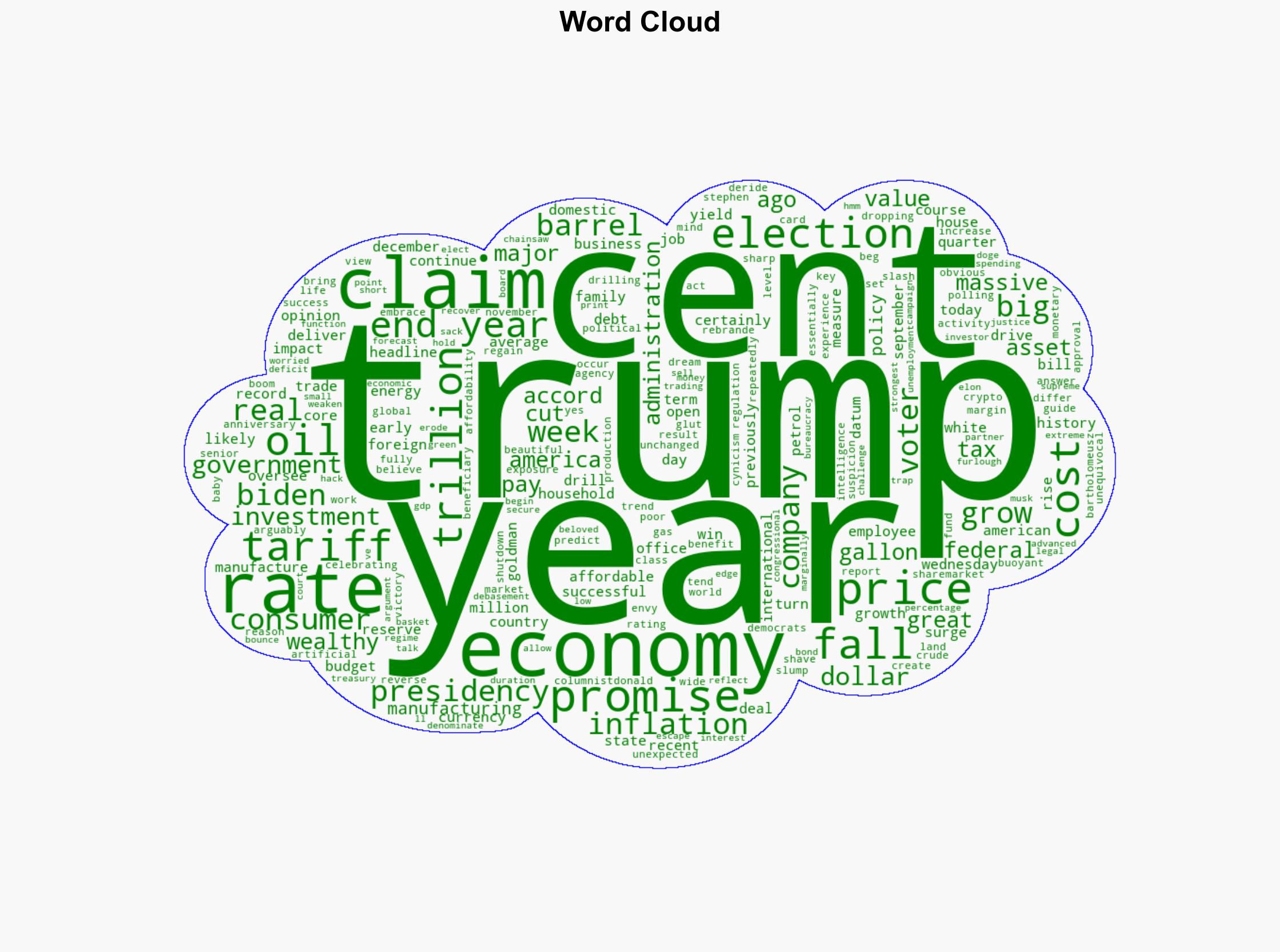

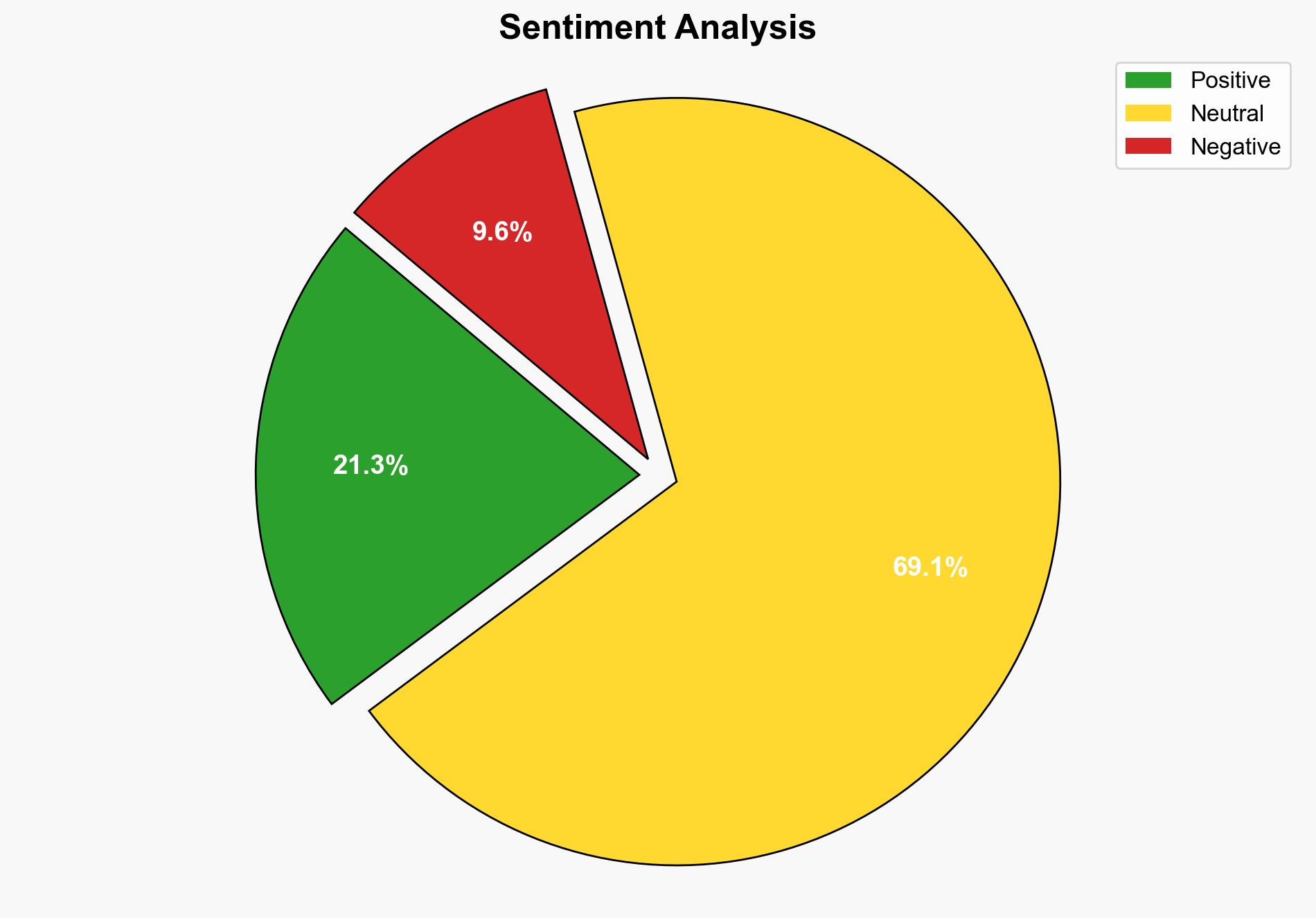

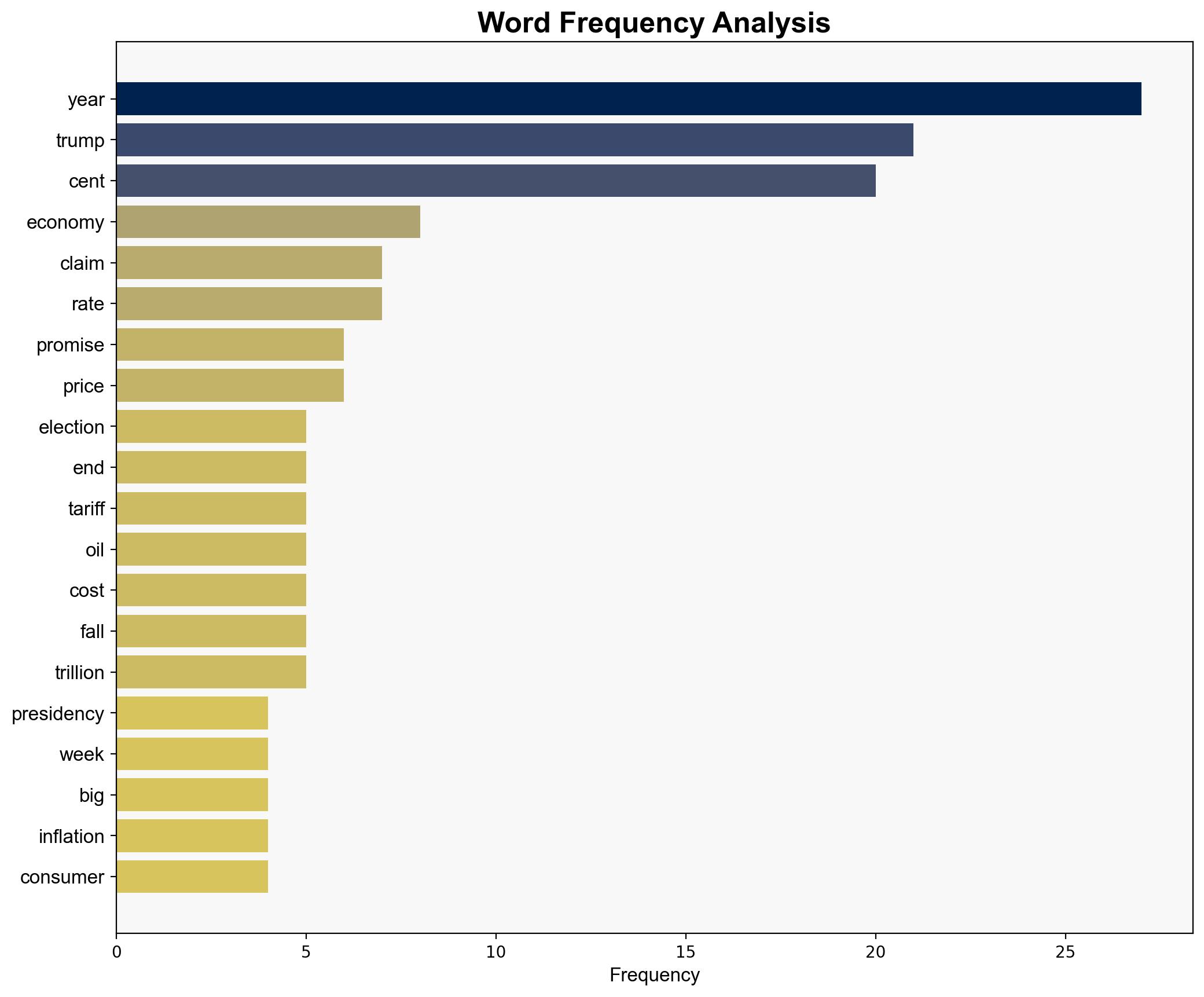

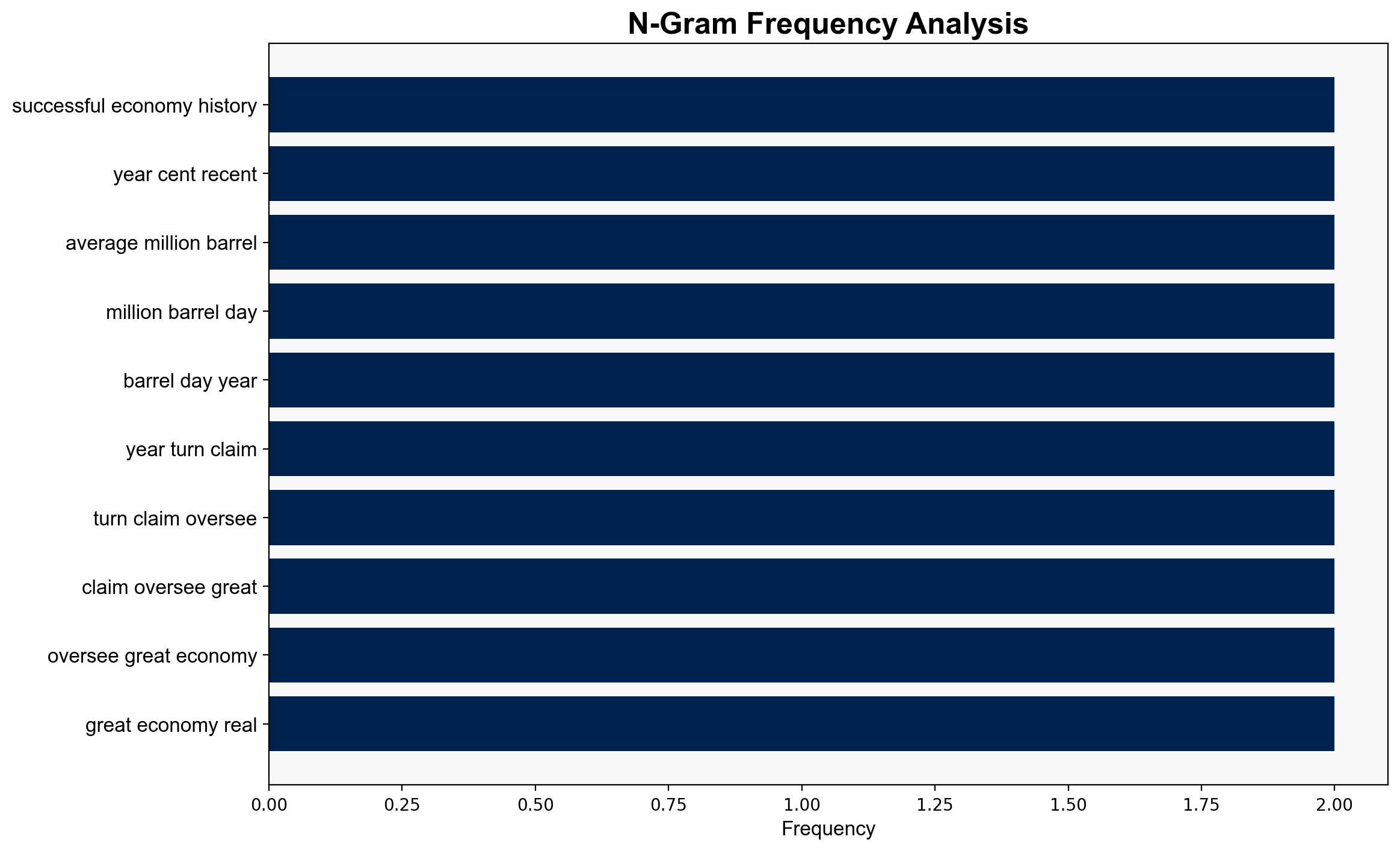

The analysis presents two primary hypotheses regarding the economic impact of Donald Trump’s presidency a year after his election victory. The first hypothesis suggests that Trump’s policies have led to economic growth primarily benefiting the wealthy, while the second posits that these policies have failed to deliver broad economic benefits, contributing to inflation and public dissatisfaction. The first hypothesis is better supported by the available data, but significant uncertainties remain. Confidence Level: Moderate. Recommended action: Monitor economic indicators and public sentiment to assess the long-term impacts of current policies.

2. Competing Hypotheses

1. **Hypothesis A**: Trump’s economic policies have successfully driven economic growth, particularly benefiting wealthy households and investors, as evidenced by stock market gains and tax cuts.

2. **Hypothesis B**: Trump’s economic policies have not resulted in widespread economic benefits, with inflation remaining a concern and approval ratings declining due to unmet promises on affordability and economic growth.

3. Key Assumptions and Red Flags

– **Assumptions**: Hypothesis A assumes that stock market performance and tax cuts are accurate indicators of economic success. Hypothesis B assumes that inflation and public sentiment are more reflective of economic health.

– **Red Flags**: Potential cognitive bias in interpreting economic indicators as uniformly positive or negative. The lack of comprehensive data on the impact of tariffs and regulatory changes introduces uncertainty.

– **Inconsistent Data**: Discrepancies in economic growth rates and inflation figures suggest potential data manipulation or selective reporting.

4. Implications and Strategic Risks

– **Economic Risks**: Continued inflation could lead to decreased consumer confidence and spending, potentially stalling economic growth.

– **Geopolitical Risks**: Tariff policies may strain international relations and impact global trade dynamics.

– **Psychological Risks**: Declining public approval could lead to increased political polarization and instability.

5. Recommendations and Outlook

- Monitor inflation trends and public sentiment to gauge the effectiveness of economic policies.

- Engage in diplomatic efforts to mitigate potential trade conflicts arising from tariff policies.

- Scenario Projections:

- Best Case: Economic policies lead to sustained growth and improved public approval.

- Worst Case: Inflation and political dissatisfaction lead to economic stagnation and increased polarization.

- Most Likely: Moderate economic growth with persistent inflation concerns and mixed public sentiment.

6. Key Individuals and Entities

– Donald Trump

– Stephen Bartholomeusz

– Elon Musk

7. Thematic Tags

national security threats, economic policy, public sentiment, geopolitical dynamics