WeRide Lists on Hong Kong Stock Exchange Becoming World’s First Publicly Traded Robotaxi Company in Hong Kong and US – GlobeNewswire

Published on: 2025-11-06

Intelligence Report: WeRide Lists on Hong Kong Stock Exchange Becoming World’s First Publicly Traded Robotaxi Company in Hong Kong and US – GlobeNewswire

1. BLUF (Bottom Line Up Front)

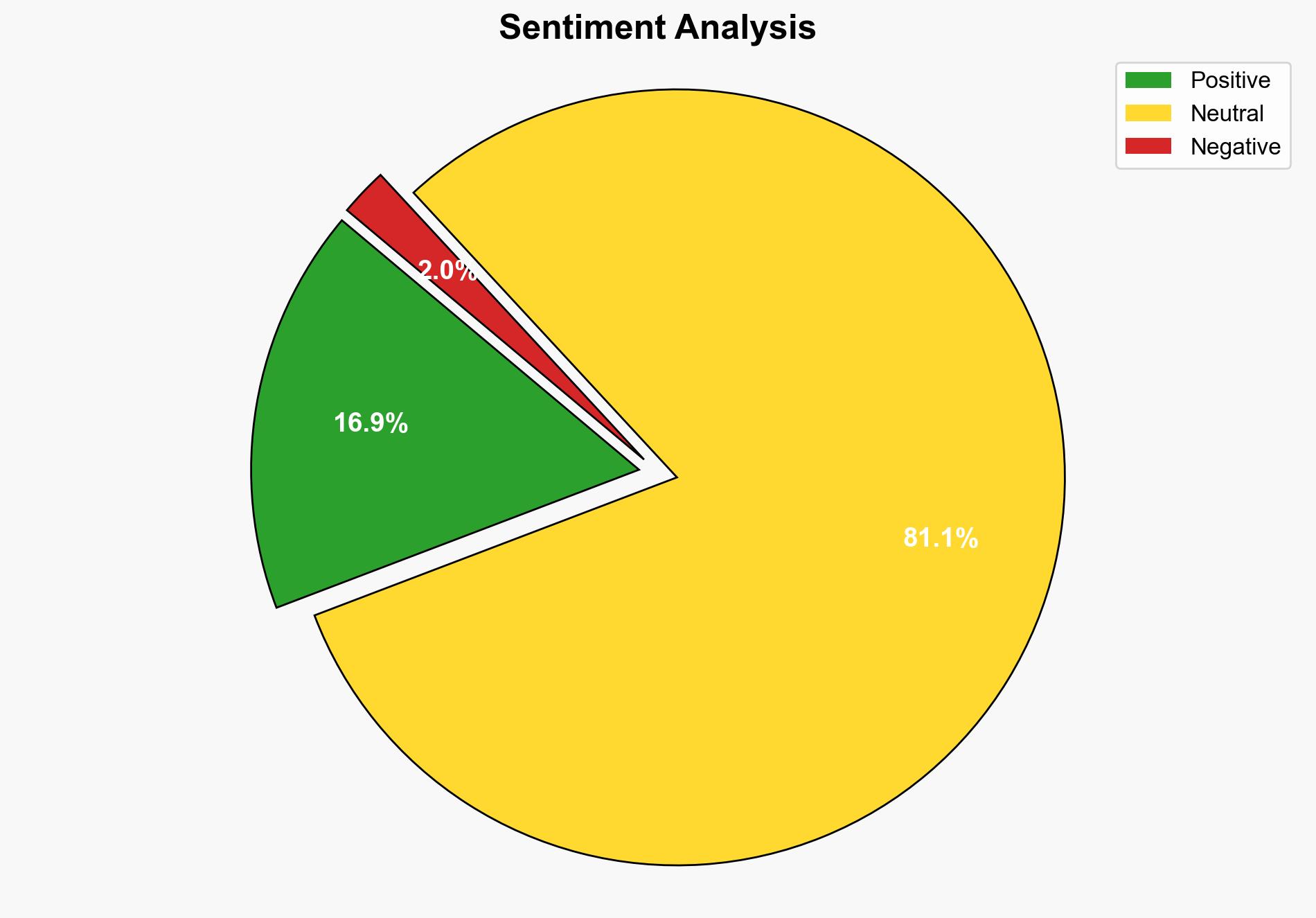

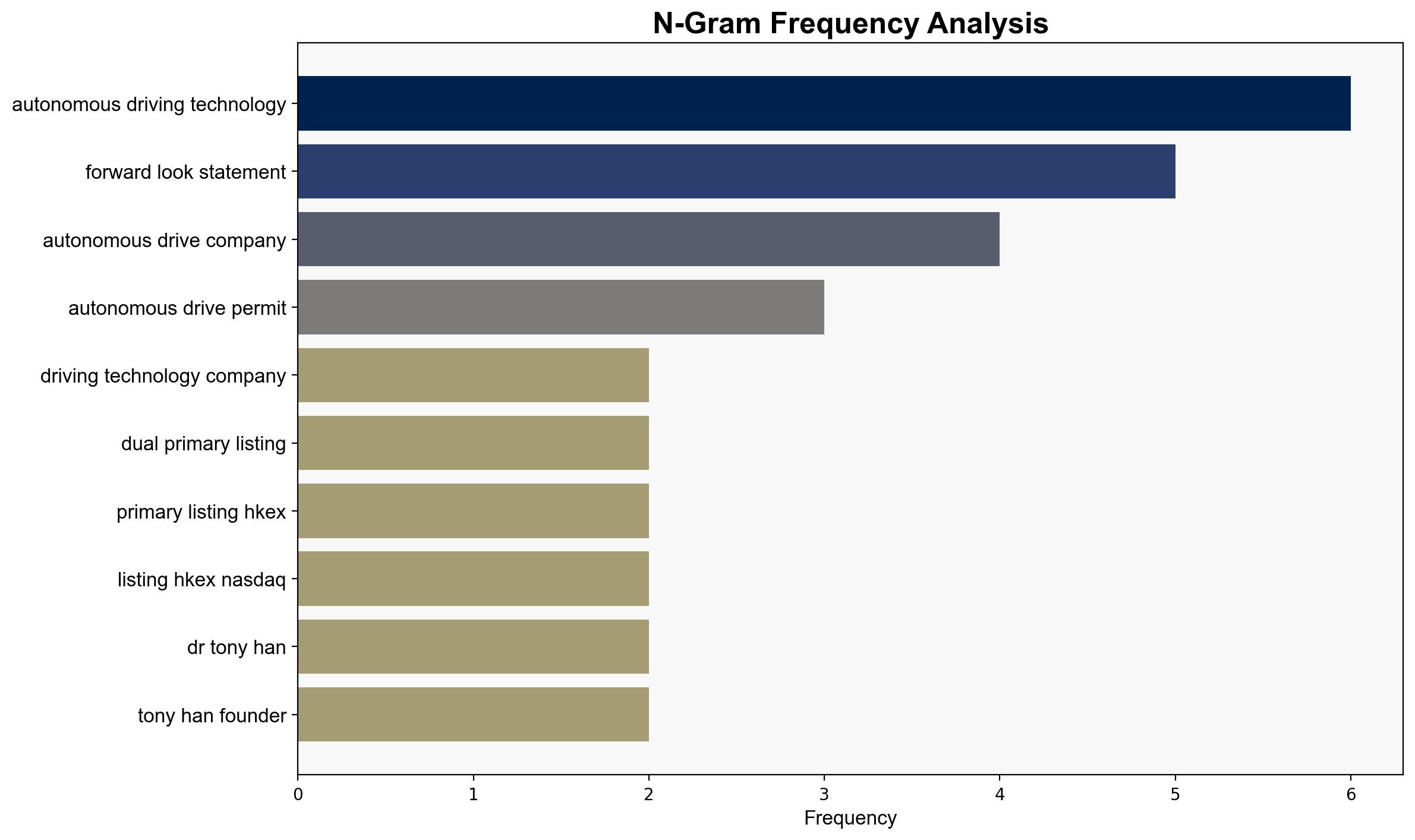

WeRide’s dual listing on the Hong Kong and Nasdaq stock exchanges marks a significant milestone in the autonomous vehicle industry, potentially positioning the company as a global leader in robotaxi services. The most supported hypothesis suggests that this move will enhance WeRide’s financial capabilities and accelerate its global expansion. Confidence level: High. Recommended action: Monitor WeRide’s strategic partnerships and technological advancements for potential market disruptions.

2. Competing Hypotheses

Hypothesis 1: WeRide’s dual listing will significantly enhance its financial resources and global market presence, enabling rapid expansion and technological innovation.

Hypothesis 2: The dual listing may not substantially impact WeRide’s market position due to potential overvaluation and market saturation in the autonomous vehicle sector.

Using the Analysis of Competing Hypotheses (ACH) 2.0, Hypothesis 1 is better supported by the evidence of strategic partnerships with major industry players like NVIDIA, Bosch, and Uber, and the company’s commitment to technological innovation and global deployment.

3. Key Assumptions and Red Flags

Assumptions:

– WeRide’s technology and business model are scalable and adaptable to different markets.

– The global regulatory environment will remain favorable for autonomous vehicle deployment.

Red Flags:

– Potential overvaluation of WeRide’s stock could lead to financial instability.

– Regulatory changes or technological failures could impede expansion.

4. Implications and Strategic Risks

The successful listing could trigger increased competition in the autonomous vehicle sector, prompting other companies to seek similar financial strategies. There is a risk of geopolitical tensions affecting WeRide’s operations, particularly in regions with strict regulatory environments. Additionally, technological failures or cybersecurity threats could undermine trust in autonomous driving solutions.

5. Recommendations and Outlook

- Monitor WeRide’s financial performance and stock valuation to assess sustainability.

- Engage with regulatory bodies to understand potential changes impacting autonomous vehicles.

- Scenario Projections:

- Best Case: WeRide successfully expands globally, leading to increased market share and technological leadership.

- Worst Case: Regulatory hurdles and technological setbacks hinder expansion, resulting in financial losses.

- Most Likely: Gradual expansion with moderate success in key markets, contingent on regulatory and technological developments.

6. Key Individuals and Entities

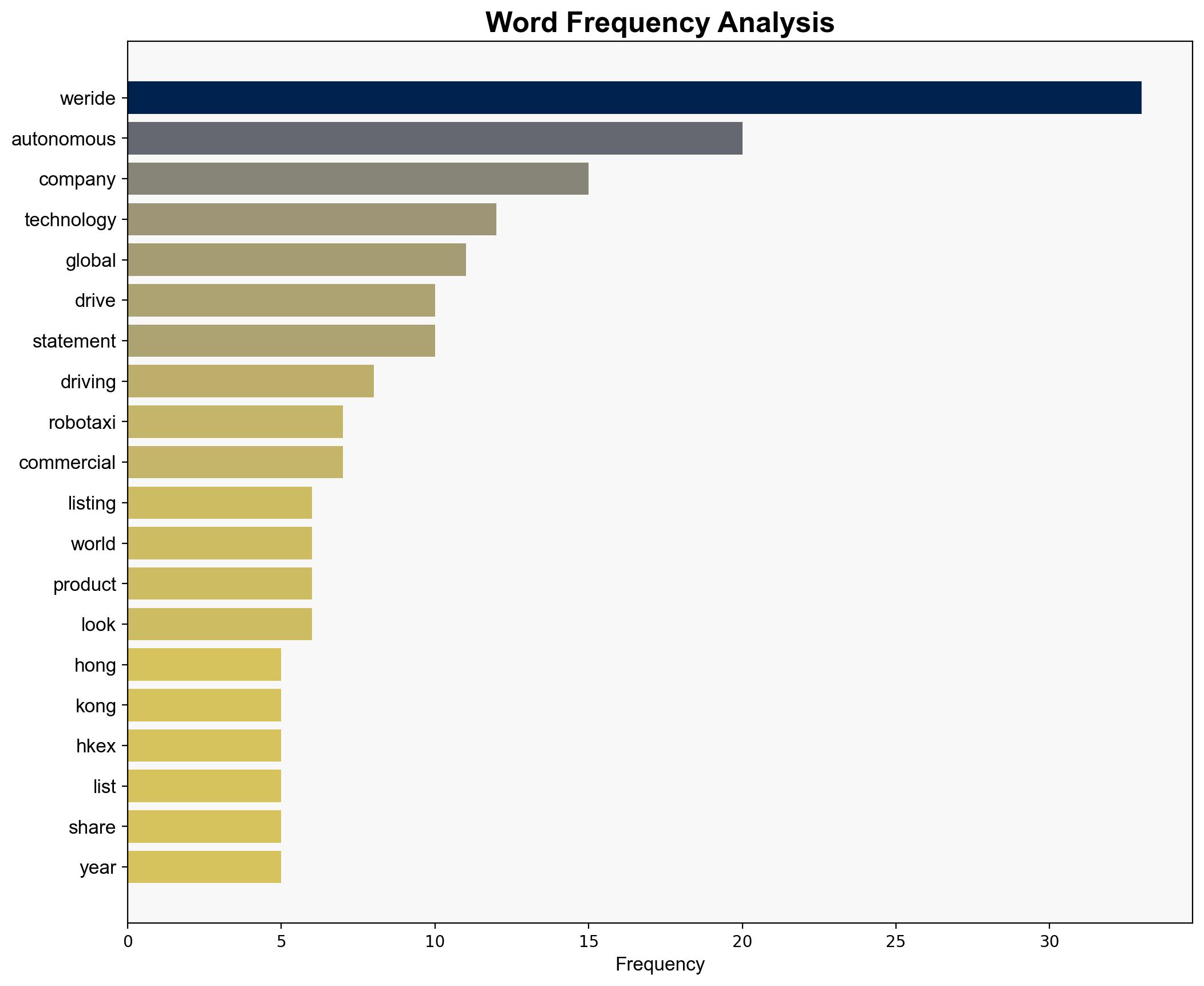

– Dr. Tony Han

– WeRide

– NVIDIA

– Bosch

– Uber

7. Thematic Tags

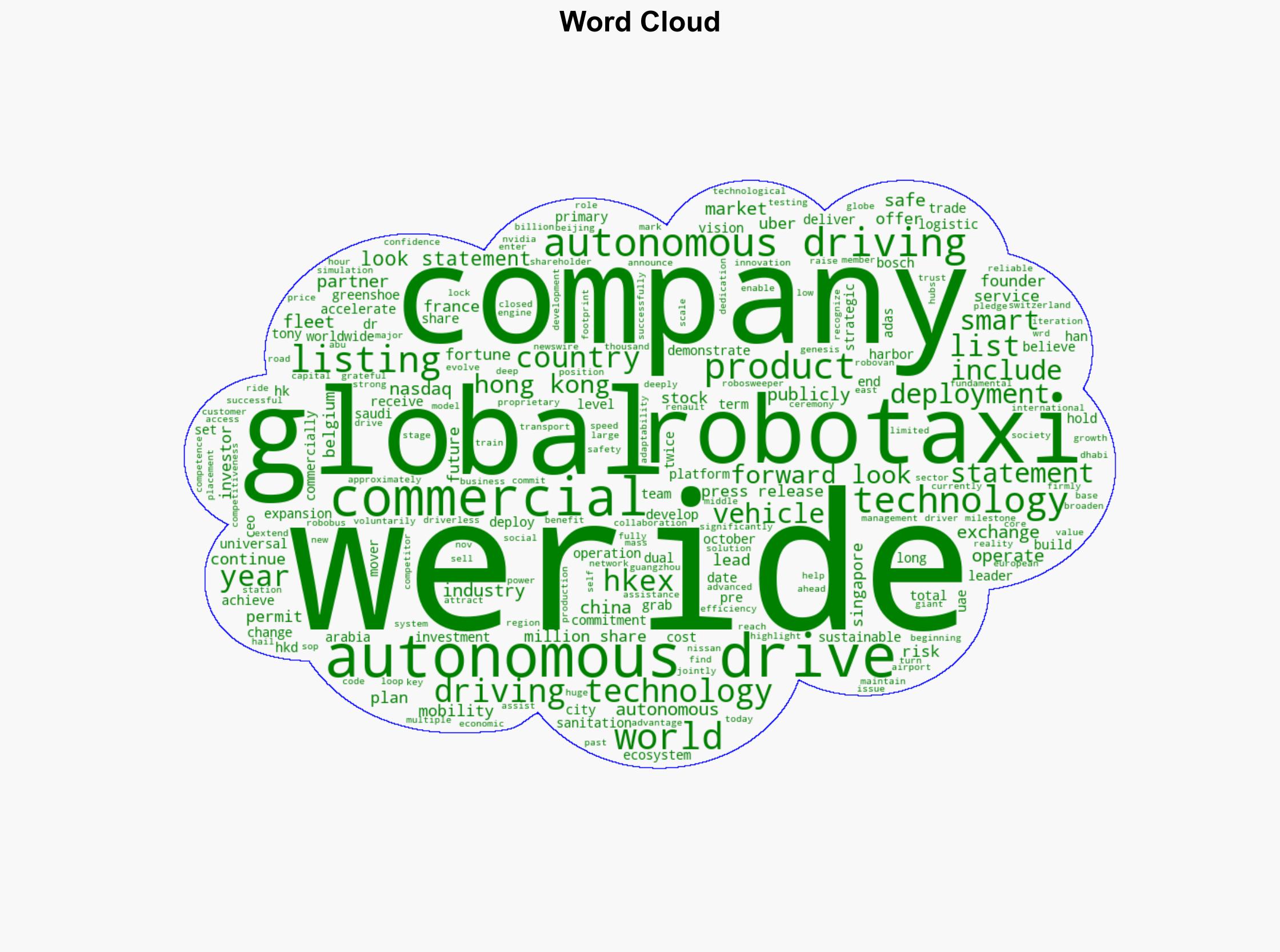

autonomous vehicles, financial markets, technological innovation, global expansion