This Major Energy Company Is Blaming The White House For Its Bankruptcy – Moneydigest.com

Published on: 2025-11-11

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: This Major Energy Company Is Blaming The White House For Its Bankruptcy – Moneydigest.com

1. BLUF (Bottom Line Up Front)

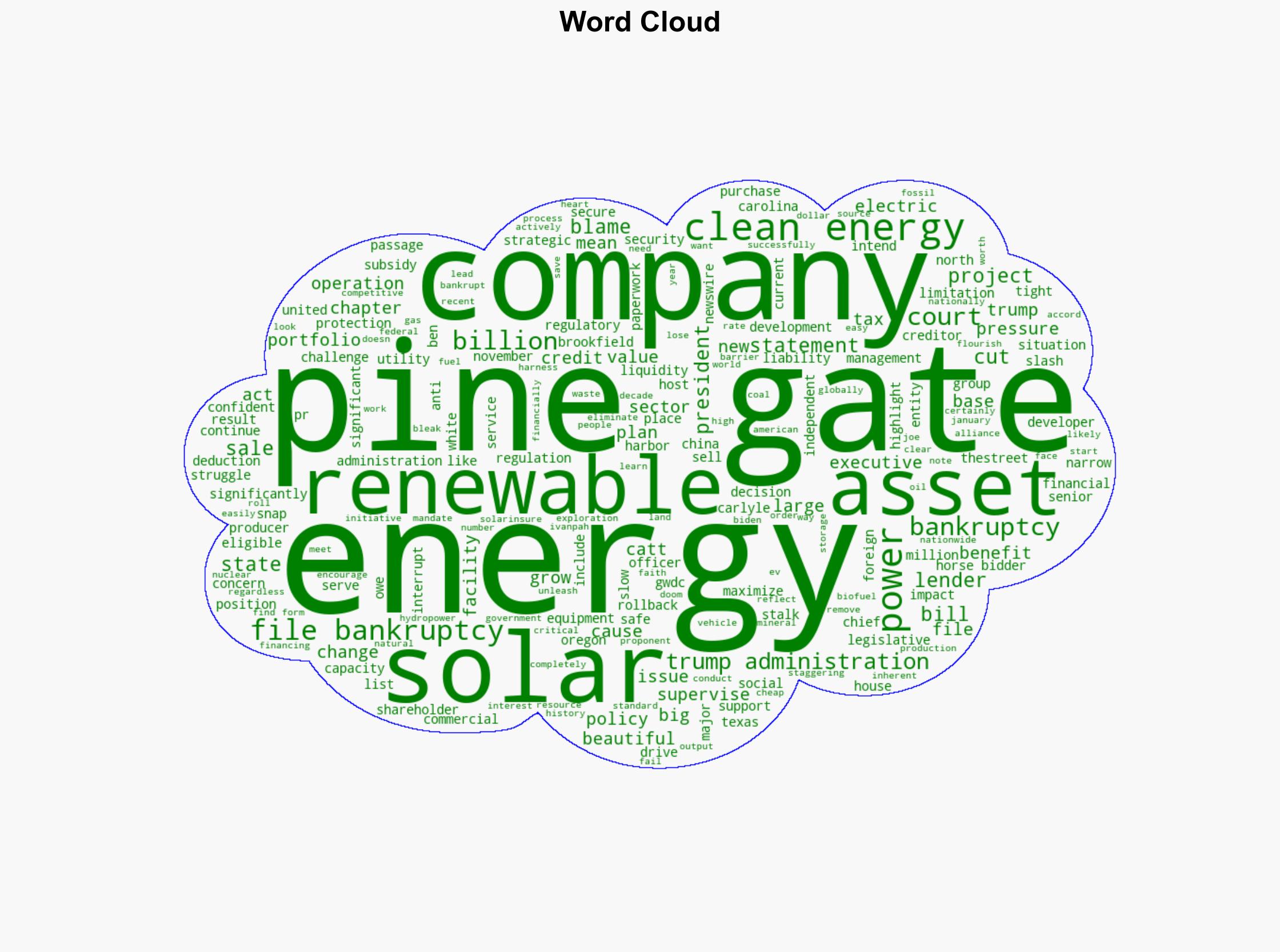

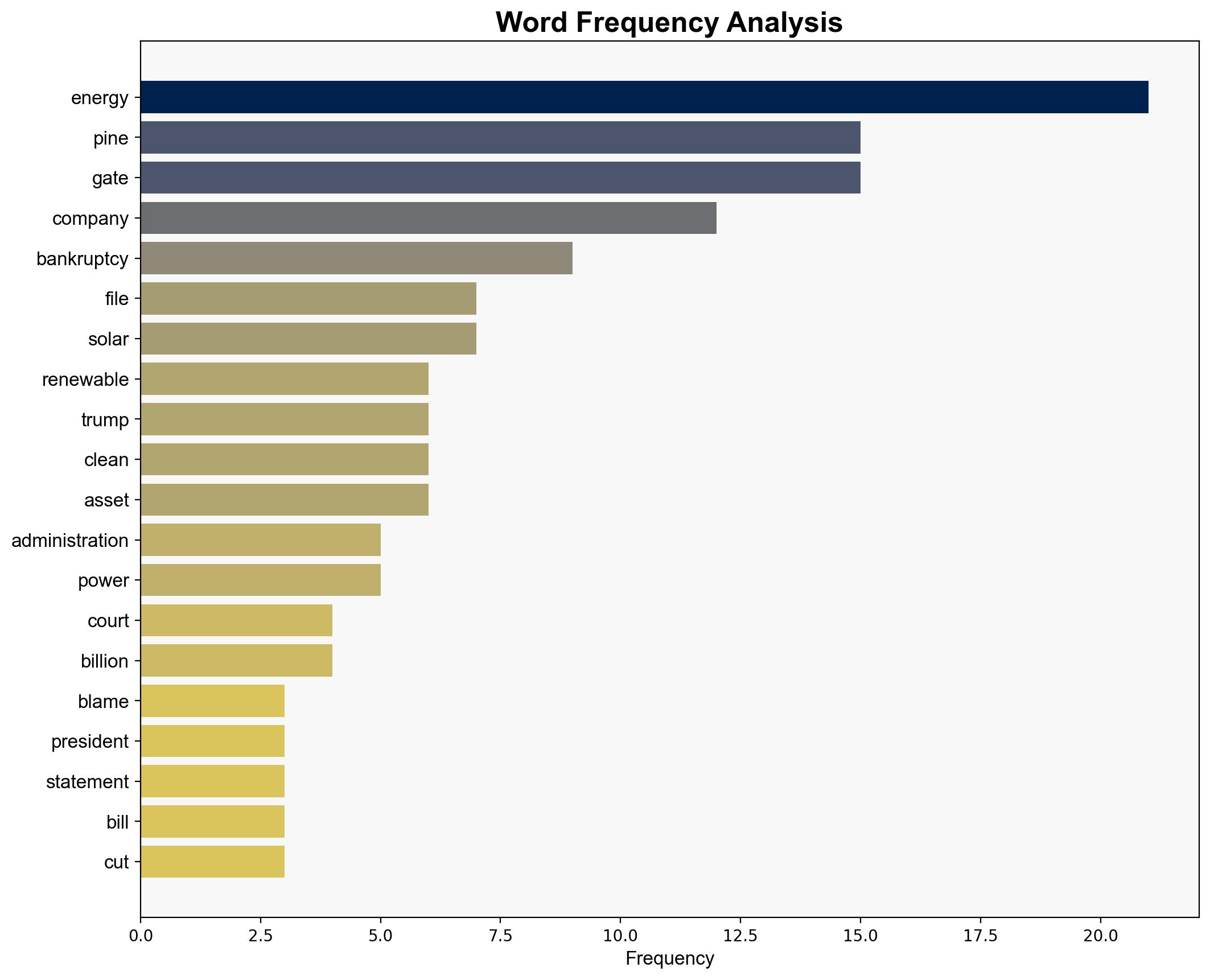

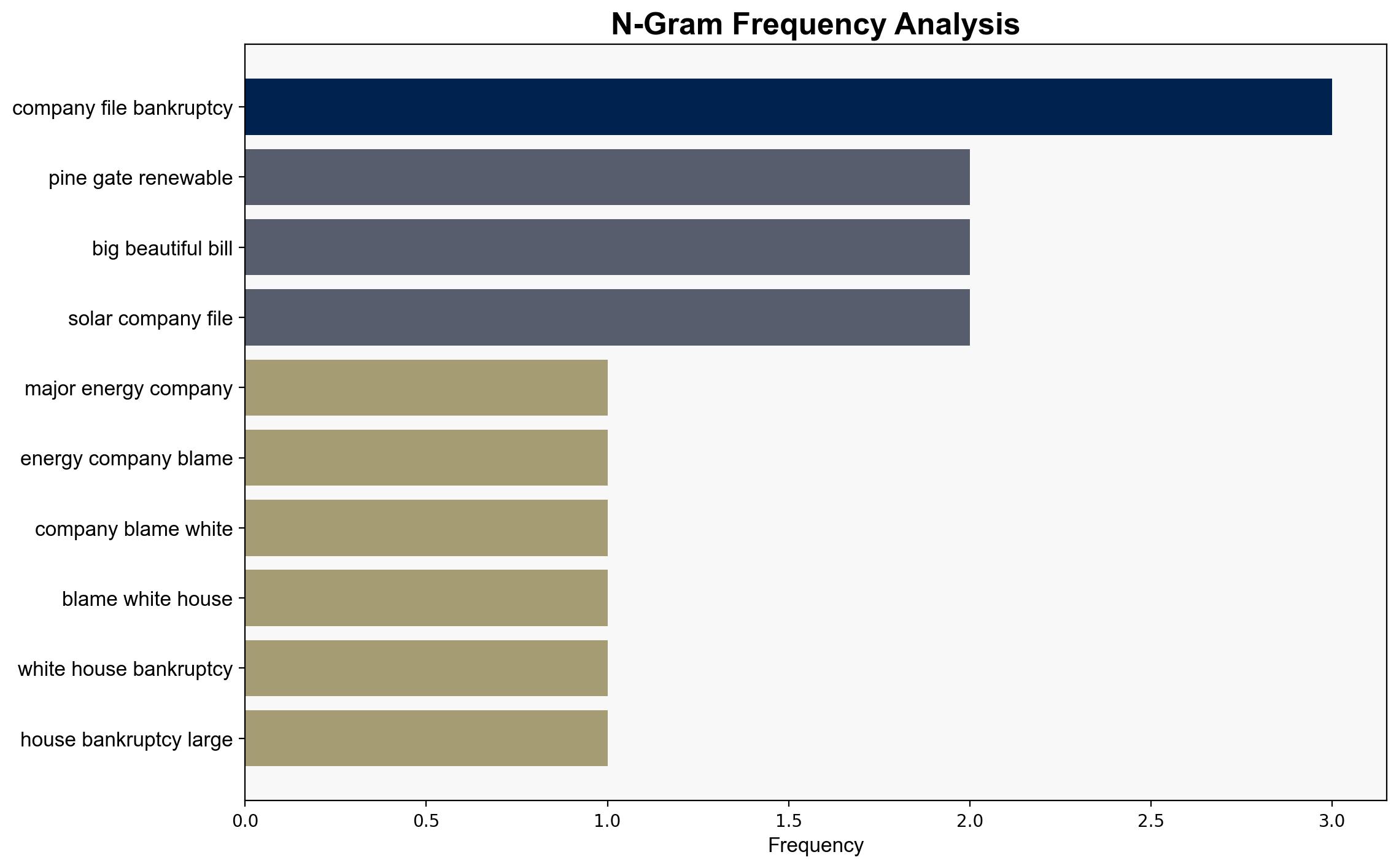

The strategic judgment is that Pine Gate Renewables’ bankruptcy is primarily driven by a combination of internal financial mismanagement and external policy shifts under the Trump administration, with a moderate confidence level. It is recommended that stakeholders in the renewable energy sector enhance financial resilience and engage in proactive policy advocacy to mitigate similar risks.

2. Competing Hypotheses

Hypothesis 1: Pine Gate Renewables’ bankruptcy is largely due to the Trump administration’s policy shifts, which reduced subsidies and support for renewable energy, leading to financial strain.

Hypothesis 2: The bankruptcy is primarily a result of Pine Gate’s internal financial mismanagement and inability to adapt to changing market conditions, with external policy shifts being a secondary factor.

Hypothesis 2 is assessed as more likely due to the presence of liquidity issues and financial mismanagement indicators, despite the external policy environment being unfavorable.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that Pine Gate’s financial disclosures are accurate and that policy shifts directly impacted their financial health. There is a risk of bias in attributing blame solely to external factors without considering internal management failures.

Red Flags: The company’s public blaming of the Trump administration may serve as a deflection from internal issues. The timing of the bankruptcy filing and the strategic sale process could indicate attempts to shield management from accountability.

4. Implications and Strategic Risks

The bankruptcy of Pine Gate Renewables could lead to a loss of investor confidence in the renewable energy sector, potentially slowing down future investments. There is a risk of political exploitation of the situation, which could further polarize energy policy debates. Additionally, the sale of assets to foreign entities may raise national security concerns.

5. Recommendations and Outlook

- Renewable energy companies should diversify funding sources and improve financial management practices to withstand policy shifts.

- Engage in policy advocacy to ensure stable and supportive regulatory environments for renewable energy.

- Best-case scenario: The sector adapts, leading to increased innovation and resilience.

- Worst-case scenario: Continued bankruptcies lead to a significant slowdown in renewable energy development.

- Most-likely scenario: A moderate recovery with increased scrutiny on financial practices within the sector.

6. Key Individuals and Entities

Ben Catt (CEO of Pine Gate Renewables), Carlyle Group, Brookfield Asset Management.

7. Thematic Tags

Regional Focus: United States, Renewable Energy, Policy Impact, Financial Management

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Methodology