Americans Living Paycheck to Paycheck Rises to 24 in 2025 Led by Millennials and Gen X BofA Report – International Business Times

Published on: 2025-11-12

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Americans Living Paycheck to Paycheck Rises to 24 in 2025 Led by Millennials and Gen X BofA Report – International Business Times

1. BLUF (Bottom Line Up Front)

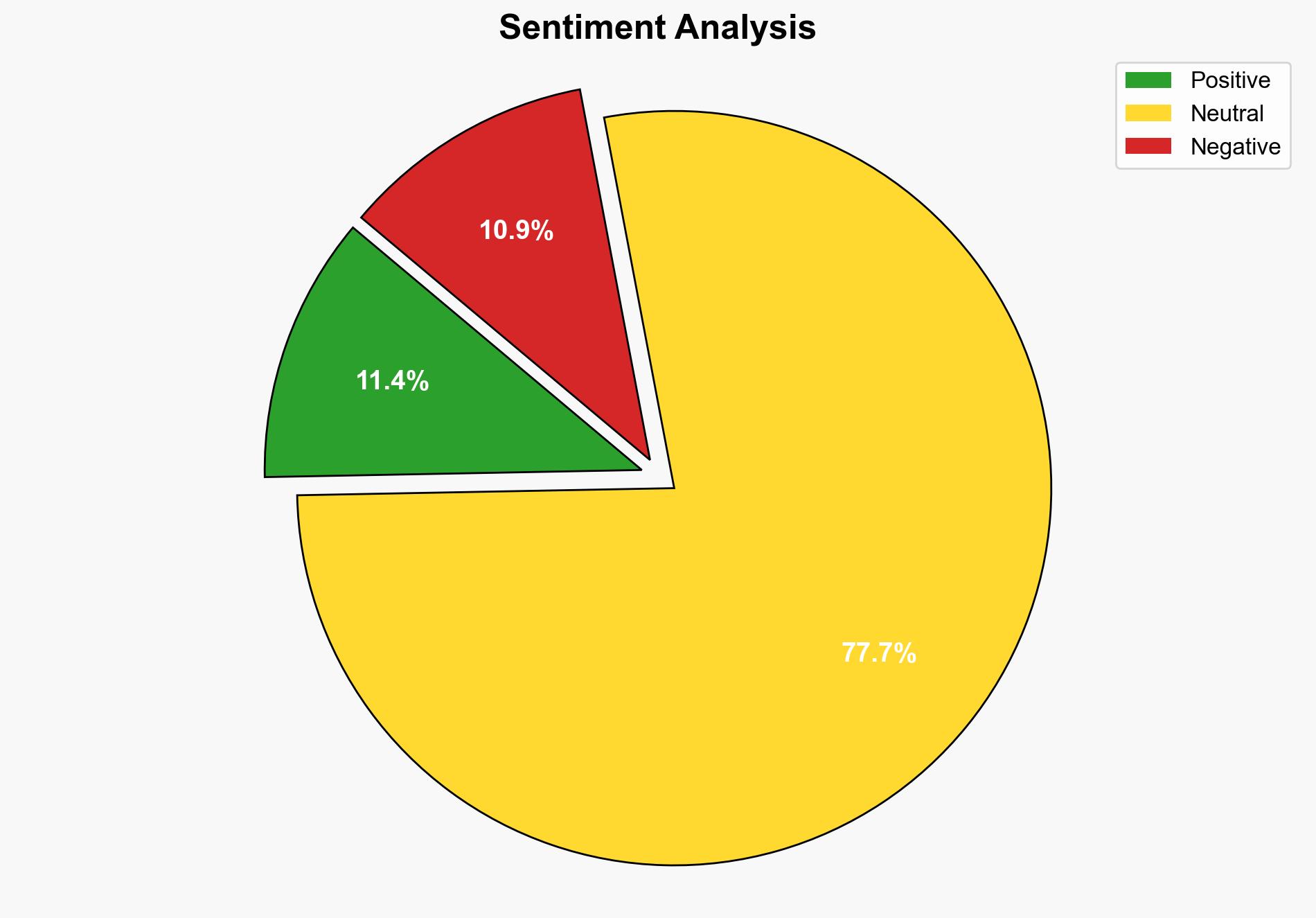

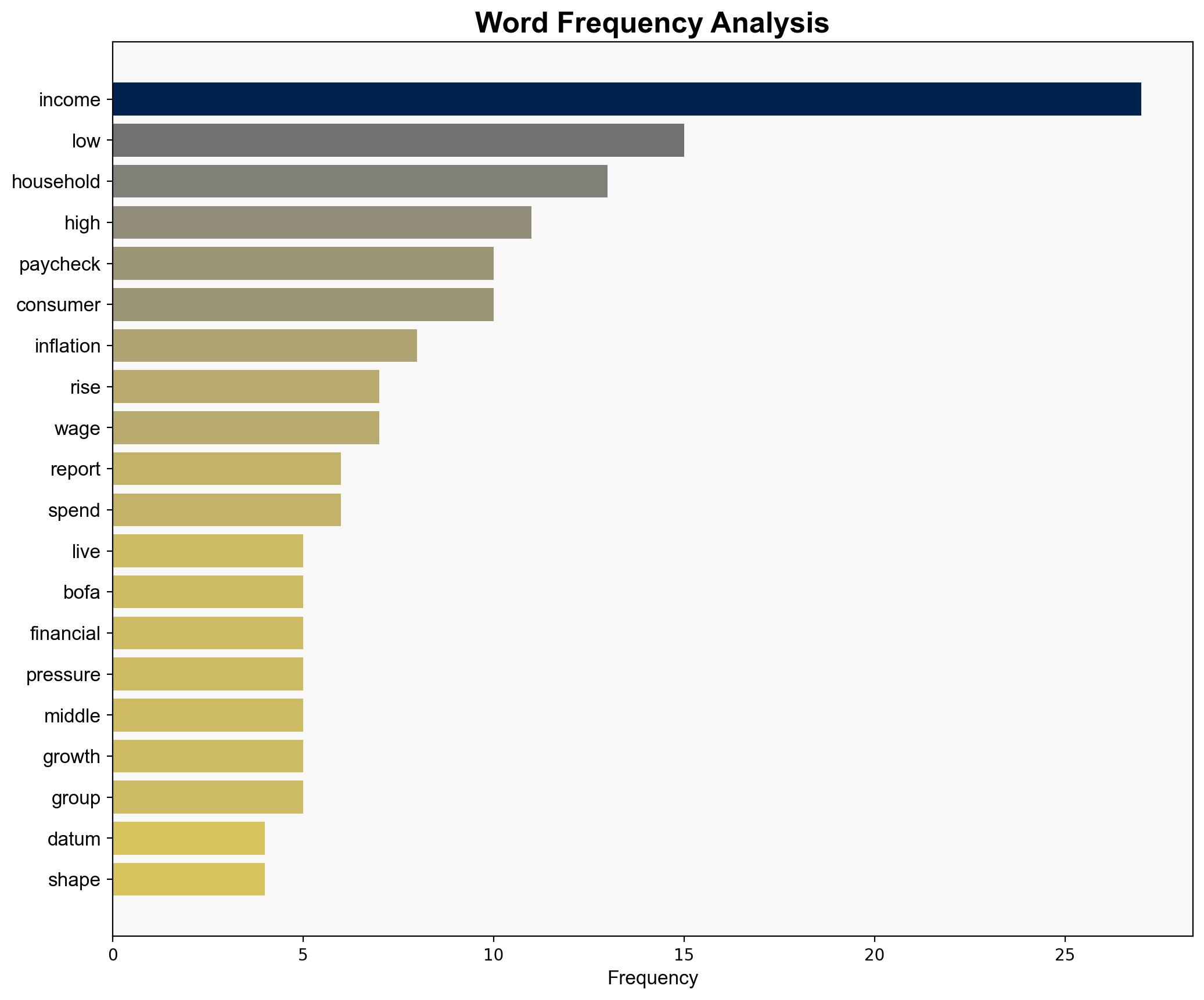

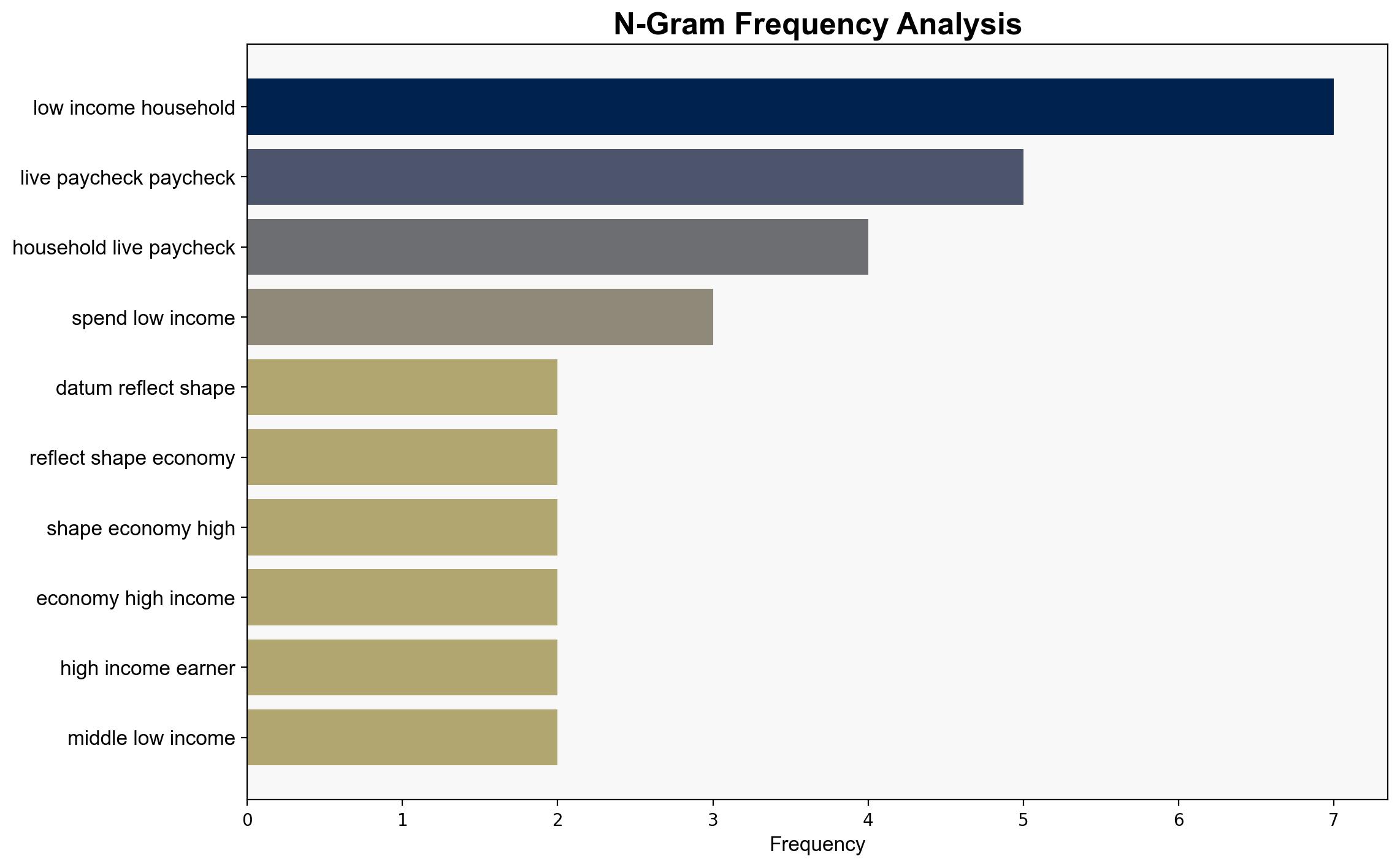

The most supported hypothesis is that the rise in Americans living paycheck to paycheck is primarily driven by inflation outpacing wage growth, particularly affecting Millennials and Gen X. This trend is exacerbated by economic bifurcation, where high-income earners continue to thrive while low and middle-income groups face increasing financial strain. Confidence level: Moderate. Recommended action: Implement targeted economic policies to address wage stagnation and inflation impacts on vulnerable demographics.

2. Competing Hypotheses

Hypothesis 1: The increase in Americans living paycheck to paycheck is primarily due to inflation outpacing wage growth, disproportionately affecting low and middle-income households.

Hypothesis 2: The trend is driven by broader economic structural changes, including shifts in consumer behavior and spending patterns, which are not solely attributable to inflation and wage dynamics.

Hypothesis 1 is more likely due to the direct correlation between inflation rates and the financial strain reported, as well as the specific mention of wage stagnation in the source material. Hypothesis 2 is less supported as it lacks direct evidence linking structural economic changes to the paycheck-to-paycheck trend.

3. Key Assumptions and Red Flags

Assumptions: The data from the BofA report accurately reflects national trends. Inflation and wage growth are the primary drivers of financial strain.

Red Flags: Potential bias in the BofA report, as it may emphasize factors aligning with its economic interests. Lack of comprehensive data on regional economic variations and their impact.

4. Implications and Strategic Risks

The growing financial vulnerability of low and middle-income Americans could lead to increased socio-economic disparities, potentially escalating into political unrest or increased demand for government intervention. Economic bifurcation may also result in reduced consumer spending in key sectors, impacting overall economic growth.

5. Recommendations and Outlook

- Actionable Steps: Develop policies to enhance wage growth, particularly for low and middle-income groups. Consider targeted subsidies or tax relief to mitigate inflation impacts.

- Best Scenario: Successful policy interventions lead to wage growth outpacing inflation, reducing the number of Americans living paycheck to paycheck.

- Worst Scenario: Continued economic bifurcation exacerbates socio-economic disparities, leading to increased political and social instability.

- Most-likely Scenario: Incremental improvements in wage growth and inflation control, with slow reduction in financial strain for affected demographics.

6. Key Individuals and Entities

Chris Kempczinski (McDonald’s CEO), Scott Boatwright (Chipotle CEO)

7. Thematic Tags

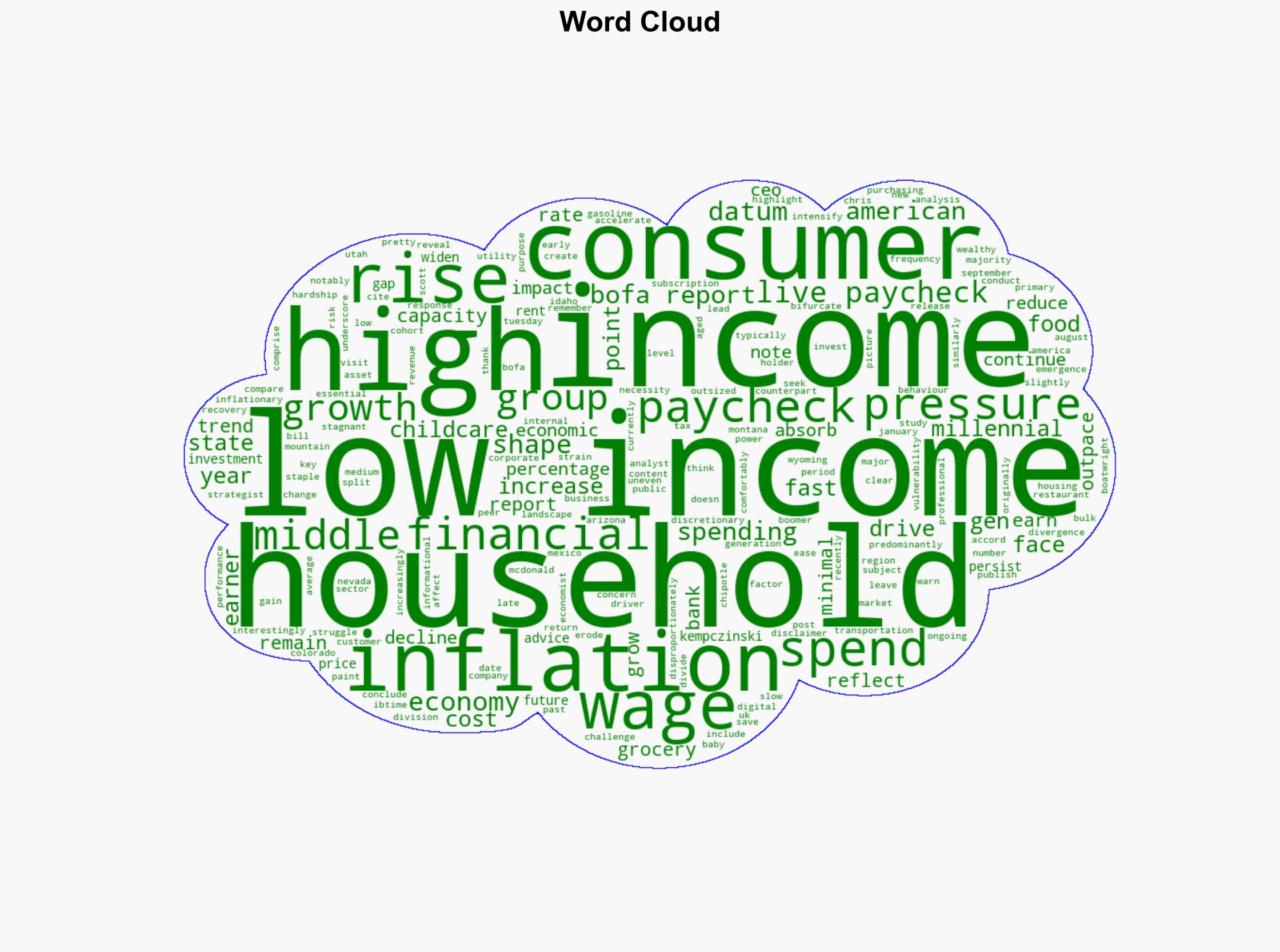

Economic Inequality, Inflation, Wage Growth, Consumer Behavior, Socio-economic Disparities

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology