CBI arrests AXIS Bank manager in Mumbai over accounts to hide money stolen from cyber crimes – The Times of India

Published on: 2025-11-12

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: CBI arrests AXIS Bank manager in Mumbai over accounts to hide money stolen from cyber crimes – The Times of India

1. BLUF (Bottom Line Up Front)

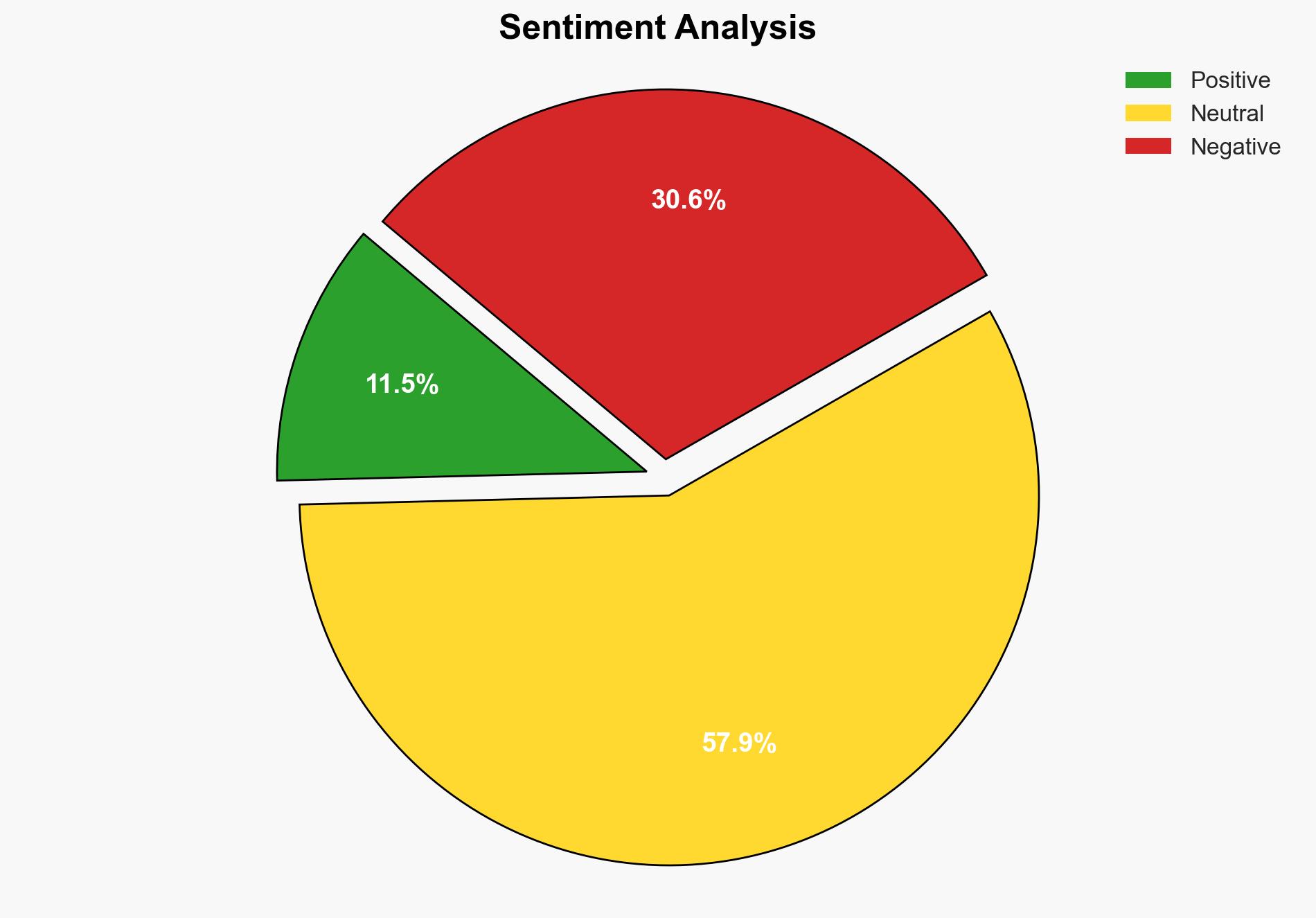

The arrest of an AXIS Bank manager in Mumbai highlights a significant vulnerability within the banking sector, where internal collusion facilitates cybercrime. With a moderate confidence level, the most supported hypothesis is that this incident is part of a broader, organized cybercriminal network exploiting banking systems. Strategic recommendations include enhancing internal controls and inter-agency collaboration to mitigate risks.

2. Competing Hypotheses

Hypothesis 1: The AXIS Bank manager’s arrest is an isolated incident of corruption, where the individual acted independently for personal gain.

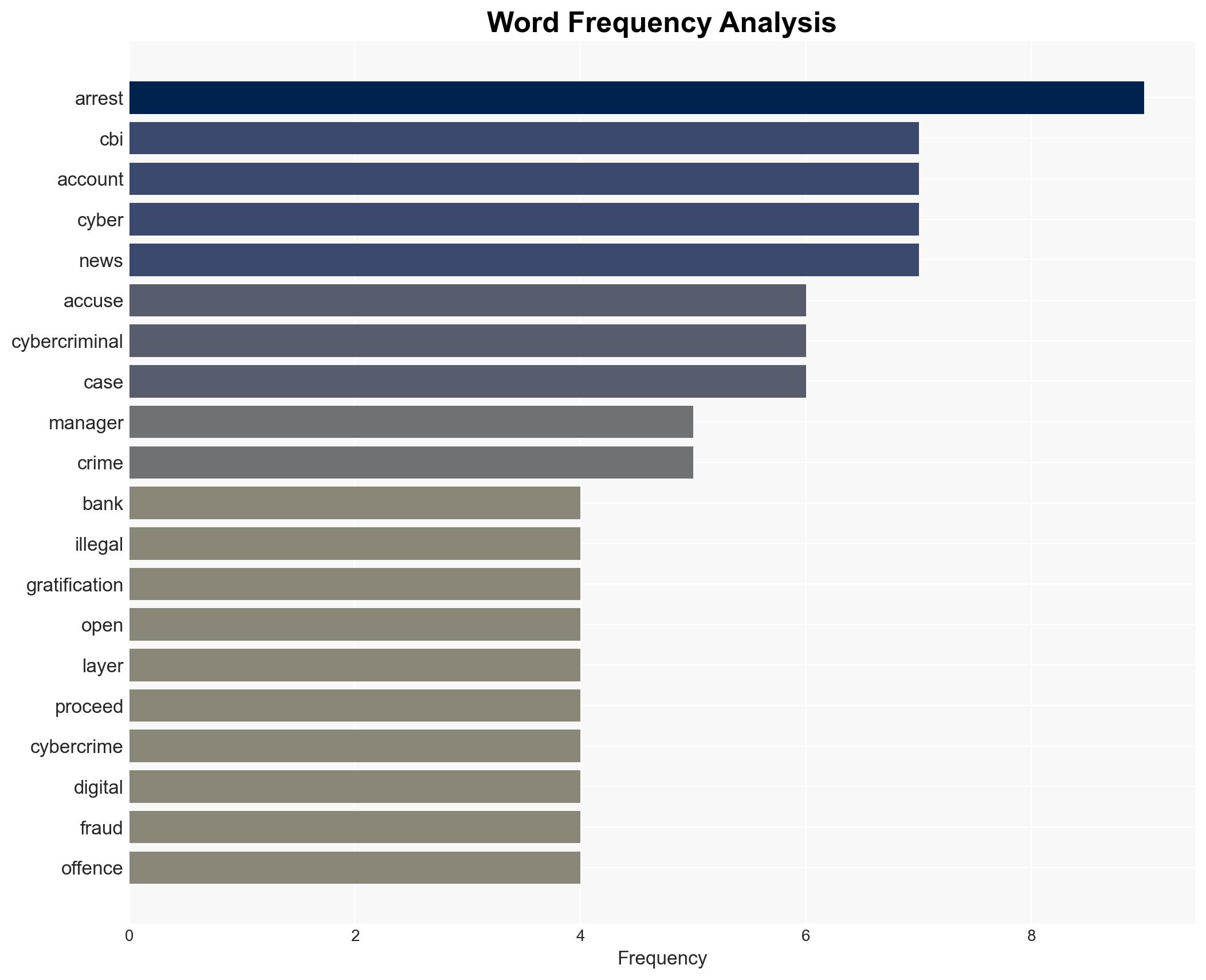

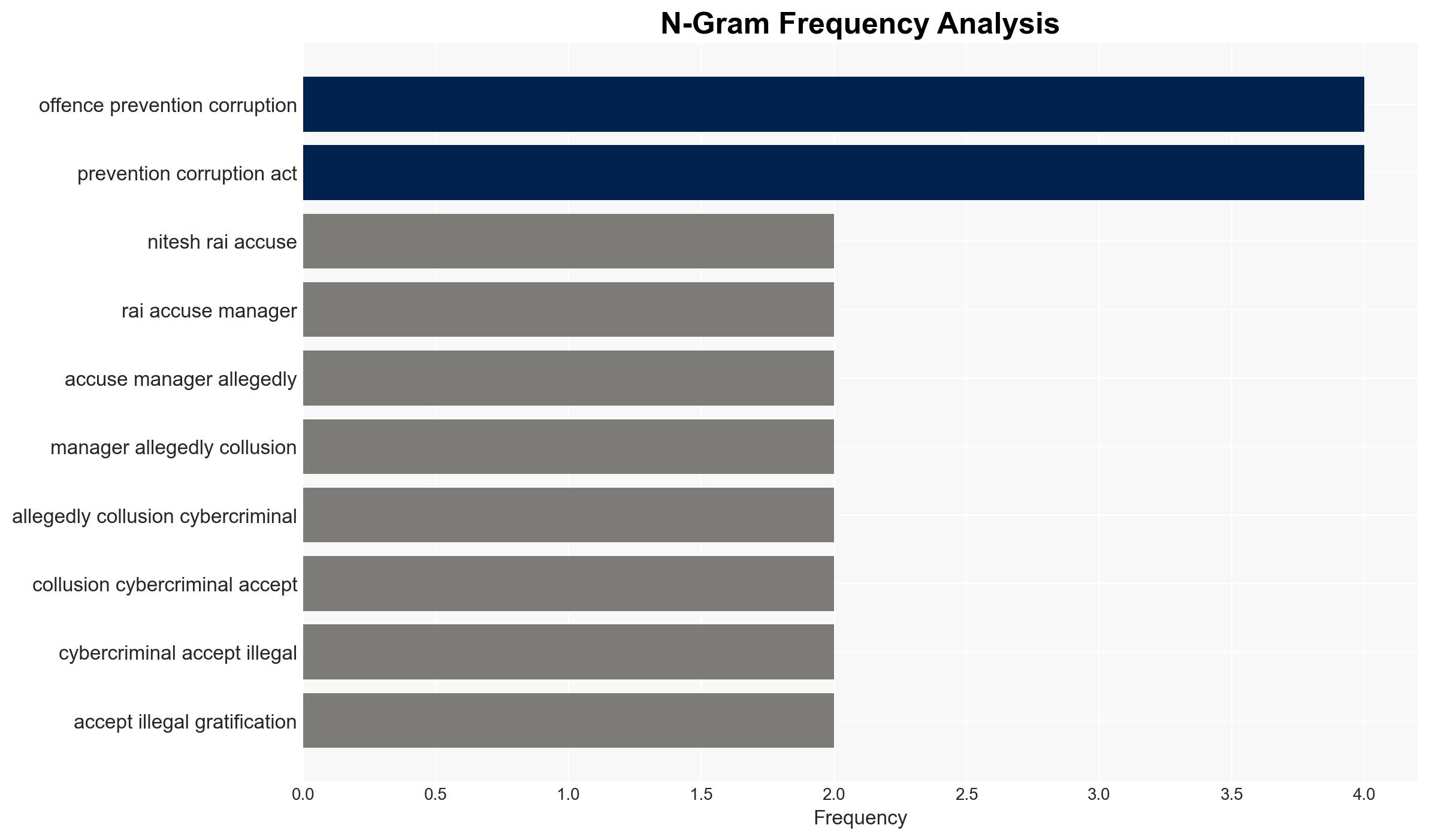

Hypothesis 2: The arrest is part of a larger, organized cybercriminal network that systematically exploits banking systems through collusion with insiders.

Assessment: Hypothesis 2 is more likely given the CBI’s statement on the wide pattern of organized cybercrime networks exploiting banking systems. The involvement of multiple cybercrime cases and the structured creation of mule accounts suggest a coordinated effort rather than isolated misconduct.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that the CBI’s investigation is thorough and unbiased. The integrity of the banking system is presumed to be generally robust, with this being an exception.

Red Flags: The potential for other bank employees to be involved or for similar schemes to exist in other financial institutions. The possibility of underreporting or misreporting by involved parties.

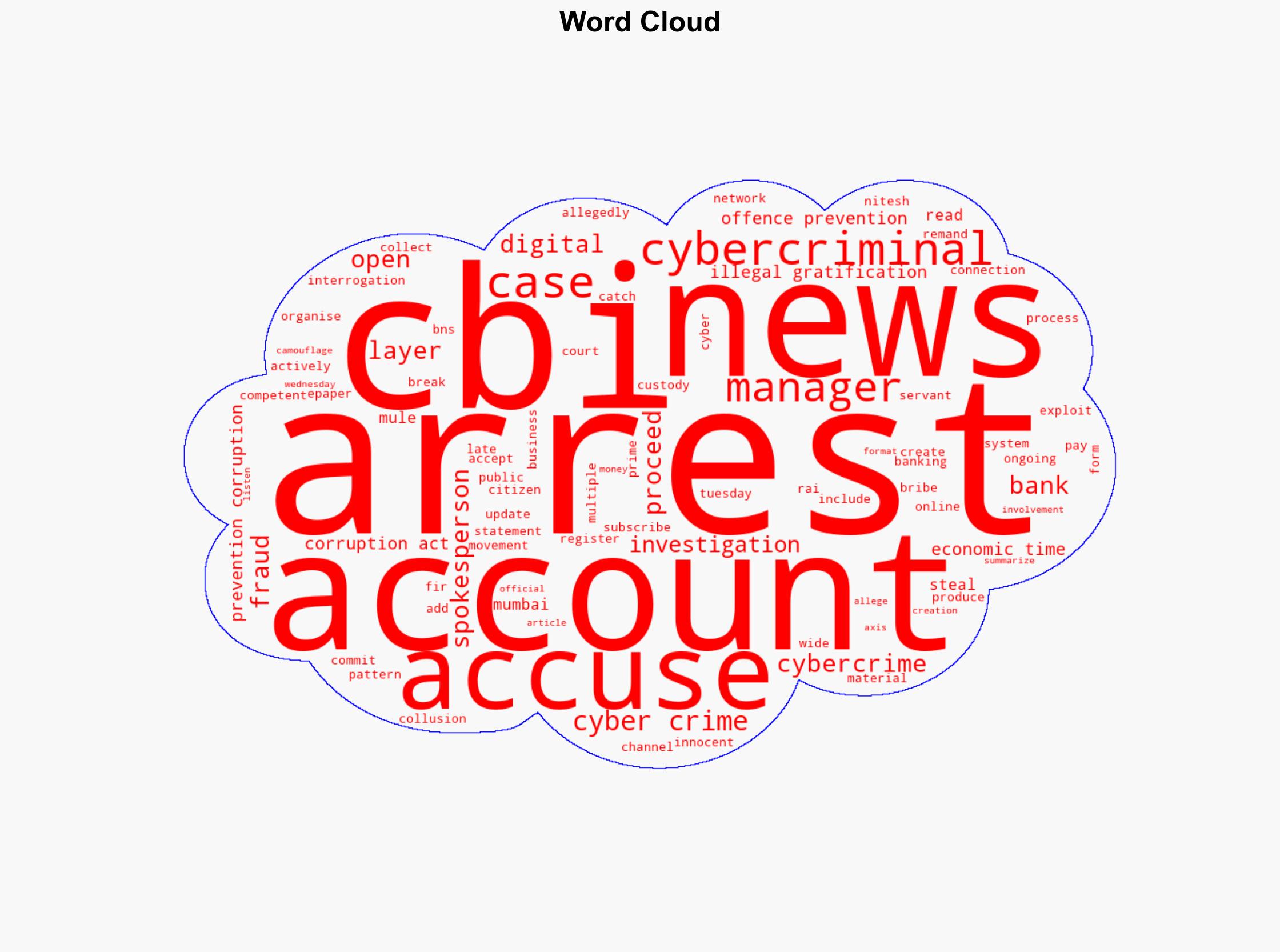

Deception Indicators: The use of mule accounts and layering techniques suggests deliberate obfuscation of illegal activities, indicating a sophisticated level of deception.

4. Implications and Strategic Risks

The incident poses significant risks to the banking sector’s reputation and trustworthiness, potentially leading to increased regulatory scrutiny and financial instability. Politically, it could strain public confidence in financial oversight institutions. Cyber risks are heightened as organized networks may continue to exploit systemic vulnerabilities. Economically, there could be a ripple effect impacting investor confidence and international partnerships.

5. Recommendations and Outlook

- Actionable Steps: Implement stricter internal controls and employee vetting processes within banks. Enhance collaboration between financial institutions and law enforcement to detect and prevent insider threats.

- Best Scenario: Strengthened security measures and successful dismantling of the cybercriminal network, restoring public trust.

- Worst Scenario: Continued exploitation by cybercriminals leading to widespread financial disruption and loss of consumer confidence.

- Most-likely Scenario: Incremental improvements in security with ongoing challenges in fully eradicating insider threats and organized cybercrime.

6. Key Individuals and Entities

Nitesh Rai (Accused AXIS Bank Manager)

Central Bureau of Investigation (CBI)

7. Thematic Tags

Cybersecurity, Banking, Corruption, Financial Crime

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology