CollectWise YC F24 Is Hiring – Hacker News

Published on: 2025-11-13

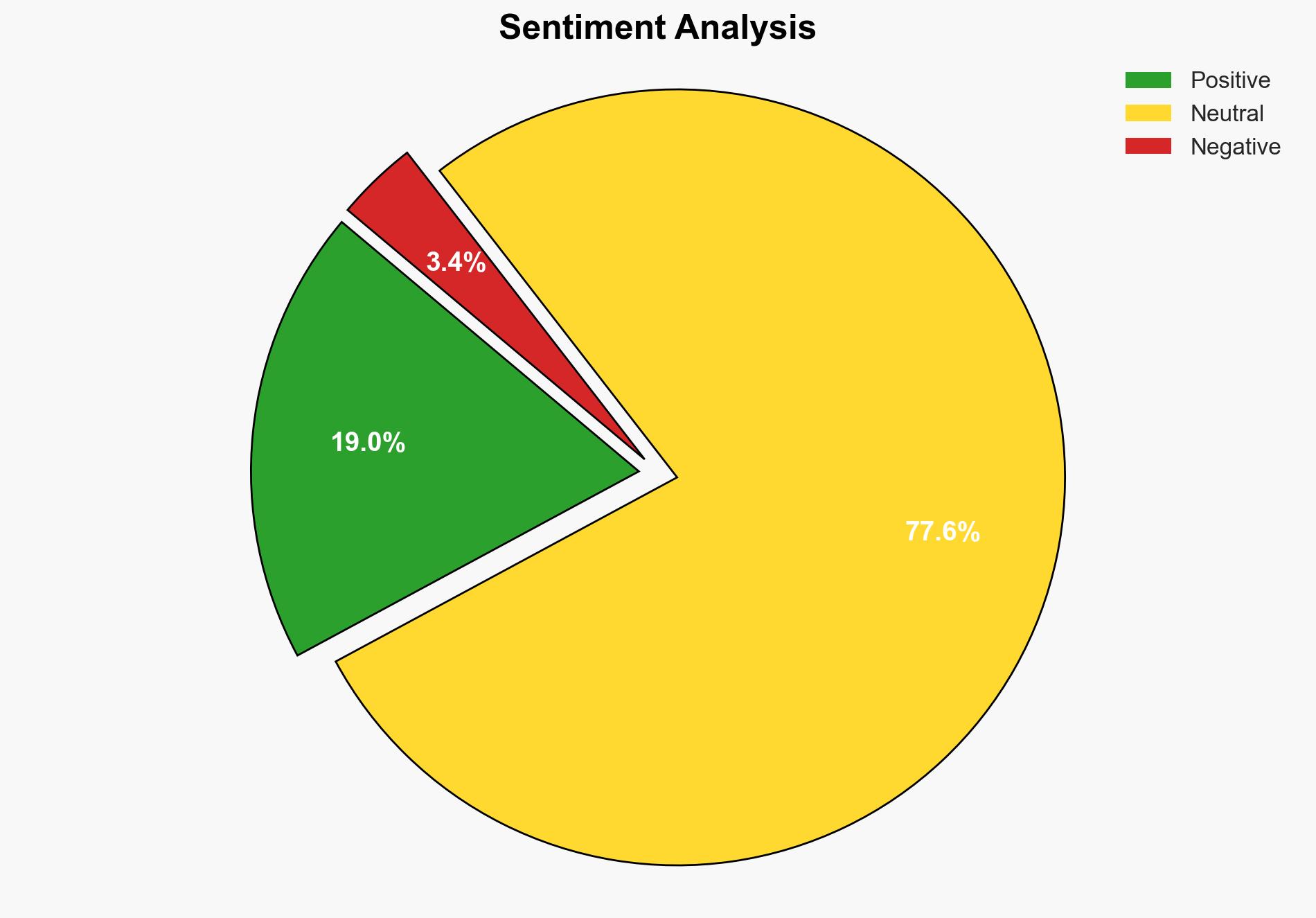

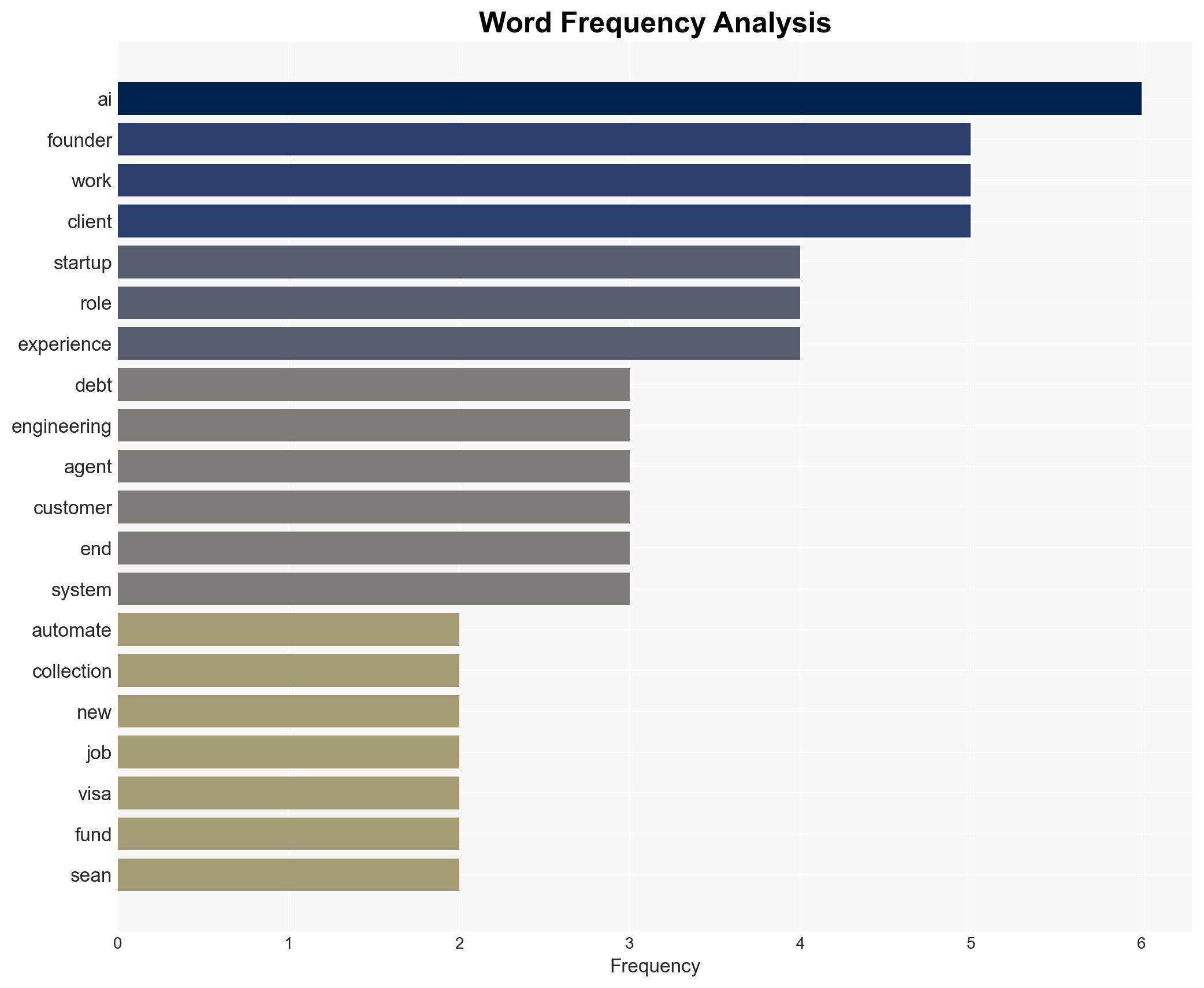

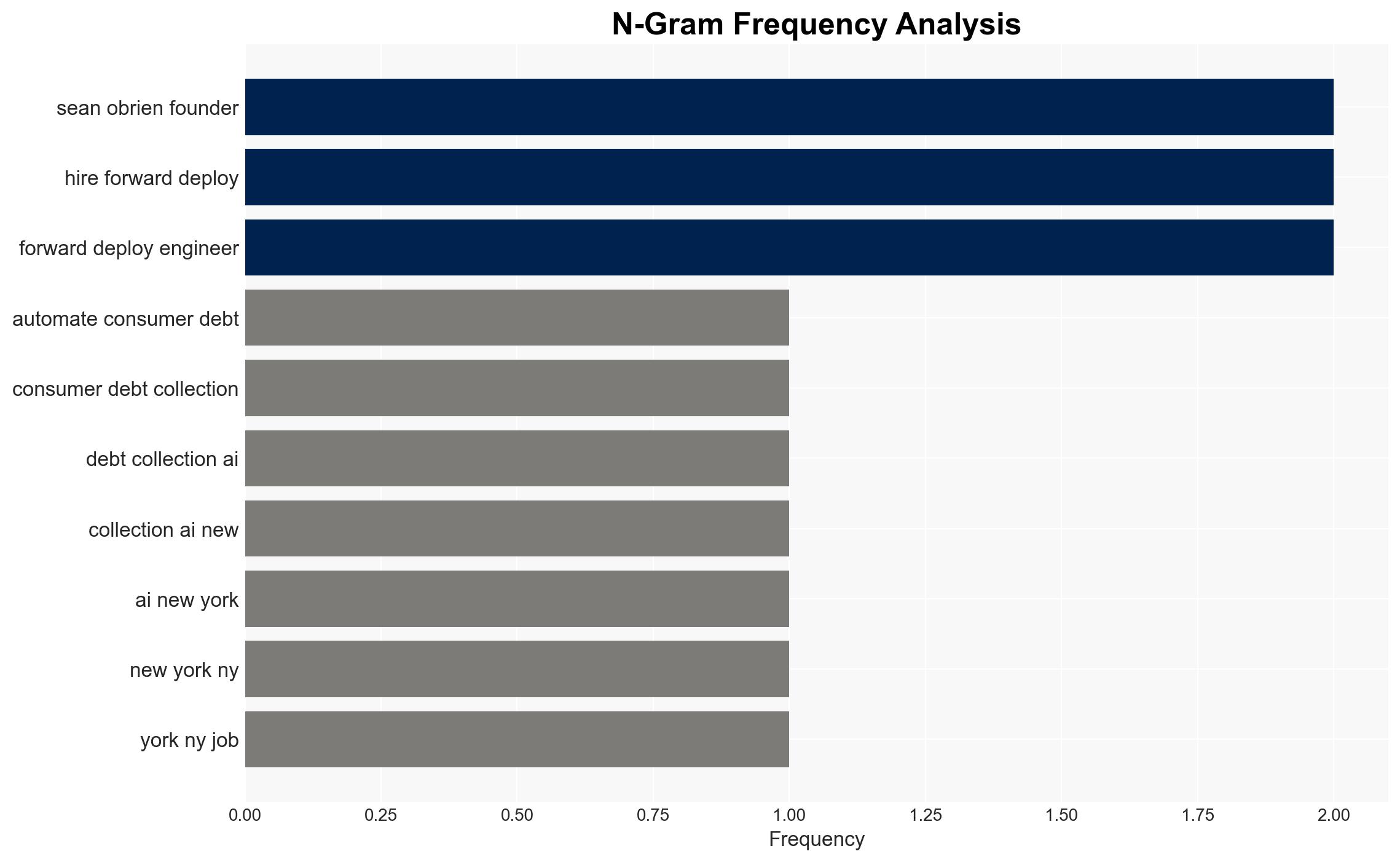

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: CollectWise YC F24 Is Hiring – Hacker News

1. BLUF (Bottom Line Up Front)

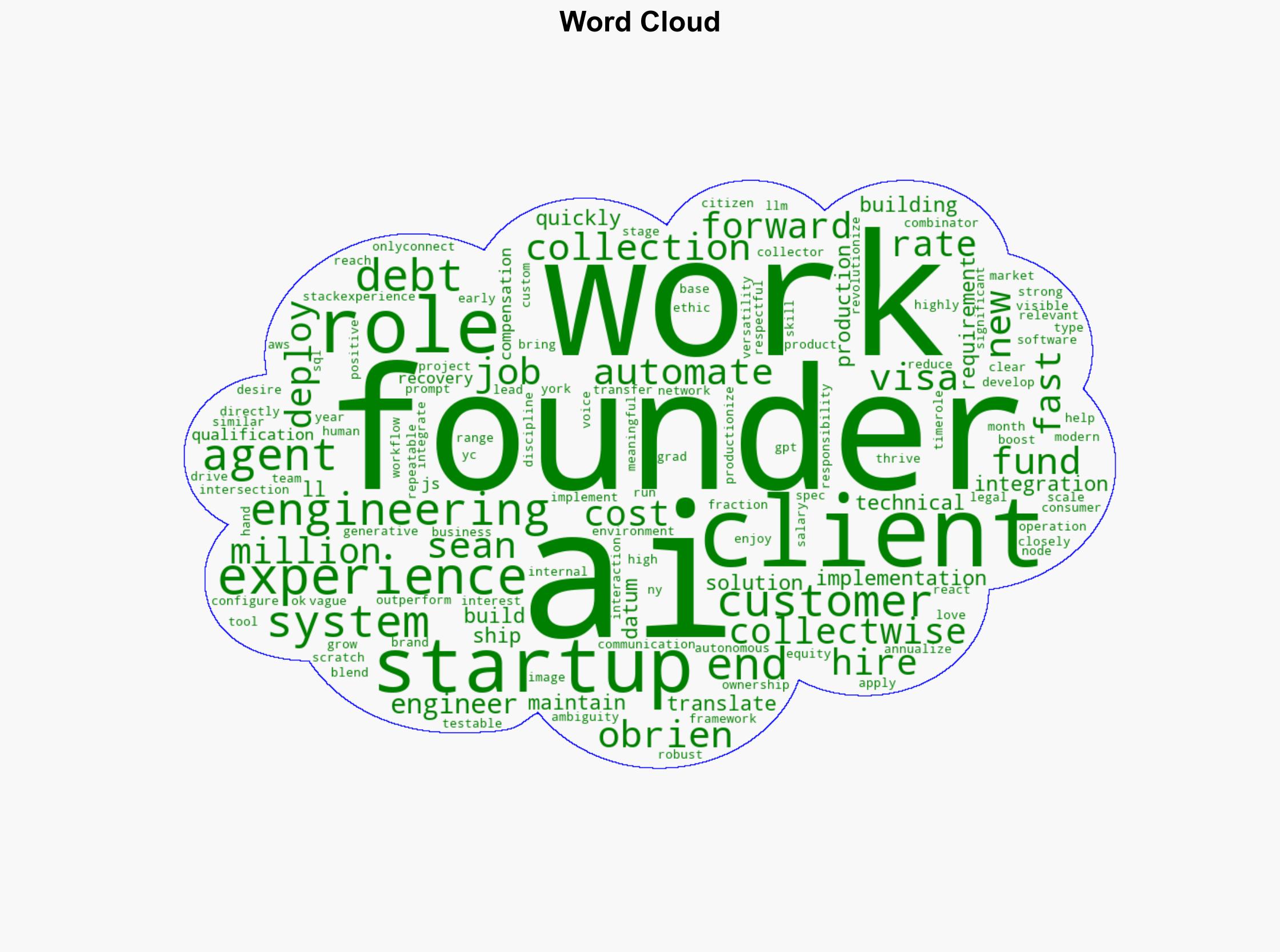

CollectWise, a Y Combinator-backed startup, is aggressively expanding its engineering team to enhance its AI-driven debt collection platform. The strategic move aims to leverage generative AI to disrupt the traditional debt collection industry by improving efficiency and reducing costs. Confidence Level: Moderate. Recommended action: Monitor the integration of AI in financial services for potential regulatory and competitive impacts.

2. Competing Hypotheses

Hypothesis 1: CollectWise is expanding its engineering team to capitalize on a growing market opportunity in AI-driven debt collection, aiming to significantly disrupt the industry.

Hypothesis 2: CollectWise’s hiring is primarily driven by a need to address internal operational challenges and improve existing systems rather than market expansion.

Assessment: Hypothesis 1 is more likely given the strategic focus on AI and the backing by Y Combinator, suggesting a growth-oriented approach. Hypothesis 2 is less supported due to the lack of evidence indicating operational difficulties.

3. Key Assumptions and Red Flags

Assumptions: The AI technology employed by CollectWise is sufficiently advanced to outperform traditional methods. The market is receptive to AI-driven debt collection solutions.

Red Flags: Potential over-reliance on AI without adequate human oversight could lead to compliance and ethical issues. The rapid scaling of operations might outpace the company’s ability to maintain quality and regulatory compliance.

4. Implications and Strategic Risks

Implications: Successful implementation could lead to significant cost savings and efficiency gains in the debt collection industry, potentially influencing broader financial services.

Strategic Risks: Regulatory scrutiny could increase as AI systems become more prevalent in financial operations. Cybersecurity risks may escalate as AI systems handle sensitive financial data.

5. Recommendations and Outlook

- Monitor regulatory developments related to AI in financial services to anticipate compliance challenges.

- Encourage CollectWise to implement robust cybersecurity measures to protect sensitive data.

- Best-case scenario: CollectWise successfully disrupts the debt collection industry, setting a new standard for efficiency.

- Worst-case scenario: Regulatory hurdles and cybersecurity breaches undermine CollectWise’s operations and reputation.

- Most-likely scenario: CollectWise achieves moderate success, leading to incremental improvements in debt collection processes.

6. Key Individuals and Entities

Sean O’Brien, Founder of CollectWise.

7. Thematic Tags

Cybersecurity, AI in Financial Services, Regulatory Compliance, Startup Growth

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology