The shutdown has ended but this economist isnt rejoicing quite yet – The Conversation Africa

Published on: 2025-11-13

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: The shutdown has ended but this economist isn’t rejoicing quite yet – The Conversation Africa

1. BLUF (Bottom Line Up Front)

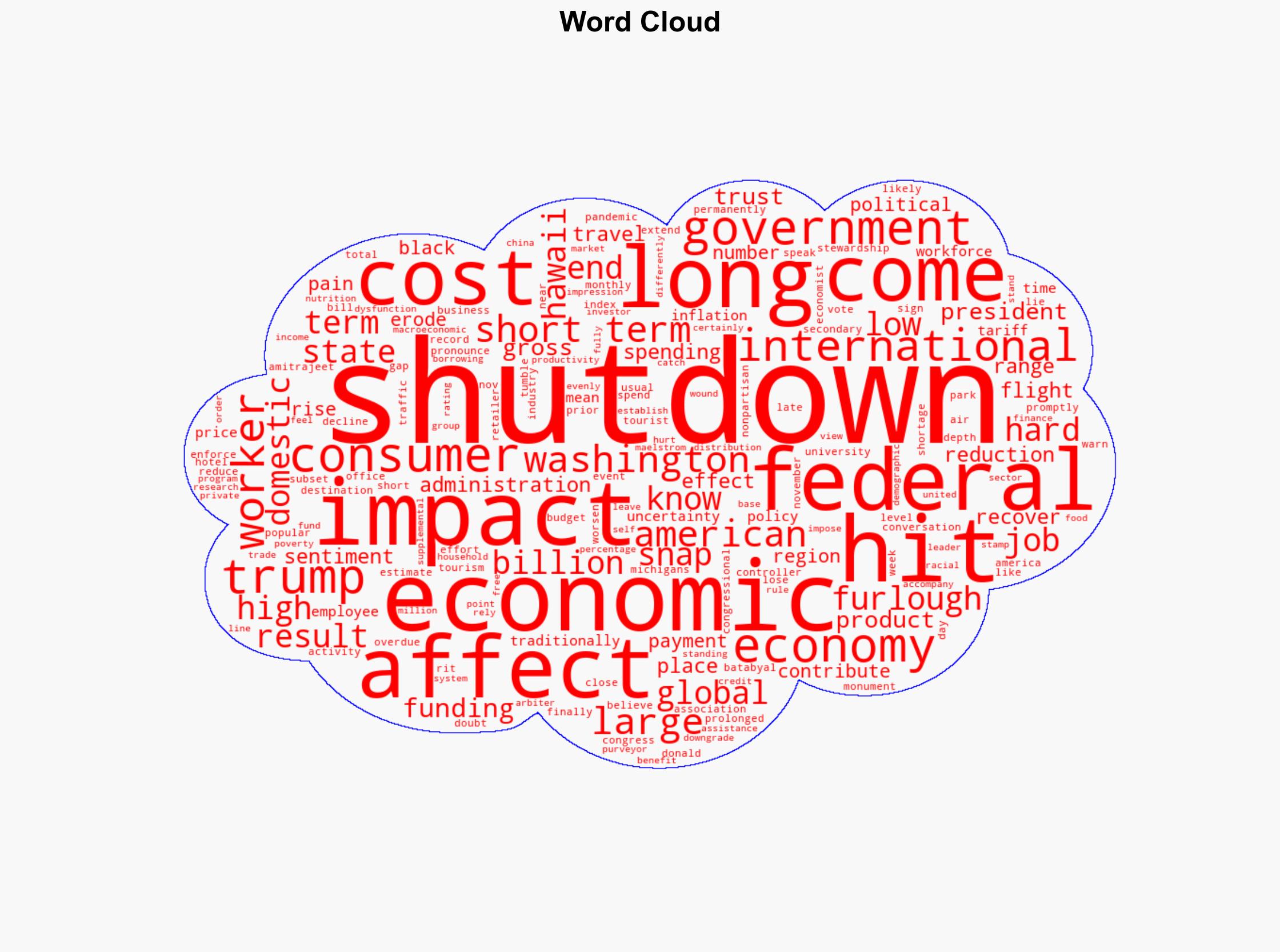

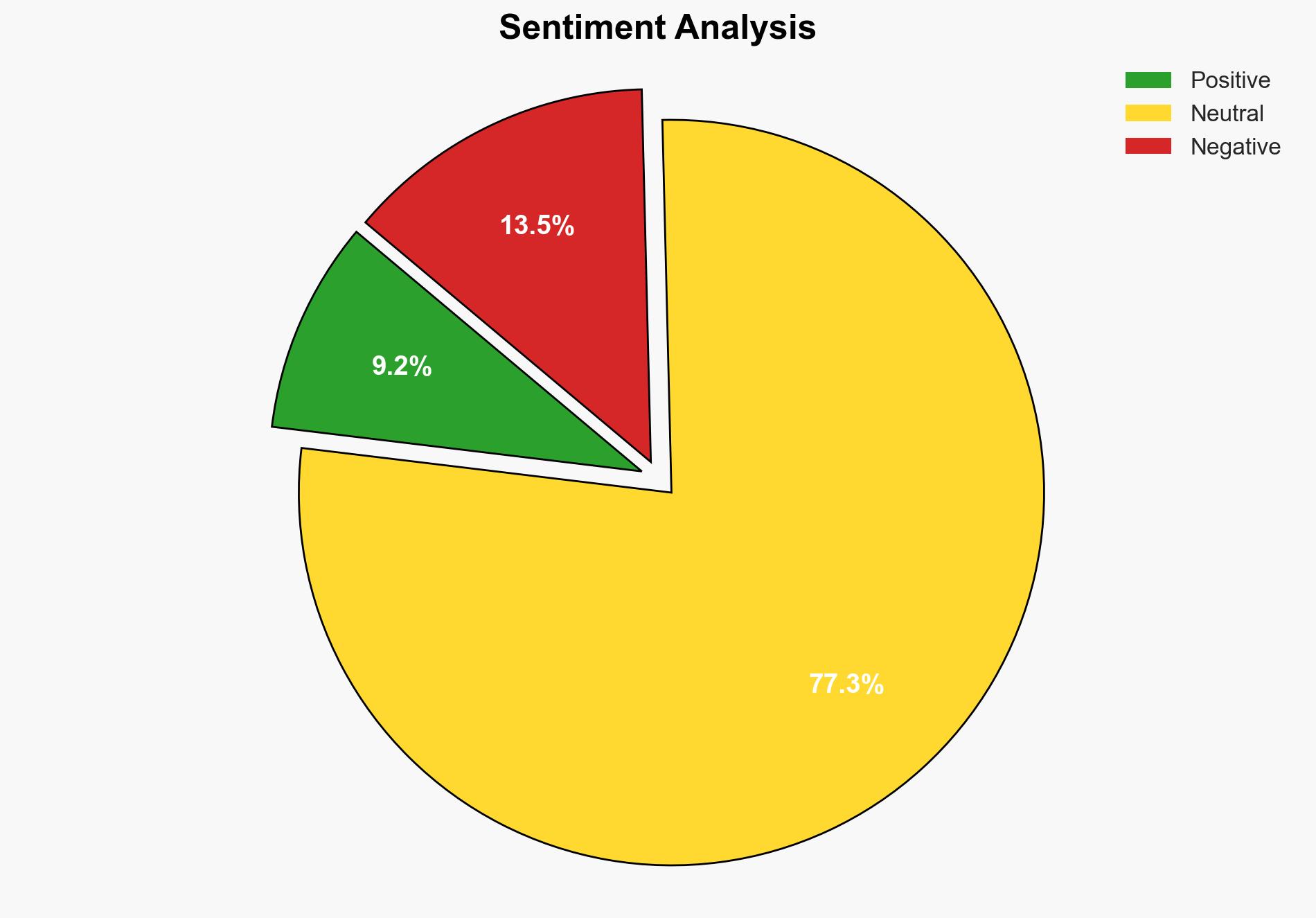

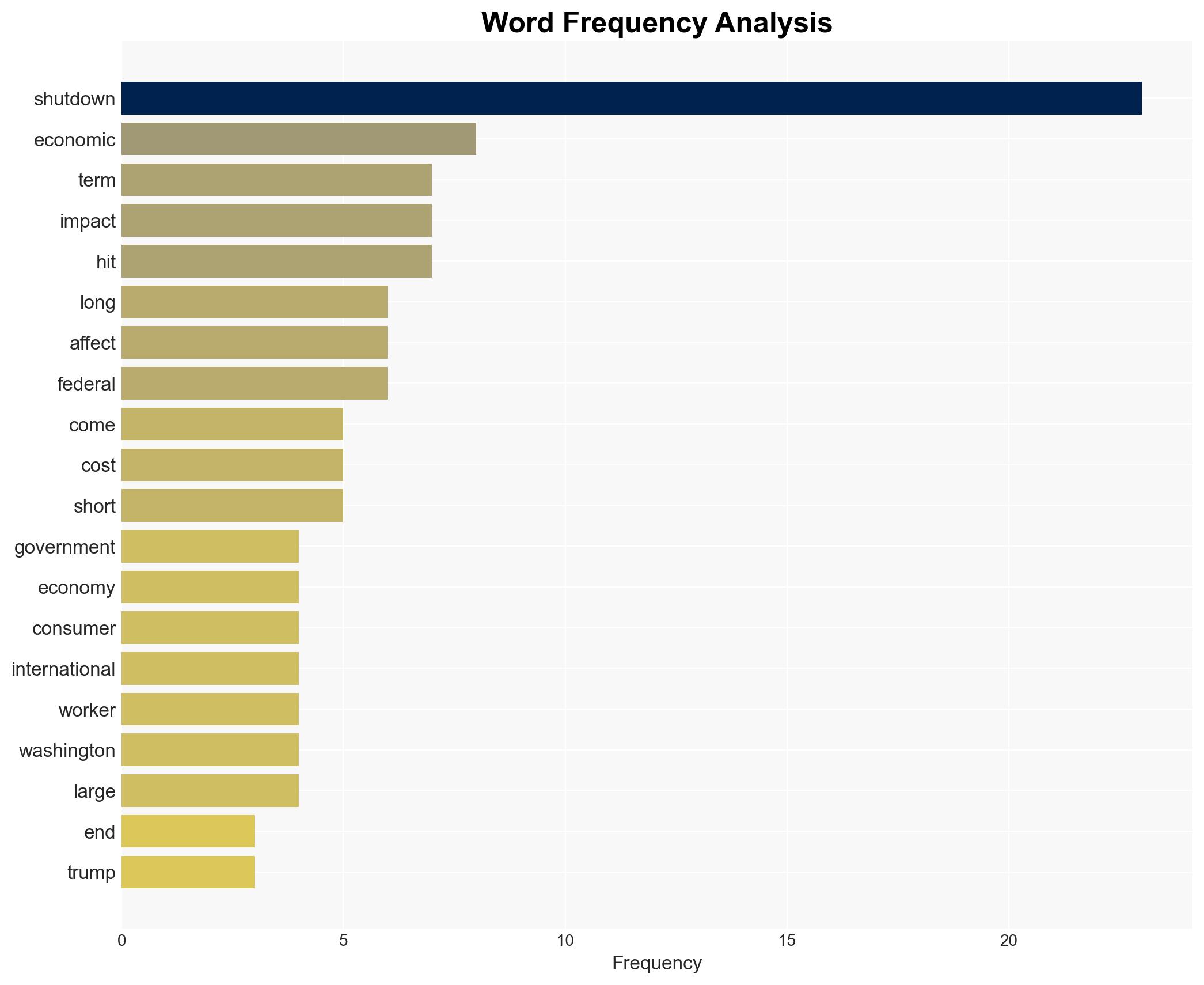

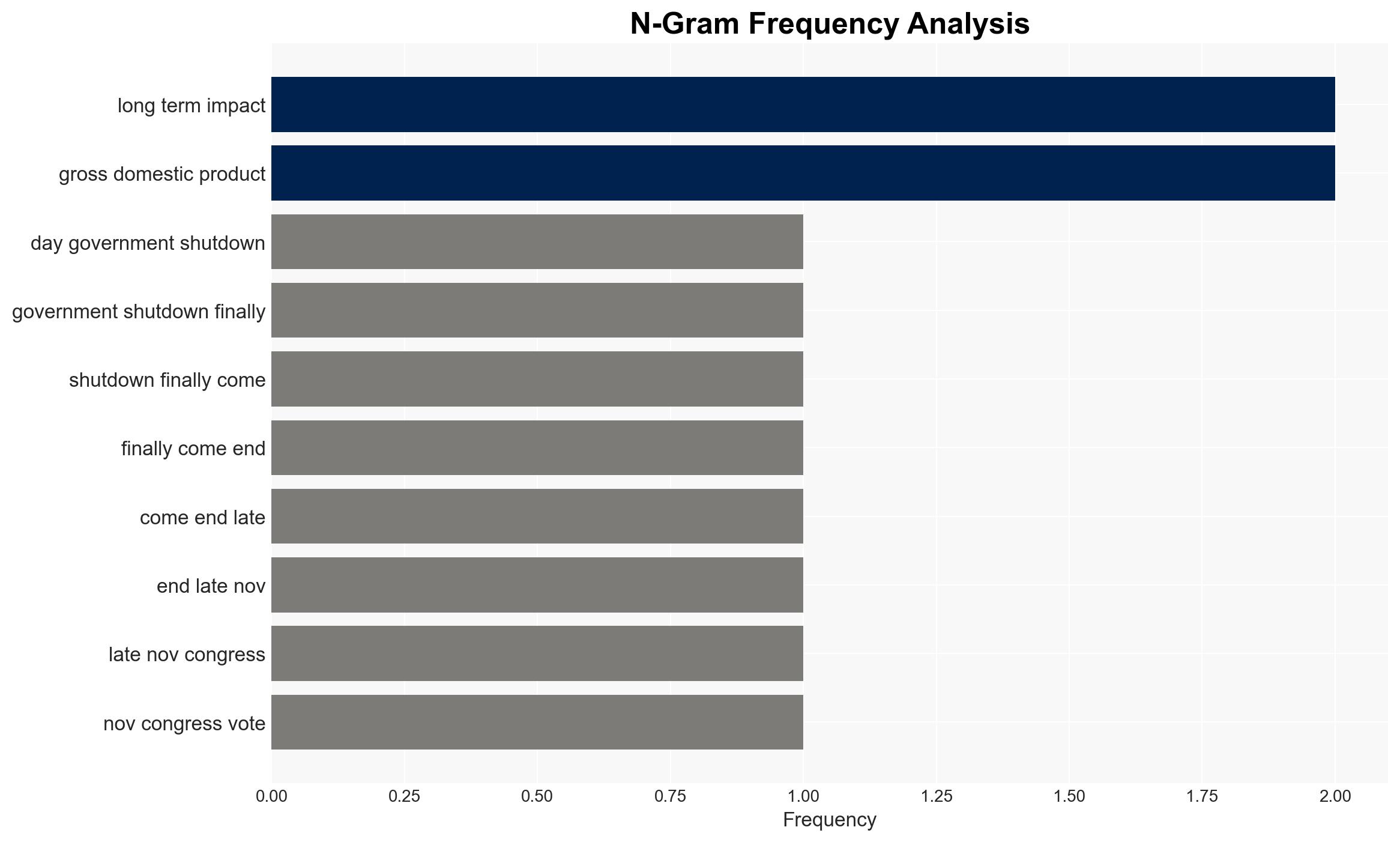

The recent government shutdown has ended, but its economic repercussions are expected to persist in both the short and long term. The most supported hypothesis is that the shutdown will have a lasting negative impact on the U.S. economy, affecting consumer confidence, international trust, and economic stability. Confidence Level: Moderate. Recommended action includes strategic fiscal planning and international diplomatic engagement to restore confidence.

2. Competing Hypotheses

Hypothesis 1: The economic impact of the shutdown will be temporary, with recovery expected as government operations resume and consumer confidence rebounds.

Hypothesis 2: The shutdown will have a prolonged negative impact on the U.S. economy, exacerbating existing vulnerabilities and diminishing international trust in U.S. economic leadership.

Hypothesis 2 is more likely due to the evidence of reduced consumer sentiment, potential long-term impacts on GDP, and international perceptions of political dysfunction.

3. Key Assumptions and Red Flags

Assumptions include the belief that government operations will stabilize quickly post-shutdown and that consumer confidence will rebound. Red flags include potential underestimation of international perceptions and the risk of future political instability leading to additional shutdowns. There is also a risk of bias in assuming uniform economic recovery across all demographics and regions.

4. Implications and Strategic Risks

The shutdown’s implications include potential downgrades in U.S. credit ratings, increased borrowing costs, and diminished global economic standing. Strategic risks involve cascading economic threats, such as reduced consumer spending and investment, and political risks, including further polarization and legislative gridlock. These could escalate into broader economic instability and reduced U.S. influence in global economic governance.

5. Recommendations and Outlook

- Implement strategic fiscal policies to stabilize consumer confidence and stimulate economic recovery.

- Engage in international diplomacy to reassure global partners of U.S. economic stability and leadership.

- Best-case scenario: Quick economic recovery with restored consumer confidence and international trust.

- Worst-case scenario: Prolonged economic downturn, further political instability, and diminished global influence.

- Most-likely scenario: Gradual recovery with persistent vulnerabilities and a need for ongoing fiscal and diplomatic efforts.

6. Key Individuals and Entities

President Donald Trump, Economist Amitrajeet Batabyal, University of Michigan (Consumer Sentiment Index).

7. Thematic Tags

Regional Focus: United States, Global Economic Leadership, Political Stability, Consumer Confidence.

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Methodology