Bitfarms plunges 18 after plan to wind down Bitcoin mining ops – Cointelegraph

Published on: 2025-11-14

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Bitfarms plunges 18 after plan to wind down Bitcoin mining ops – Cointelegraph

1. BLUF (Bottom Line Up Front)

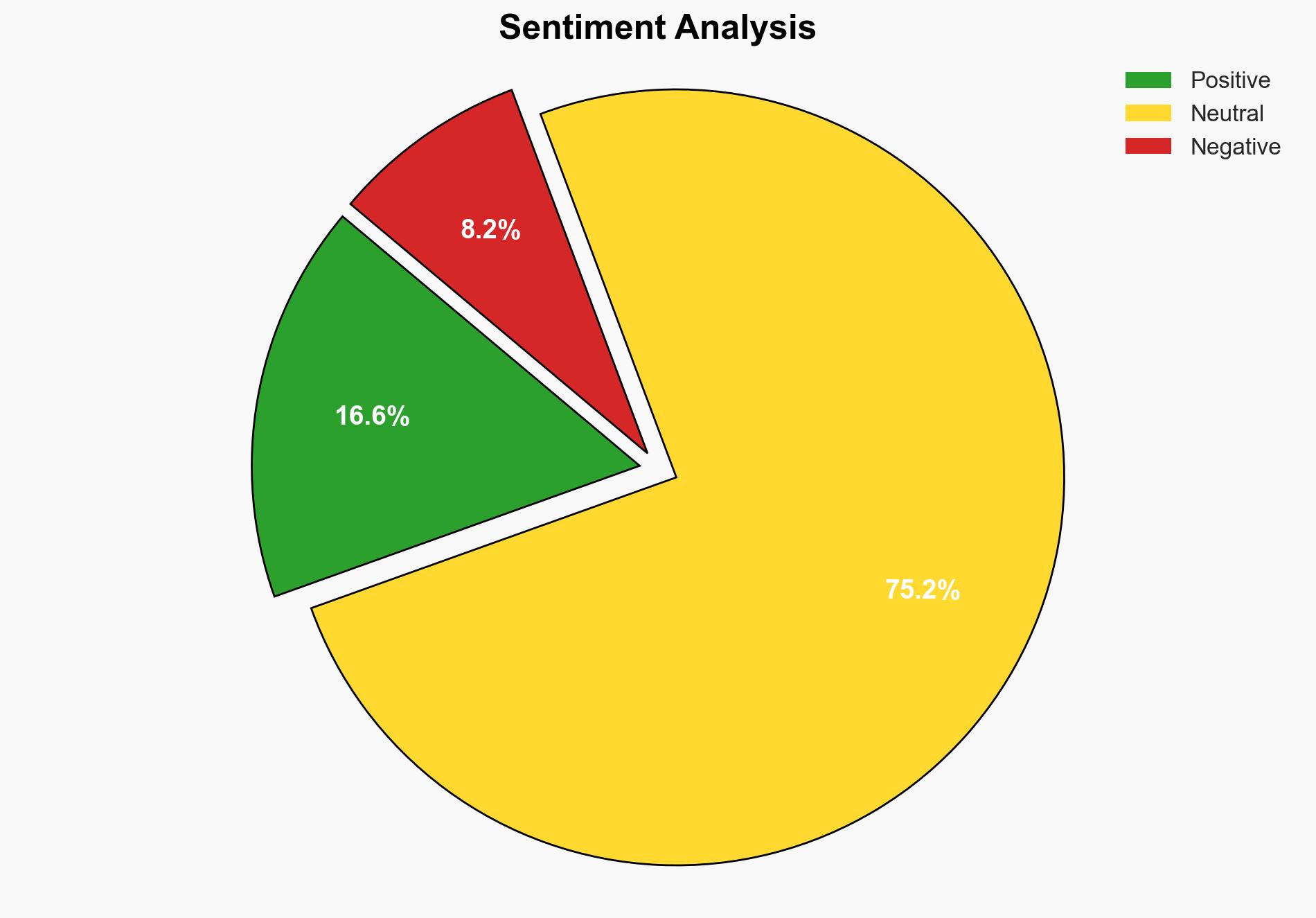

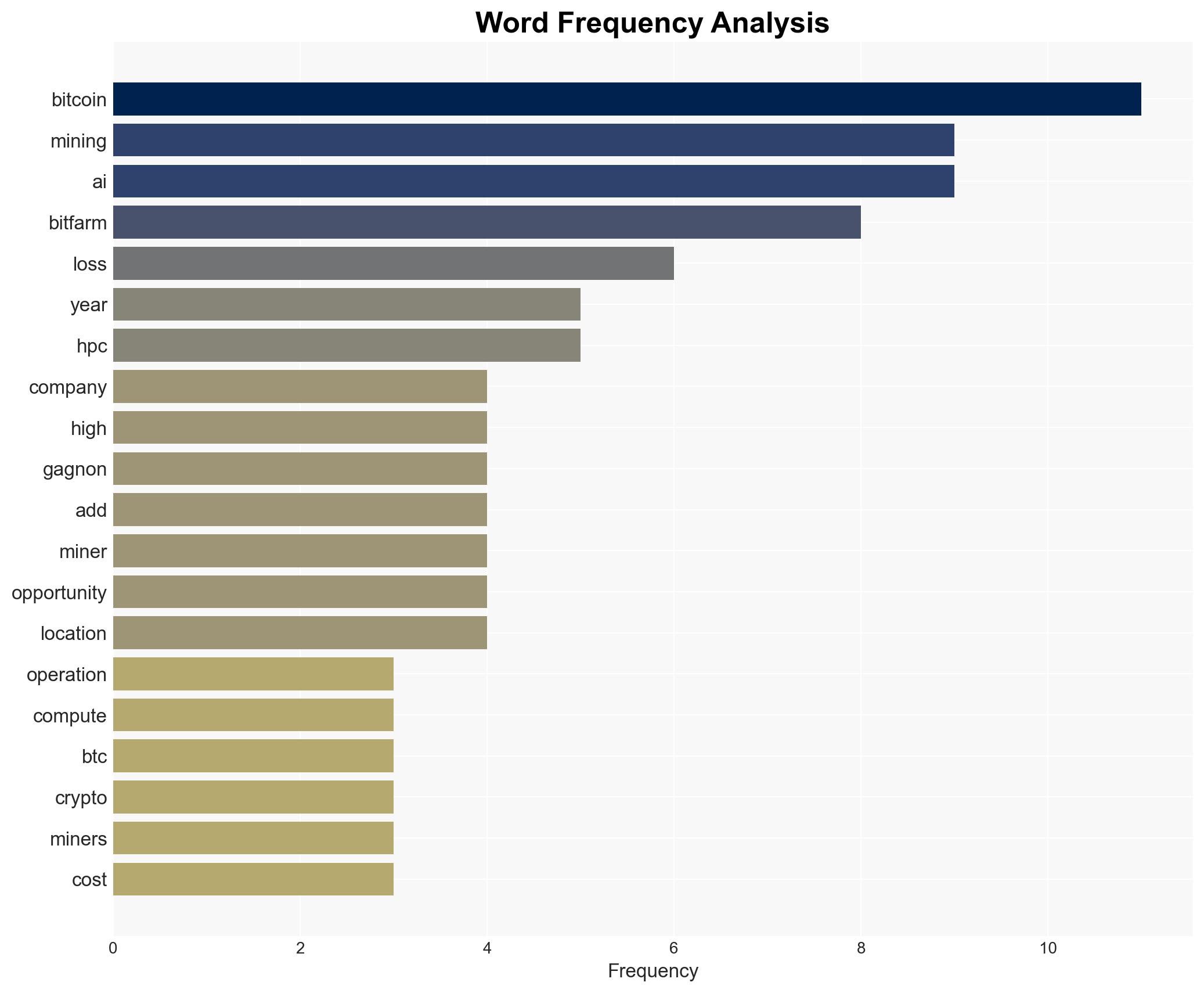

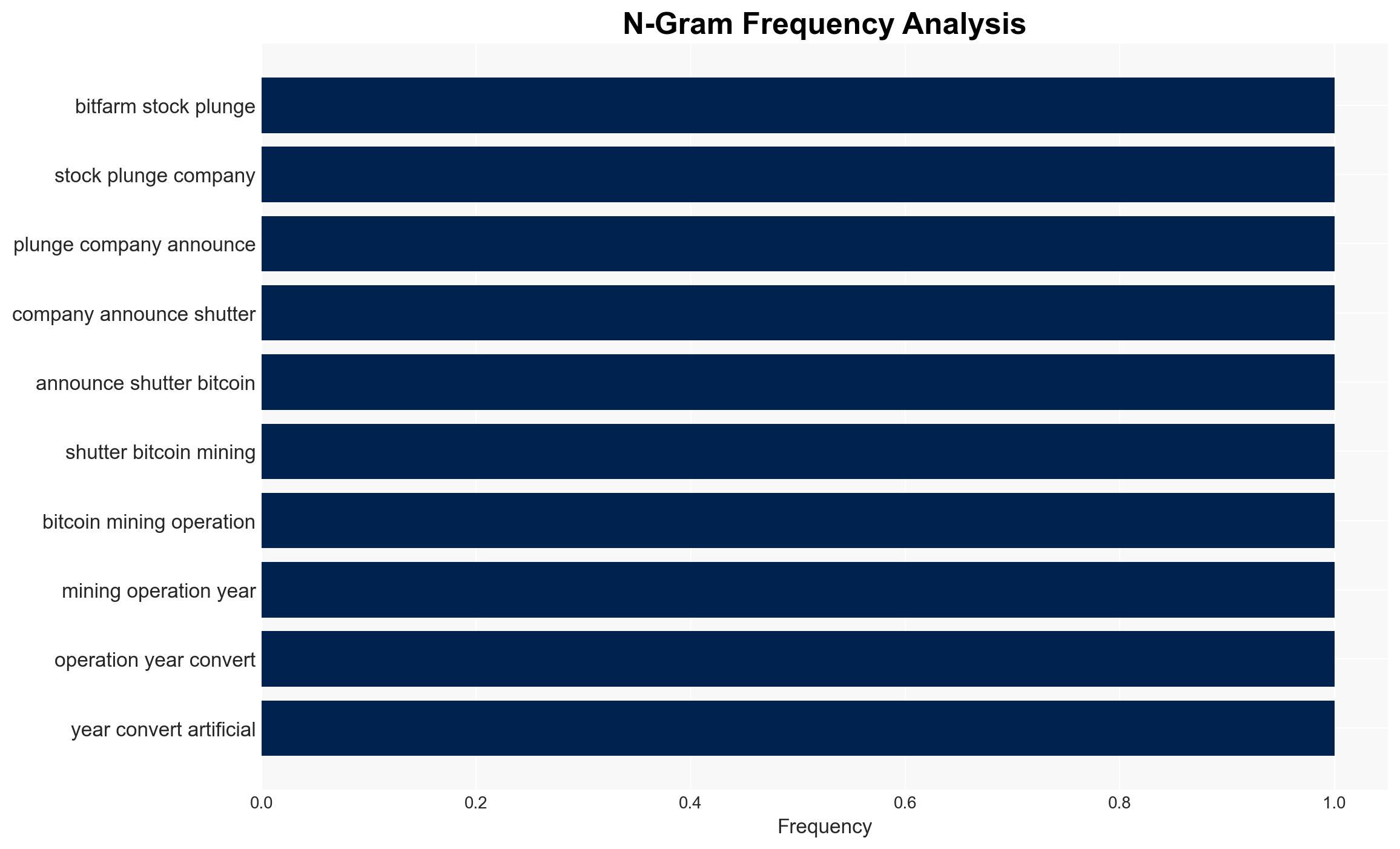

With a moderate confidence level, the most supported hypothesis is that Bitfarms is strategically pivoting from Bitcoin mining to capitalize on the growing demand for AI computing resources. This transition is driven by increased operational costs and declining profitability in Bitcoin mining. Recommended actions include monitoring the transition’s impact on Bitfarms’ financial health and assessing broader industry shifts towards AI computing.

2. Competing Hypotheses

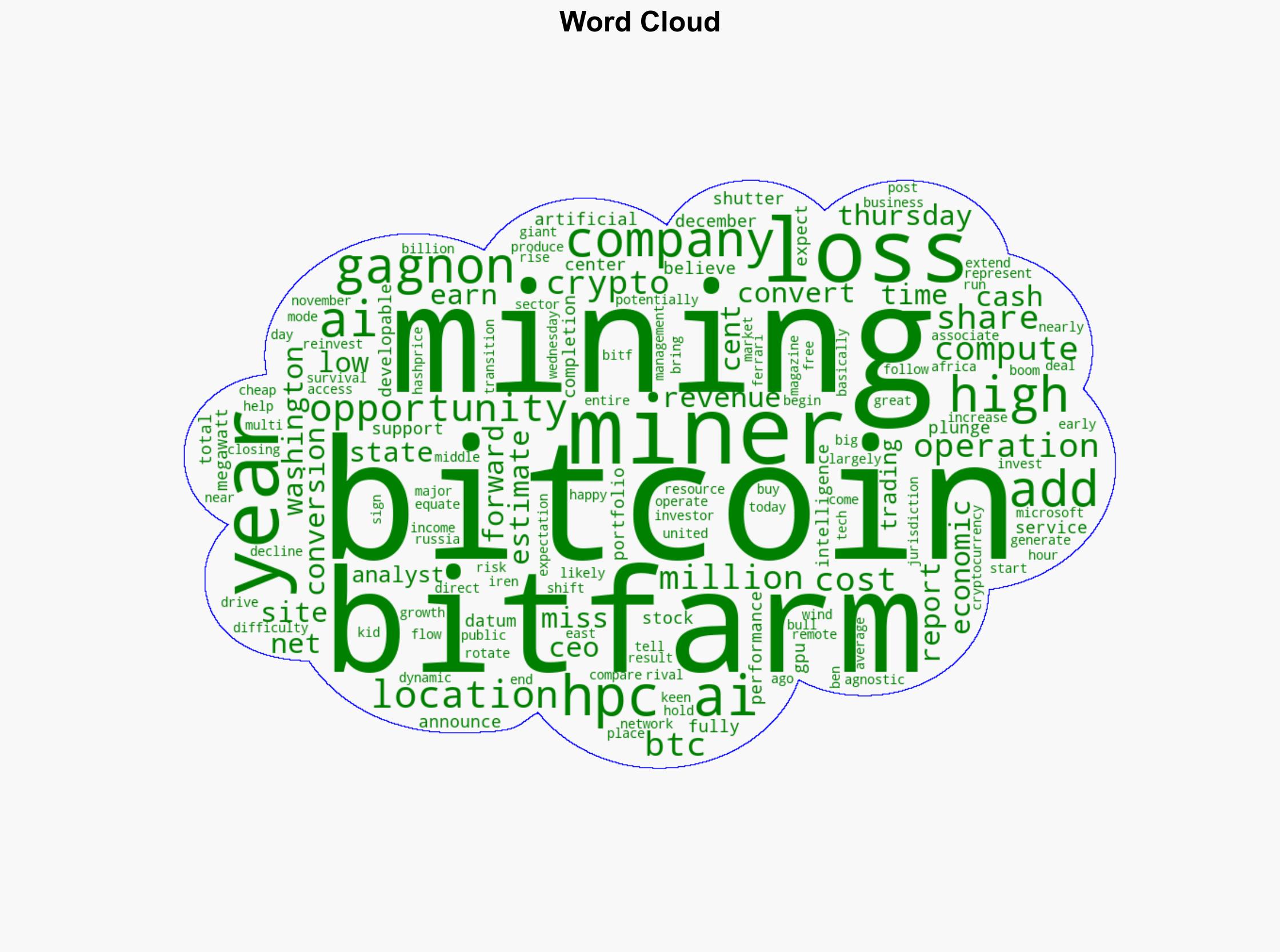

Hypothesis 1: Bitfarms is transitioning from Bitcoin mining to AI computing due to declining profitability in the cryptocurrency sector and rising operational costs.

Hypothesis 2: Bitfarms is using the AI transition narrative as a cover for financial instability and operational challenges within its Bitcoin mining operations.

Hypothesis 1 is more likely given the broader industry trend of miners shifting to AI computing due to its higher economic potential and the explicit statements from Bitfarms’ CEO about the strategic benefits of this transition.

3. Key Assumptions and Red Flags

Assumptions: The AI sector will continue to grow and provide higher returns than Bitcoin mining. Bitfarms has the technical capability to successfully transition its operations.

Red Flags: The rapid stock decline could indicate deeper financial issues. The timing of the announcement may be an attempt to distract from poor financial performance.

4. Implications and Strategic Risks

The transition to AI computing could set a precedent for other cryptocurrency miners, potentially leading to a significant shift in the industry landscape. This could result in increased competition in the AI sector, driving up costs and reducing profitability. Additionally, geopolitical risks may arise if AI computing centers are located in politically unstable regions.

5. Recommendations and Outlook

- Monitor Bitfarms’ financial performance and stock market reactions to gauge the success of the transition.

- Assess the impact of this trend on the broader cryptocurrency mining industry and AI computing market.

- Best-case scenario: Bitfarms successfully transitions to AI computing, leading to increased profitability and setting a positive example for the industry.

- Worst-case scenario: The transition fails due to technical or financial challenges, resulting in significant financial losses and potential bankruptcy.

- Most-likely scenario: Bitfarms faces initial challenges but gradually stabilizes as it adapts to the AI market.

6. Key Individuals and Entities

Ben Gagnon (CEO of Bitfarms)

7. Thematic Tags

Regional Focus: North America, Cryptocurrency, Artificial Intelligence, Financial Markets

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Methodology