Pakistan Bond Gains to Extend With Global Reentry Investors Say – Financial Post

Published on: 2025-11-14

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Pakistan Bond Gains to Extend With Global Reentry Investors Say – Financial Post

1. BLUF (Bottom Line Up Front)

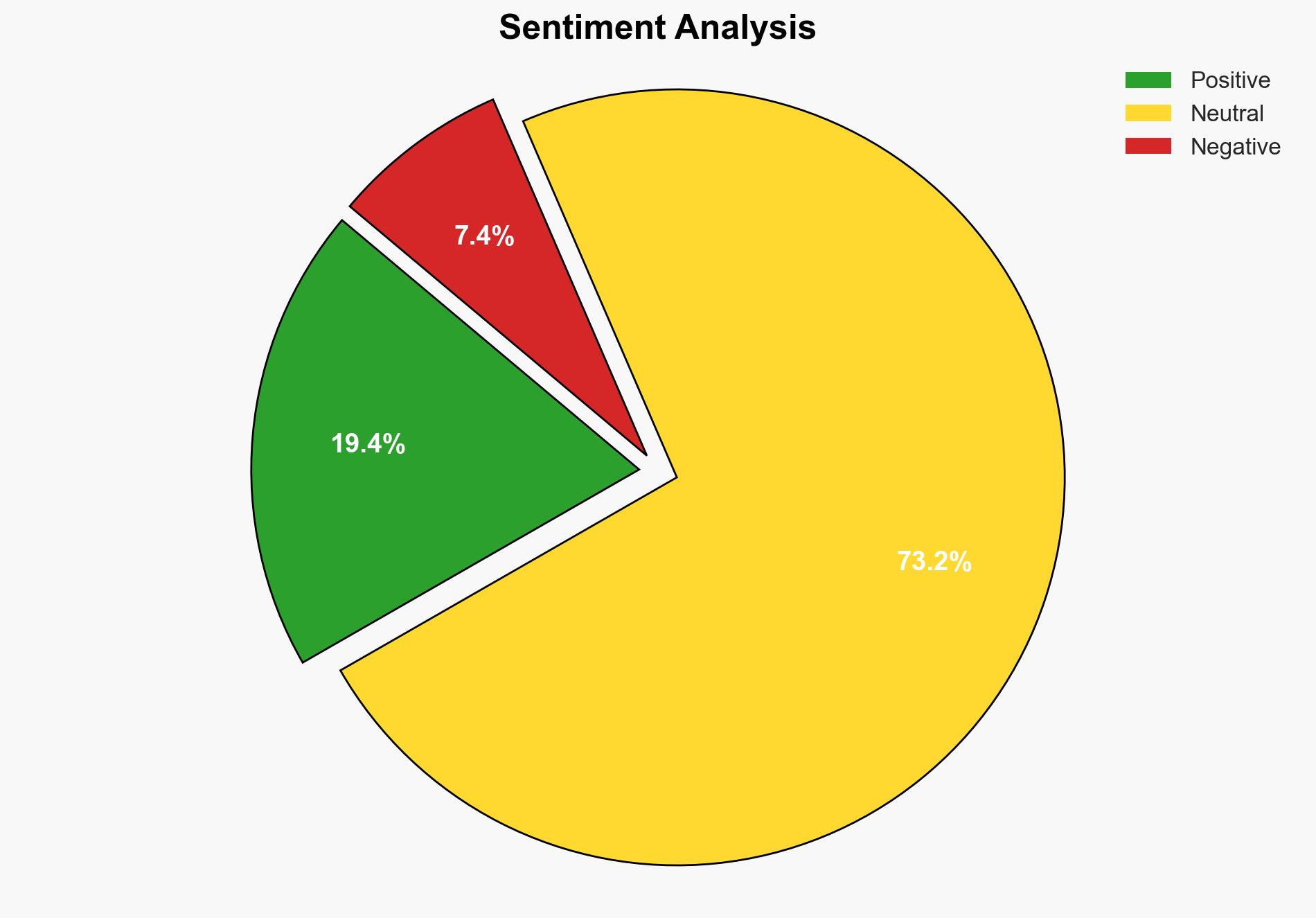

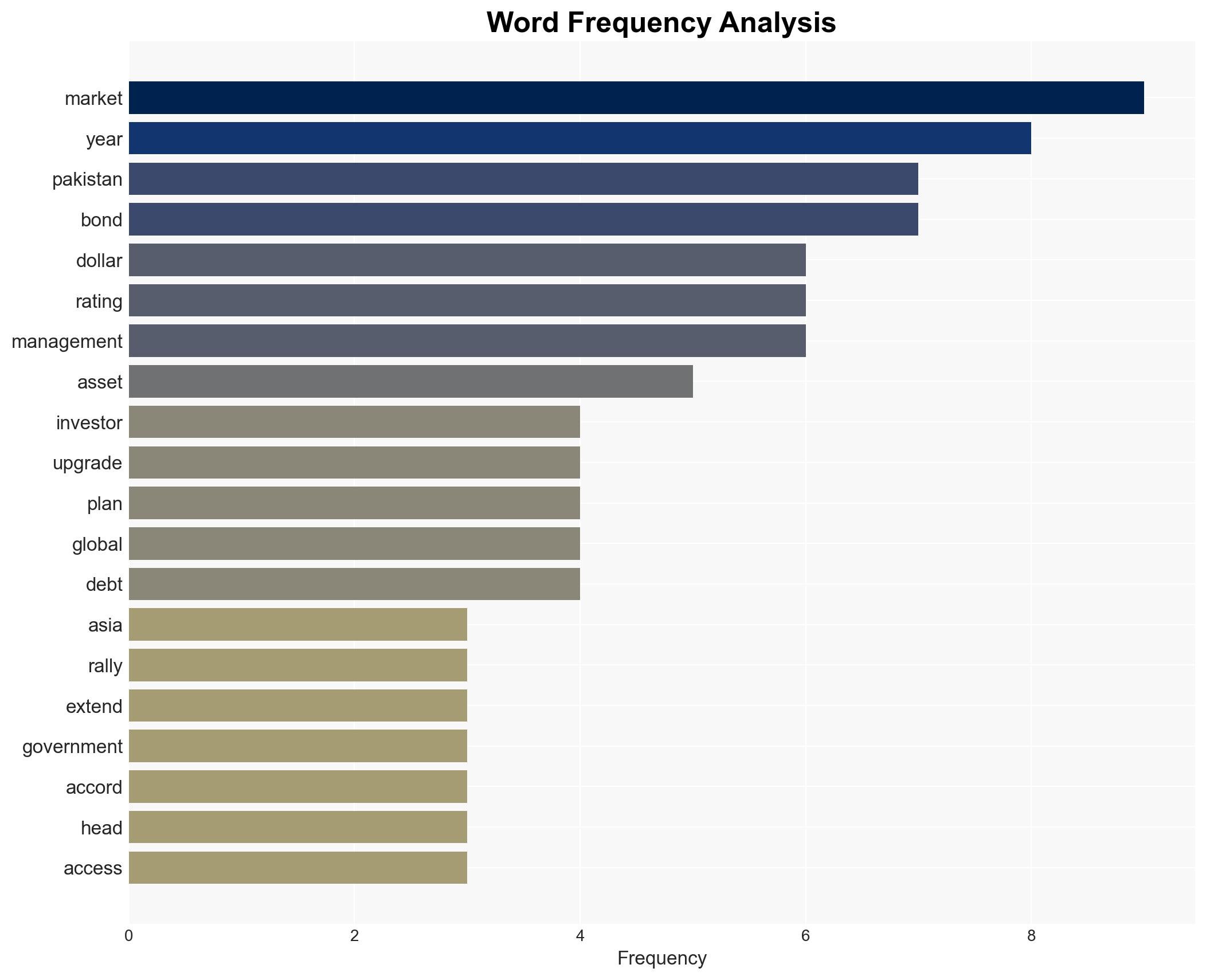

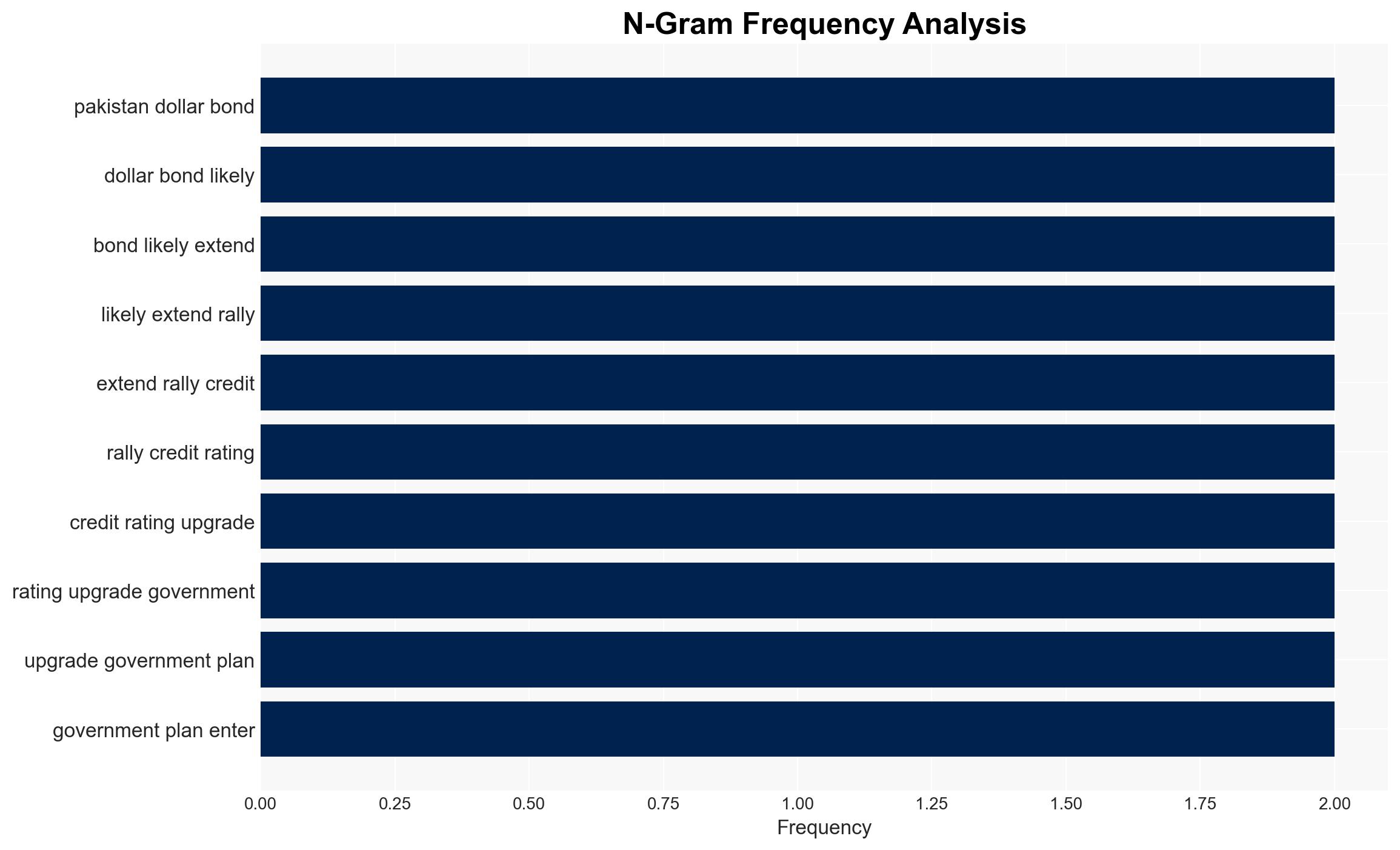

Pakistan’s reentry into the global debt market and potential bond gains are contingent on sustained economic reforms and geopolitical stability. The most supported hypothesis is that Pakistan will successfully extend its bond rally, leveraging improved credit ratings and global market access. Confidence level: Moderate. Recommended action: Monitor reform implementation and geopolitical developments closely.

2. Competing Hypotheses

Hypothesis 1: Pakistan’s bond rally will extend due to credit rating upgrades and successful reentry into global debt markets. This is supported by the government’s commitment to fiscal reforms and IMF-backed programs, which have improved investor sentiment.

Hypothesis 2: Pakistan’s bond rally may falter due to geopolitical tensions, particularly with neighboring India and Afghanistan, and potential economic challenges such as rising energy prices and sluggish growth.

Hypothesis 1 is more likely given the current trajectory of reforms and investor optimism, but geopolitical and economic risks present significant uncertainties.

3. Key Assumptions and Red Flags

Assumptions: The analysis assumes that Pakistan will maintain its reform momentum and that geopolitical tensions will not escalate significantly. It also assumes that global economic conditions will remain favorable for emerging markets.

Red Flags: Any deviation from fiscal discipline or reform commitments could undermine investor confidence. Geopolitical tensions or adverse economic developments could also disrupt market access.

4. Implications and Strategic Risks

Economic Risks: Rising energy prices and sluggish economic growth could strain Pakistan’s finances, potentially leading to increased borrowing costs and reduced investor confidence.

Geopolitical Risks: Tensions with India and instability in Afghanistan could impact regional stability, affecting investor sentiment and market access.

Political Risks: Any political instability or changes in government policy could disrupt reform efforts and market confidence.

5. Recommendations and Outlook

- Actionable Steps: Pakistan should continue to implement fiscal reforms and maintain transparency in its economic policies to sustain investor confidence. Additionally, diplomatic efforts to mitigate geopolitical tensions should be prioritized.

- Best Scenario: Successful reform implementation and stable geopolitical conditions lead to sustained bond gains and improved economic stability.

- Worst Scenario: Geopolitical tensions escalate, and economic challenges lead to a loss of investor confidence and increased borrowing costs.

- Most-likely Scenario: Continued reform efforts and cautious optimism among investors result in moderate bond gains, with ongoing monitoring of geopolitical and economic risks.

6. Key Individuals and Entities

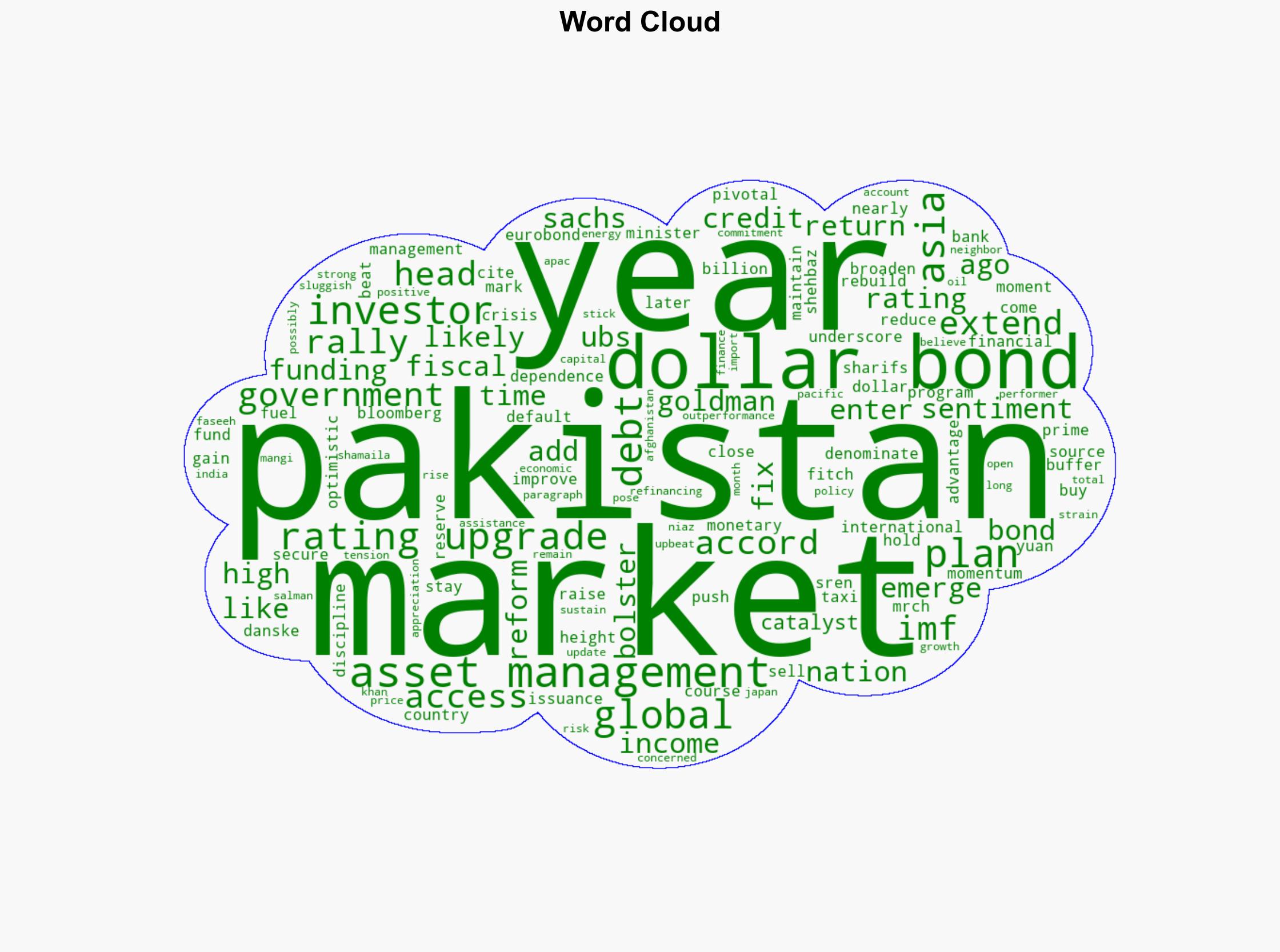

Prime Minister Shehbaz Sharif, Shamaila Khan (UBS Asset Management), Salman Niaz (Goldman Sachs Asset Management), Sren Mrch (Danske Bank Asset Management).

7. Thematic Tags

Regional Focus: South Asia, Economic Reform, Geopolitical Stability, Emerging Markets

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Methodology