Why Bitcoin XRP Solana and Ether Slide as Gold and Silver Soar – CoinDesk

Published on: 2025-11-14

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Why Bitcoin XRP Solana and Ether Slide as Gold and Silver Soar – CoinDesk

1. BLUF (Bottom Line Up Front)

The divergence between cryptocurrency and precious metal markets is primarily driven by global fiscal health concerns and potential credit market risks. The most supported hypothesis is that investor confidence in traditional safe havens is strengthening due to fiscal instability, leading to a shift away from riskier digital assets. Confidence Level: Moderate. Recommended action includes monitoring fiscal policy developments and credit market conditions to anticipate further market shifts.

2. Competing Hypotheses

Hypothesis 1: The decline in cryptocurrencies and the rise in precious metals are due to increasing global fiscal instability and a shift in investor confidence towards traditional safe havens.

Hypothesis 2: The cryptocurrency market is experiencing a temporary correction driven by internal market dynamics, such as credit market pressures and over-leveraging, independent of broader economic conditions.

Hypothesis 1 is more likely given the alignment of fiscal health concerns with the observed market trends, whereas Hypothesis 2 does not fully account for the simultaneous rise in precious metals.

3. Key Assumptions and Red Flags

Assumptions include the belief that fiscal instability directly influences investor behavior towards safe havens. A red flag is the potential underestimation of internal cryptocurrency market dynamics, such as credit risk and over-leveraging. Deception indicators include potential misinformation regarding the stability of digital assets and the health of credit markets.

4. Implications and Strategic Risks

The primary risk is a cascading economic impact if fiscal instability leads to a broader loss of confidence in digital assets, potentially triggering a credit freeze. This could escalate into a significant economic downturn, affecting global markets. Political risks include increased regulatory scrutiny on cryptocurrencies. Cyber risks involve potential exploitation of market volatility by malicious actors.

5. Recommendations and Outlook

- Monitor fiscal policy developments and credit market conditions closely to anticipate further market shifts.

- Encourage diversification strategies for investors to mitigate risk exposure in volatile markets.

- Best-case scenario: Stabilization of fiscal policies leads to a balanced recovery in both cryptocurrency and precious metal markets.

- Worst-case scenario: A severe credit market freeze exacerbates the decline in cryptocurrencies, leading to broader economic instability.

- Most-likely scenario: Continued divergence with precious metals maintaining strength as cryptocurrencies face ongoing pressure.

6. Key Individuals and Entities

Greg Magadini, Director of Derivative at Amberdata, provides insights into market dynamics and potential risks.

7. Thematic Tags

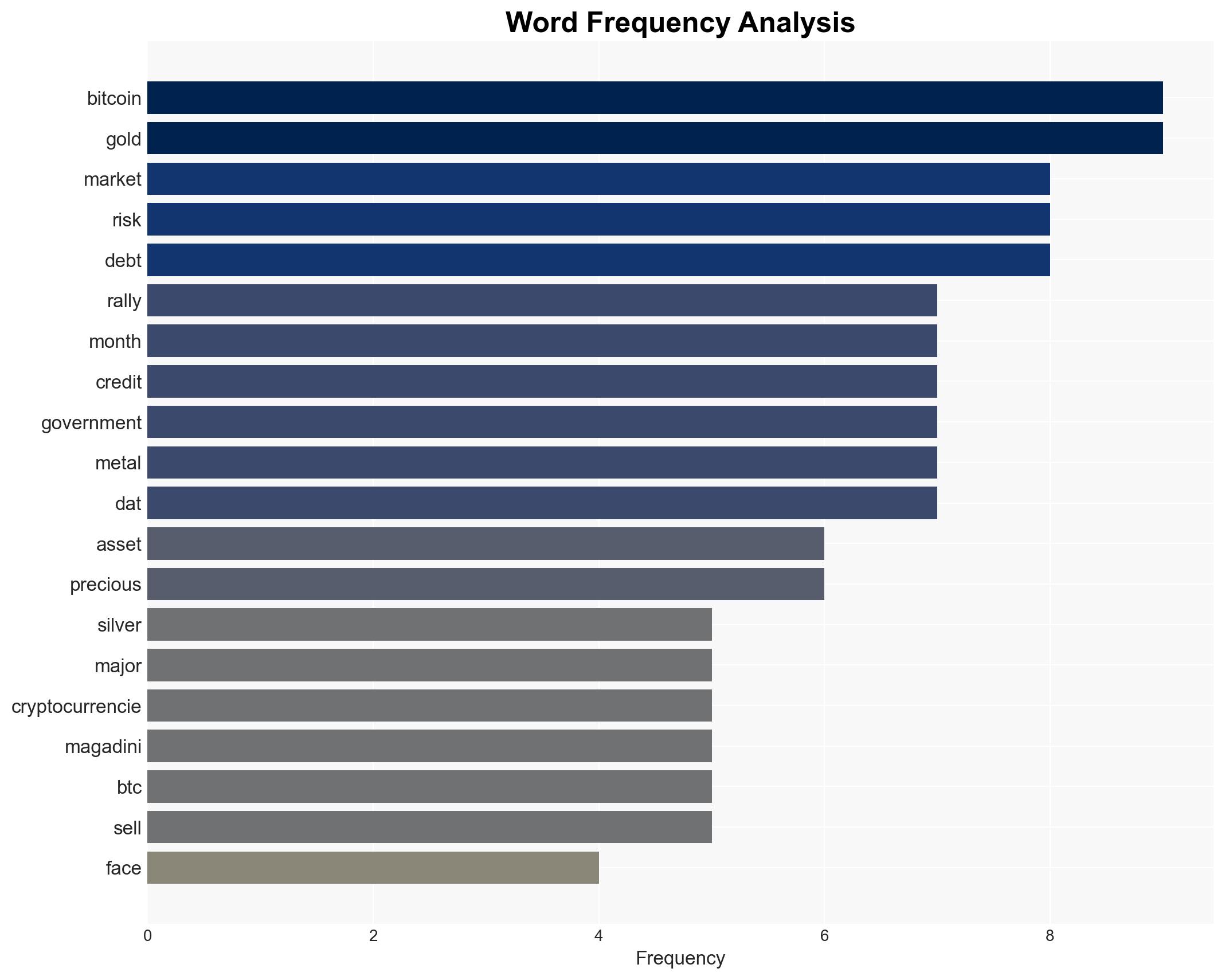

Cybersecurity, Economic Stability, Market Dynamics, Fiscal Policy, Investor Behavior

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology