Crypto Market Crash Heres Why Bitcoin ETH SOL ZEC Other Altcoins Are Falling – Coingape

Published on: 2025-11-14

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Crypto Market Crash Heres Why Bitcoin ETH SOL ZEC Other Altcoins Are Falling – Coingape

1. BLUF (Bottom Line Up Front)

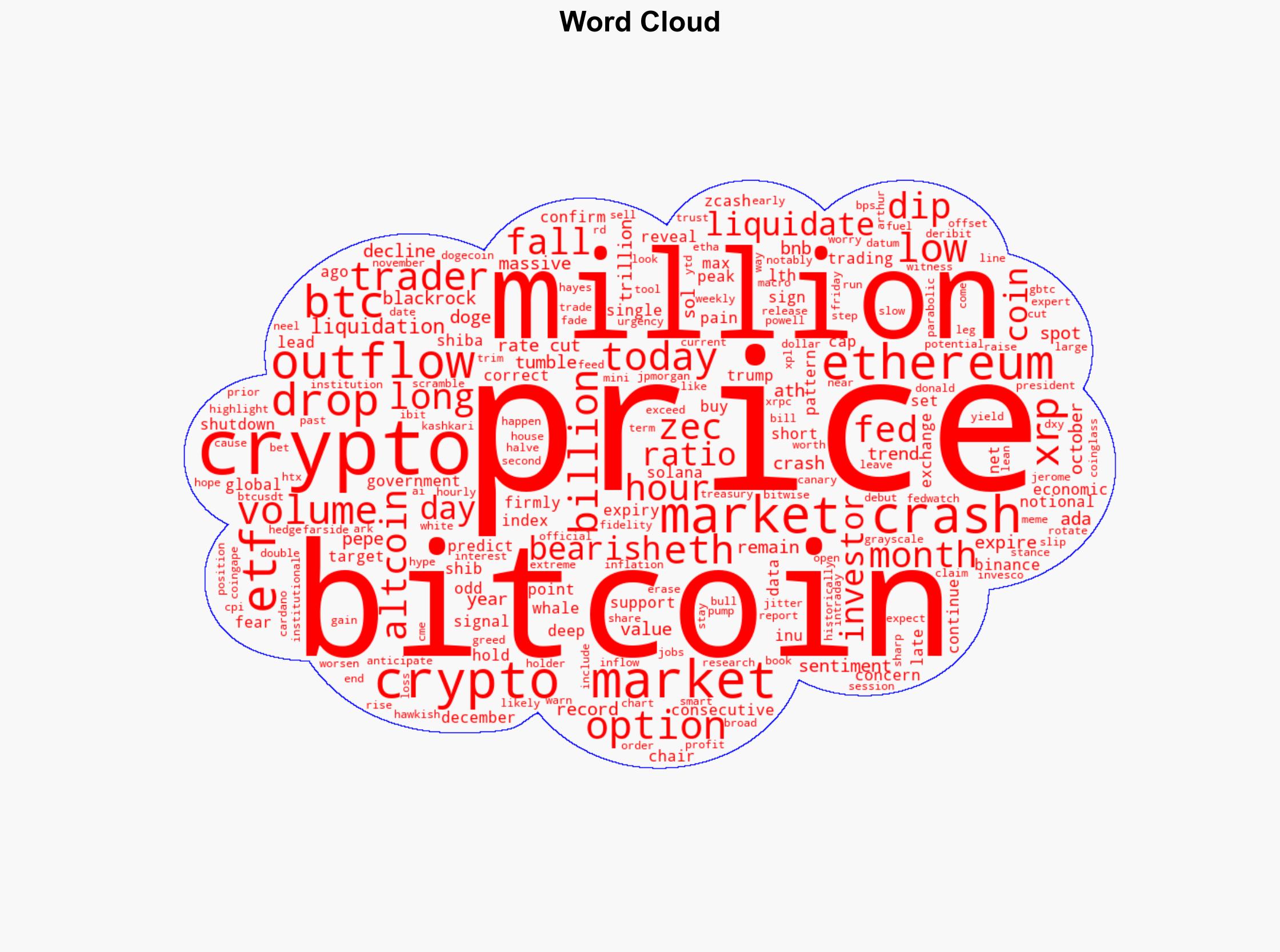

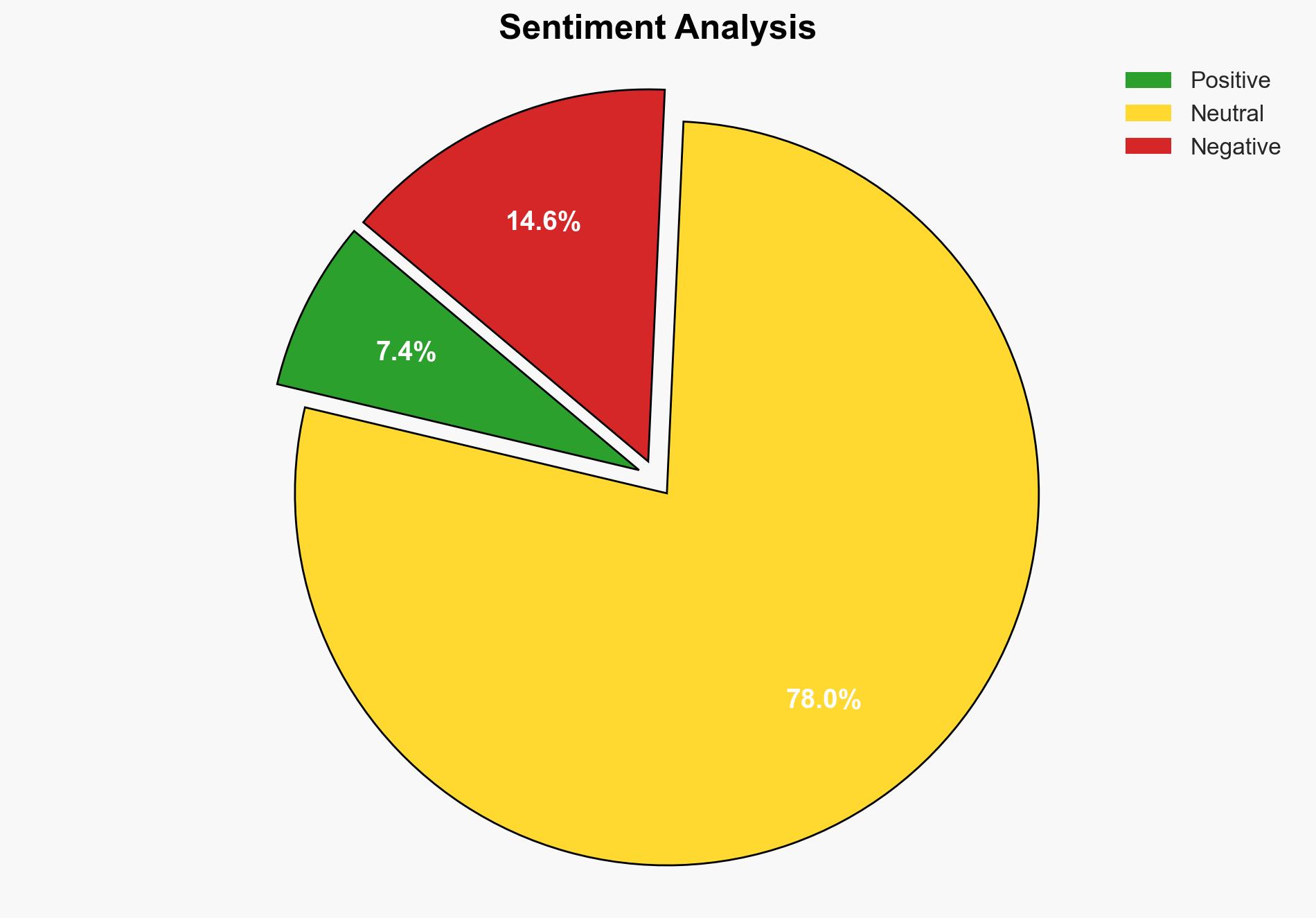

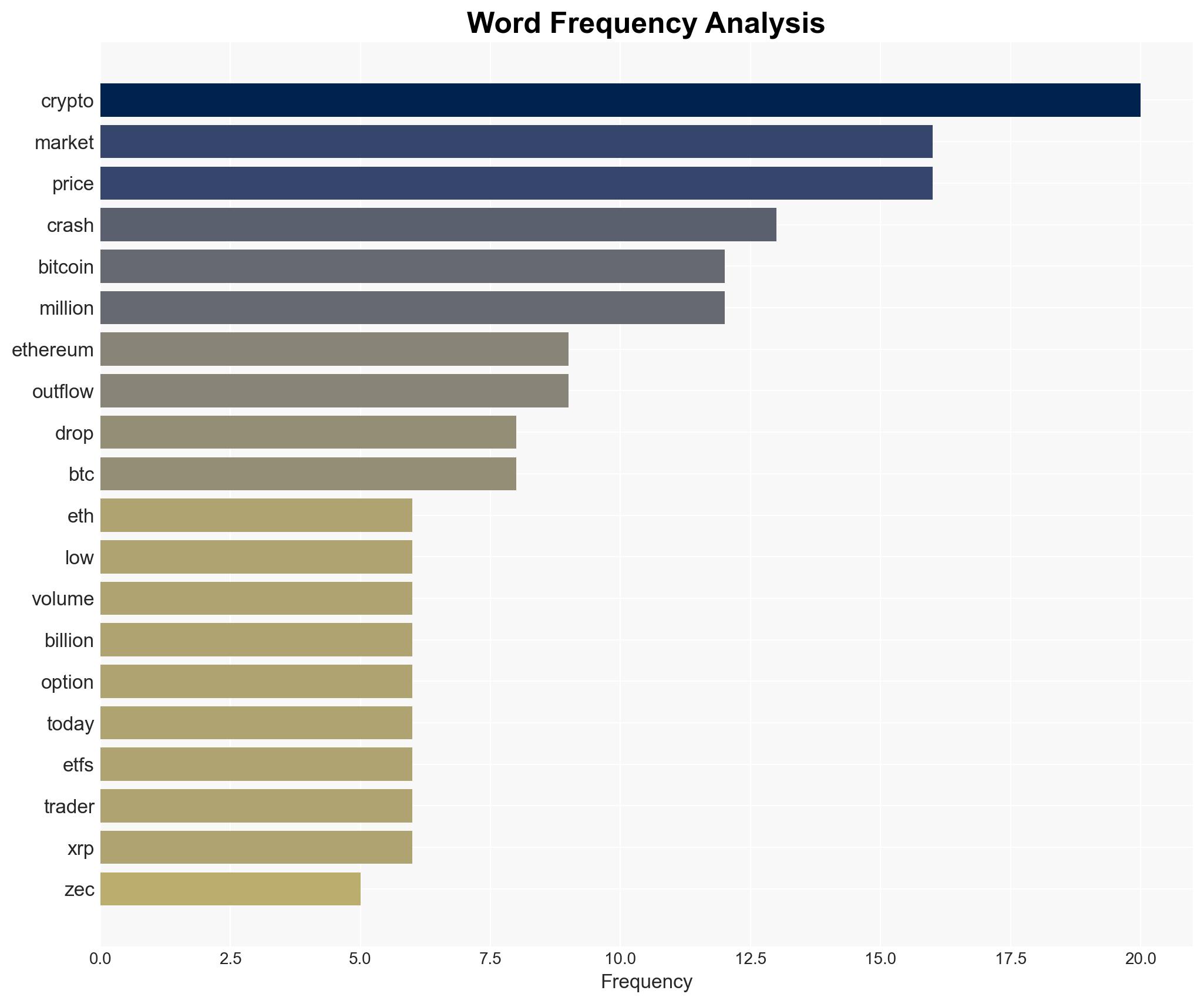

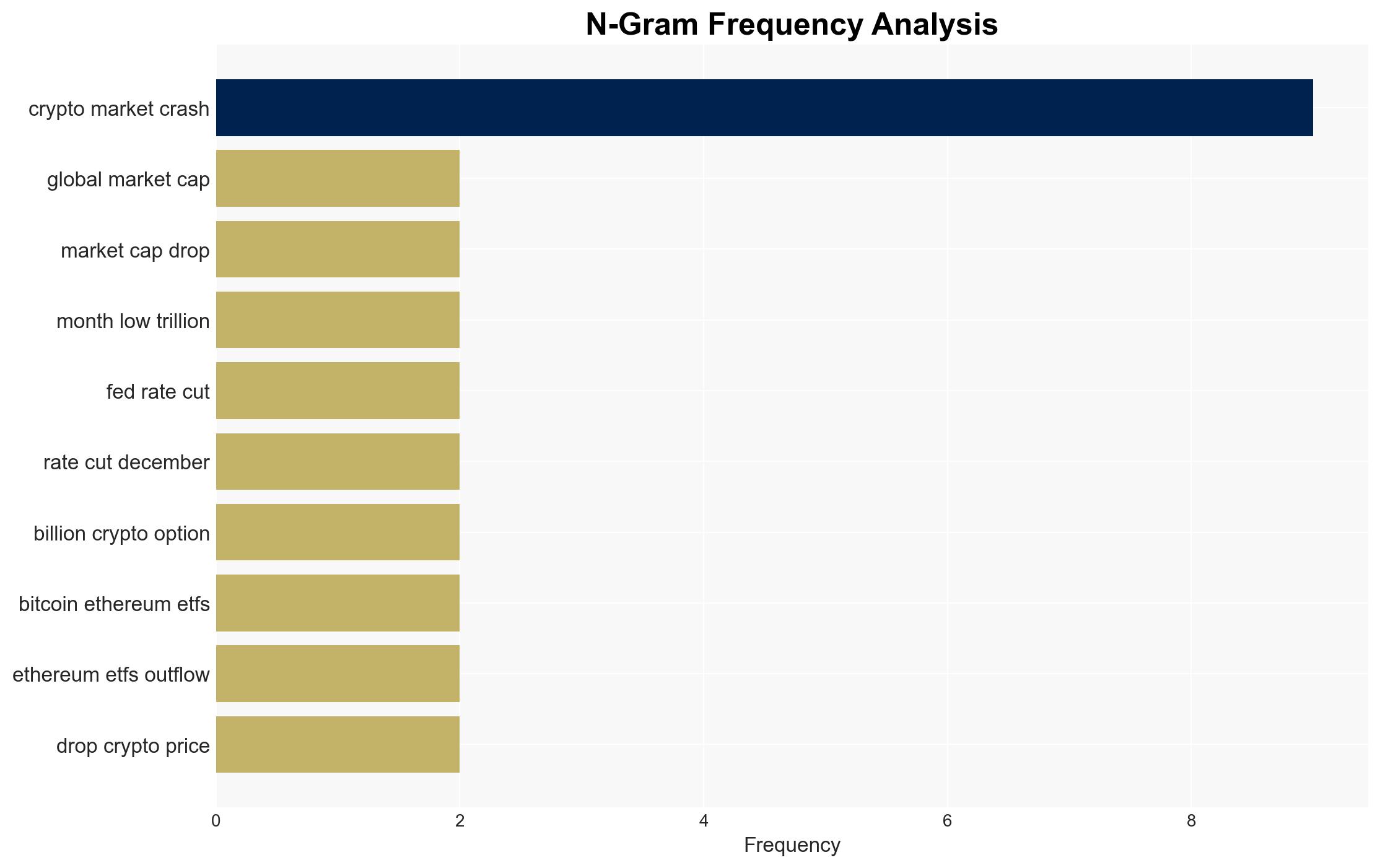

The current crypto market crash is primarily driven by macroeconomic uncertainties, including inflation concerns and potential changes in Federal Reserve policies, compounded by specific market dynamics such as high trading volumes and significant options expiries. Confidence Level: Moderate. Recommended action includes monitoring macroeconomic indicators and market sentiment to anticipate further volatility.

2. Competing Hypotheses

Hypothesis 1: The crypto market crash is primarily due to macroeconomic factors, such as inflation concerns, Federal Reserve policy uncertainties, and global economic jitters. These factors have led to a decrease in investor confidence, resulting in market sell-offs.

Hypothesis 2: The crash is largely driven by internal market dynamics, including high trading volumes, significant options expiries, and institutional outflows from crypto ETFs. These factors have exacerbated price declines and increased market volatility.

Assessment: Hypothesis 1 is more likely due to the broader impact of macroeconomic factors on investor sentiment across multiple asset classes, including cryptocurrencies. However, Hypothesis 2 cannot be entirely discounted as it highlights specific market mechanics contributing to the crash.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that macroeconomic indicators such as inflation and Federal Reserve policies are accurately influencing investor behavior. Additionally, it is assumed that the reported trading volumes and options expiries are reliable indicators of market sentiment.

Red Flags: Potential bias in attributing market movements solely to macroeconomic factors without considering internal market dynamics. Deception indicators include the possibility of market manipulation or misinformation affecting investor decisions.

4. Implications and Strategic Risks

The ongoing crypto market crash poses several strategic risks, including potential loss of investor confidence in cryptocurrencies as a viable asset class, increased regulatory scrutiny, and heightened volatility in related financial markets. Escalation scenarios include further economic downturns exacerbating market declines and potential cyber threats targeting crypto exchanges amid heightened volatility.

5. Recommendations and Outlook

- Actionable Steps: Monitor macroeconomic indicators, particularly Federal Reserve announcements and inflation data, to anticipate market movements. Engage with financial analysts to assess the impact of options expiries and trading volumes on market stability.

- Best Scenario: Stabilization of macroeconomic conditions leads to a recovery in crypto markets, with renewed investor confidence and reduced volatility.

- Worst Scenario: Continued macroeconomic instability and internal market pressures result in prolonged market declines and potential regulatory interventions.

- Most-likely Scenario: Short-term volatility persists with periodic recoveries, contingent on macroeconomic developments and market sentiment shifts.

6. Key Individuals and Entities

Federal Reserve Chair Jerome Powell, Federal Reserve official Neel Kashkari, major institutional investors such as BlackRock, Fidelity, and Grayscale.

7. Thematic Tags

Cybersecurity, Macroeconomics, Market Volatility, Cryptocurrency

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Methodology