MicroStrategy Now Owes More Than Its Bitcoin Is Worth – BeInCrypto

Published on: 2025-11-14

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: MicroStrategy Now Owes More Than Its Bitcoin Is Worth – BeInCrypto

1. BLUF (Bottom Line Up Front)

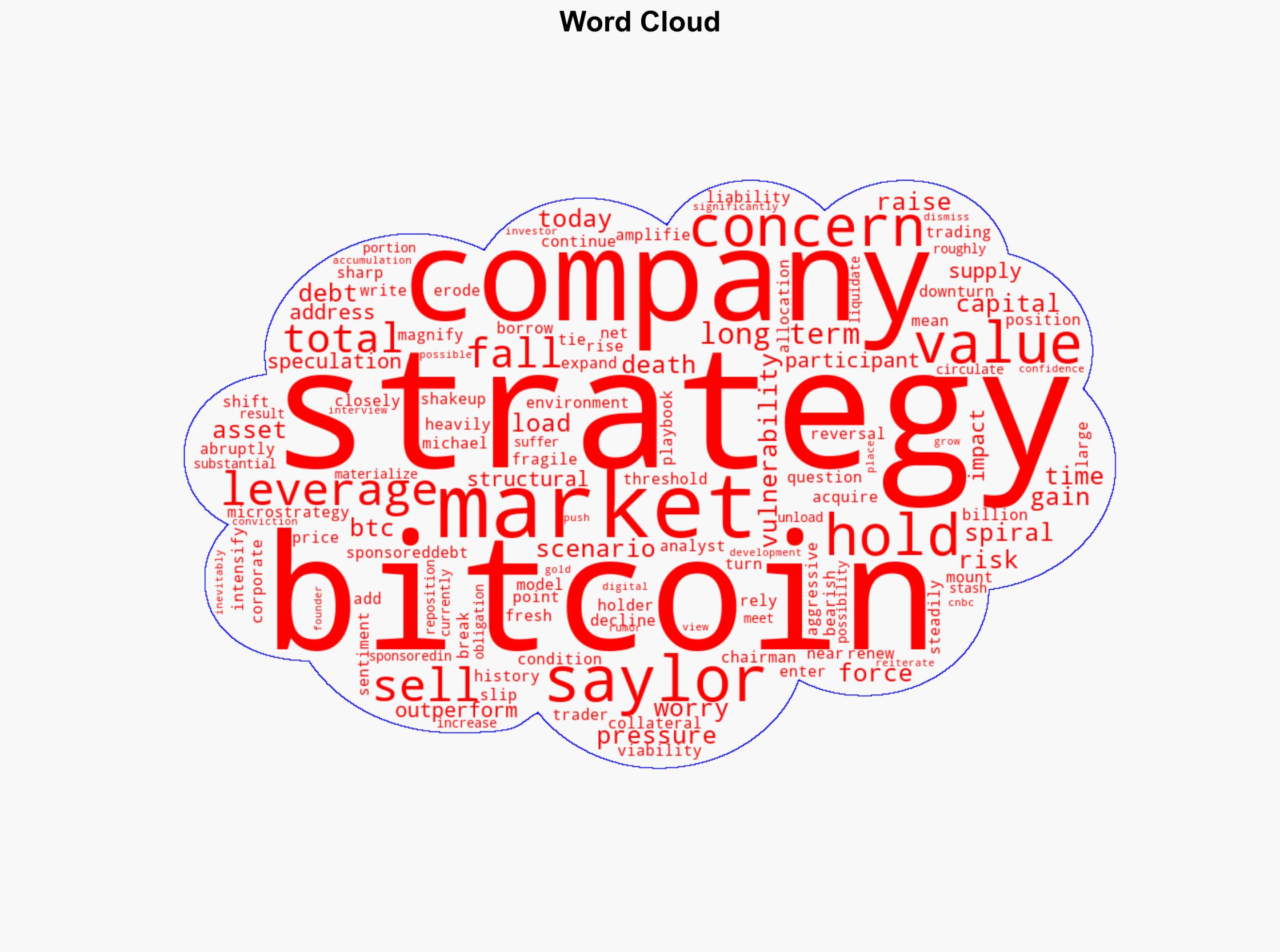

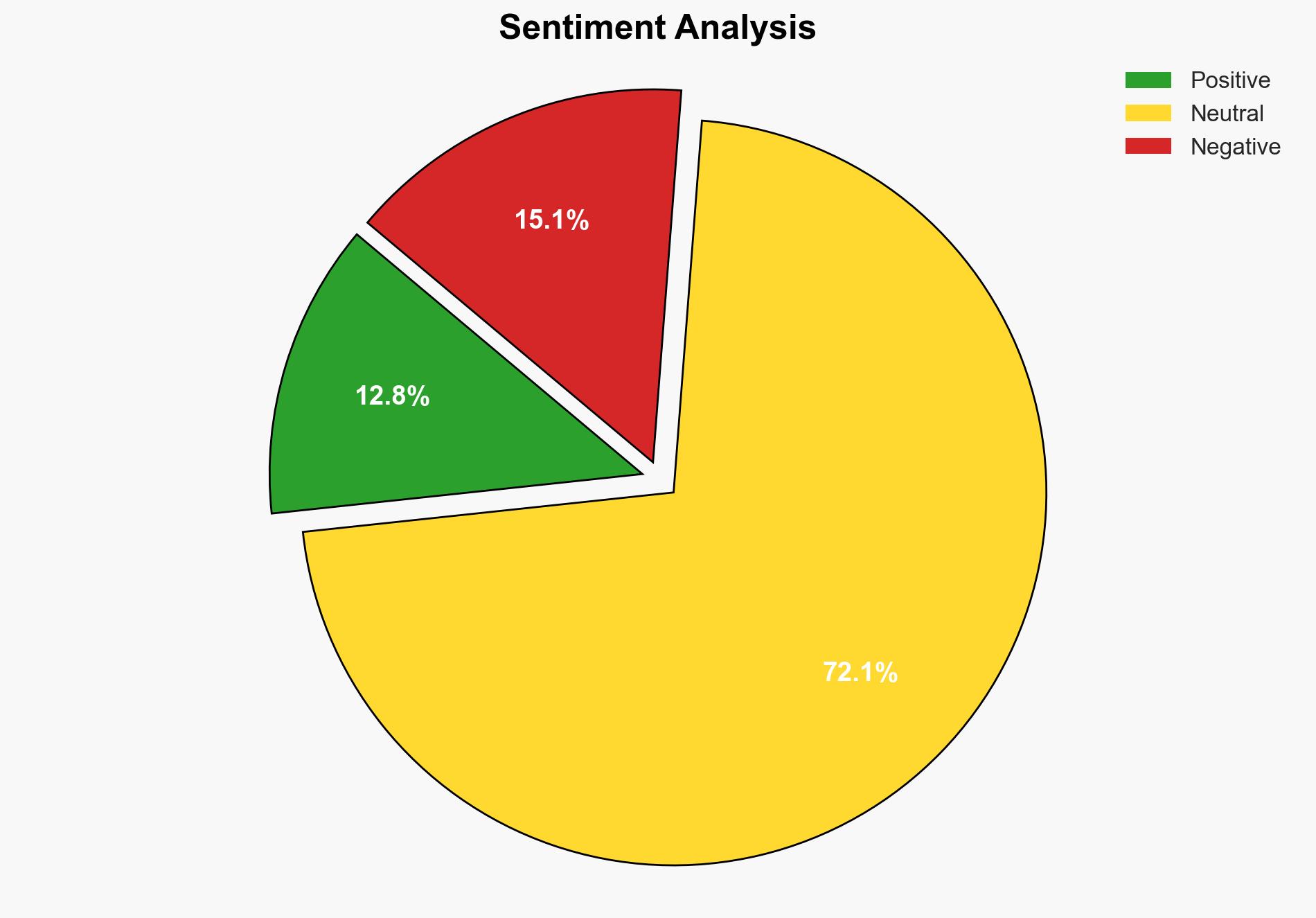

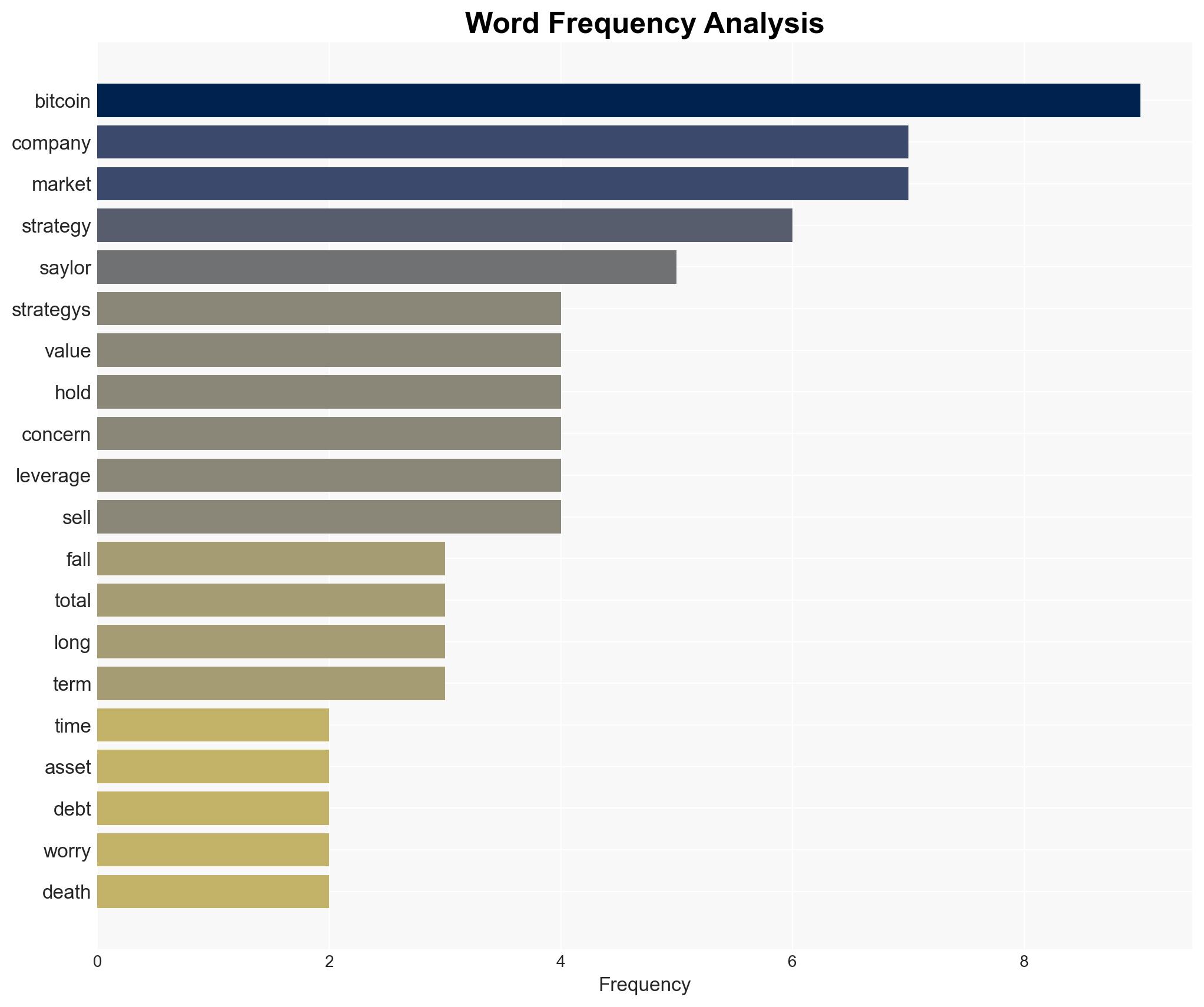

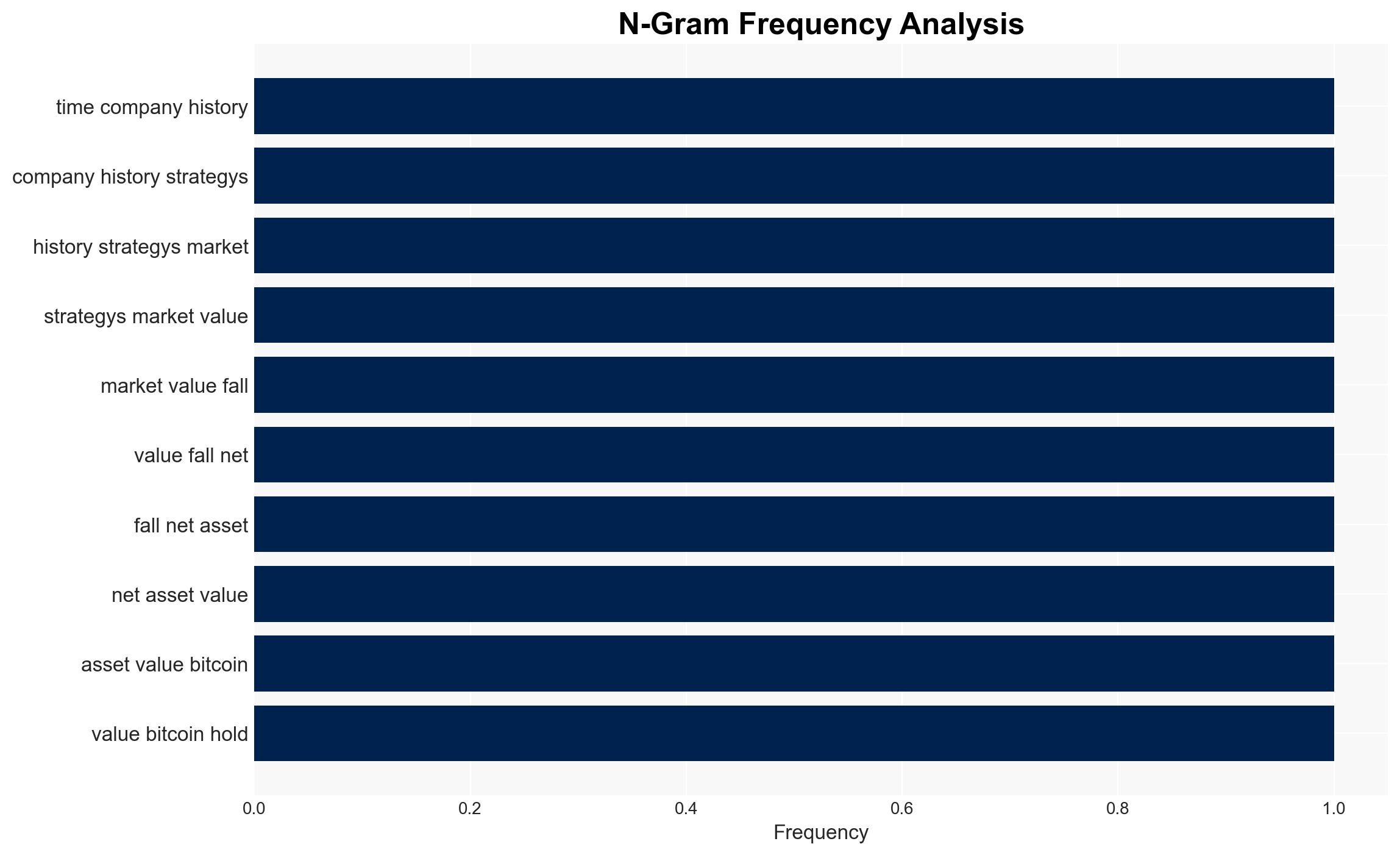

MicroStrategy’s strategy of leveraging debt to acquire Bitcoin has placed the company in a precarious financial position as Bitcoin’s market value declines. The most supported hypothesis is that MicroStrategy will need to adjust its strategy to avoid a financial crisis, potentially through asset liquidation or restructuring. Confidence Level: Moderate.

2. Competing Hypotheses

Hypothesis 1: MicroStrategy will successfully navigate the current downturn by maintaining its Bitcoin holdings and leveraging its long-term conviction in Bitcoin’s value appreciation.

Hypothesis 2: MicroStrategy will be forced to liquidate a significant portion of its Bitcoin holdings to meet debt obligations, exacerbating market pressures and potentially triggering a broader market impact.

Hypothesis 2 is more likely due to the immediate financial pressures and the potential for Bitcoin’s value to continue declining, which would further erode MicroStrategy’s collateral value.

3. Key Assumptions and Red Flags

Assumptions include the continued volatility of Bitcoin prices and MicroStrategy’s ability to access additional capital if needed. Red flags include the company’s high leverage ratio and the potential for market manipulation or misinformation regarding Bitcoin’s value and MicroStrategy’s financial health. Deception indicators may arise from overly optimistic public statements by company leadership without substantive backing.

4. Implications and Strategic Risks

The primary risk is economic, with potential cascading effects on the cryptocurrency market if MicroStrategy is forced to liquidate its holdings. This could lead to a loss of investor confidence and further market destabilization. Politically, regulatory scrutiny may increase as authorities assess the systemic risks posed by highly leveraged cryptocurrency investments. Informational risks include potential misinformation campaigns that could influence market perceptions and investor behavior.

5. Recommendations and Outlook

- MicroStrategy should consider restructuring its debt obligations to reduce immediate financial pressures.

- Explore strategic partnerships or asset sales to bolster liquidity without triggering a market panic.

- Engage with regulators to ensure compliance and mitigate potential legal risks.

- Best Case: Bitcoin’s value stabilizes or increases, allowing MicroStrategy to maintain its holdings and recover financial stability.

- Worst Case: Continued decline in Bitcoin value forces asset liquidation, leading to significant financial loss and market destabilization.

- Most Likely: A combination of asset liquidation and restructuring to manage debt obligations while maintaining a portion of Bitcoin holdings.

6. Key Individuals and Entities

Michael Saylor, Chairman of MicroStrategy, is a key figure due to his influence on the company’s strategic direction and public statements regarding Bitcoin investments.

7. Thematic Tags

Cybersecurity, Cryptocurrency, Financial Risk, Market Volatility

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Forecast futures under uncertainty via probabilistic logic.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us

·