End of crypto bull run Analysts say its too early to panic – Ambcrypto.com

Published on: 2025-11-15

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: End of crypto bull run Analysts say its too early to panic – Ambcrypto.com

1. BLUF (Bottom Line Up Front)

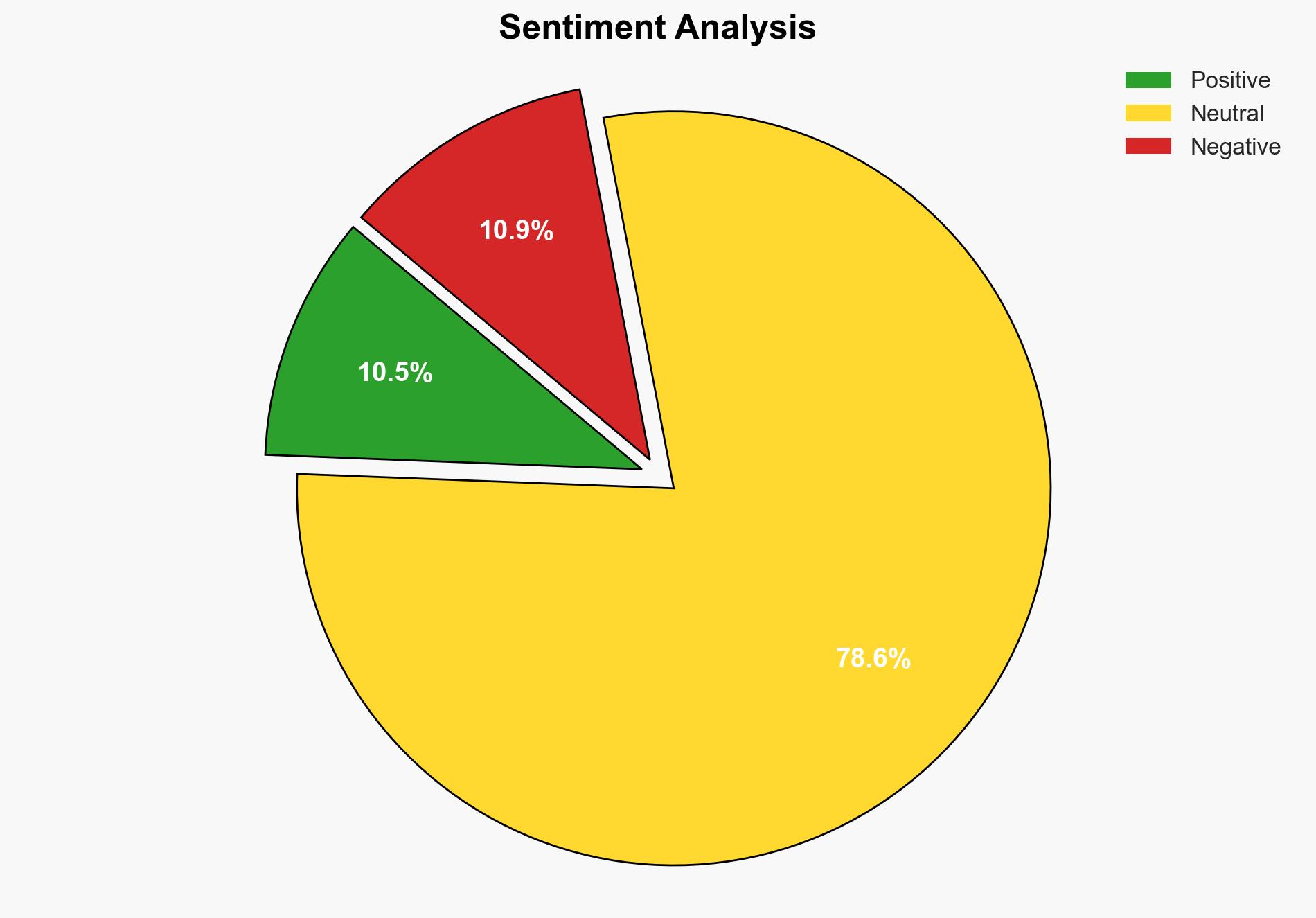

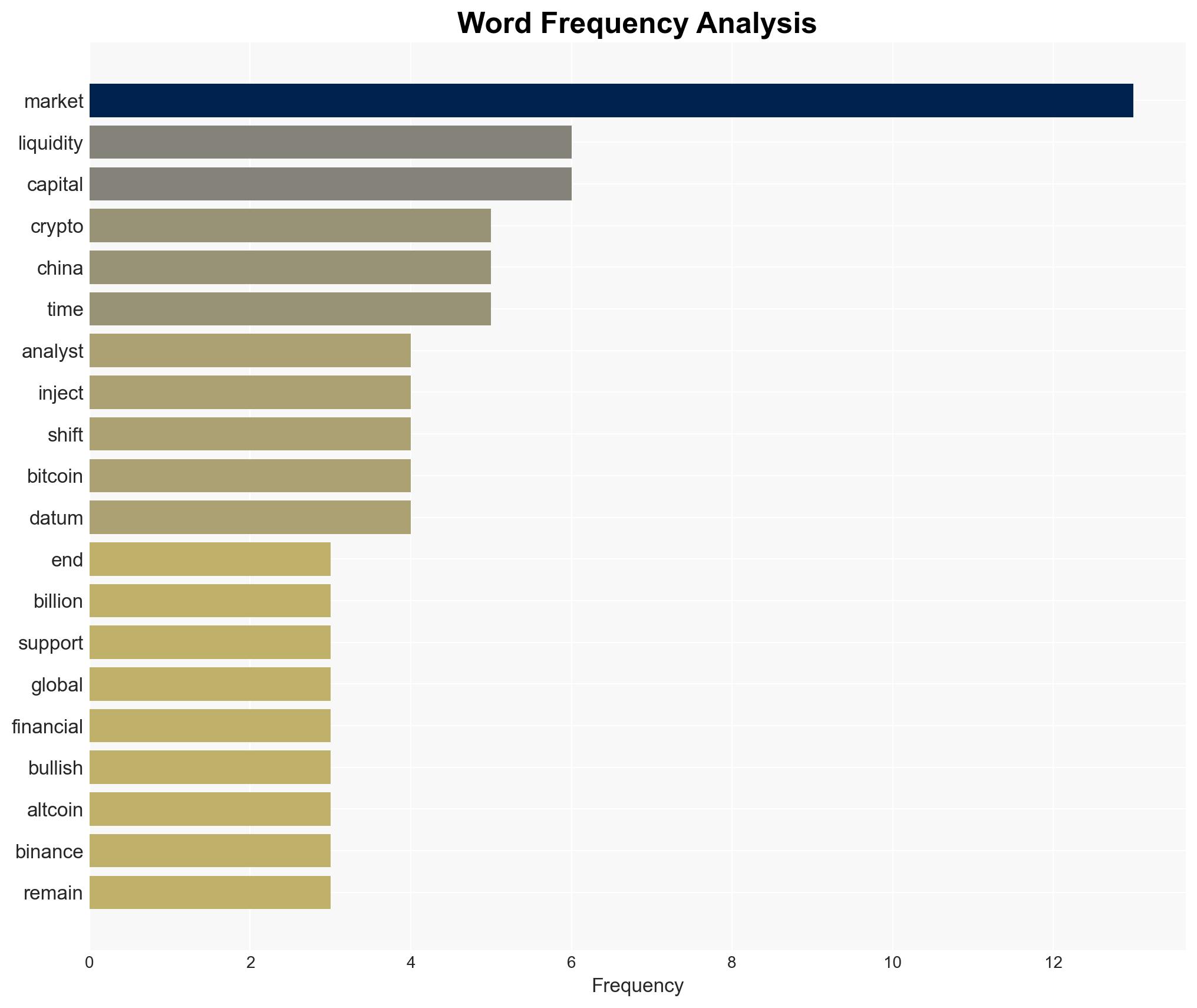

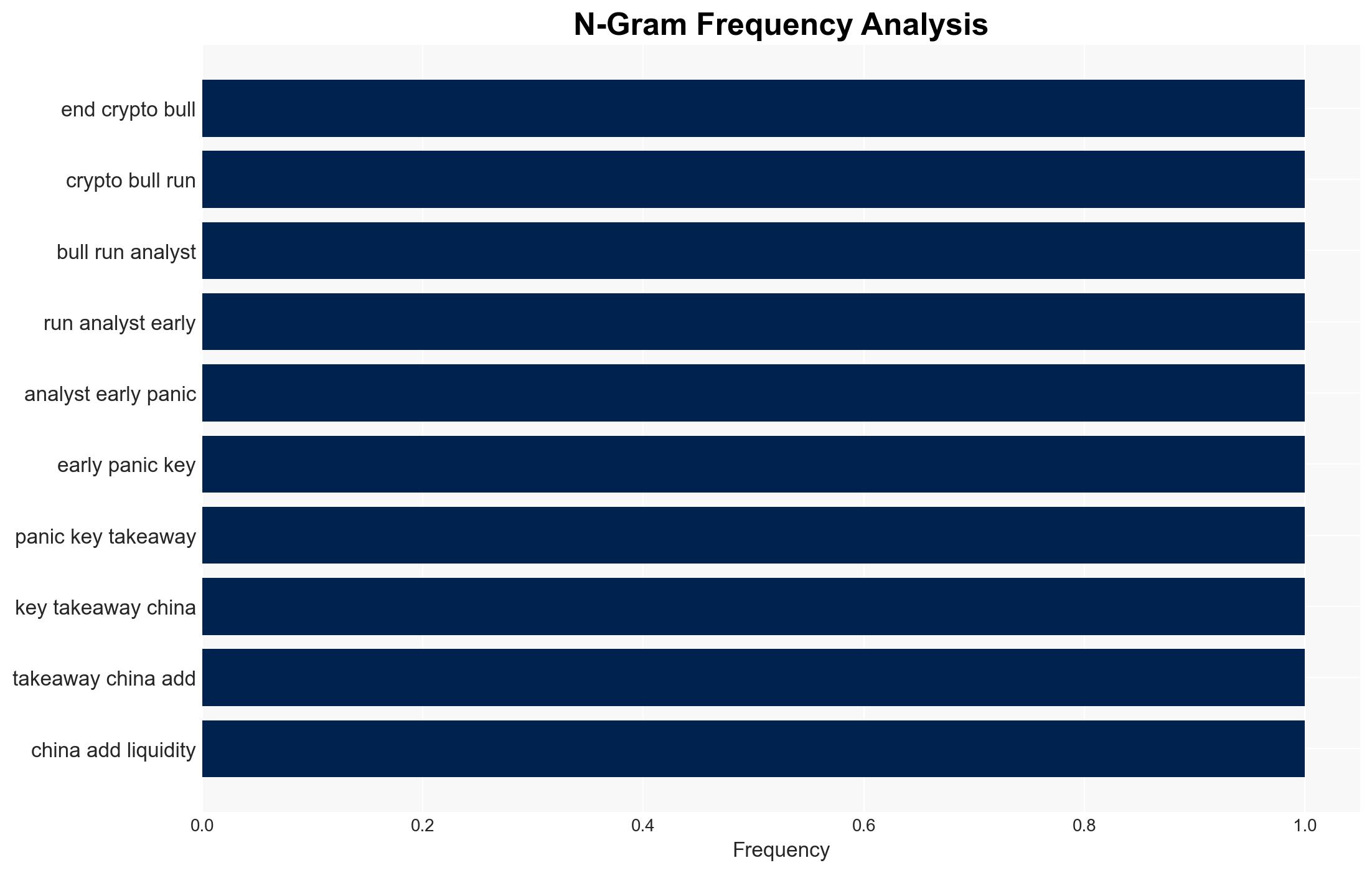

Despite recent volatility in the cryptocurrency market, the strategic judgment is that it is premature to declare the end of the crypto bull run. The most supported hypothesis is that the market is experiencing a temporary correction influenced by external economic factors, such as China’s liquidity injections. Confidence level: Moderate. Recommended action: Monitor China’s financial policies and market reactions closely, and advise stakeholders to prepare for potential short-term volatility while maintaining a long-term bullish outlook.

2. Competing Hypotheses

Hypothesis 1: The crypto market is undergoing a temporary correction due to external economic factors, such as China’s liquidity injections, which will stabilize and resume its bullish trend.

Hypothesis 2: The crypto bull run is ending due to a fundamental shift in market dynamics, including weakened investor sentiment and potential regulatory pressures.

Hypothesis 1 is more likely given the historical resilience of Bitcoin and the influence of external liquidity factors, such as China’s recent capital injections, which indicate support for global financial markets.

3. Key Assumptions and Red Flags

Assumptions: The assumption is that China’s liquidity injections will have a stabilizing effect on the market. Another assumption is that the current dip is part of a cyclical pattern rather than a structural decline.

Red Flags: Potential bias in relying heavily on China’s economic actions as a stabilizing force. Deception indicators include overly optimistic interpretations of market resilience without considering potential regulatory impacts.

4. Implications and Strategic Risks

The primary risk is that if the market does not stabilize, it could lead to a loss of investor confidence and a more pronounced downturn. Political risks include potential regulatory crackdowns on cryptocurrencies, particularly in major markets like the U.S. and China. Economic risks involve broader financial market instability impacting crypto valuations. Cyber risks include increased vulnerability to market manipulation and cyber-attacks during periods of volatility.

5. Recommendations and Outlook

- Monitor China’s financial policies and liquidity actions closely to anticipate market impacts.

- Advise stakeholders to prepare for short-term volatility while maintaining a long-term bullish strategy.

- Best-case scenario: Market stabilizes and resumes upward trend due to external liquidity support.

- Worst-case scenario: Prolonged downturn due to regulatory pressures and loss of investor confidence.

- Most-likely scenario: Short-term volatility followed by stabilization and gradual recovery.

6. Key Individuals and Entities

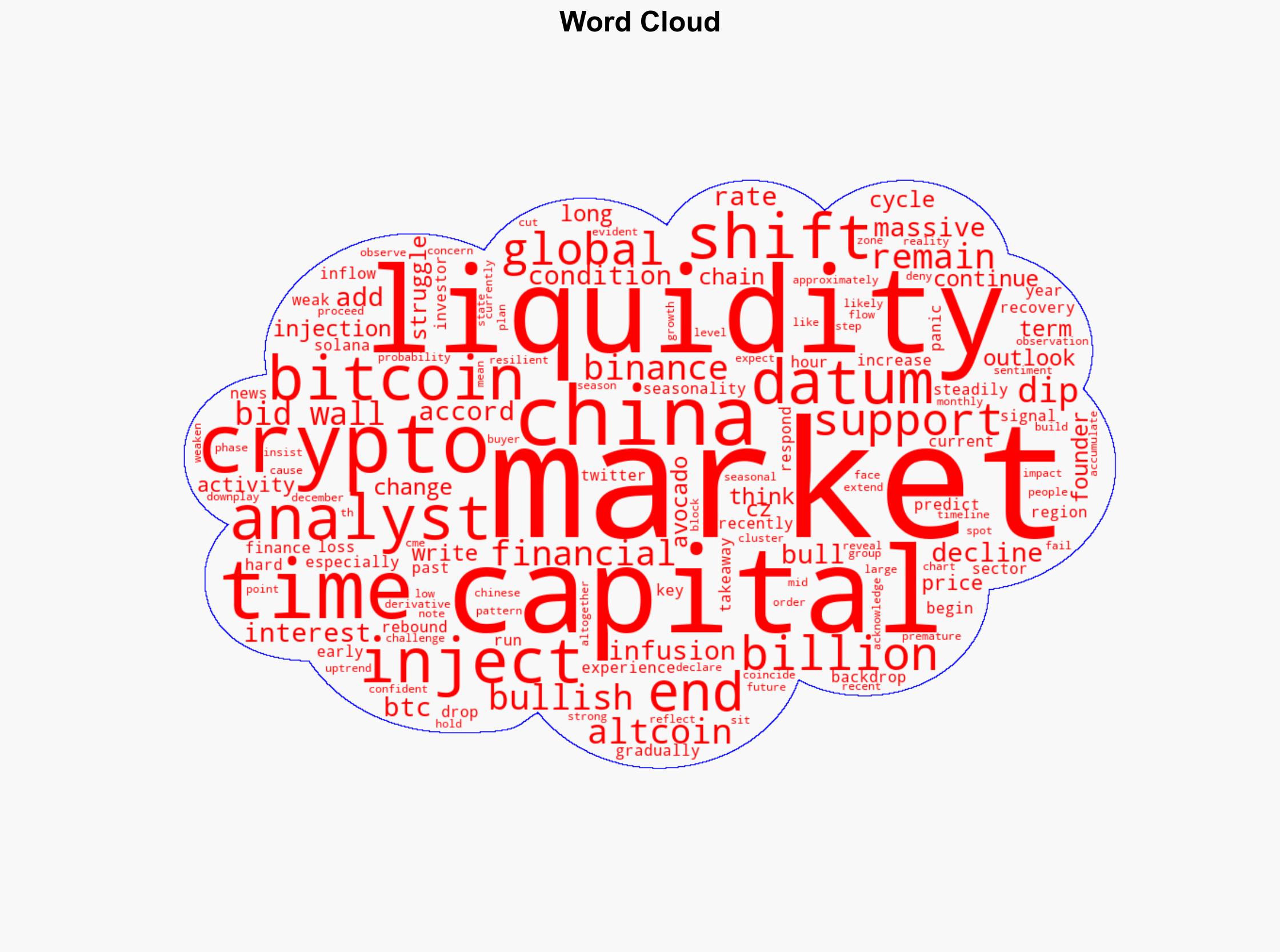

Binance founder Changpeng Zhao (CZ) – Advocates for a long-term bullish outlook despite current market conditions.

Analyst Avocado – Observes shifts in seasonal patterns and market cycles.

7. Thematic Tags

Regional Focus, Regional Focus: China, Global Financial Markets, Cryptocurrency Market Dynamics

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·