Equity valuations at risk if growth fails to pick up Chris Woods Greed Fear – The Times of India

Published on: 2025-11-15

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Equity valuations at risk if growth fails to pick up Chris Woods Greed Fear – The Times of India

1. BLUF (Bottom Line Up Front)

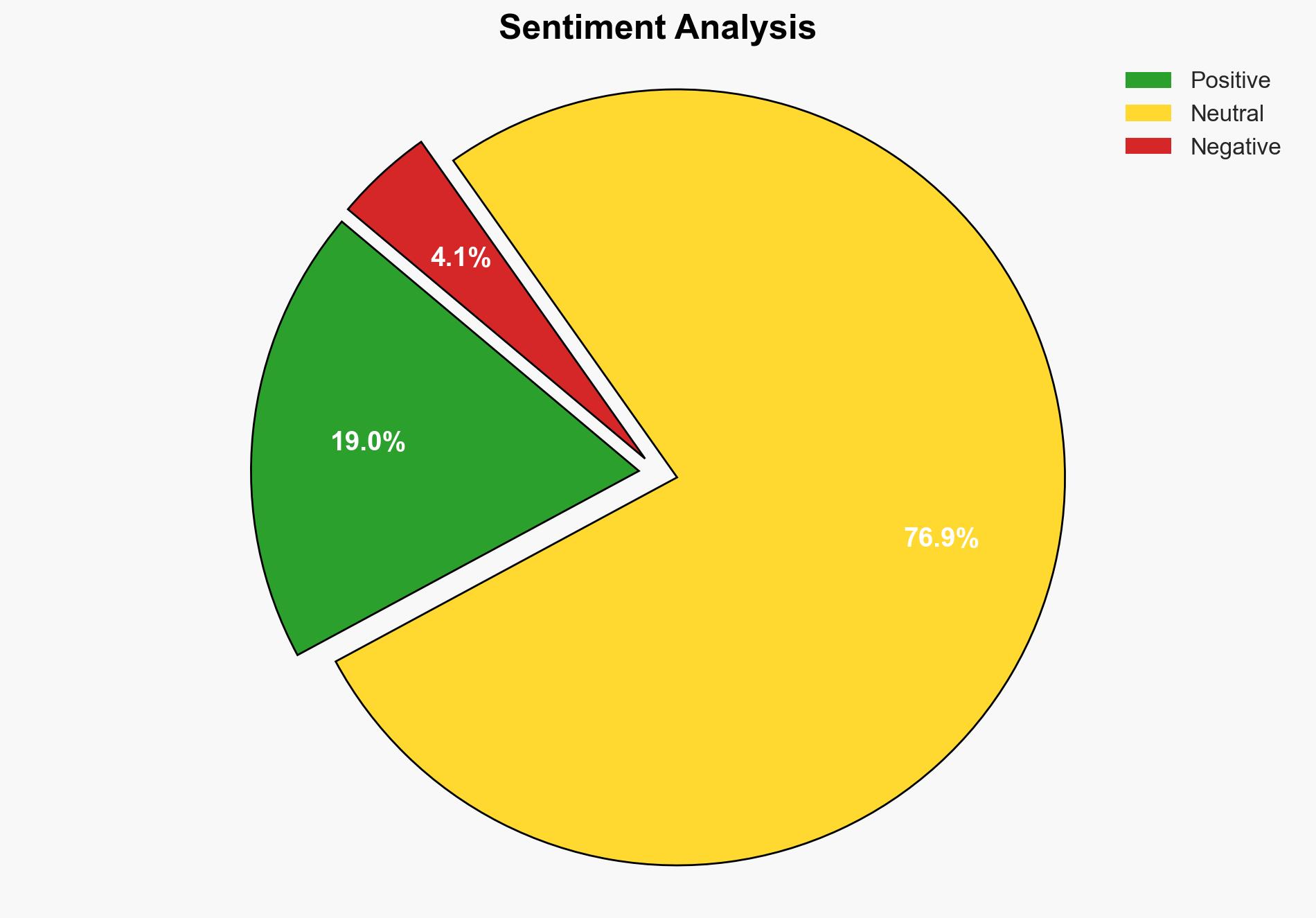

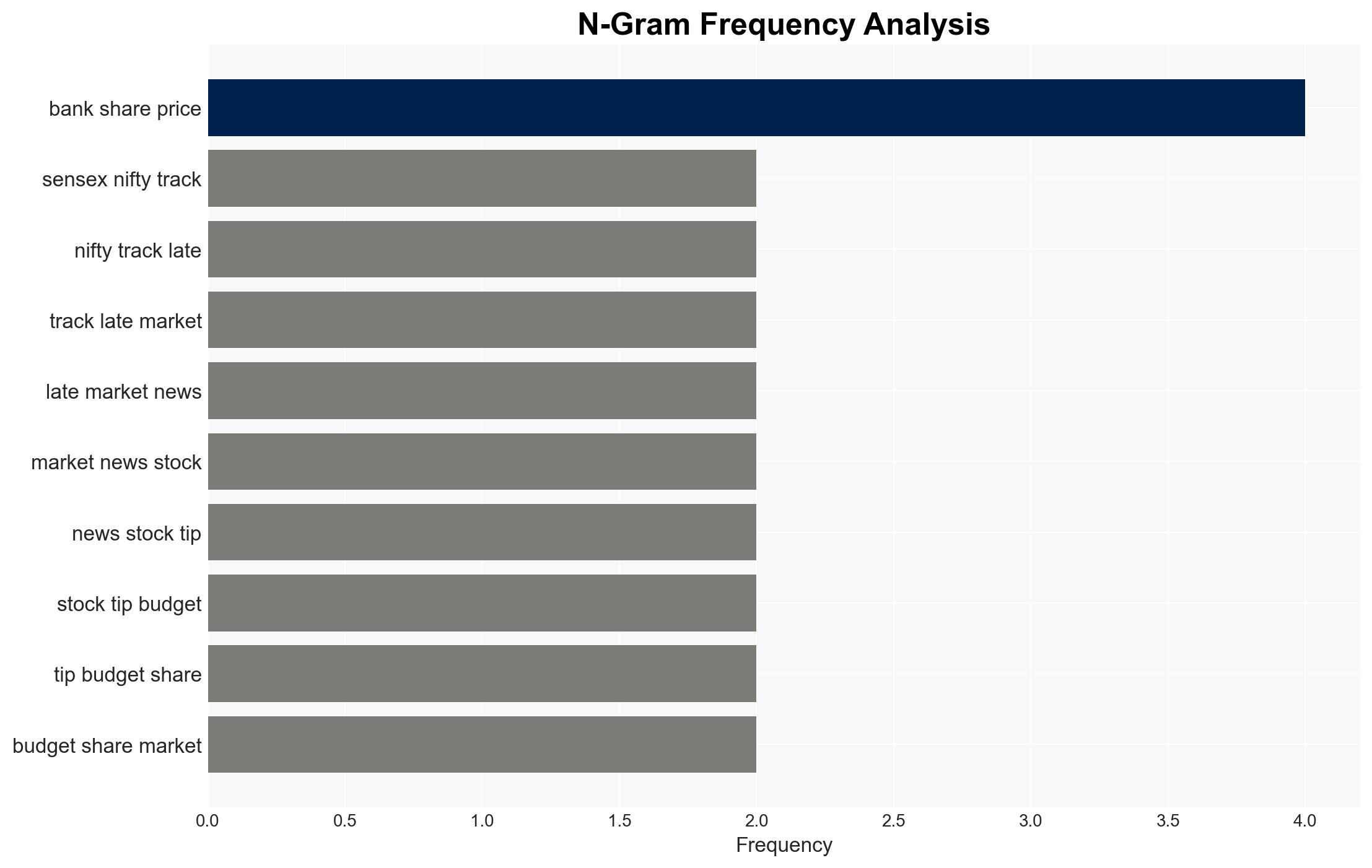

The strategic judgment is that Indian equity valuations are at significant risk if economic growth does not accelerate, with a moderate confidence level. The most supported hypothesis is that India’s service sector and political dynamics will hinder growth, leading to potential devaluation. Recommended actions include monitoring fiscal policies and market indicators closely, and diversifying investment portfolios to mitigate risk.

2. Competing Hypotheses

Hypothesis 1: India’s economic growth will remain sluggish due to service sector vulnerabilities and political uncertainties, leading to a decline in equity valuations.

Hypothesis 2: Despite current challenges, India will experience a rebound in economic growth driven by government reforms and global market dynamics, stabilizing or increasing equity valuations.

The first hypothesis is more likely due to current evidence of service sector revenue growth slowing and political populism affecting fiscal policies, which could deter investment and economic momentum.

3. Key Assumptions and Red Flags

Assumptions: The analysis assumes that current service sector trends and political dynamics will persist. It also assumes that global market conditions will not drastically improve to offset domestic challenges.

Red Flags: Potential bias in overestimating the impact of political populism without considering counterbalancing reforms. Deception indicators include overly optimistic government forecasts that may not reflect ground realities.

4. Implications and Strategic Risks

Economic implications include potential devaluation of the BSE index and increased investor caution. Politically, state-level populism could lead to unsustainable fiscal policies. Economically, a failure to address service sector weaknesses could lead to long-term growth stagnation, affecting investor confidence and foreign direct investment.

5. Recommendations and Outlook

- Actionable Steps: Encourage diversification of investment portfolios to include more stable markets. Monitor fiscal policy changes and service sector performance closely.

- Best Scenario: Government reforms stimulate growth, stabilizing equity valuations.

- Worst Scenario: Continued economic slowdown leads to significant equity devaluation and reduced investor confidence.

- Most-likely Scenario: Moderate growth with ongoing volatility in equity valuations due to mixed economic signals and political uncertainties.

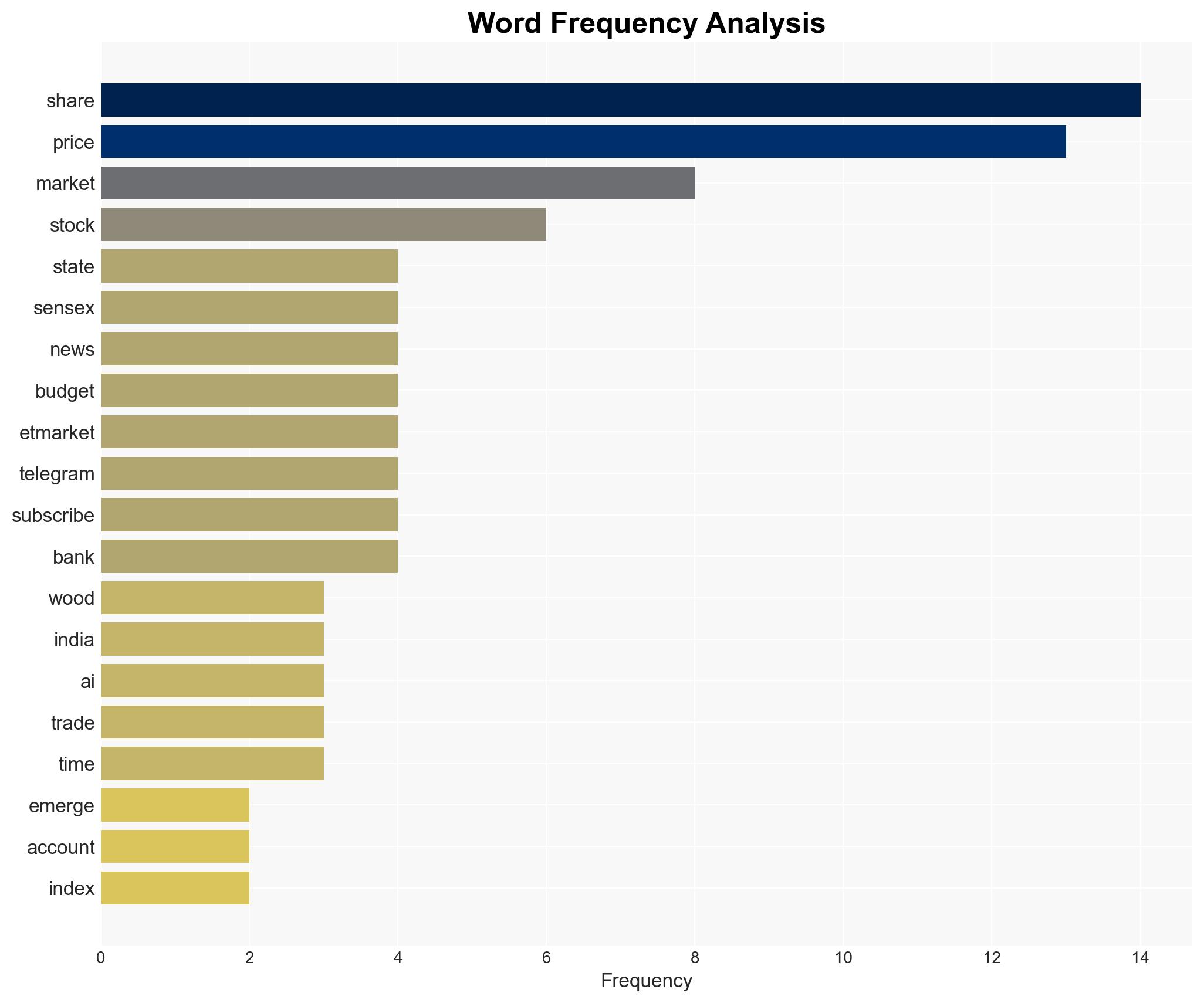

6. Key Individuals and Entities

Chris Wood (Analyst), MSCI Emerging Market Index, BSE Index, Indian Central and State Governments.

7. Thematic Tags

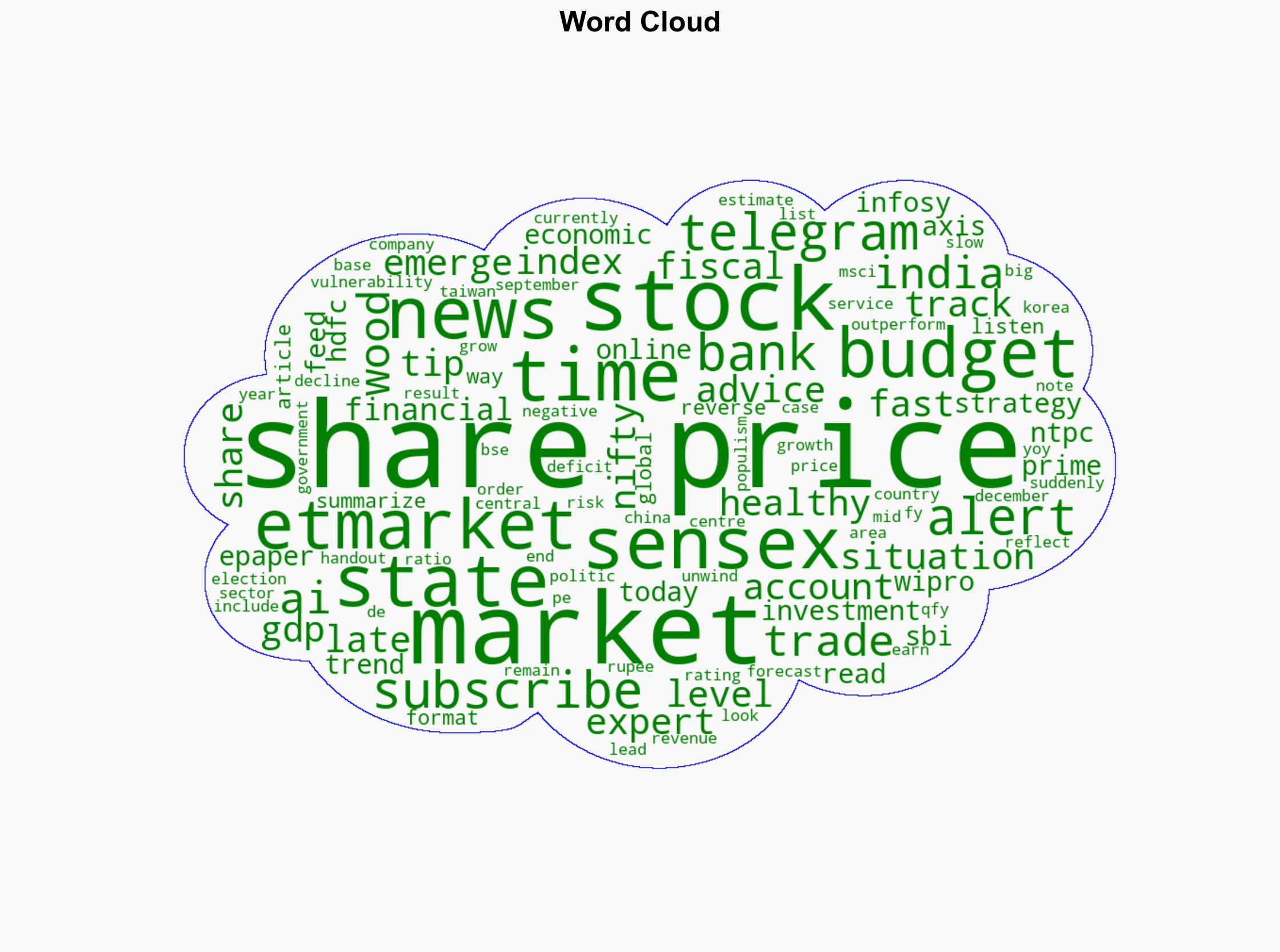

Cybersecurity, Economic Growth, Equity Valuation, Political Risk, Market Analysis, Investment Strategy

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us

·