Crude oil futures fall as Russian port resumes oil loading – BusinessLine

Published on: 2025-11-17

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

“`html

Intelligence Report:

1. BLUF (Bottom Line Up Front)

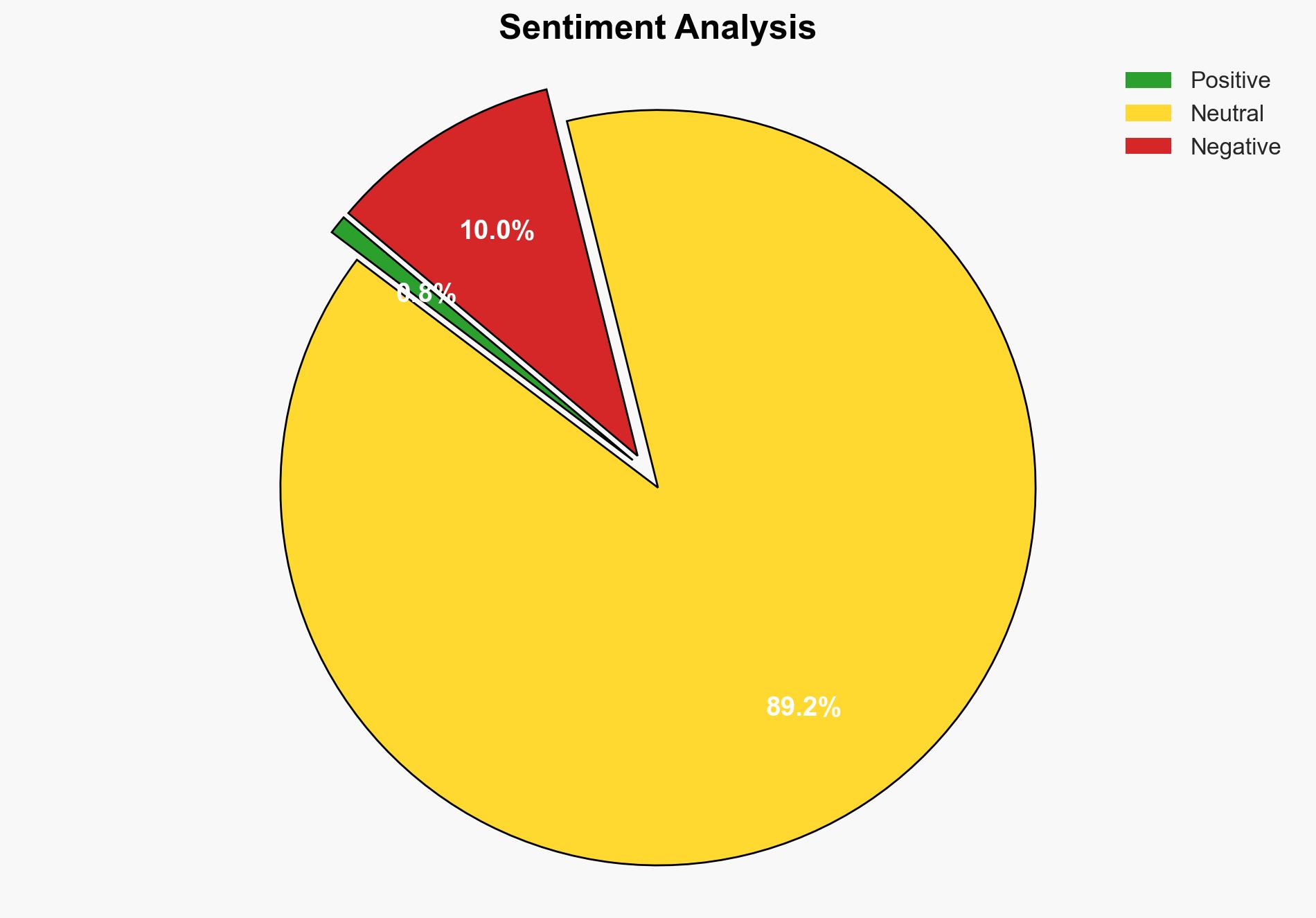

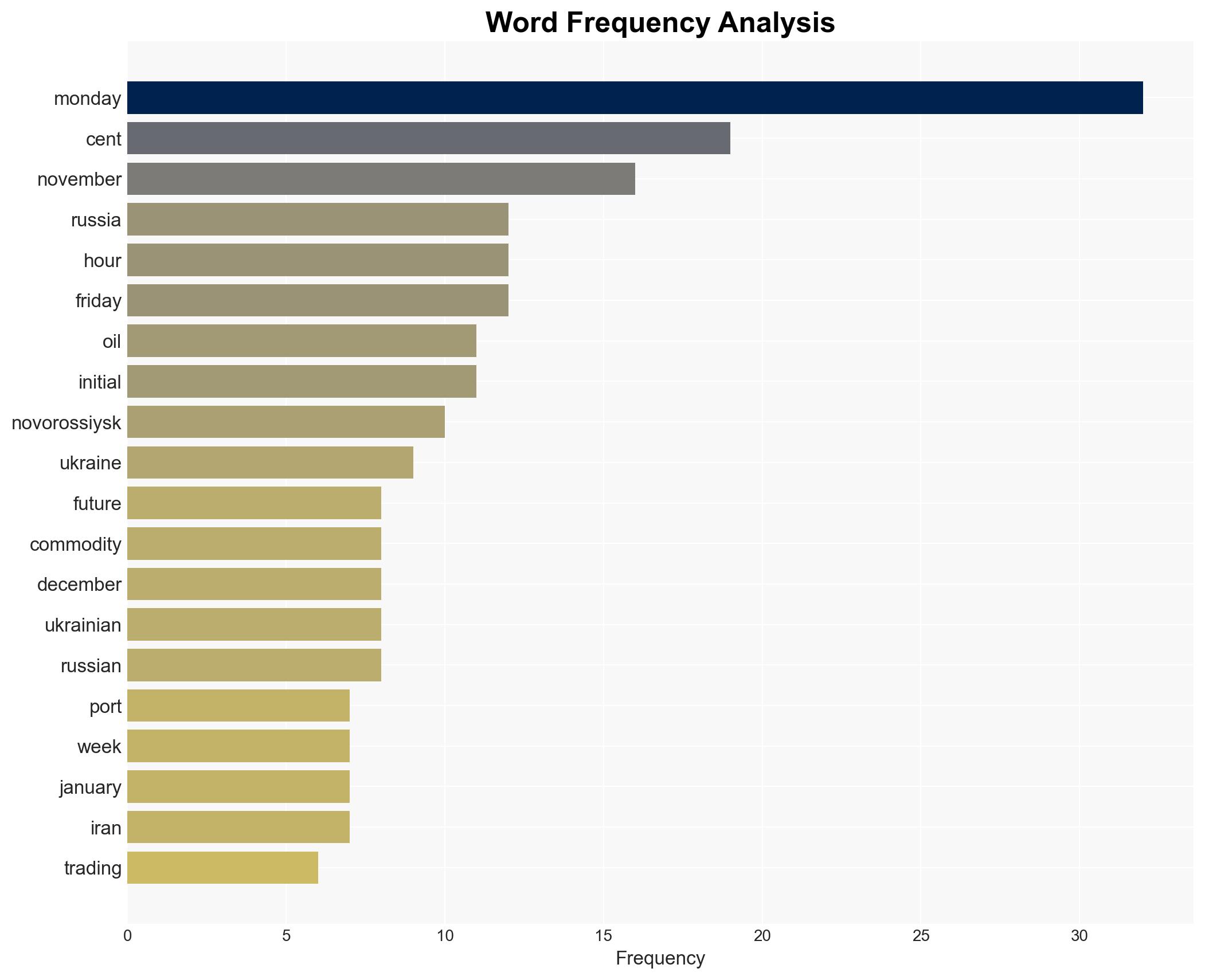

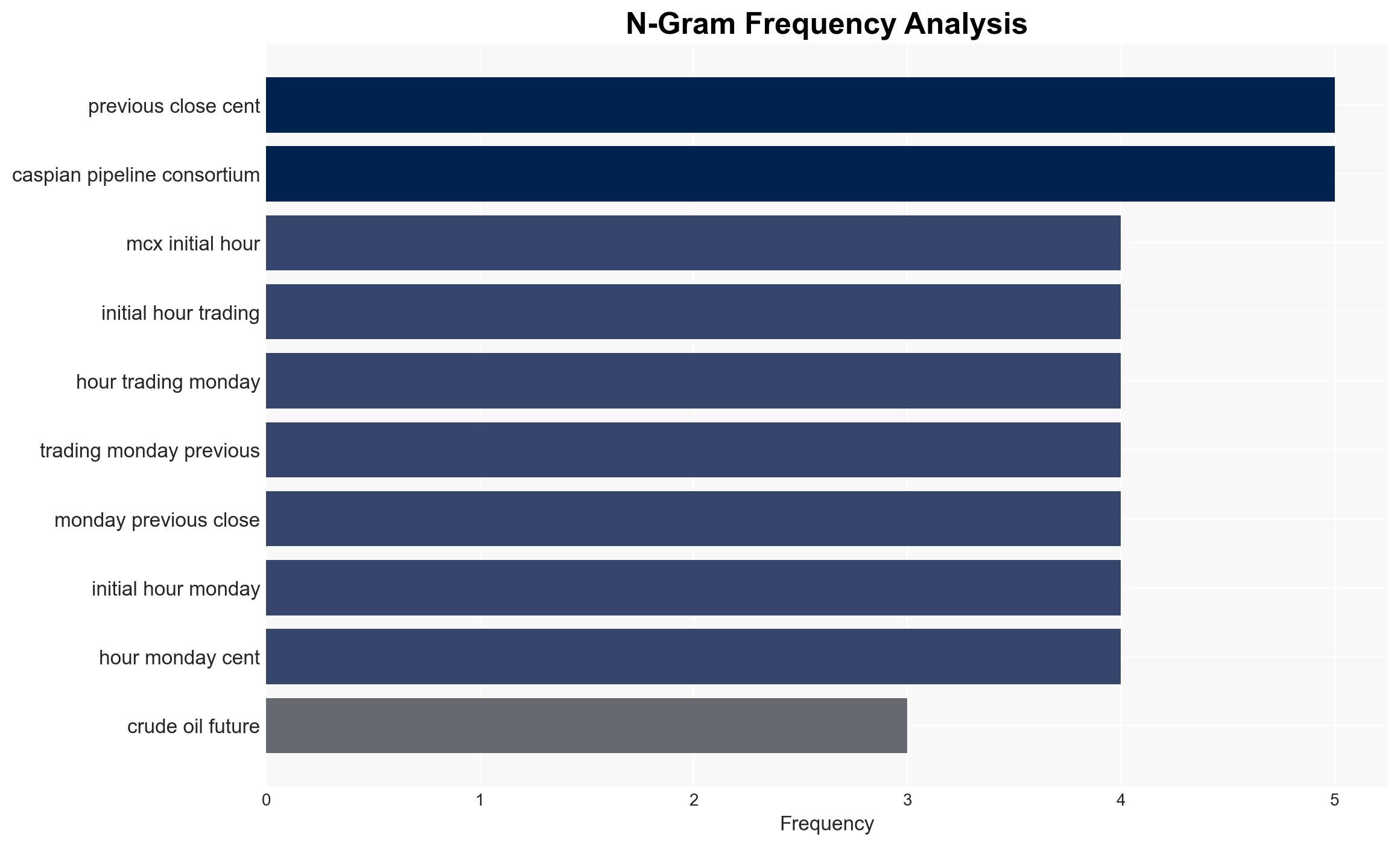

The resumption of oil loading at Russia’s Novorossiysk port following a temporary shutdown due to a drone attack by Ukraine has led to a decrease in crude oil futures. The most supported hypothesis is that the market reaction is primarily driven by the resumption of operations, rather than a fundamental shift in geopolitical dynamics. Confidence level: Moderate. Recommended action: Monitor further developments in the region and assess potential impacts on global oil supply chains.

2. Competing Hypotheses

Hypothesis 1: The decline in crude oil futures is primarily due to the resumption of operations at Novorossiysk port, alleviating immediate supply concerns.

Hypothesis 2: The decline is a temporary market reaction, and underlying geopolitical tensions between Russia and Ukraine will continue to exert upward pressure on oil prices.

Hypothesis 1 is more likely given the immediate market response to the operational resumption, which directly addresses supply disruptions. However, Hypothesis 2 remains plausible due to ongoing geopolitical instability.

3. Key Assumptions and Red Flags

Assumptions include the reliability of reports on the resumption of operations and the absence of further immediate disruptions. Red flags include the potential for further Ukrainian attacks on Russian infrastructure and the strategic use of misinformation by involved parties to manipulate market perceptions.

4. Implications and Strategic Risks

The resumption of operations at Novorossiysk port reduces immediate supply disruptions but does not eliminate the risk of future attacks, which could lead to further volatility in oil markets. Escalation scenarios include increased military engagements between Russia and Ukraine, potential cyber-attacks on energy infrastructure, and broader economic sanctions impacting global supply chains.

5. Recommendations and Outlook

- Monitor geopolitical developments closely, particularly any further attacks on energy infrastructure.

- Engage with industry stakeholders to assess potential impacts on supply chains and develop contingency plans.

- Best-case scenario: Stability in the region leads to a sustained decrease in oil prices.

- Worst-case scenario: Escalation of conflict results in significant disruptions to global oil supply.

- Most-likely scenario: Continued volatility in oil markets driven by intermittent disruptions and geopolitical tensions.

6. Key Individuals and Entities

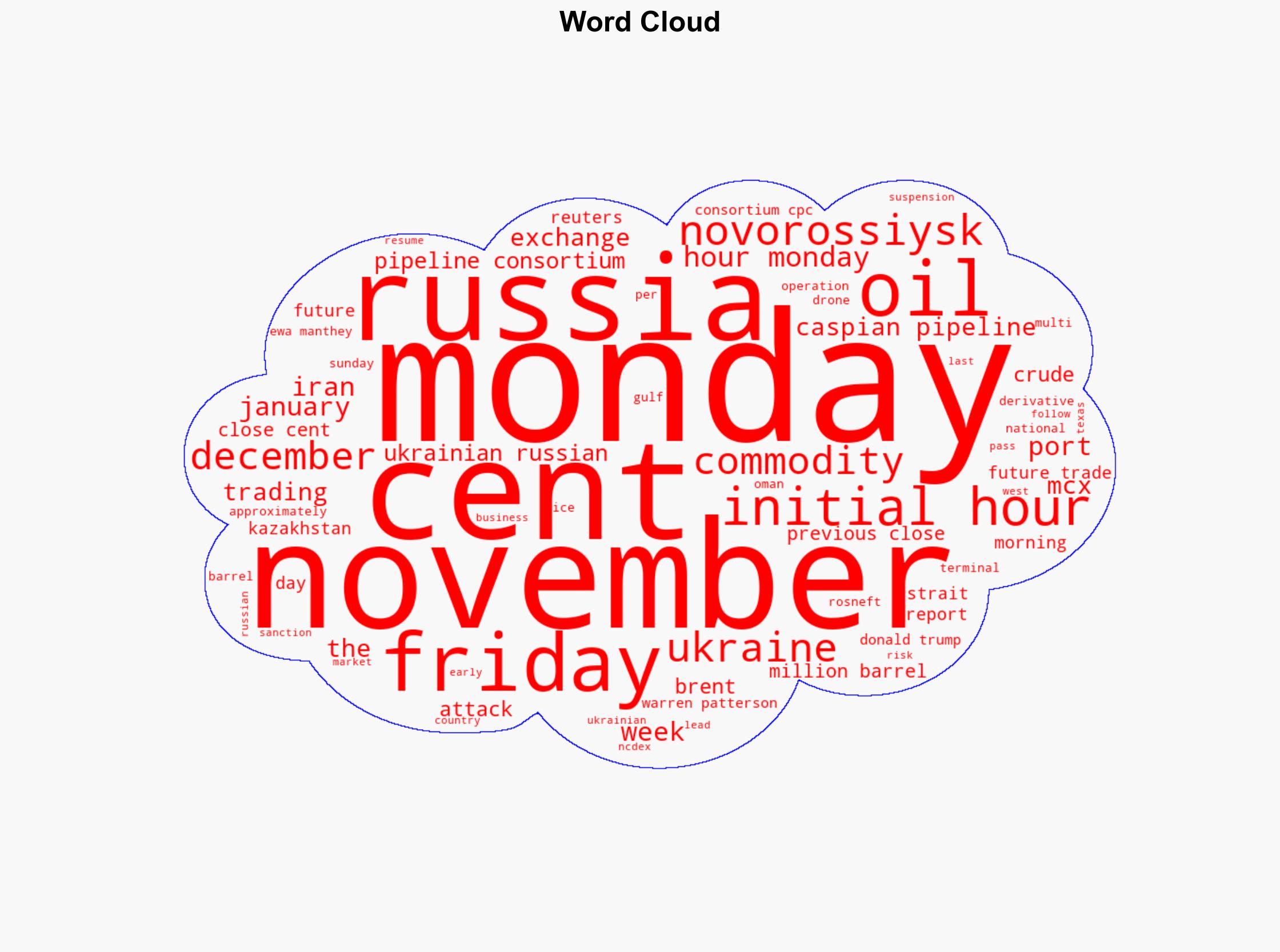

Warren Patterson, Ewa Manthey, Rosneft, Caspian Pipeline Consortium.

7. Thematic Tags

Regional Focus, Regional Focus: Russia, Ukraine, Global Oil Markets

“`

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·