Firo FIRO Hits a 3-Year High What Risks and Opportunities Are Emerging – BeInCrypto

Published on: 2025-11-17

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Firo FIRO Hits a 3-Year High – Risks and Opportunities

1. BLUF (Bottom Line Up Front)

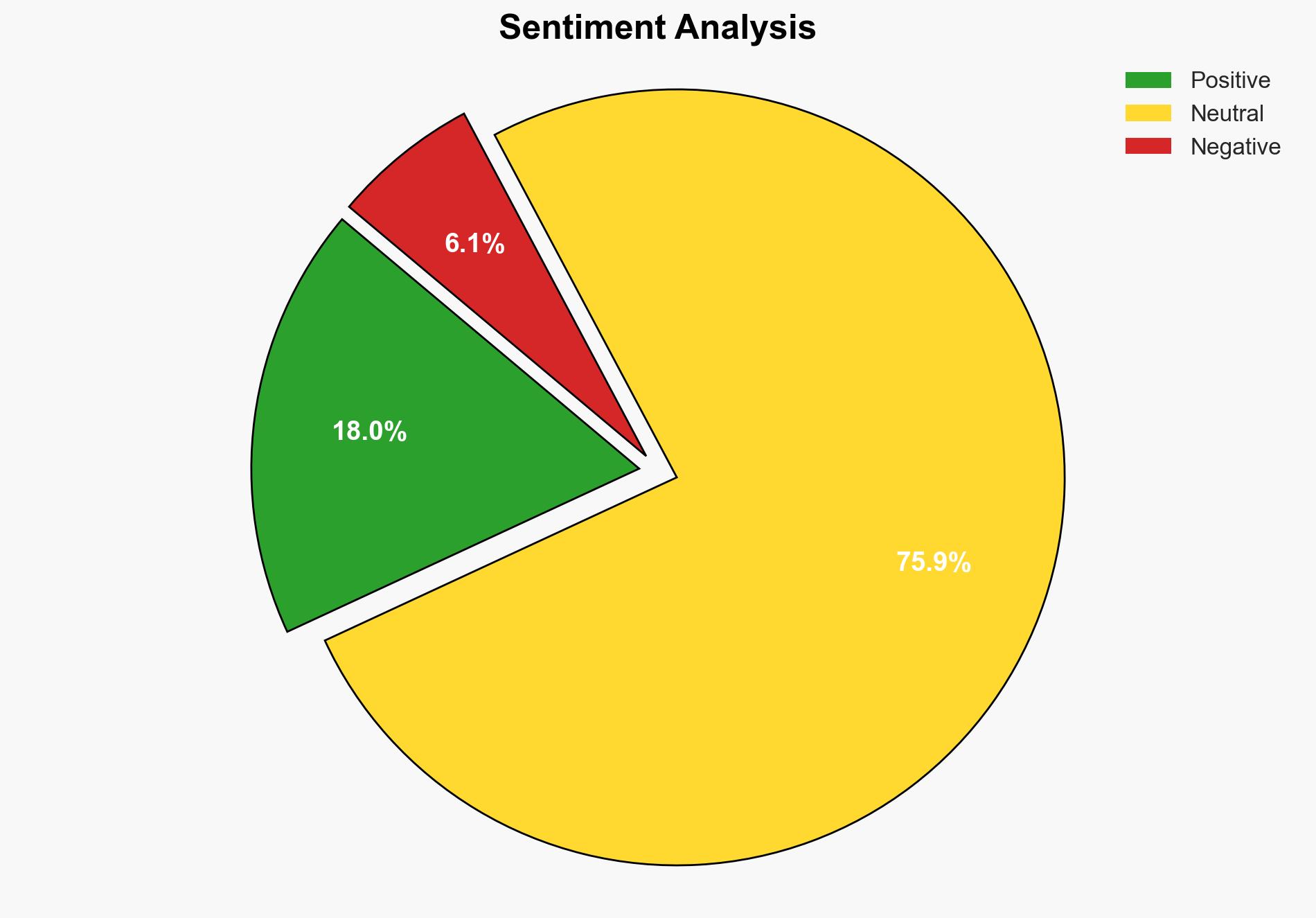

The most supported hypothesis is that Firo’s recent surge is primarily driven by speculative investment and technological upgrades, but it faces significant risks from market volatility and regulatory pressures. Confidence Level: Moderate. Recommended action: Monitor regulatory developments and market sentiment closely, while considering strategic partnerships to enhance stability and growth.

2. Competing Hypotheses

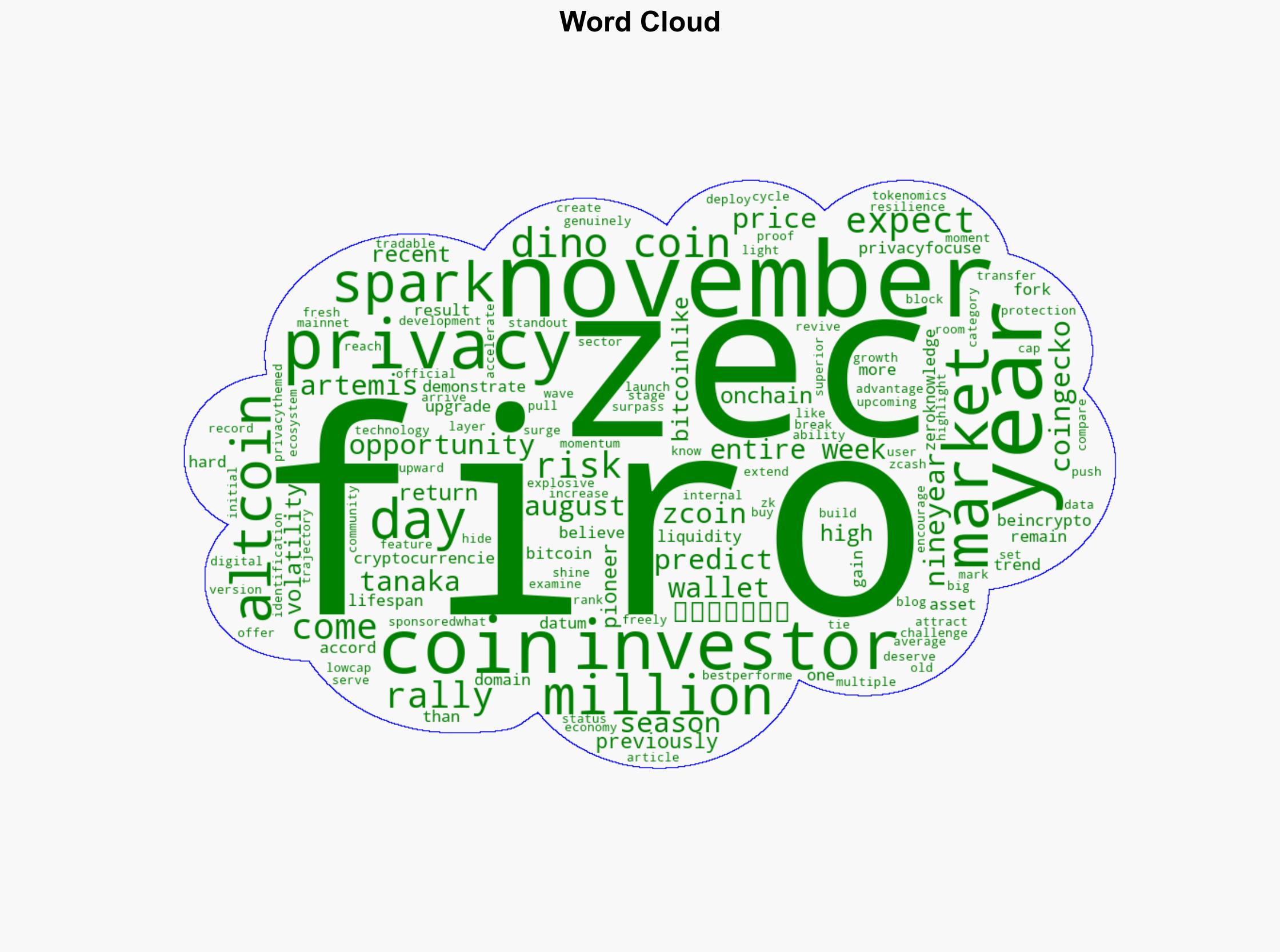

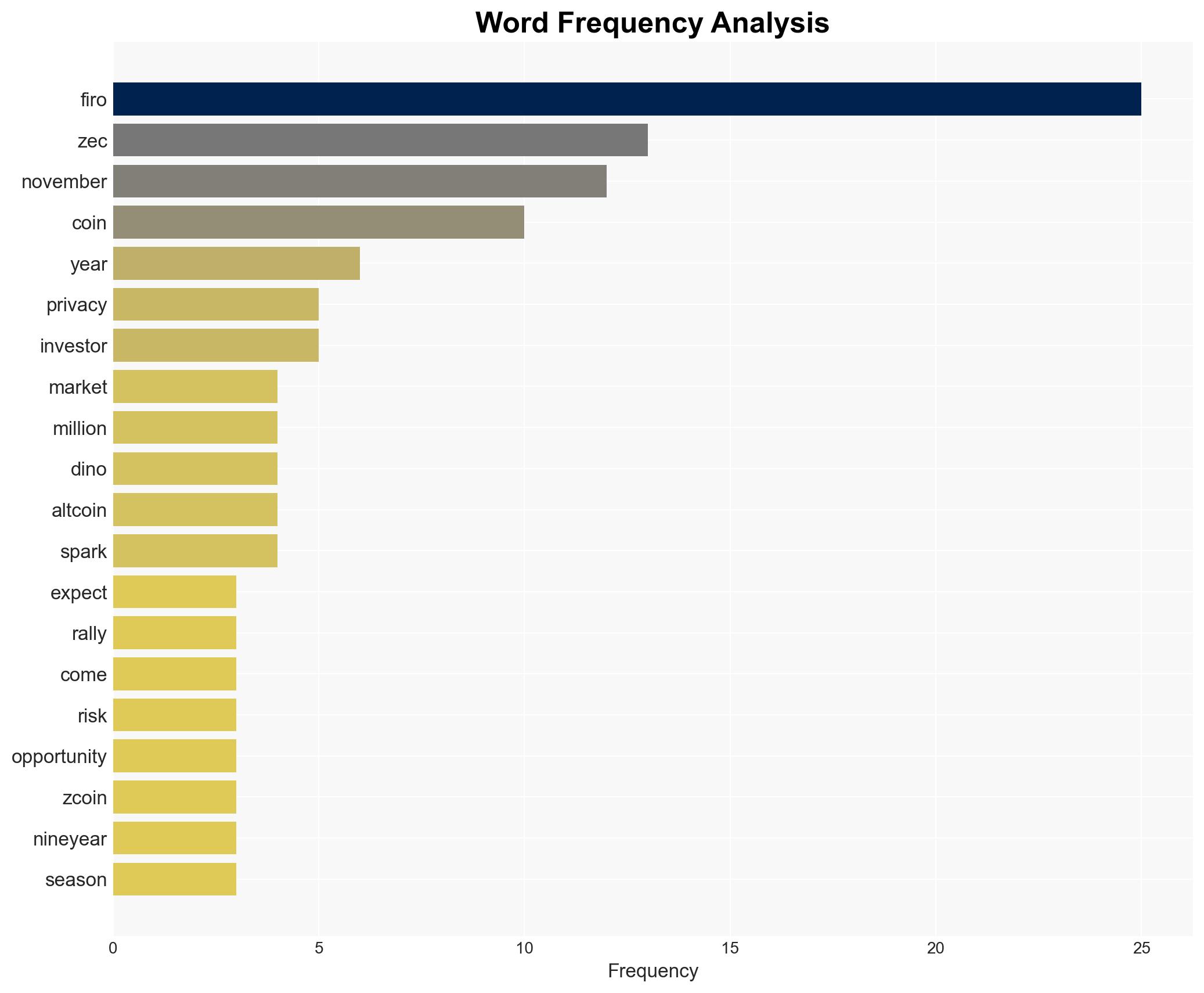

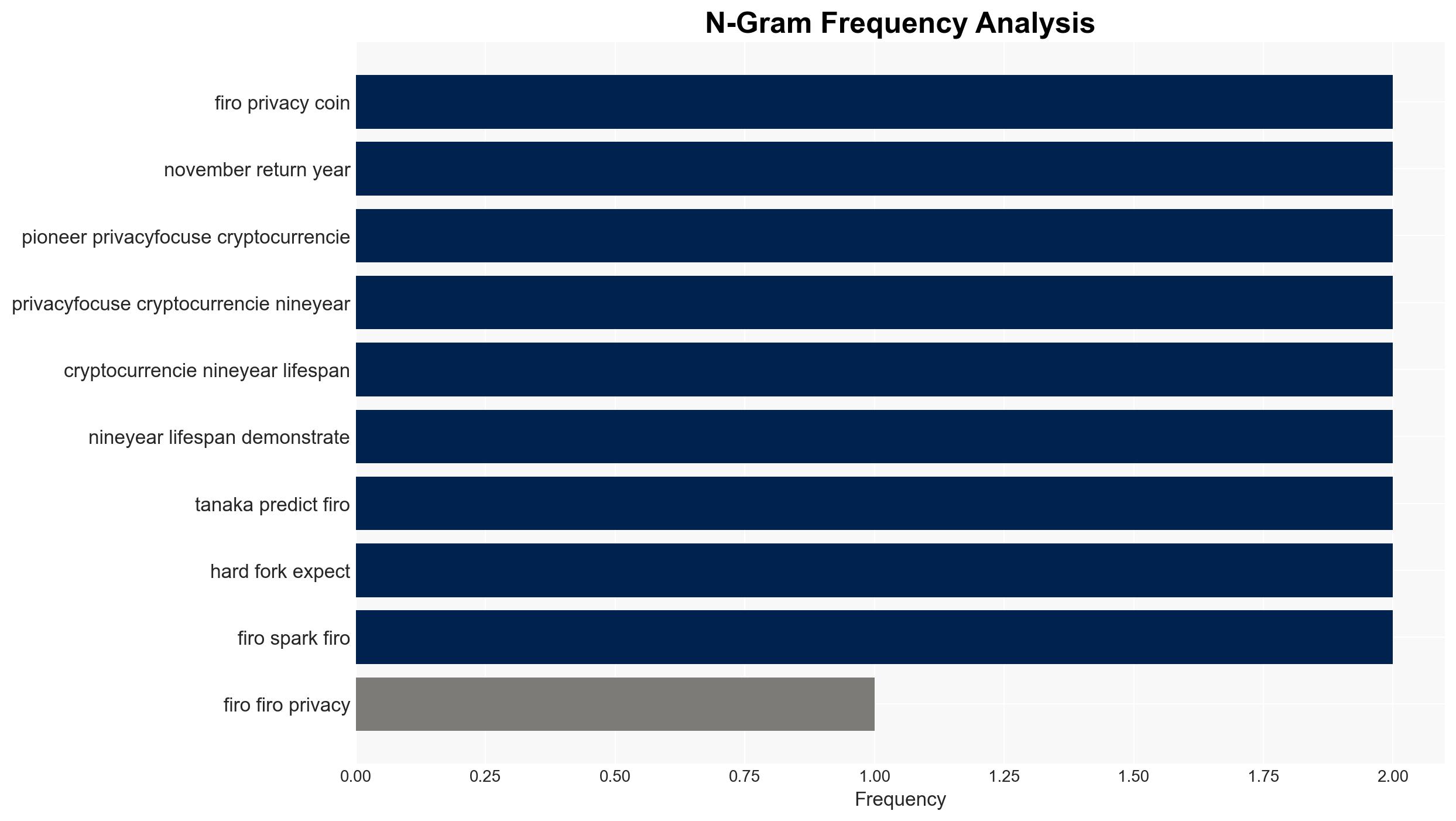

Hypothesis 1: Firo’s price surge is sustainable due to technological advancements and increasing investor interest in privacy coins.

Hypothesis 2: Firo’s price surge is temporary, driven by speculative trading and market manipulation, with a high risk of a subsequent price correction.

Hypothesis 2 is more likely due to the concentration of Firo in a few wallets and historical volatility in privacy coins, suggesting potential for market manipulation and speculative trading.

3. Key Assumptions and Red Flags

Assumptions: The market will continue to value privacy features; technological upgrades will enhance Firo’s appeal.

Red Flags: Concentration of Firo in a few wallets indicates potential for market manipulation; historical volatility and regulatory scrutiny of privacy coins.

Deception Indicators: Over-reliance on Zcash’s trajectory as a predictor for Firo’s success may be misleading.

4. Implications and Strategic Risks

Economic Risks: A significant sell-off by large holders could lead to a sharp price decline, affecting investor confidence.

Regulatory Risks: Increased government scrutiny on privacy coins could lead to restrictions or bans, impacting Firo’s marketability.

Informational Risks: Misinformation or exaggerated claims about Firo’s capabilities could mislead investors, leading to market instability.

5. Recommendations and Outlook

- Monitor large wallet activities to anticipate potential market movements.

- Engage with regulatory bodies to ensure compliance and mitigate legal risks.

- Promote transparency and accurate information to build investor trust.

- Best-case scenario: Firo establishes itself as a leading privacy coin with sustained growth due to technological advancements and strategic partnerships.

- Worst-case scenario: Regulatory crackdowns lead to a significant decline in Firo’s value and market presence.

- Most-likely scenario: Firo experiences continued volatility with periods of growth and correction, influenced by market sentiment and regulatory developments.

6. Key Individuals and Entities

Investor Tanaka: Predicts Firo’s potential in the altcoin market.

Artemis: Provides data on privacy coin performance.

Zerebus: Offers insights into Firo’s market trajectory.

7. Thematic Tags

Cybersecurity, Cryptocurrency, Market Volatility, Regulatory Compliance

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us

·