Fintech leaders call for united front against AI-driven cyber crime – ComputerWeekly.com

Published on: 2025-11-18

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Fintech Leaders Call for United Front Against AI-Driven Cyber Crime

1. BLUF (Bottom Line Up Front)

With a high confidence level, the most supported hypothesis is that AI-driven cybercrime is rapidly evolving, necessitating a coordinated response from fintech leaders to protect the financial ecosystem. Immediate strategic actions include enhancing collaboration across industry players and implementing advanced behavioral analytics to preemptively identify and mitigate threats.

2. Competing Hypotheses

Hypothesis 1: AI-driven cybercrime is advancing faster than the financial industry’s ability to respond, posing a significant threat to consumer protection and financial stability.

Hypothesis 2: The financial industry is adequately adapting to AI-driven threats through collaboration and technological advancements, maintaining a balanced threat landscape.

Hypothesis 1 is more likely due to the rapid evolution of AI tools that lower the barrier for sophisticated cybercrime, as highlighted by fintech leaders. The urgency expressed by industry experts suggests current measures are insufficient, supporting the need for enhanced collaboration and technology adoption.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that AI tools will continue to evolve, making cybercrime more sophisticated and accessible. There is an assumption that financial institutions can effectively collaborate and share intelligence without significant barriers.

Red Flags: The rapid pace of AI development may outstrip current regulatory and technological responses. Potential deception indicators include underreporting of breaches by ecosystem players to avoid reputational damage.

4. Implications and Strategic Risks

The primary implication is the potential for increased financial instability if AI-driven cybercrime is not adequately addressed. This could lead to a loss of consumer trust, economic losses, and regulatory challenges. Strategic risks include the possibility of a major breach that could trigger regulatory overhauls or increased international tensions if state actors are involved.

5. Recommendations and Outlook

- Enhance cross-industry collaboration through public-private partnerships to share intelligence and best practices.

- Invest in advanced AI-driven behavioral analytics to detect and mitigate threats in real-time.

- Develop regulatory frameworks that encourage transparency and information sharing among financial institutions.

- Best-case scenario: Effective collaboration and technology adoption mitigate AI-driven threats, maintaining consumer trust and financial stability.

- Worst-case scenario: A significant breach occurs, causing widespread financial disruption and loss of consumer confidence.

- Most-likely scenario: Incremental improvements in threat detection and collaboration reduce, but do not eliminate, the risk of AI-driven cybercrime.

6. Key Individuals and Entities

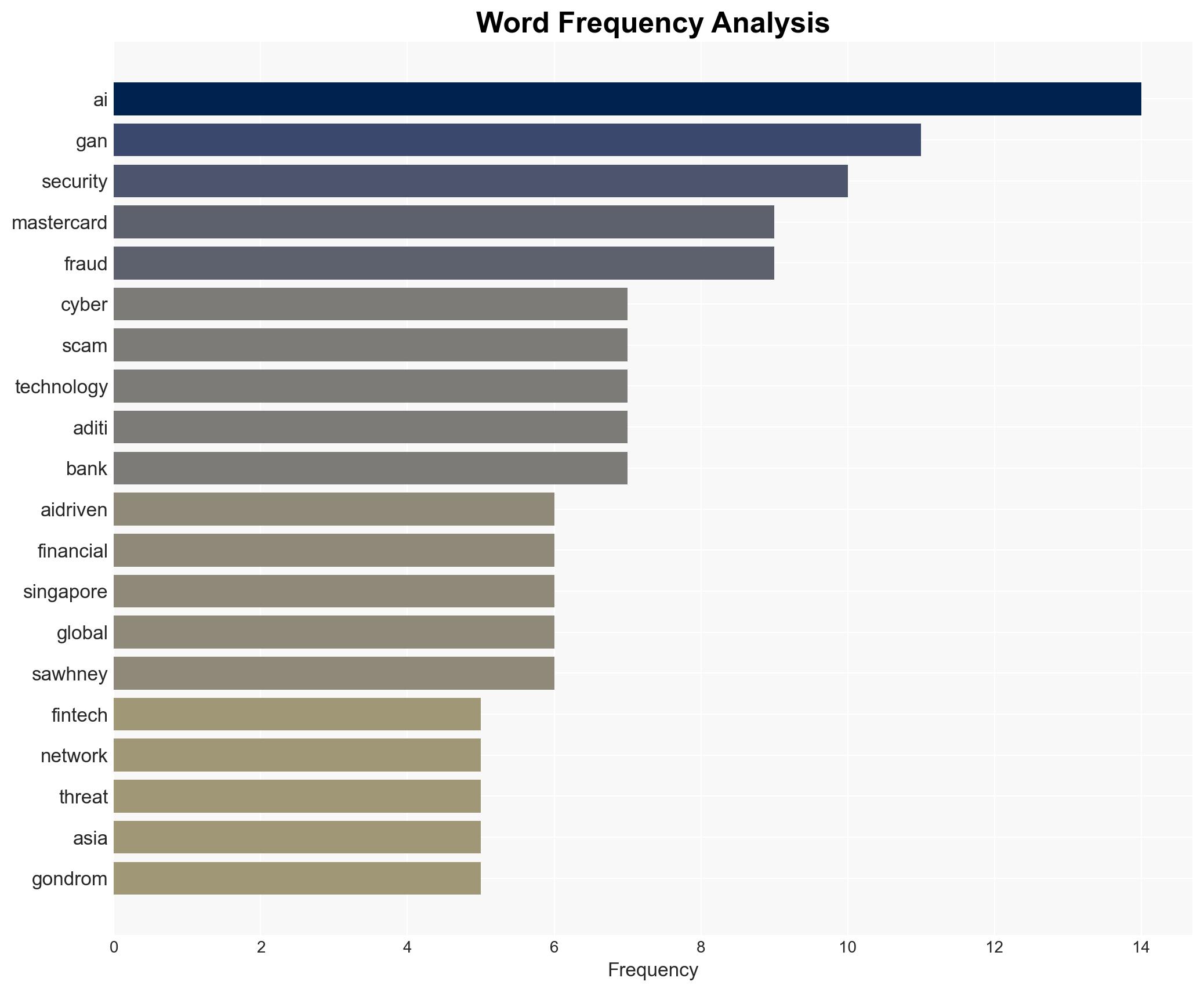

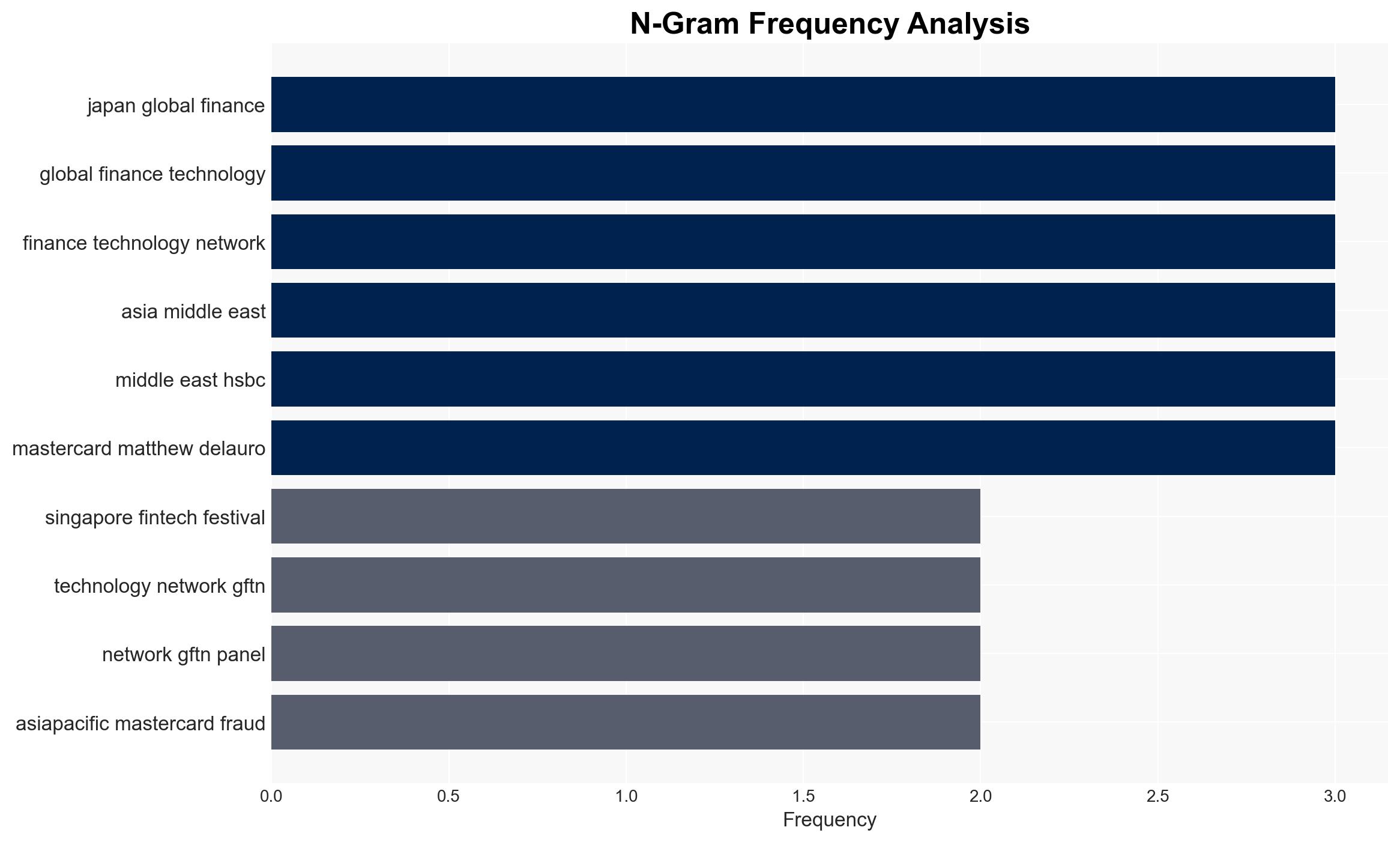

Pieter Franken, Aditi Sawhney, Kathleen Gan, Tobias Gondrom, Matthew Delauro

7. Thematic Tags

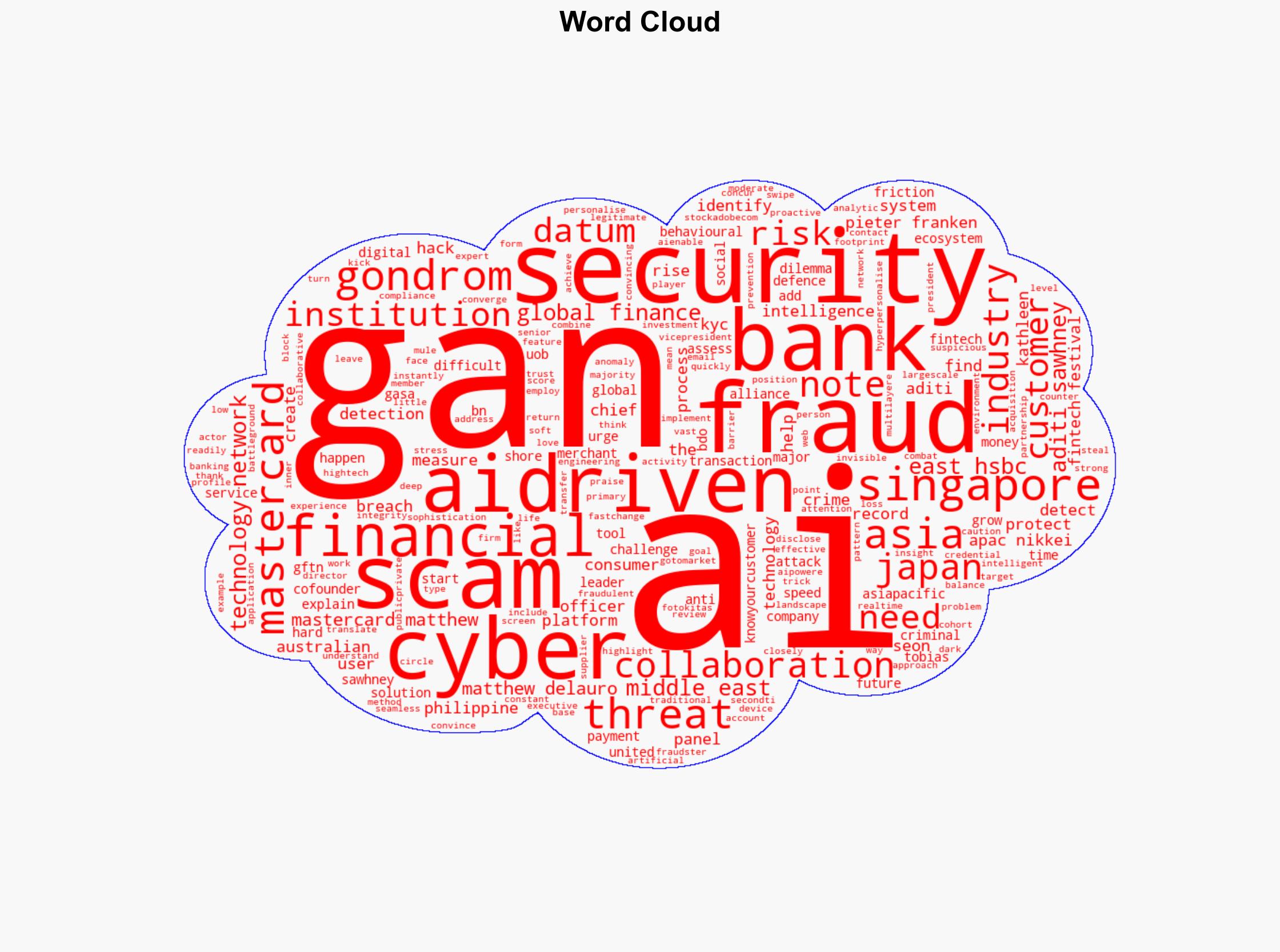

Cybersecurity, AI, Fintech, Collaboration, Behavioral Analytics

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Cognitive Bias Stress Test: Structured challenge to expose and correct biases.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us

·