Oil slips as loadings resume at Russian hub markets weigh sanctions impact – CNA

Published on: 2025-11-18

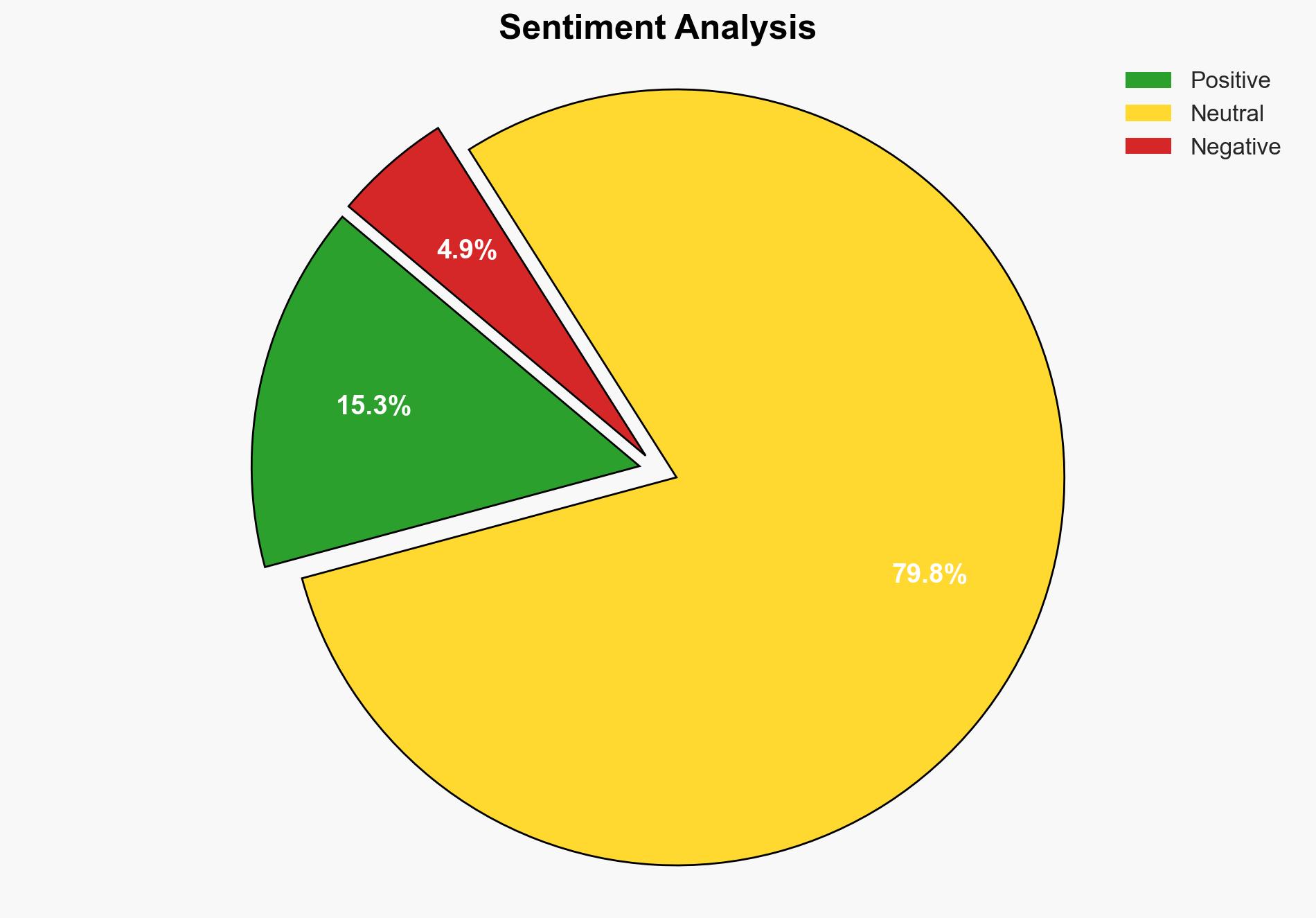

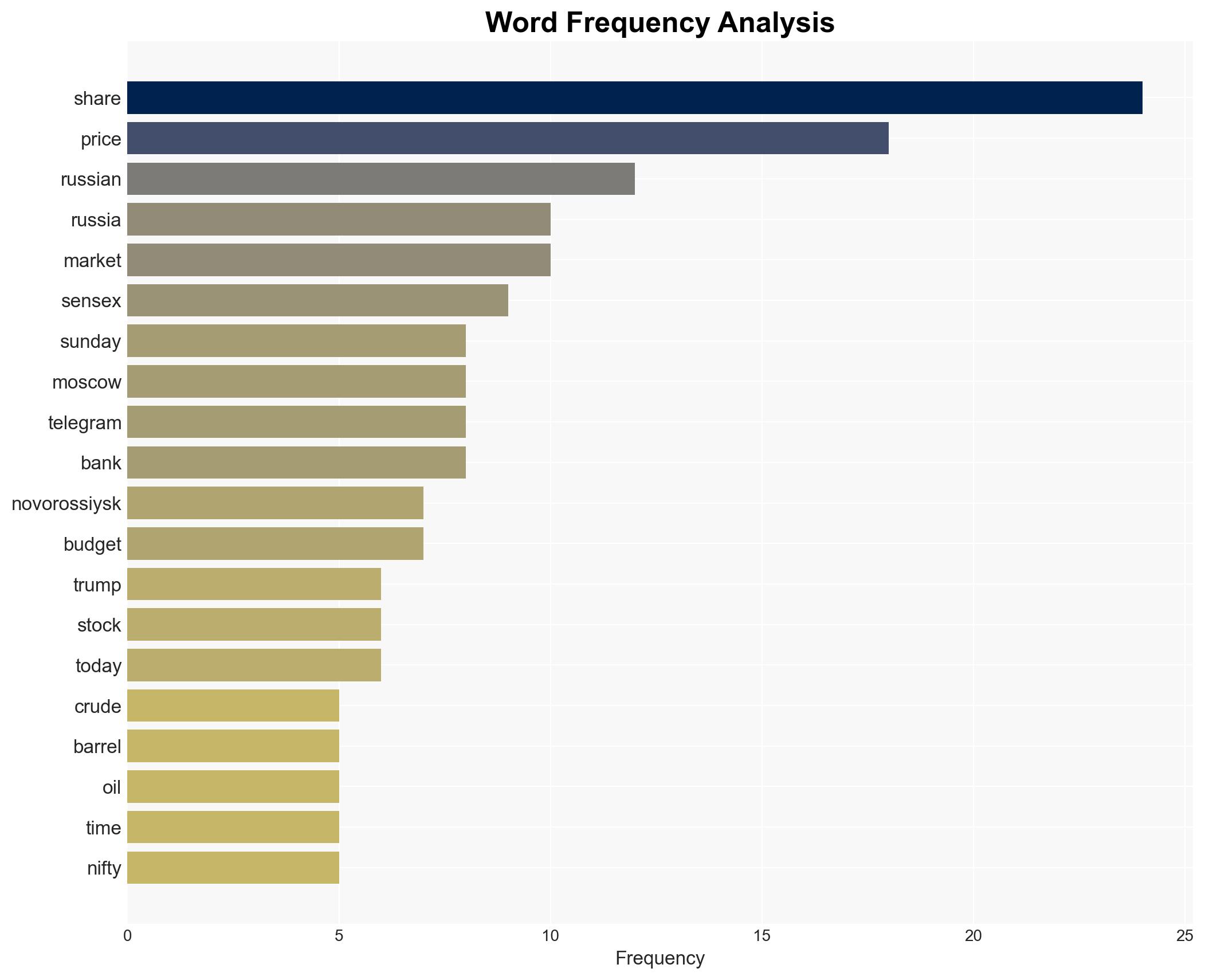

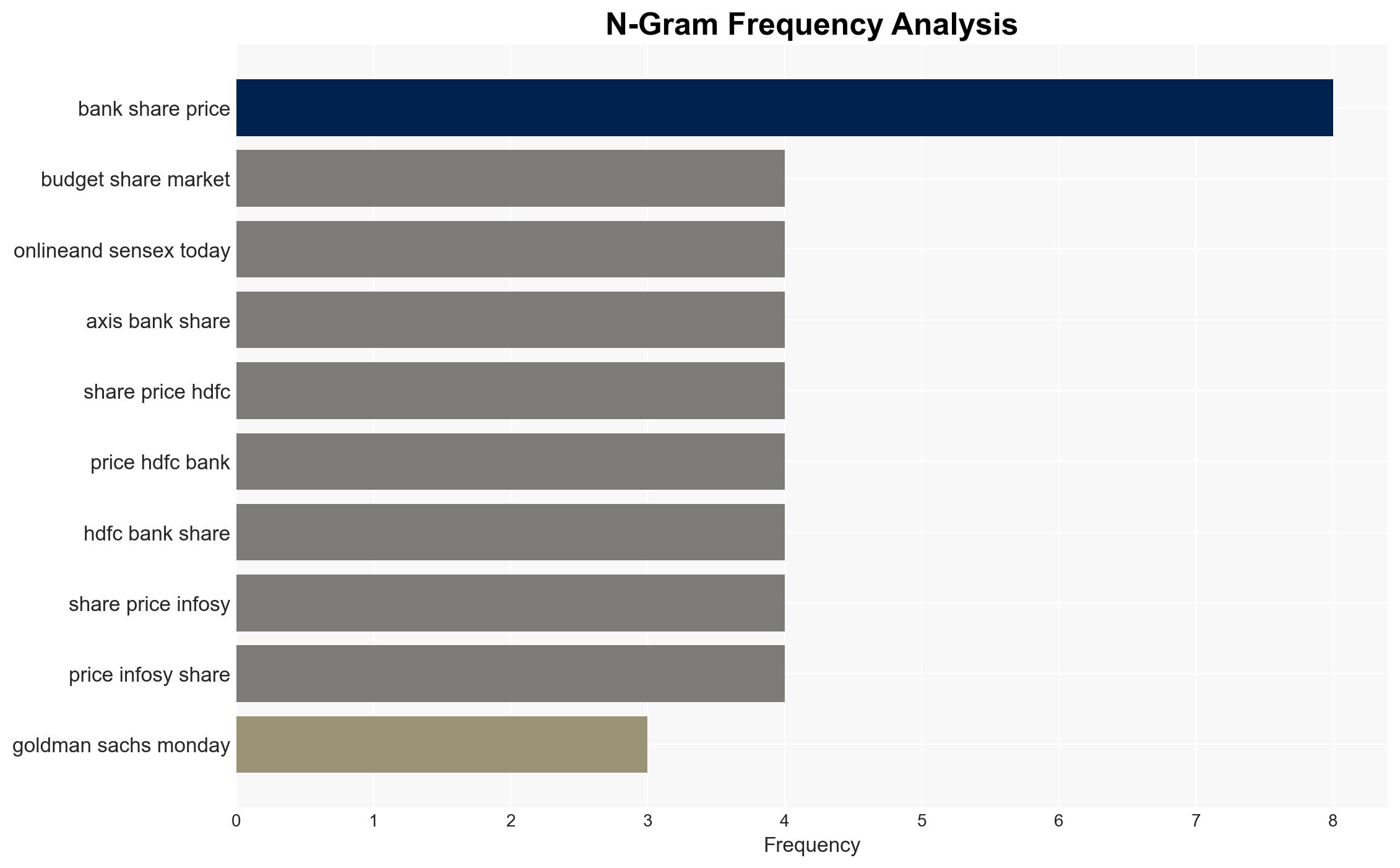

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

With a moderate confidence level, the most supported hypothesis is that the resumption of oil loadings at Russia’s Novorossiysk port will temporarily stabilize oil prices, but the long-term impact of Western sanctions will likely lead to a decrease in Russian oil exports and revenue. Recommended action includes monitoring the geopolitical developments and preparing for potential volatility in global oil markets.

2. Competing Hypotheses

Hypothesis 1: The resumption of oil loadings at Novorossiysk will stabilize oil prices in the short term, but Western sanctions will significantly curb Russian oil exports in the long term, leading to a decrease in global supply and potential price increases.

Hypothesis 2: Despite the resumption of oil loadings, the impact of Western sanctions will be limited, and Russia will find alternative markets or methods to sustain its oil export levels, maintaining a stable global supply and preventing significant price increases.

Hypothesis 1 is more likely due to the historical effectiveness of economic sanctions in reducing export volumes and the current geopolitical tensions that may limit Russia’s ability to find alternative markets.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that Western sanctions will be enforced effectively and that Russia’s ability to circumvent these sanctions is limited. Another assumption is that global demand for oil will remain constant.

Red Flags: Potential red flags include any new alliances or trade agreements Russia may form to bypass sanctions, changes in global oil demand, or shifts in Western political will to enforce sanctions.

Deception Indicators: Official Russian statements downplaying the impact of sanctions or overemphasizing their ability to find alternative markets could be misleading.

4. Implications and Strategic Risks

The primary strategic risk is the potential volatility in global oil markets, which could lead to economic instability in countries heavily reliant on oil imports. Politically, increased tensions between Russia and Western countries could escalate into broader geopolitical conflicts. Economically, a significant reduction in Russian oil exports could lead to higher global oil prices, impacting inflation rates worldwide.

5. Recommendations and Outlook

- Actionable Steps: Monitor geopolitical developments closely, particularly any new trade agreements involving Russia. Diversify energy sources to mitigate the impact of potential oil price increases.

- Best-case Scenario: Russia complies with international norms, leading to a lifting of sanctions and stabilization of oil markets.

- Worst-case Scenario: Escalation of geopolitical tensions leads to further sanctions and significant disruptions in global oil supply.

- Most-likely Scenario: Continued enforcement of sanctions results in a gradual decrease in Russian oil exports, leading to moderate increases in global oil prices.

6. Key Individuals and Entities

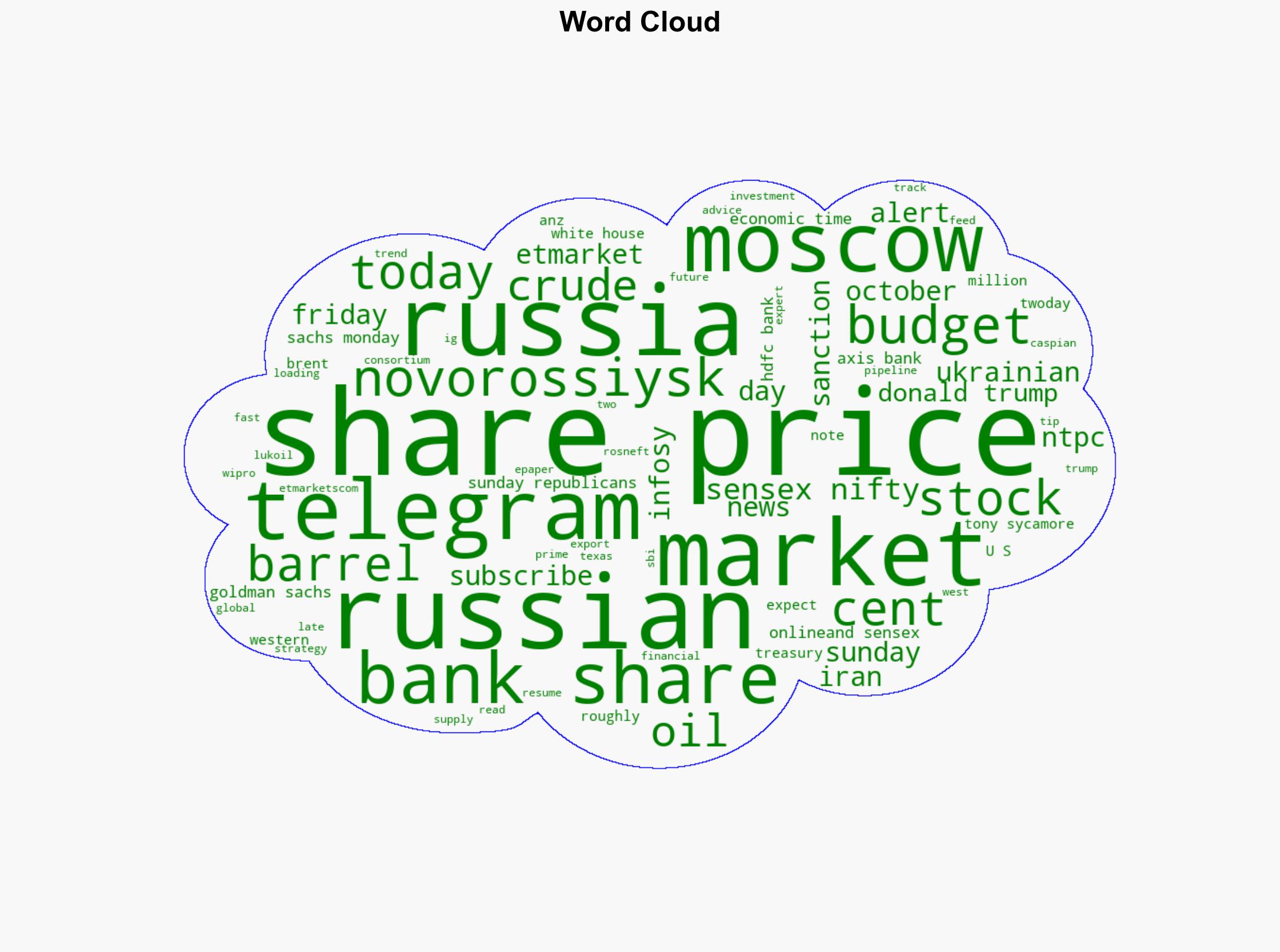

Individuals: Tony Sycamore (IG Analyst), Donald Trump (Former U.S. President)

Entities: Novorossiysk Port, Caspian Pipeline Consortium, Rosneft, Lukoil, U.S. Treasury, ANZ, Goldman Sachs

7. Thematic Tags

Regional Focus, Regional Focus: Russia, Global Oil Markets, Western Sanctions

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us

·