Here’s How Much Traders Expect Nvidia Stock To Move After Wednesday’s Earnings – Investopedia

Published on: 2025-11-18

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

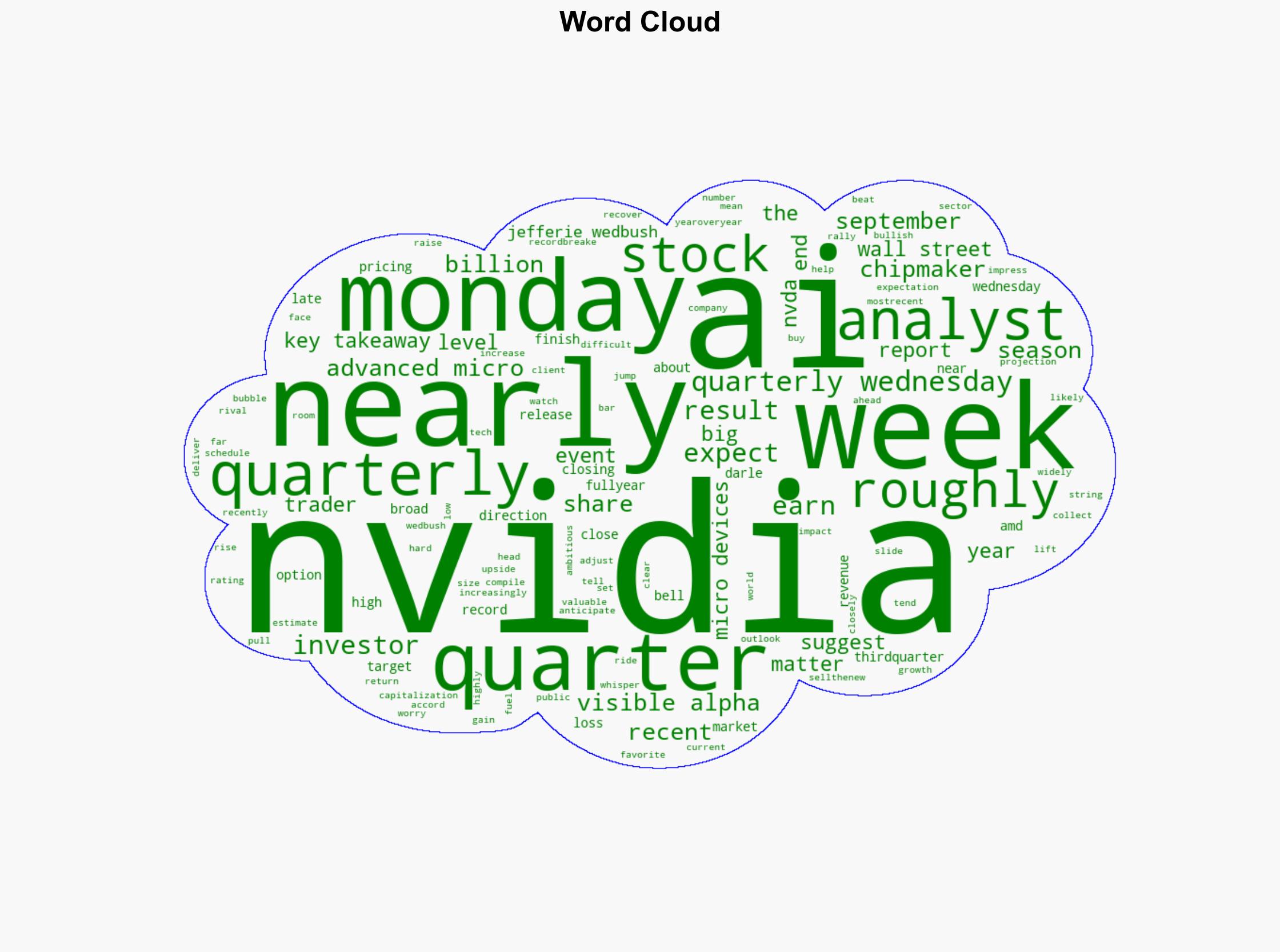

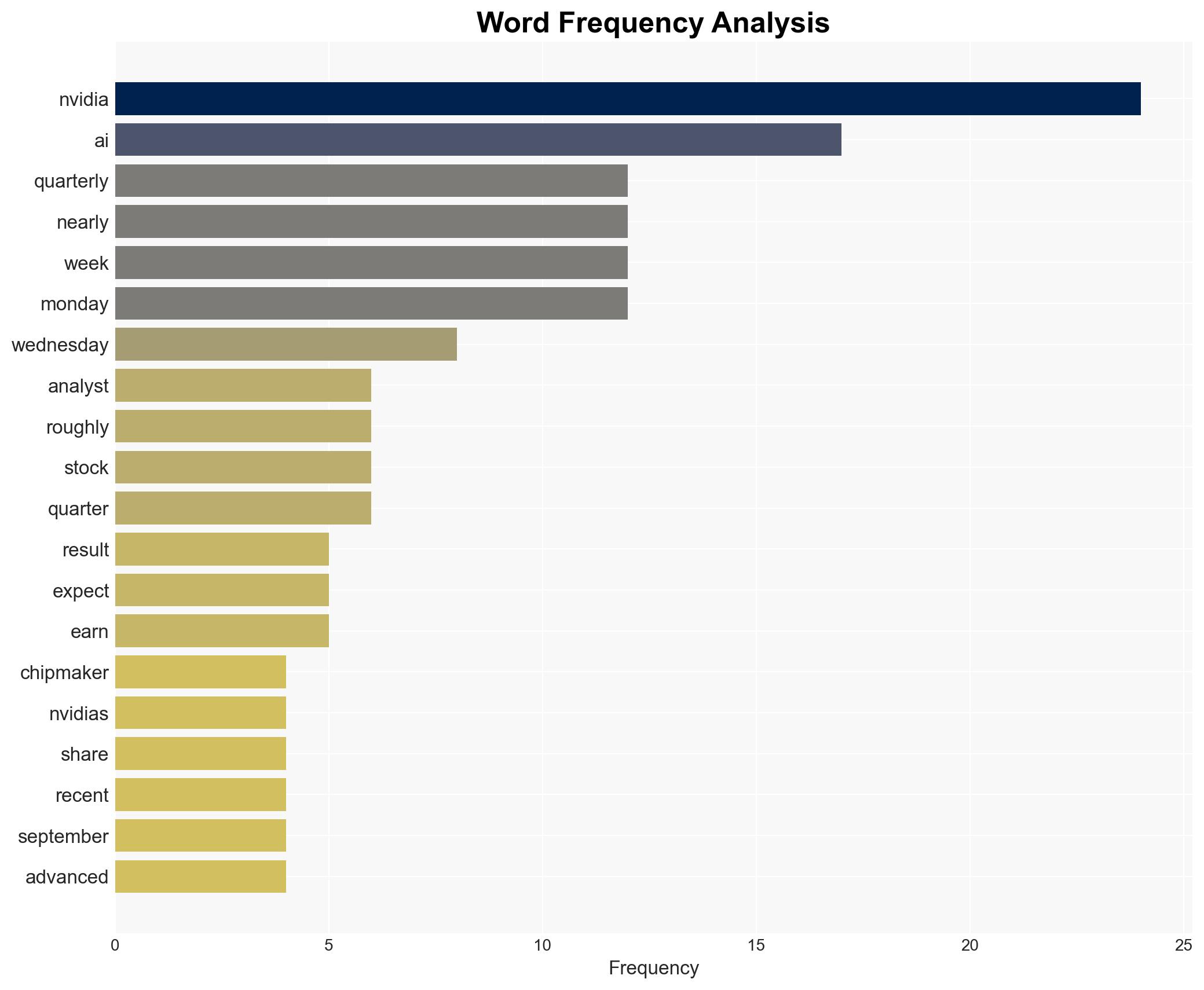

Intelligence Report: Nvidia Stock Movement Post-Earnings Release

1. BLUF (Bottom Line Up Front)

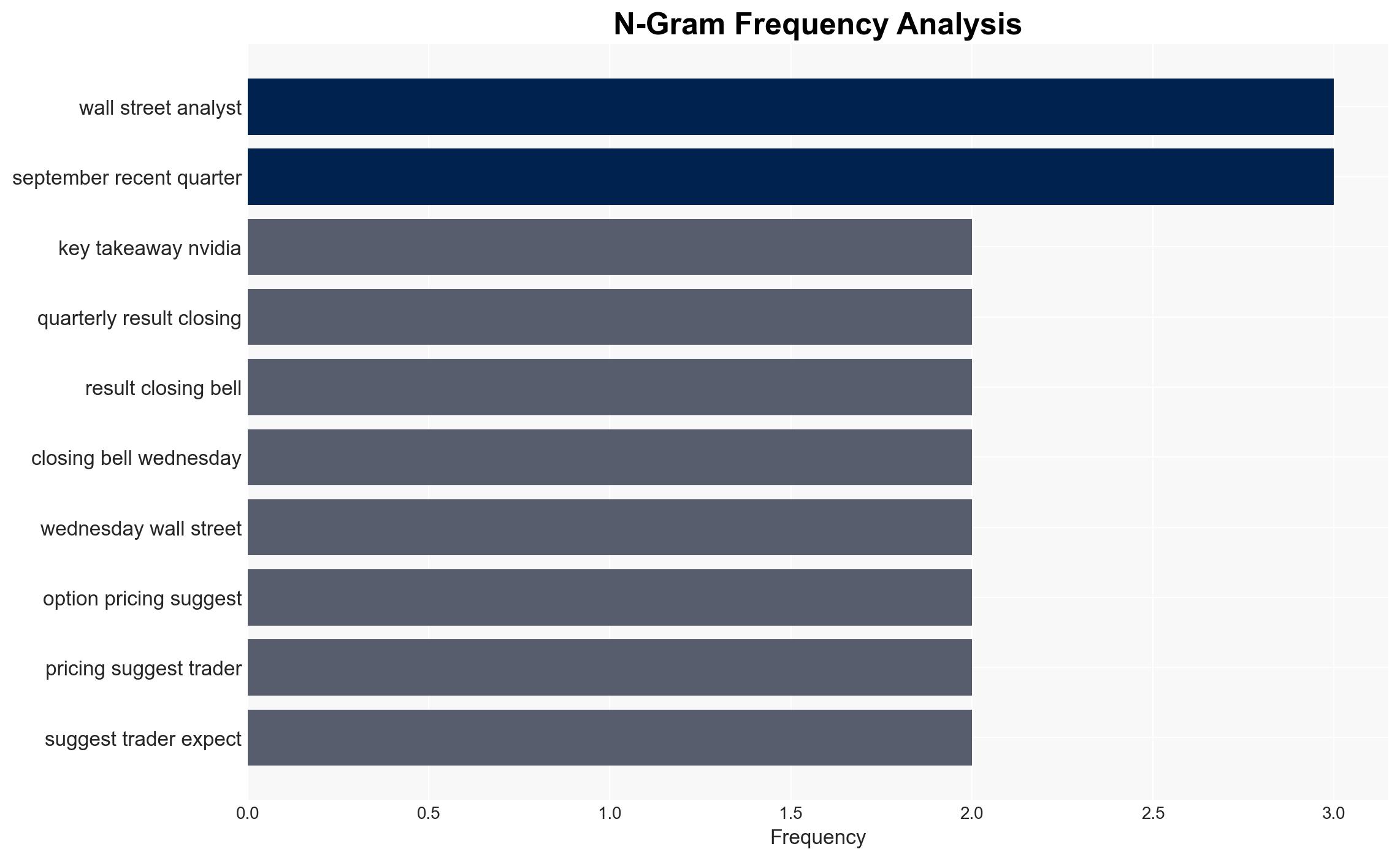

With a moderate confidence level, the most supported hypothesis is that Nvidia’s stock will experience significant volatility following the earnings release, driven by high market expectations and recent historical patterns. Recommended action includes monitoring Nvidia’s earnings closely and preparing for potential market adjustments.

2. Competing Hypotheses

Hypothesis 1: Nvidia’s stock will experience significant volatility post-earnings due to high expectations and recent patterns of “sell-the-news” events.

Hypothesis 2: Nvidia’s stock will stabilize or increase post-earnings as the company meets or exceeds market expectations, driven by strong AI sector performance.

Hypothesis 1 is more likely due to the historical tendency of Nvidia’s stock to decline even after strong earnings, coupled with the current high market expectations which may not be fully met.

3. Key Assumptions and Red Flags

Assumptions include the belief that Nvidia’s past earnings performance is a reliable indicator of future stock movement. A red flag is the potential over-reliance on AI sector growth projections, which may not materialize as expected. Deception indicators include overly optimistic analyst projections that may not account for broader market conditions.

4. Implications and Strategic Risks

The primary risk is economic, as significant stock volatility could impact investor confidence in the AI sector. A cascading threat includes potential negative spillover effects on related tech stocks, such as AMD. An escalation scenario involves a broader market correction if Nvidia’s earnings significantly underperform expectations.

5. Recommendations and Outlook

- Actionable steps: Monitor Nvidia’s earnings release closely and prepare for rapid response to stock movements. Diversify investments to mitigate risk.

- Best scenario: Nvidia exceeds expectations, leading to a stock rally and positive market sentiment.

- Worst scenario: Nvidia underperforms, triggering a sell-off and broader tech sector decline.

- Most-likely scenario: Nvidia meets expectations, resulting in temporary volatility followed by stabilization.

6. Key Individuals and Entities

Jefferies and Wedbush analysts are key entities influencing market expectations through their reports and projections.

7. Thematic Tags

Cybersecurity, Economic Volatility, AI Sector, Stock Market Analysis

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us