Dow closes down nearly 500 points as AI bubble fears hammer stocks – ABC News

Published on: 2025-11-18

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

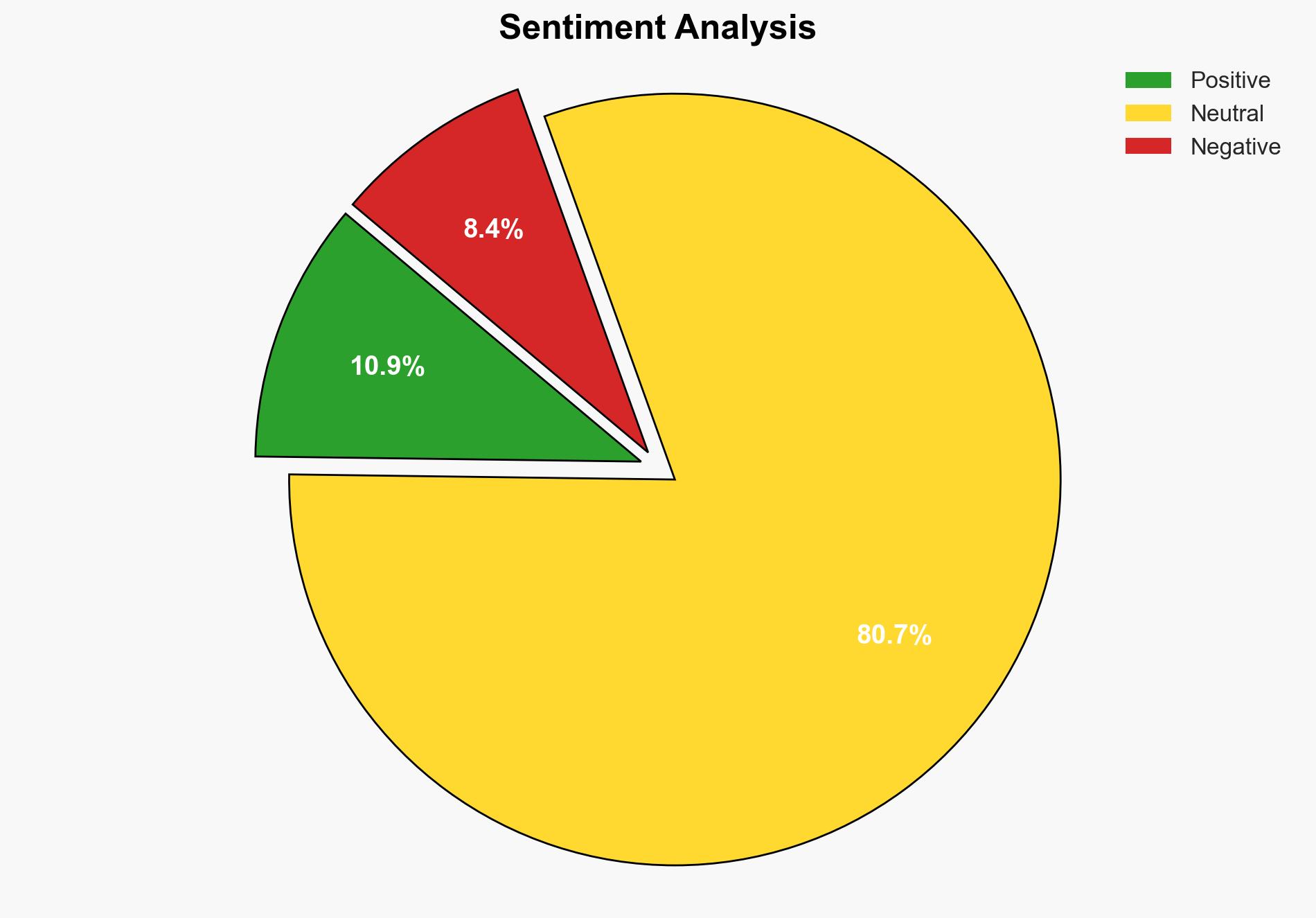

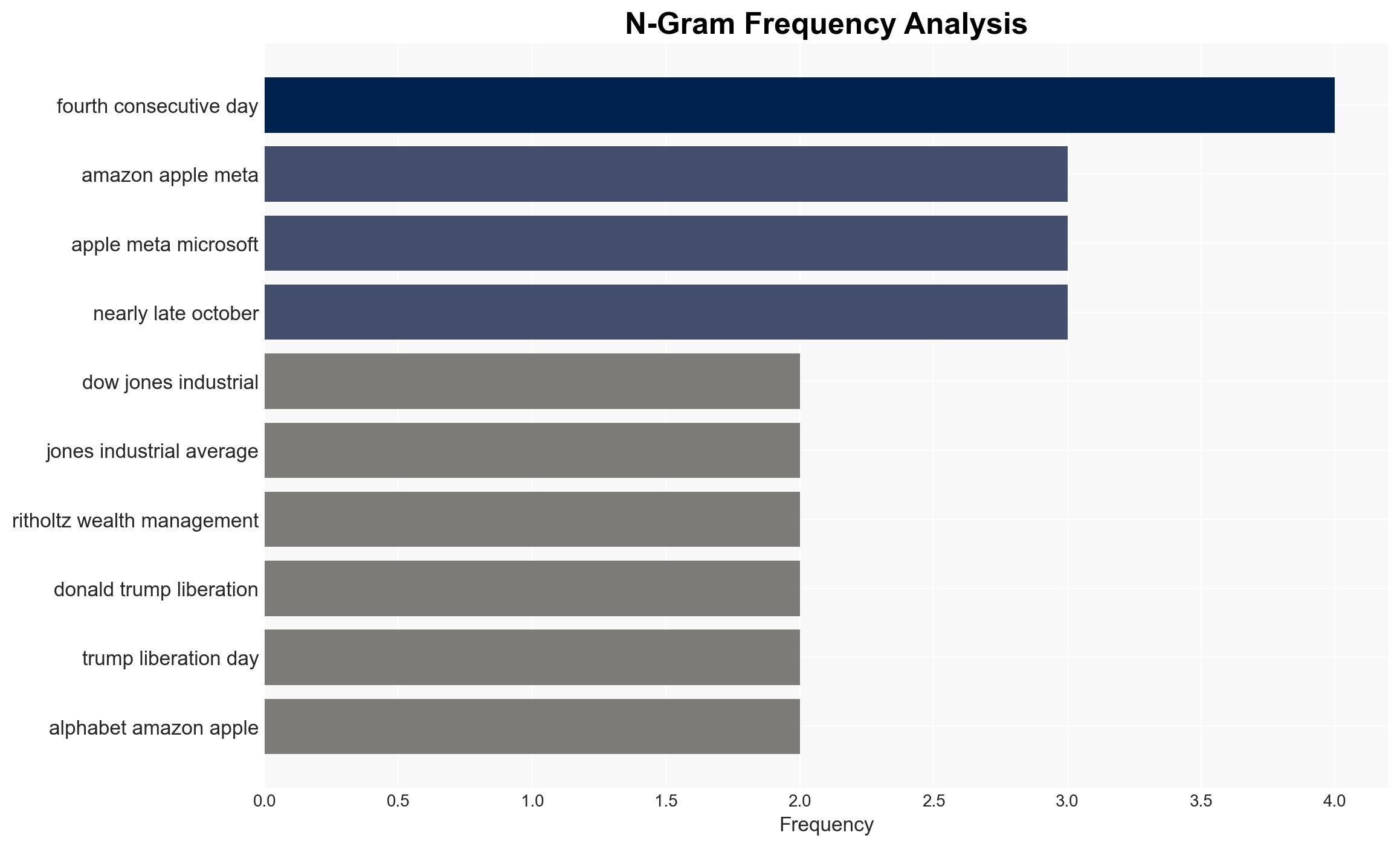

The current downturn in the stock market, particularly affecting technology stocks, is likely a temporary correction driven by investor concerns over the sustainability of AI-related investments. With a moderate confidence level, the most supported hypothesis is that this is a market correction rather than the onset of a prolonged downturn. Strategic recommendations include monitoring AI sector developments closely and advising investors to diversify portfolios to mitigate risk.

2. Competing Hypotheses

Hypothesis 1: The market downturn is a temporary correction due to overvaluation concerns in AI-related stocks, which will stabilize as the market adjusts to realistic expectations.

Hypothesis 2: The downturn signals the beginning of a broader economic decline, exacerbated by overinvestment in AI technologies and potential geopolitical tensions affecting tech giants.

Hypothesis 1 is more likely given the historical pattern of market corrections following rapid technological investment surges. The evidence suggests investor skepticism about immediate AI payoffs, but not a fundamental economic shift.

3. Key Assumptions and Red Flags

Assumptions include the belief that AI technologies will eventually yield economic benefits and that current market reactions are typical of speculative bubbles. A red flag is the potential for geopolitical events to exacerbate market instability. Deception indicators could involve misinformation about AI capabilities and market potential.

4. Implications and Strategic Risks

The primary risk is economic, with potential spillover into political and informational domains if tech giants face sustained financial pressure. A prolonged downturn could lead to reduced innovation and increased regulatory scrutiny. Cybersecurity risks may rise as companies cut costs, potentially affecting infrastructure resilience.

5. Recommendations and Outlook

- Advise investors to diversify portfolios to reduce exposure to volatile tech stocks.

- Monitor AI sector developments and regulatory changes closely.

- Engage with tech companies to assess cybersecurity measures amidst potential budget cuts.

- Best-case scenario: Market stabilizes as AI investments begin to yield returns.

- Worst-case scenario: Prolonged economic downturn with significant tech sector contraction.

- Most-likely scenario: Market correction stabilizes within months, with gradual recovery in tech stocks.

6. Key Individuals and Entities

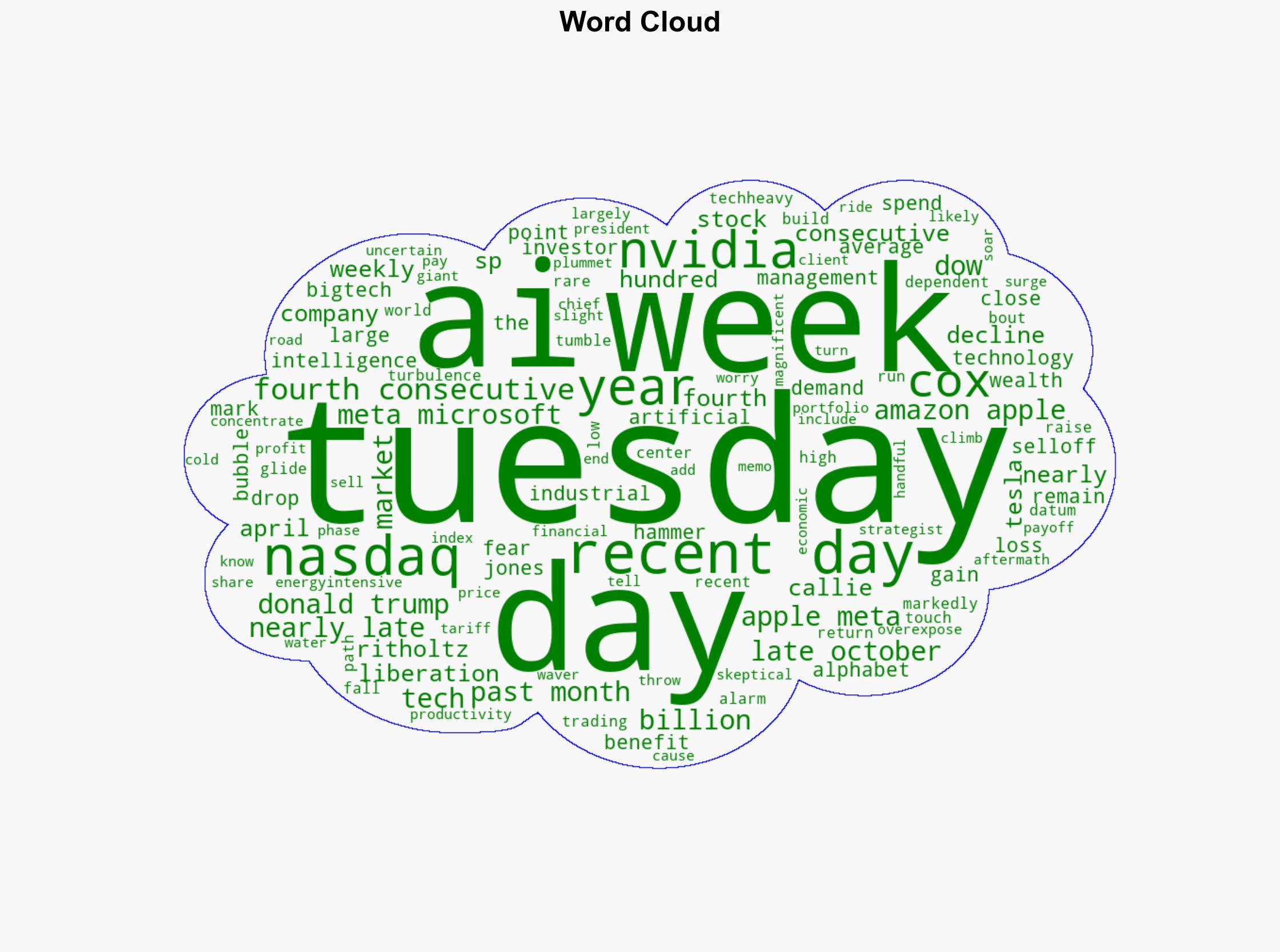

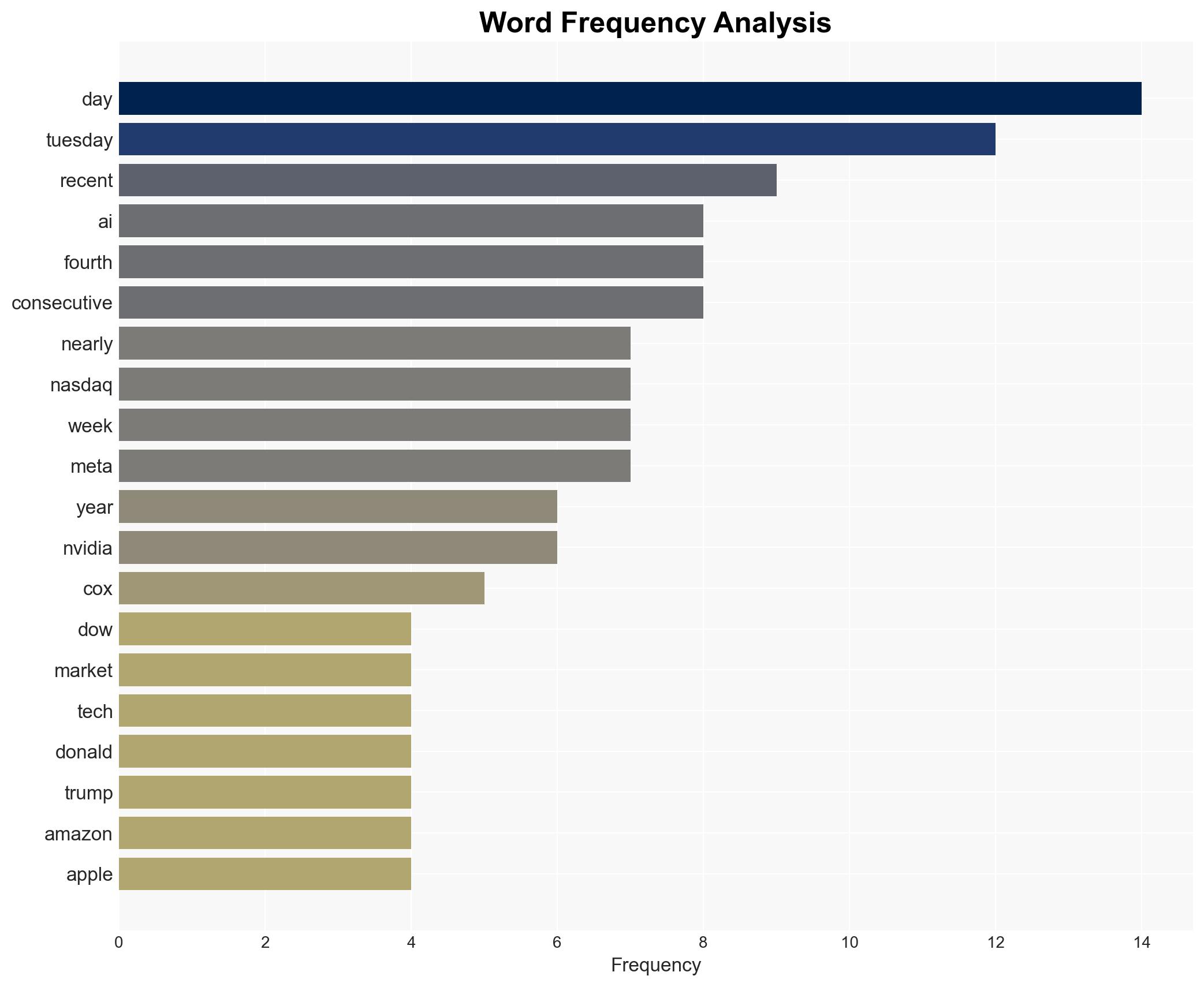

Callie Cox, Chief Market Strategist at Ritholtz Wealth Management, provides insights into investor sentiment. Major tech companies such as Alphabet, Amazon, Apple, Meta, Microsoft, Tesla, and Nvidia are central to the current market dynamics.

7. Thematic Tags

Cybersecurity, Economic Stability, AI Investment, Market Correction

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us