Kraken bags 800M for expansion plans at 20B valuation – Cointelegraph

Published on: 2025-11-19

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Kraken’s Expansion and Strategic Positioning

1. BLUF (Bottom Line Up Front)

Kraken’s recent $800 million funding round, valuing the company at $20 billion, positions it for significant global expansion and regulatory engagement. The most supported hypothesis is that Kraken is strategically preparing for a potential IPO while strengthening its market presence. Confidence level: Moderate. Recommended action: Monitor Kraken’s regulatory interactions and market movements closely to anticipate shifts in the crypto exchange landscape.

2. Competing Hypotheses

Hypothesis 1: Kraken is primarily focused on global expansion and enhancing its product suite to increase market share and competitiveness, particularly against rivals like Coinbase.

Hypothesis 2: Kraken is strategically positioning itself for an IPO by bolstering its financials and regulatory compliance, leveraging the funding to enhance its attractiveness to investors.

The most likely hypothesis is Hypothesis 2, given the involvement of significant strategic investors and the historical context of Kraken’s IPO considerations. The emphasis on regulatory footprint and strategic partnerships suggests preparation for public market entry.

3. Key Assumptions and Red Flags

Assumptions: Kraken’s expansion efforts will be met with favorable regulatory environments in target regions. The crypto market will remain stable enough to support continued investment and growth.

Red Flags: Potential regulatory hurdles in key markets could impede expansion. Over-reliance on strategic partners like Citadel Securities may expose Kraken to external risks.

Deception Indicators: Public statements about regulatory friendliness may mask underlying challenges or delays in compliance efforts.

4. Implications and Strategic Risks

Kraken’s expansion into diverse markets like Latin America, Asia Pacific, and the Middle East could face geopolitical and regulatory challenges, potentially leading to operational delays or increased costs. Economically, increased competition with established exchanges like Coinbase could pressure profit margins. Cyber risks may escalate as Kraken expands its digital footprint, necessitating enhanced security measures.

5. Recommendations and Outlook

- Monitor regulatory developments in target regions to anticipate potential barriers or opportunities for Kraken.

- Encourage Kraken to diversify its strategic partnerships to mitigate over-reliance on a single entity.

- Best-case scenario: Kraken successfully expands and completes a lucrative IPO, solidifying its market position.

- Worst-case scenario: Regulatory challenges stall expansion, and market volatility undermines IPO prospects.

- Most-likely scenario: Kraken achieves moderate expansion success and prepares for an IPO, but faces regulatory and competitive pressures.

6. Key Individuals and Entities

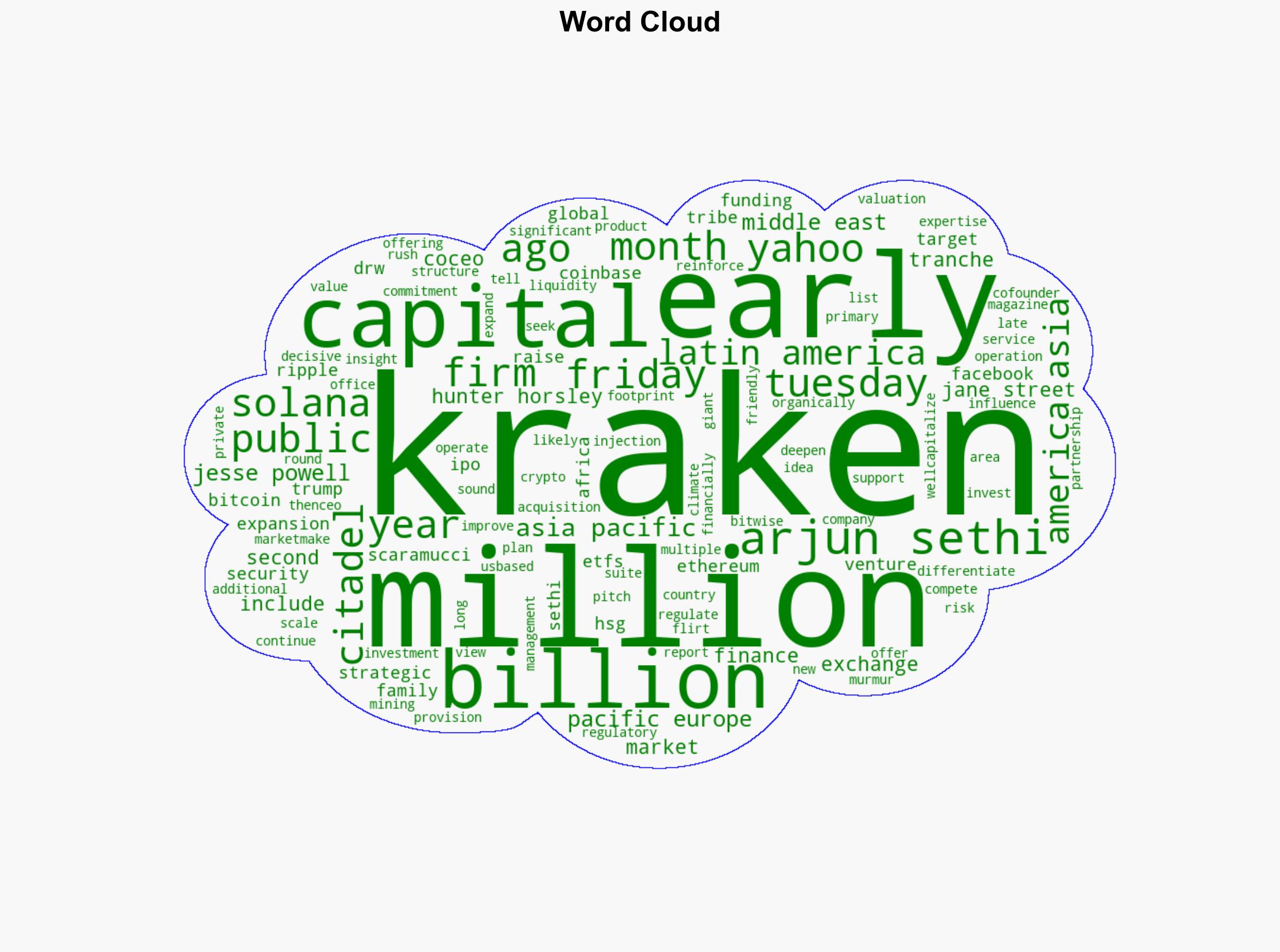

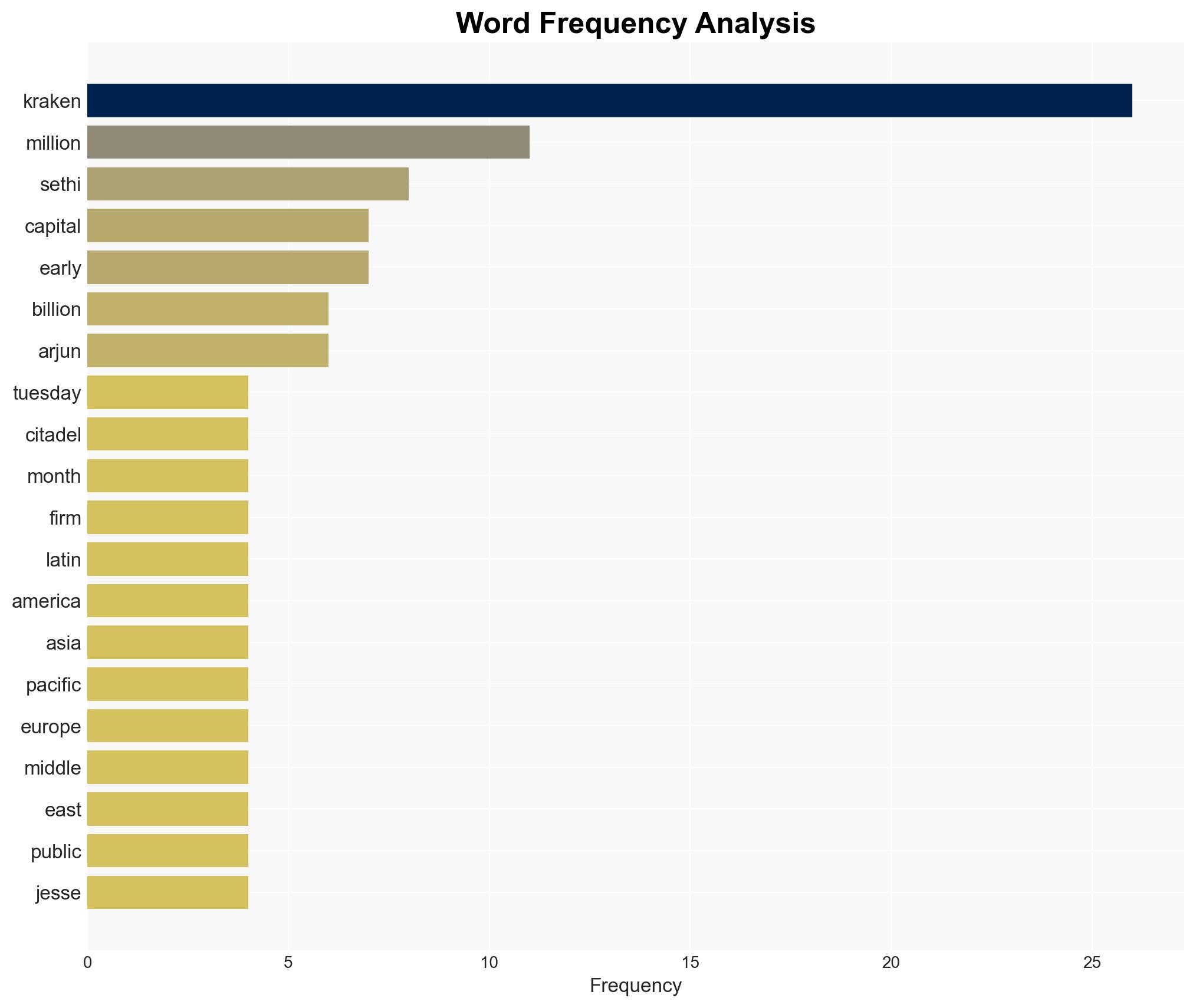

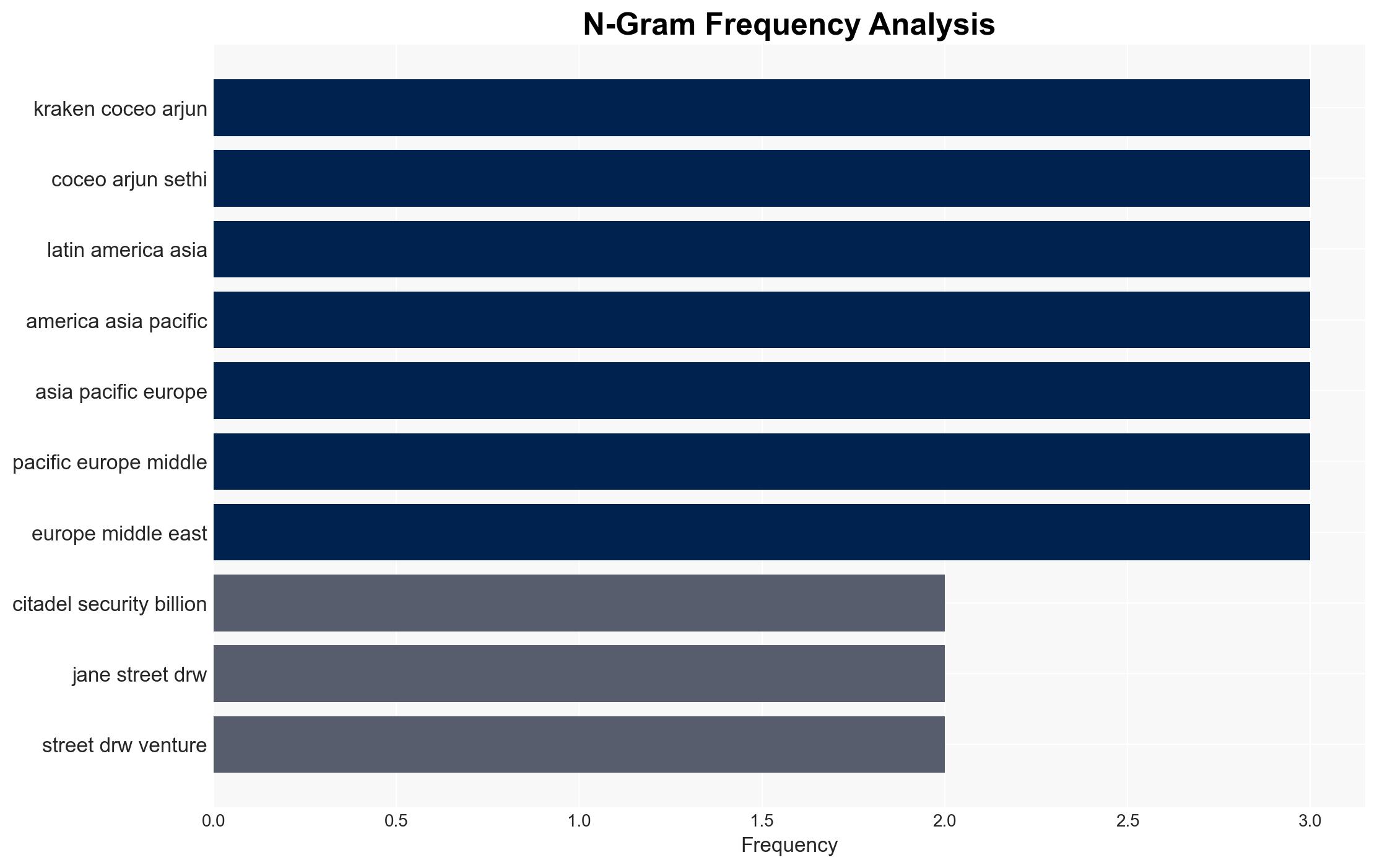

Arjun Sethi (Co-CEO), Citadel Securities, Jane Street, DRW Venture Capital, HSG, Tribe Capital, Jesse Powell (former CEO), Anthony Scaramucci.

7. Thematic Tags

Regional Focus, Regional Focus: Latin America, Asia Pacific, Europe, Middle East, Africa

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

- Narrative Pattern Analysis: Deconstruct and track propaganda or influence narratives.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us