Bitfury pivots to launch 1B tech fund after 14 years of mining Bitcoin – Cointelegraph

Published on: 2025-11-19

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Bitfury’s Strategic Pivot to a $1B Tech Fund

1. BLUF (Bottom Line Up Front)

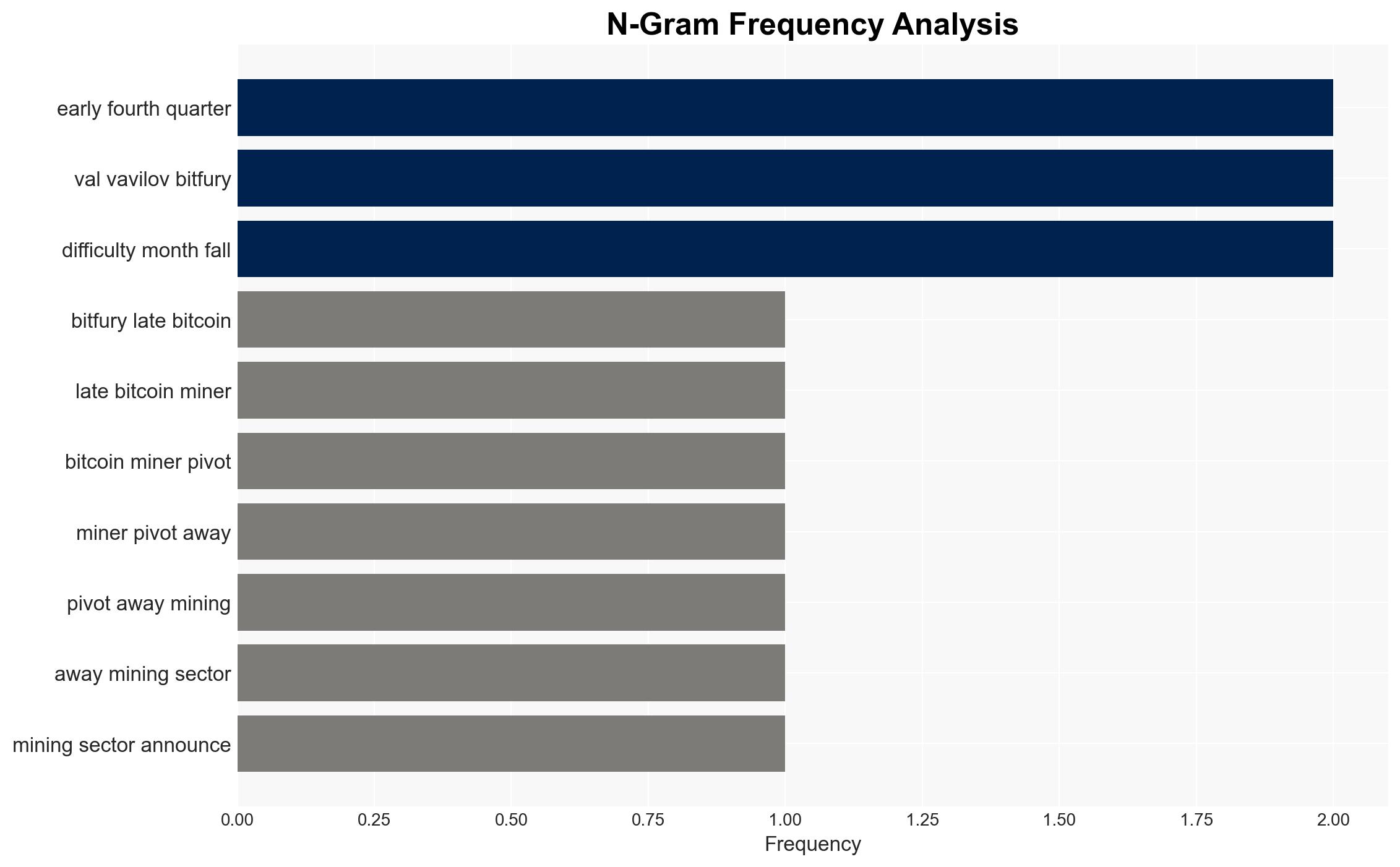

Bitfury’s pivot from Bitcoin mining to launching a $1 billion tech fund focused on AI and crypto represents a strategic shift in response to declining profitability in the mining sector. With a moderate confidence level, the most supported hypothesis is that Bitfury is repositioning itself to capitalize on emerging technologies and mitigate risks associated with the volatile crypto market. Recommended actions include monitoring Bitfury’s investment strategies and potential impacts on the AI and crypto sectors.

2. Competing Hypotheses

Hypothesis 1: Bitfury is pivoting to AI and crypto investments to diversify its portfolio and reduce dependency on Bitcoin mining due to increased costs and decreased profitability. This is supported by the company’s historical success in investments and the strategic timing of the pivot amidst market challenges.

Hypothesis 2: Bitfury’s pivot is primarily a strategic repositioning to align with emerging technological trends and societal shifts towards AI and decentralized systems, rather than a direct response to mining sector challenges. This hypothesis is supported by Bitfury’s emphasis on ethical technology and long-term resilience.

Hypothesis 1 is more likely due to the immediate financial pressures faced by Bitcoin miners and Bitfury’s historical pattern of adapting to market conditions.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that Bitfury’s pivot is driven by financial considerations and market conditions. Additionally, it is assumed that the AI and crypto sectors will continue to grow and offer viable investment opportunities.

Red Flags: Potential over-reliance on AI and crypto sectors could expose Bitfury to new risks. There is also a risk of overestimating the synergy between AI and decentralized systems.

Deception Indicators: The announcement may be an attempt to positively influence investor perceptions amidst declining mining profitability.

4. Implications and Strategic Risks

Economic Risks: Bitfury’s shift could influence other mining companies to diversify, potentially leading to decreased investment in mining infrastructure.

Cyber Risks: Increased focus on AI and decentralized systems may expose Bitfury to new cybersecurity threats.

Informational Risks: The pivot could impact market perceptions and investor confidence in the crypto sector.

5. Recommendations and Outlook

- Actionable Steps: Monitor Bitfury’s investment allocations and partnerships in the AI and crypto sectors. Assess potential impacts on market dynamics and competitor strategies.

- Best Scenario: Bitfury successfully diversifies its portfolio, leading to increased profitability and market leadership in emerging tech sectors.

- Worst Scenario: The pivot fails to yield expected returns, leading to financial instability and loss of investor confidence.

- Most-likely Scenario: Bitfury achieves moderate success in its new ventures, stabilizing its financial position while facing challenges in integrating AI and crypto technologies.

6. Key Individuals and Entities

Val Vavilov: CEO of Bitfury, driving the strategic pivot.

Bitfury: Former Bitcoin mining company now focusing on AI and crypto investments.

LiquidStack: Bitfury’s immersion-cooling solution for AI data centers.

Axelera AI: Netherlands-based chip company co-founded by Bitfury.

7. Thematic Tags

Cybersecurity, Strategic Diversification, Emerging Technologies, Crypto Market Dynamics

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us