Containerships Falling freight rates in the liner market – Naftemporiki.gr

Published on: 2025-11-19

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

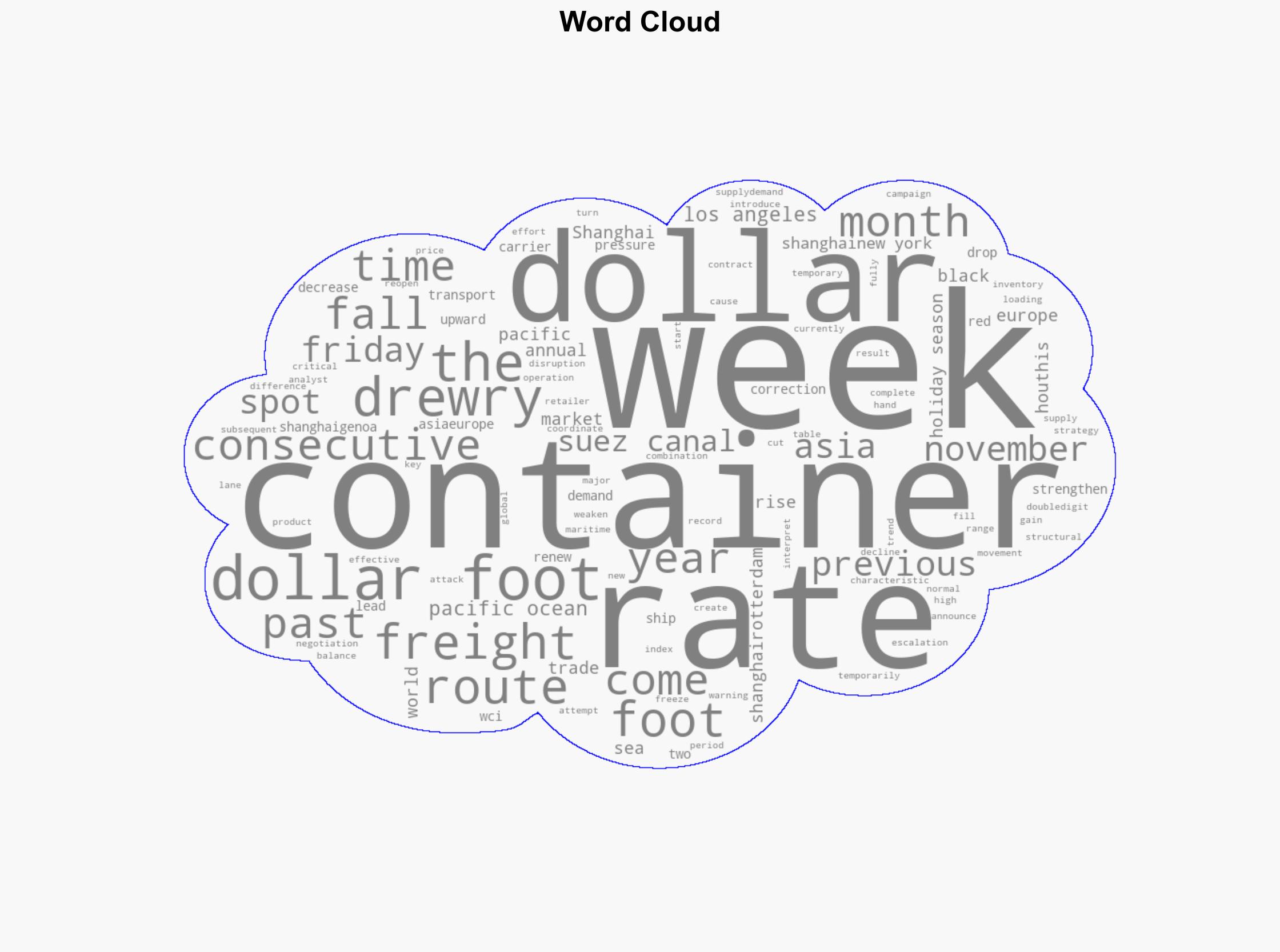

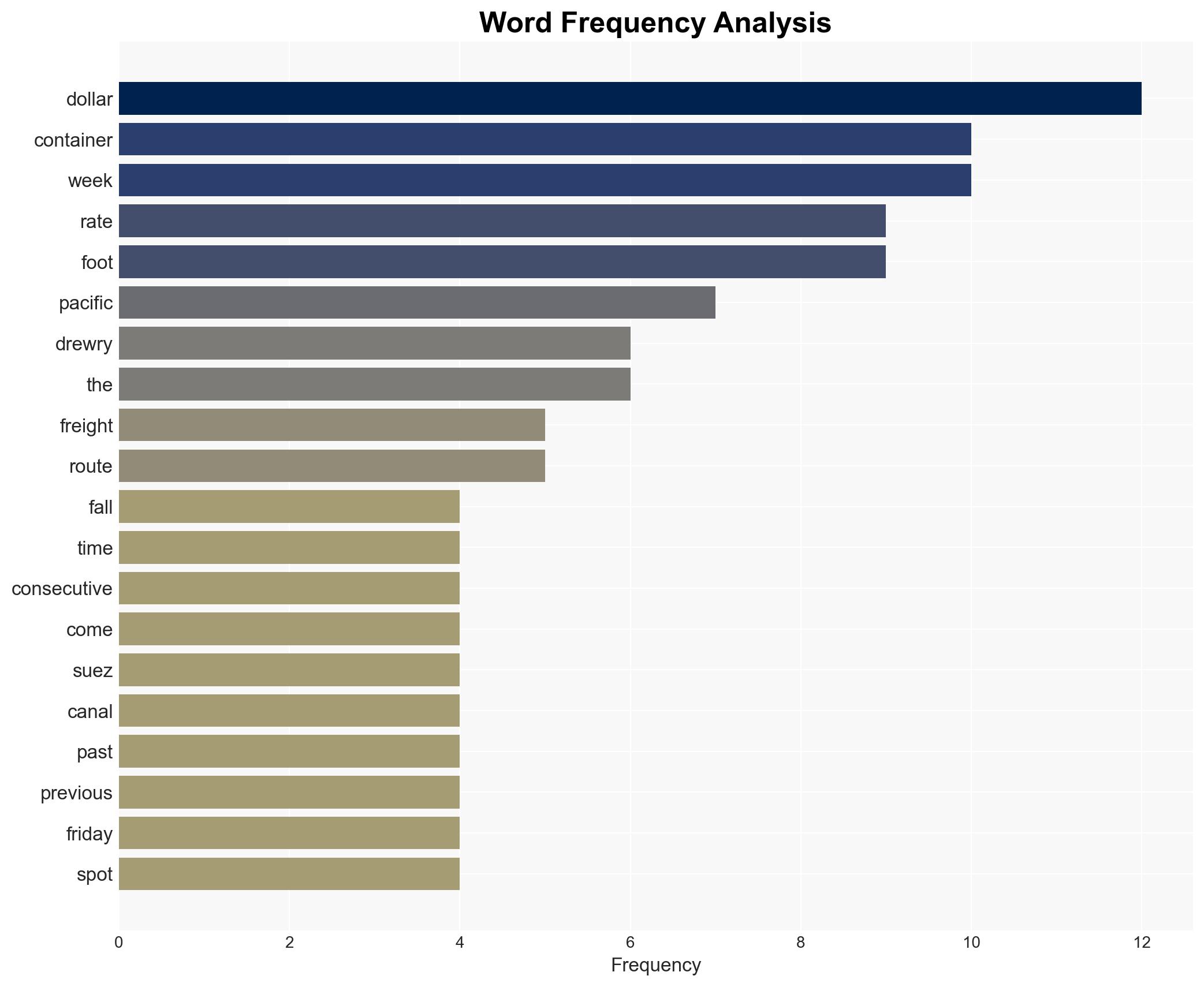

Intelligence Report: Falling Freight Rates in the Liner Market

1. BLUF (Bottom Line Up Front)

The most supported hypothesis is that the current decline in freight rates is primarily a result of a temporary market correction following seasonal demand fluctuations and strategic carrier actions. Confidence Level: Moderate. Recommended action is to closely monitor geopolitical developments, particularly in the Suez Canal and Red Sea regions, as well as carrier strategies that could influence future rate trends.

2. Competing Hypotheses

Hypothesis 1: The decline in freight rates is a temporary market correction due to seasonal demand fluctuations and strategic carrier actions.

Hypothesis 2: The decline is indicative of a longer-term structural imbalance in the supply-demand dynamics of the global shipping industry.

Hypothesis 1 is more likely due to the timing of the decline coinciding with the post-Black Friday and holiday season inventory adjustments, as well as coordinated carrier efforts to adjust rates. Hypothesis 2 is less supported as there is insufficient evidence of a fundamental shift in global trade patterns or significant overcapacity.

3. Key Assumptions and Red Flags

Assumptions: The assumption is that current geopolitical tensions, such as those involving the Houthis and the Suez Canal, will not escalate significantly. Another assumption is that carriers will continue to manage capacity effectively.

Red Flags: Any renewed escalation in geopolitical tensions or significant disruptions in key maritime routes could alter current trends. Additionally, unexpected changes in global economic conditions could impact demand.

4. Implications and Strategic Risks

The primary risk is geopolitical, with potential disruptions in the Suez Canal or Red Sea leading to increased freight rates. Economically, a prolonged imbalance in supply and demand could lead to financial strain on carriers. Politically, any escalation in regional conflicts could impact global trade flows.

5. Recommendations and Outlook

- Monitor geopolitical developments in the Suez Canal and Red Sea regions closely.

- Engage with carriers to understand their capacity management strategies.

- Best-case scenario: Rates stabilize as demand and supply reach equilibrium.

- Worst-case scenario: Geopolitical tensions lead to significant disruptions, causing a spike in rates.

- Most-likely scenario: Rates experience minor fluctuations but remain within a manageable range due to seasonal adjustments and strategic carrier actions.

6. Key Individuals and Entities

No specific individuals are identified. Key entities include global shipping carriers and regional geopolitical actors such as the Houthis.

7. Thematic Tags

Regional Focus, Regional Focus: Global, with specific attention to the Suez Canal and Red Sea regions

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us