CNBC Daily Open AI firms are getting money while their stocks are losing value – CNBC

Published on: 2025-11-19

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

Despite significant investments in AI firms by major technology companies, AI stocks are experiencing a decline in value. The most supported hypothesis is that investor expectations are not being met, leading to stock devaluation. Confidence level: Moderate. Recommended action: Monitor AI market trends and investor sentiment closely to identify potential recovery signals or further declines.

2. Competing Hypotheses

Hypothesis 1: The decline in AI stock values is primarily due to unmet investor expectations regarding financial performance and technological advancements. This hypothesis is supported by comments from industry analysts and the recent performance of major indices.

Hypothesis 2: The decline is a temporary market correction following an overvaluation period driven by speculative investments in AI. This hypothesis considers the broader market trends and historical patterns of technology stock fluctuations.

Hypothesis 1 is more likely given the specific mention of investor dissatisfaction with earnings reports and the strategic investments by companies like Microsoft and Nvidia, which suggest confidence in long-term growth despite short-term stock performance.

3. Key Assumptions and Red Flags

Assumptions: AI technology will continue to advance and integrate into various sectors, driving future growth. Investor sentiment is a critical factor in stock valuation.

Red Flags: Overreliance on speculative investments could lead to volatility. The rapid pace of AI development may outstrip regulatory frameworks, leading to potential backlash or restrictions.

4. Implications and Strategic Risks

The decline in AI stock values could lead to reduced investor confidence, impacting future funding for AI research and development. Political risks include potential regulatory actions if AI technologies are perceived as threatening jobs or privacy. Economically, a prolonged decline could affect the broader technology sector and related industries.

5. Recommendations and Outlook

- Monitor regulatory developments and investor sentiment to anticipate potential market shifts.

- Encourage diversification of AI investments to mitigate risks associated with stock volatility.

- Best-case scenario: AI stocks recover as companies meet or exceed investor expectations, leading to renewed confidence and investment.

- Worst-case scenario: Continued decline leads to a broader tech sector downturn, impacting innovation and economic growth.

- Most-likely scenario: A gradual recovery as companies adjust strategies to align with investor expectations and market conditions stabilize.

6. Key Individuals and Entities

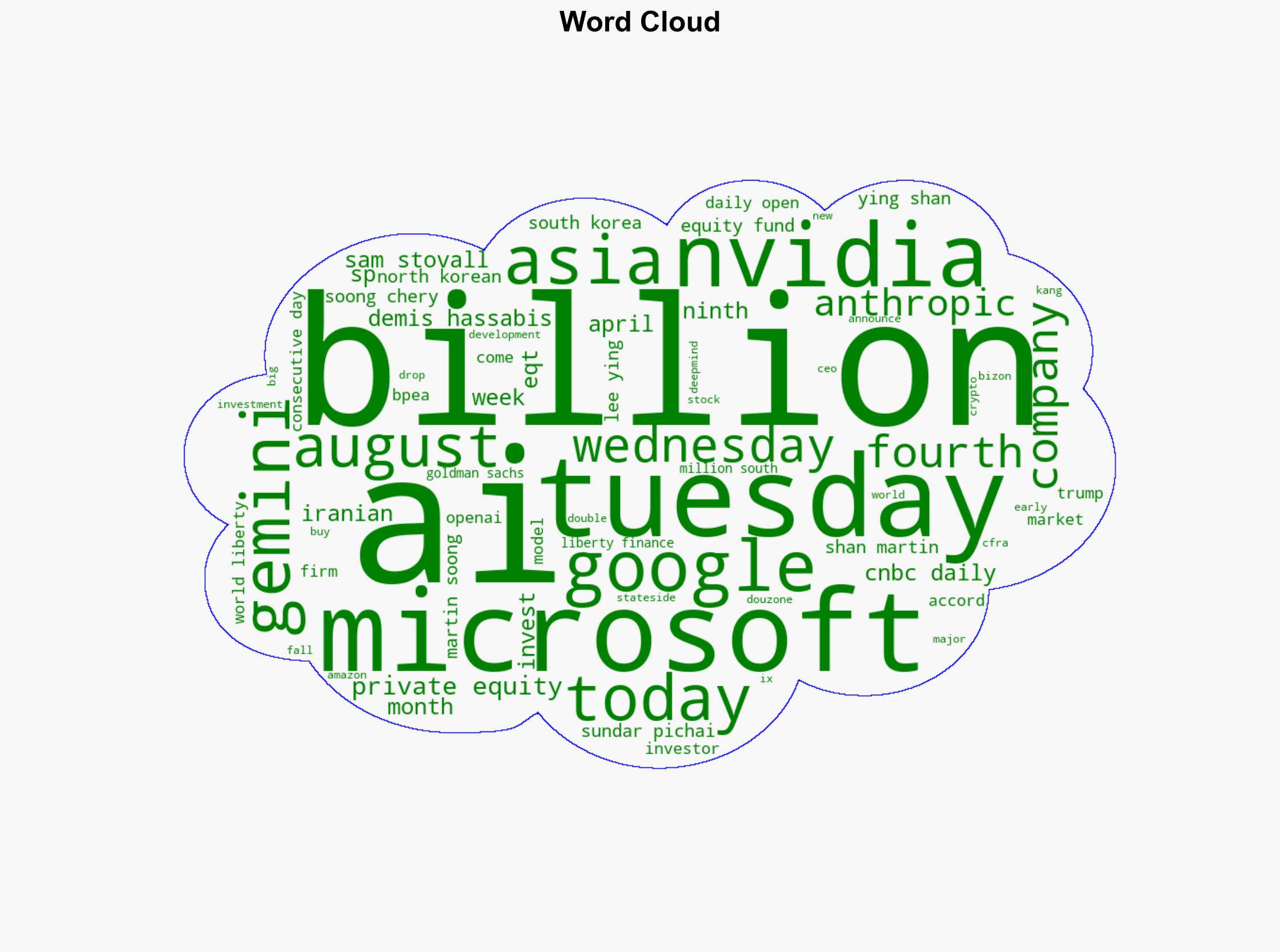

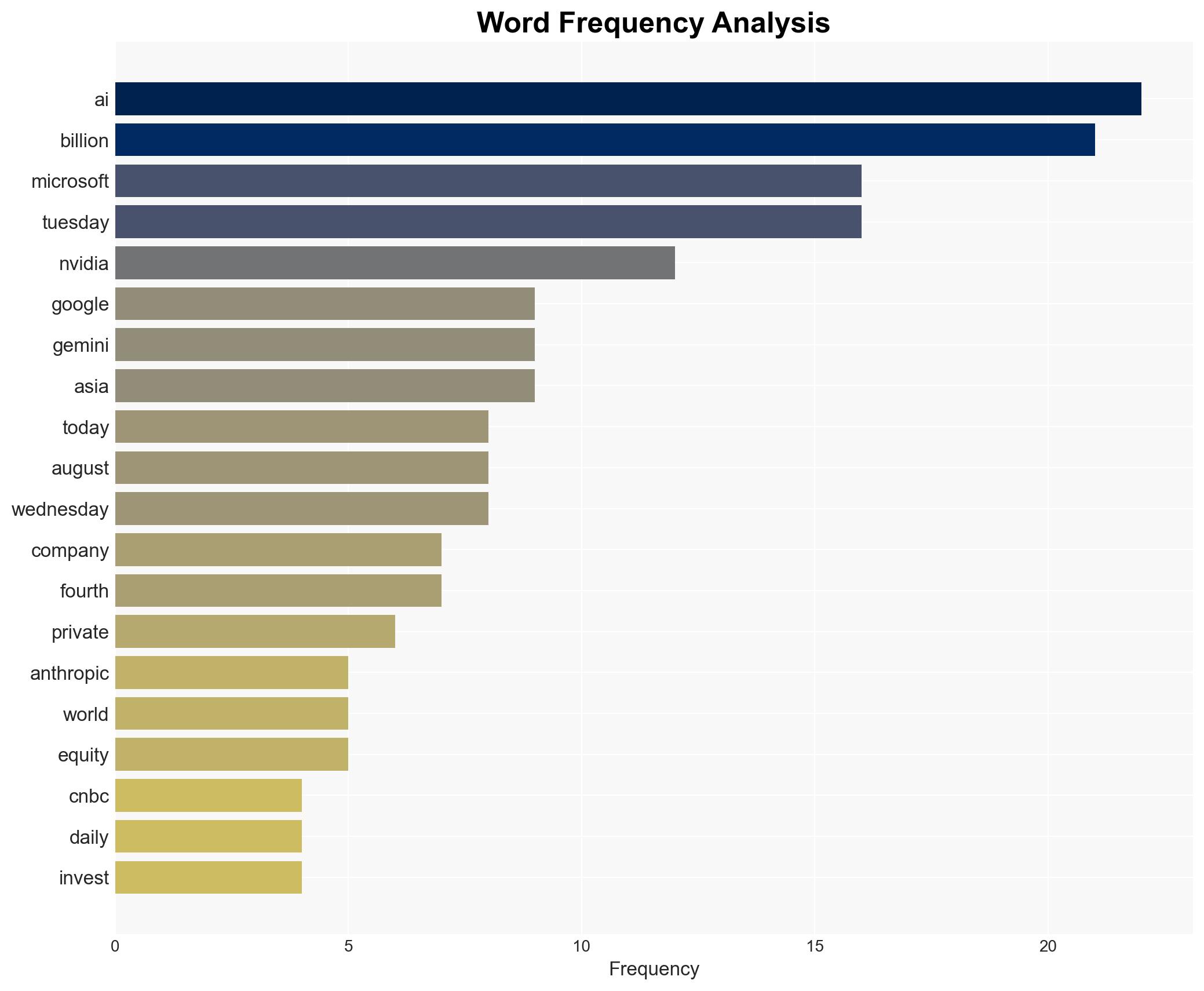

Sundar Pichai, Demis Hassabis, Sam Stovall, Microsoft, Nvidia, Google, Anthropic, OpenAI.

7. Thematic Tags

Cybersecurity, Market Trends, Investor Sentiment, AI Development, Regulatory Risks

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Forecast futures under uncertainty via probabilistic logic.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us