US Gasoline Inventories Sink To 12-Year Lows – OilPrice.com

Published on: 2025-11-20

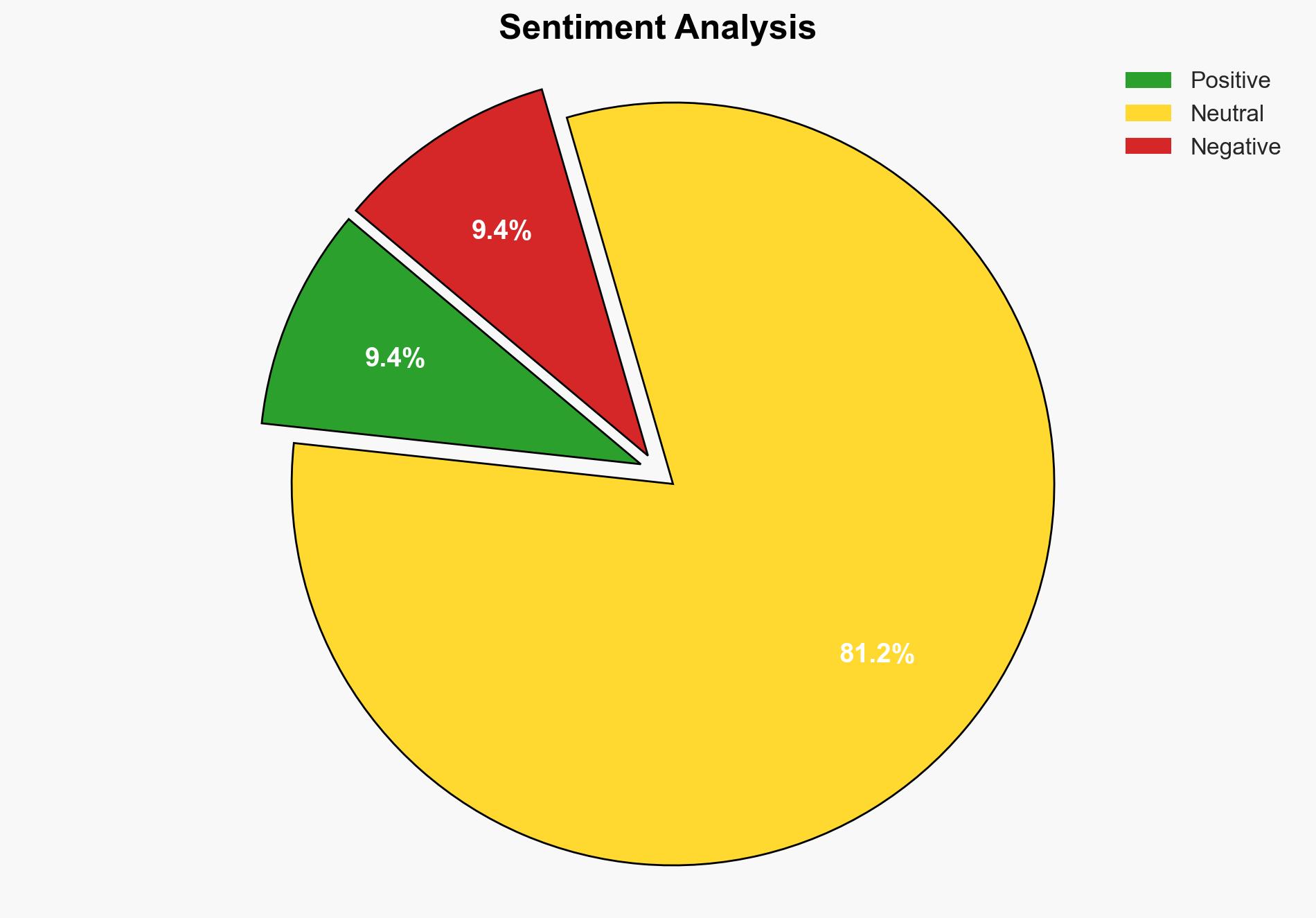

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

Confidence Level: Moderate. The most supported hypothesis is that the decline in US gasoline inventories is primarily driven by increased export demand and reduced refinery capacity, exacerbated by geopolitical tensions affecting global oil supply chains. Recommended action includes enhancing domestic refinery capacity and diversifying energy import sources to mitigate supply vulnerabilities.

2. Competing Hypotheses

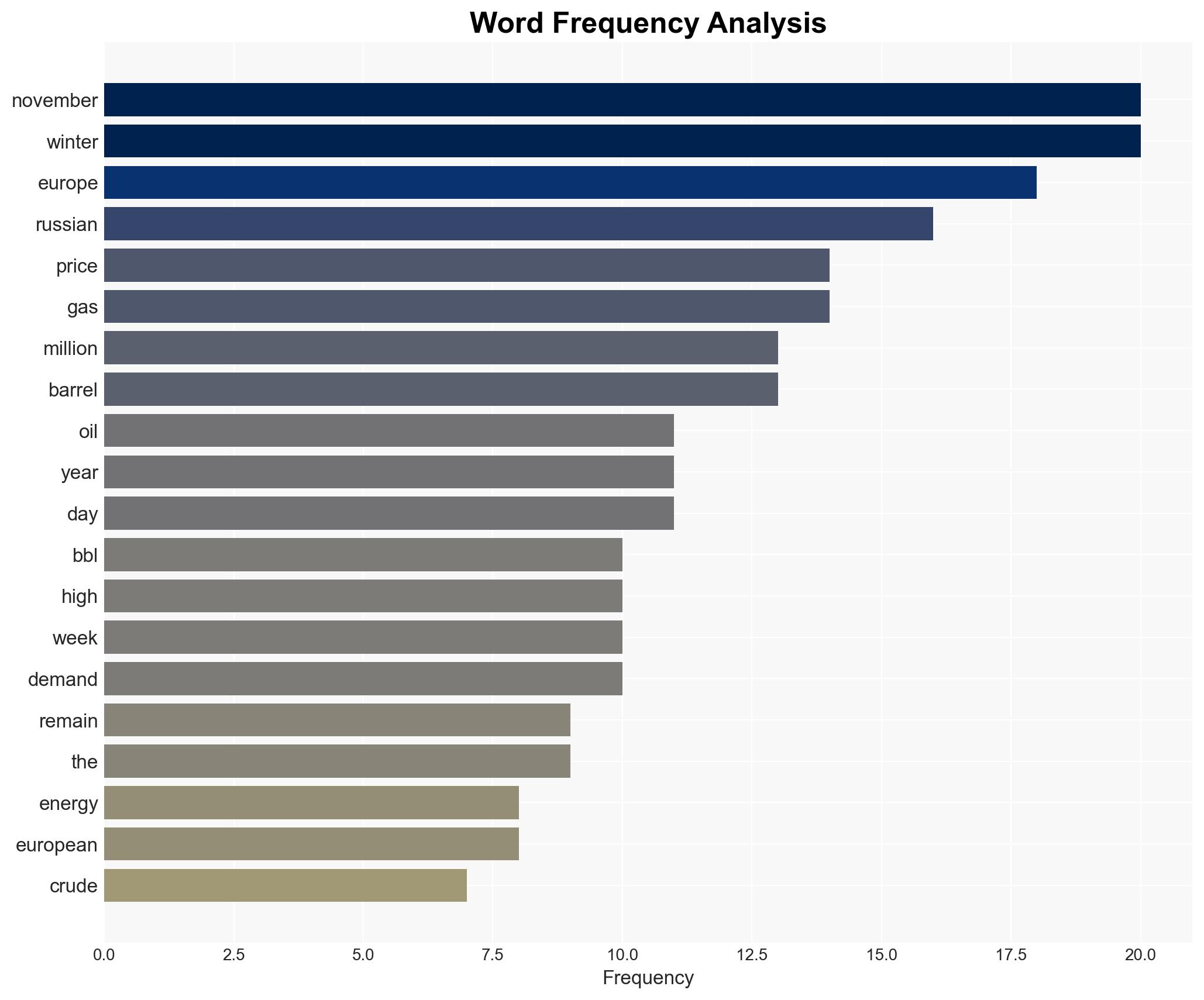

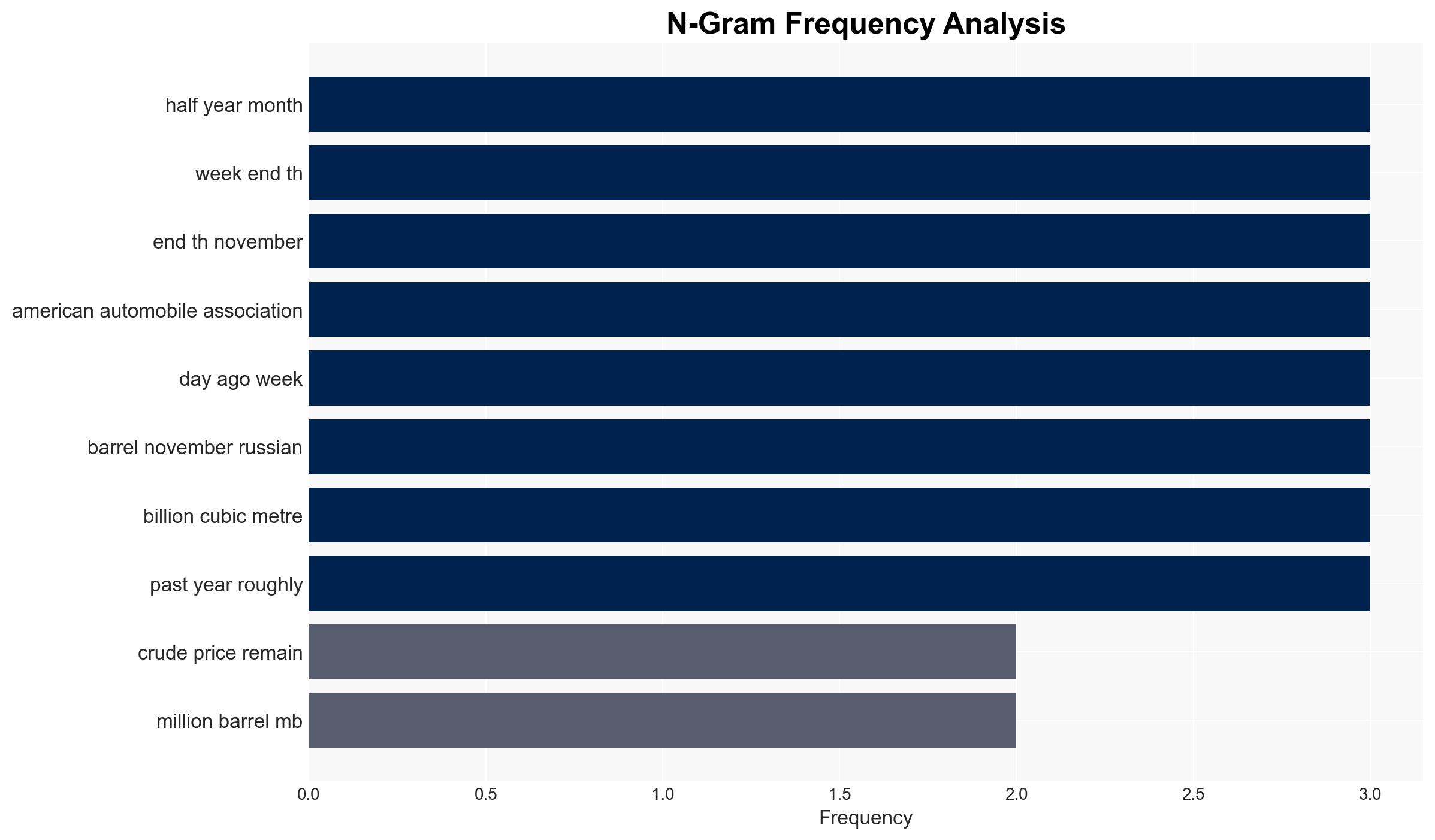

Hypothesis 1: The decline in US gasoline inventories is primarily due to increased export demand, particularly from Europe, and reduced domestic refinery capacity. This is supported by strong export demand and limited stockpile capacity ahead of winter.

Hypothesis 2: The decline is driven by strategic geopolitical maneuvers, including disruptions in Russian oil exports due to Ukrainian attacks, which have indirectly affected global supply chains and US inventories.

Hypothesis 1 is more likely due to consistent evidence of export demand and refinery capacity issues, whereas Hypothesis 2, while plausible, lacks direct evidence linking it to US inventory levels.

3. Key Assumptions and Red Flags

Assumptions include the reliability of reported inventory levels and the stability of export demand. A red flag is the potential for data manipulation or misreporting by involved entities. Deception indicators include the possibility of overstated export demand to justify price increases.

4. Implications and Strategic Risks

Economic risks include sustained high consumer fuel costs and potential inflationary pressures. Geopolitical risks involve further disruptions in global oil supply chains due to escalating tensions in Eastern Europe. Cyber risks could emerge from attacks on critical energy infrastructure, while informational risks involve misinformation affecting market perceptions.

5. Recommendations and Outlook

- Enhance domestic refinery capacity to reduce reliance on imports and stabilize inventories.

- Diversify energy import sources to mitigate geopolitical risks.

- Best-case scenario: Stabilization of inventories and prices through increased domestic production and diversified imports.

- Worst-case scenario: Further inventory declines and price spikes due to geopolitical escalations.

- Most-likely scenario: Continued moderate price increases with gradual inventory stabilization as export demand normalizes.

6. Key Individuals and Entities

No specific individuals are mentioned. Entities of interest include the US Energy Information Administration (EIA), American Automobile Association, and major oil exporters such as Russia.

7. Thematic Tags

Regional Focus, Regional Focus: United States, Europe, Russia

Structured Analytic Techniques Applied

- Causal Layered Analysis (CLA): Analyze events across surface happenings, systems, worldviews, and myths.

- Cross-Impact Simulation: Model ripple effects across neighboring states, conflicts, or economic dependencies.

- Scenario Generation: Explore divergent futures under varying assumptions to identify plausible paths.

Explore more:

Regional Focus Briefs ·

Daily Summary ·

Support us