WLFIs community governed image strained as Trump-backed project freezes wallets – Cointelegraph

Published on: 2025-11-20

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

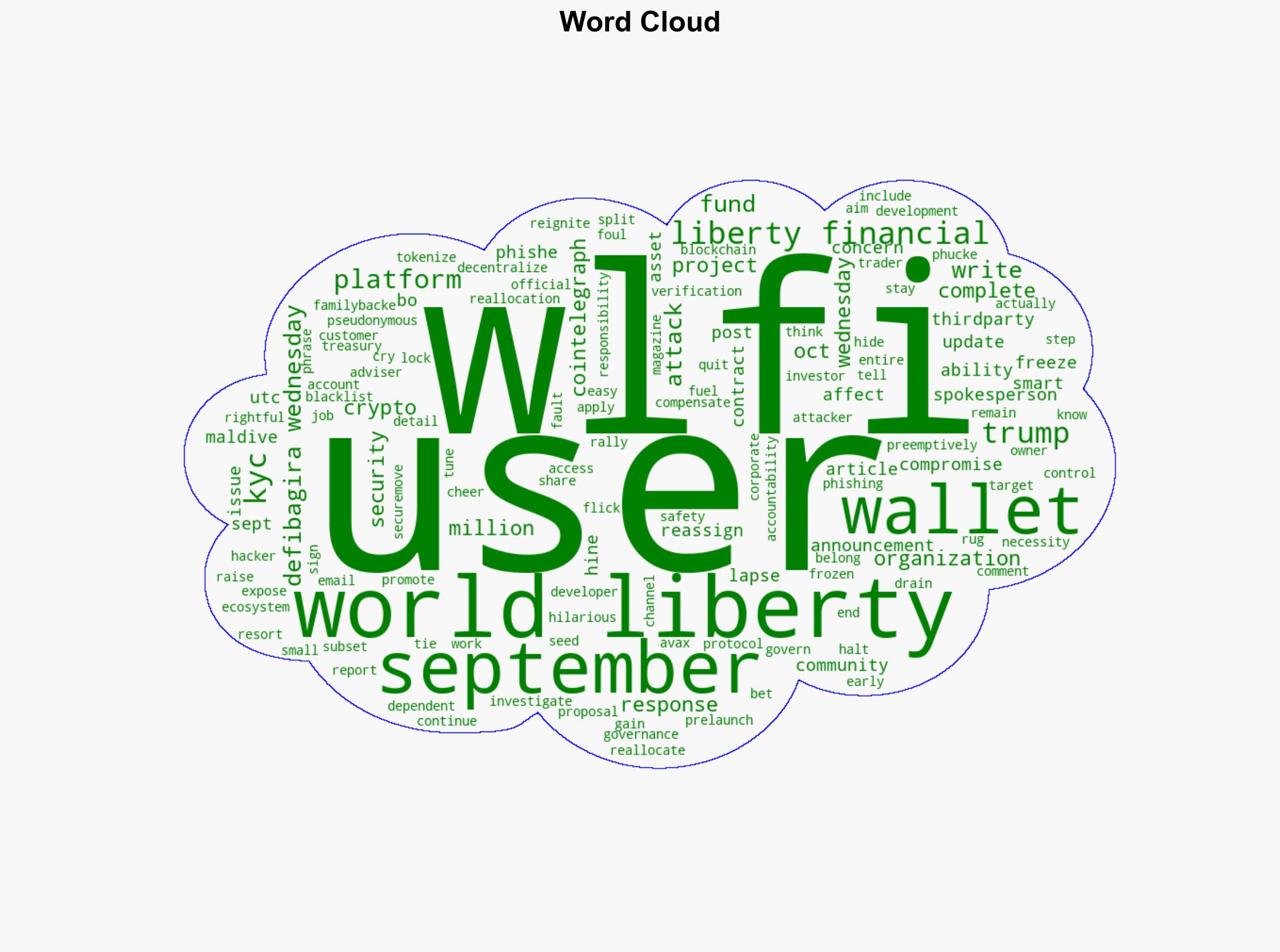

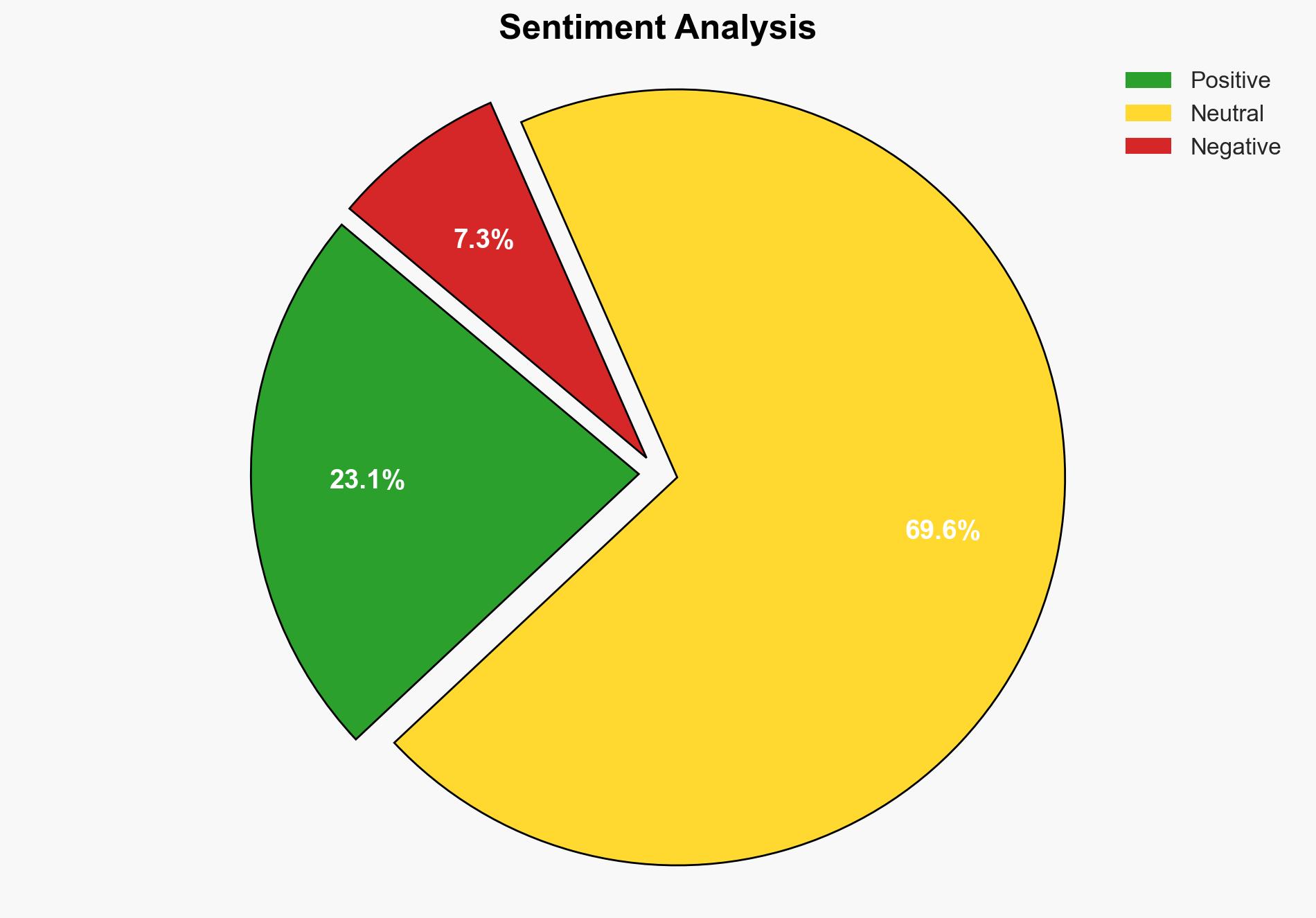

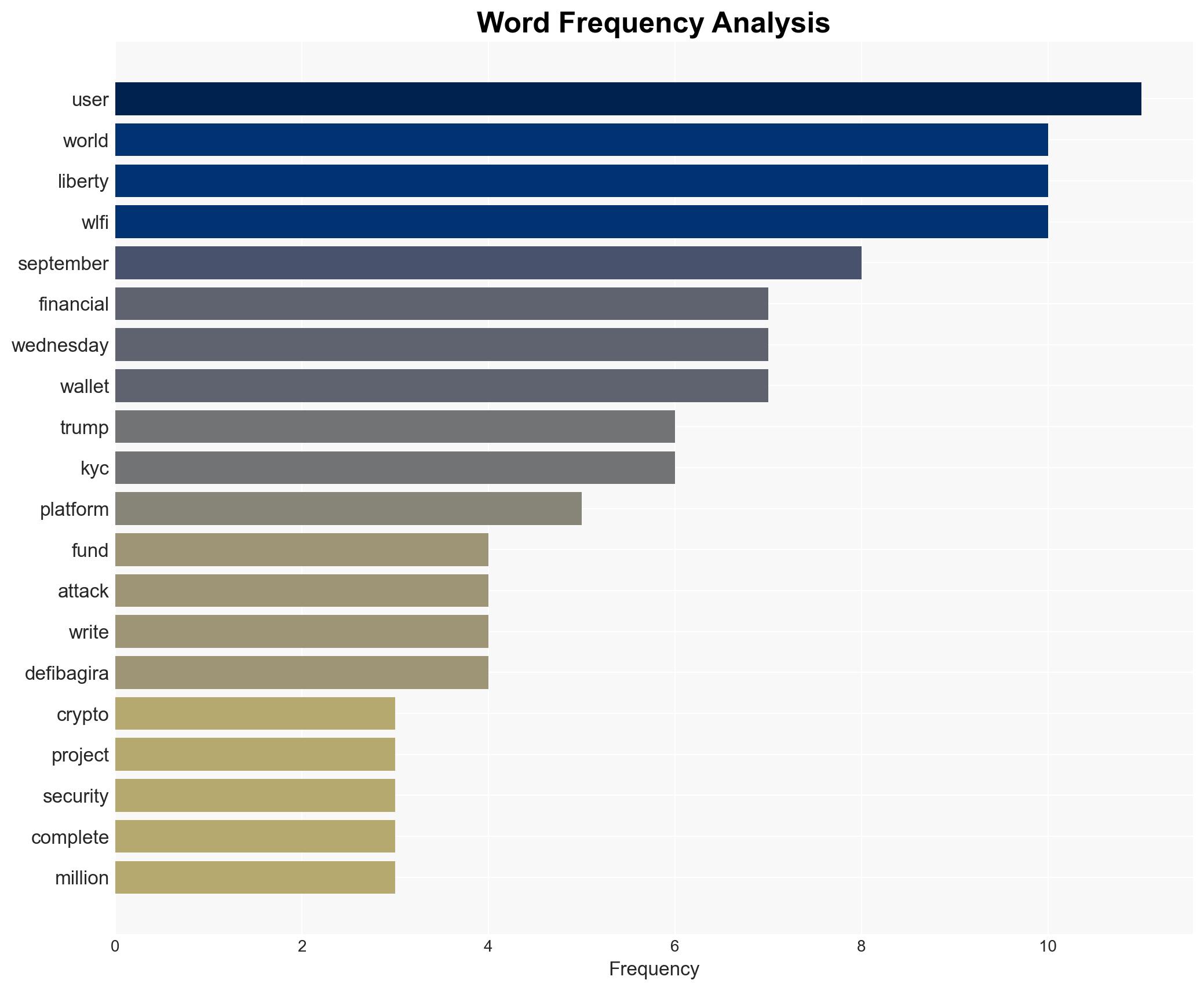

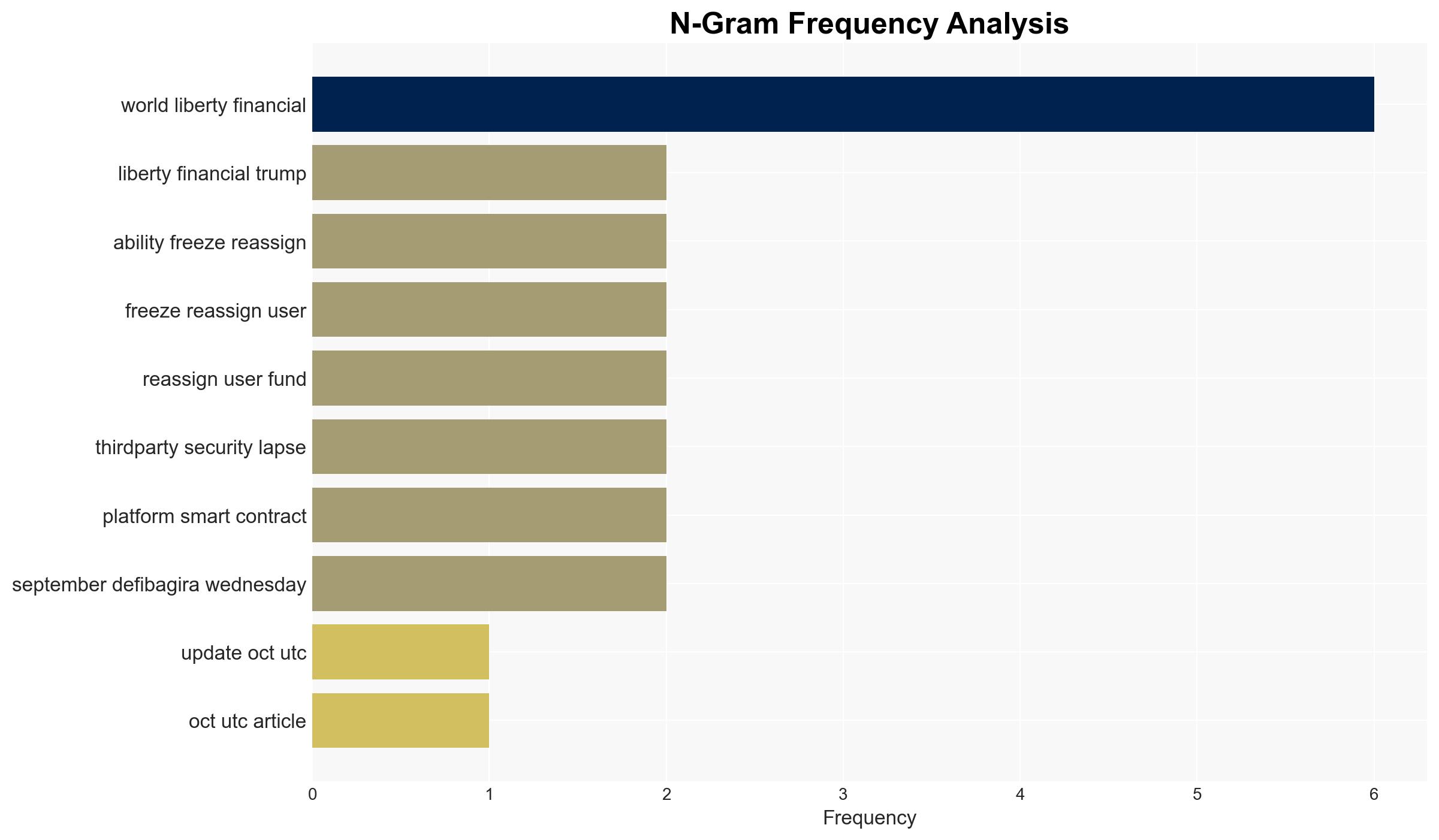

The strategic judgment is that the World Liberty Financial Initiative (WLFI) is currently facing significant credibility and operational challenges due to its recent wallet freeze incident. The most supported hypothesis is that the platform’s security vulnerabilities and governance issues are the primary factors behind the crisis, rather than external malicious intent. Confidence level: Moderate. Recommended action includes enhancing security protocols, improving transparency in governance, and engaging in proactive communication with stakeholders.

2. Competing Hypotheses

Hypothesis 1: The WLFI wallet freeze incident is primarily due to internal security lapses and governance failures, rather than external attacks. This is supported by the evidence of a third-party security lapse and issues with the platform’s smart contract.

Hypothesis 2: The incident is a result of a coordinated external attack aimed at exploiting known vulnerabilities in the WLFI platform. This is less supported due to the lack of concrete evidence pointing to a sophisticated external threat actor.

The first hypothesis is more likely due to the detailed account of internal security issues and the platform’s own admission of these vulnerabilities.

3. Key Assumptions and Red Flags

Assumptions include the belief that WLFI’s governance model is genuinely decentralized and that the platform’s security measures were robust prior to the incident. Red flags include the potential bias in WLFI’s communications, which may downplay internal failures, and the lack of transparency in the investigation process. Deception indicators could involve misdirection about the true nature of the vulnerabilities to protect the platform’s reputation.

4. Implications and Strategic Risks

The incident poses several strategic risks, including loss of investor confidence, potential regulatory scrutiny, and reputational damage to associated entities like the Trump Organization. Cascading threats include increased cyber threats targeting similar platforms, potential economic losses for investors, and informational risks if misinformation spreads about the incident’s nature and impact.

5. Recommendations and Outlook

- Enhance security protocols by conducting a comprehensive audit of the platform’s smart contracts and third-party integrations.

- Improve transparency and communication with stakeholders by providing regular updates on the investigation and remediation efforts.

- Engage with cybersecurity experts to develop a robust incident response plan.

- Best-case scenario: WLFI successfully addresses security issues, regains stakeholder trust, and strengthens its governance model.

- Worst-case scenario: Continued security breaches lead to significant financial losses and regulatory intervention.

- Most-likely scenario: WLFI stabilizes its operations but faces ongoing challenges in restoring full investor confidence.

6. Key Individuals and Entities

Donald Trump (associated with the Trump Organization’s involvement), WLFI spokespersons, and pseudonymous blockchain developer “Flick” are key individuals. The Trump Organization and WLFI are critical entities in this context.

7. Thematic Tags

Cybersecurity, Decentralized Finance, Governance, Cryptocurrency, Risk Management

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us