The Brief Big Tech flips Brussels effect – EURACTIV

Published on: 2025-11-20

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report:

1. BLUF (Bottom Line Up Front)

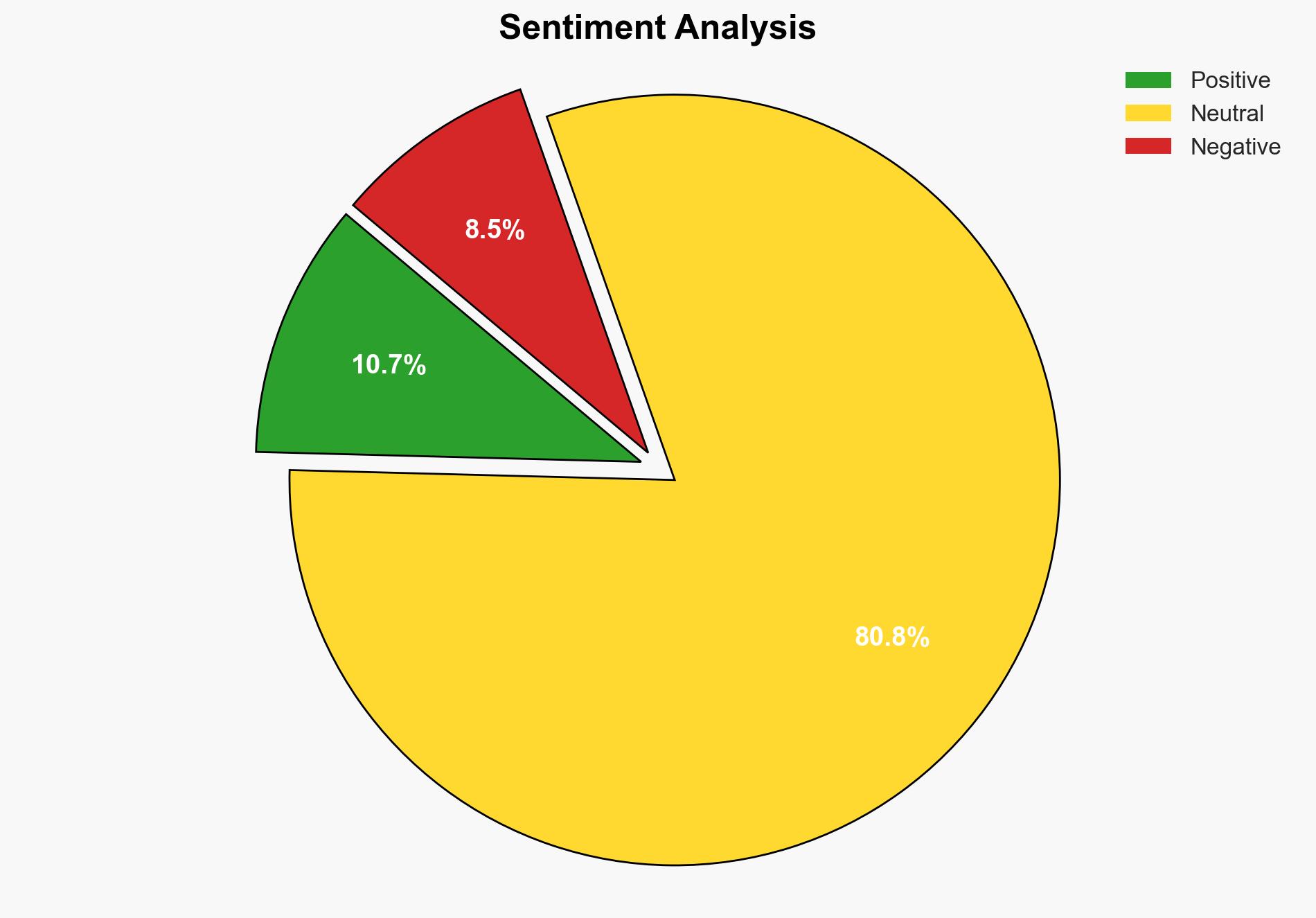

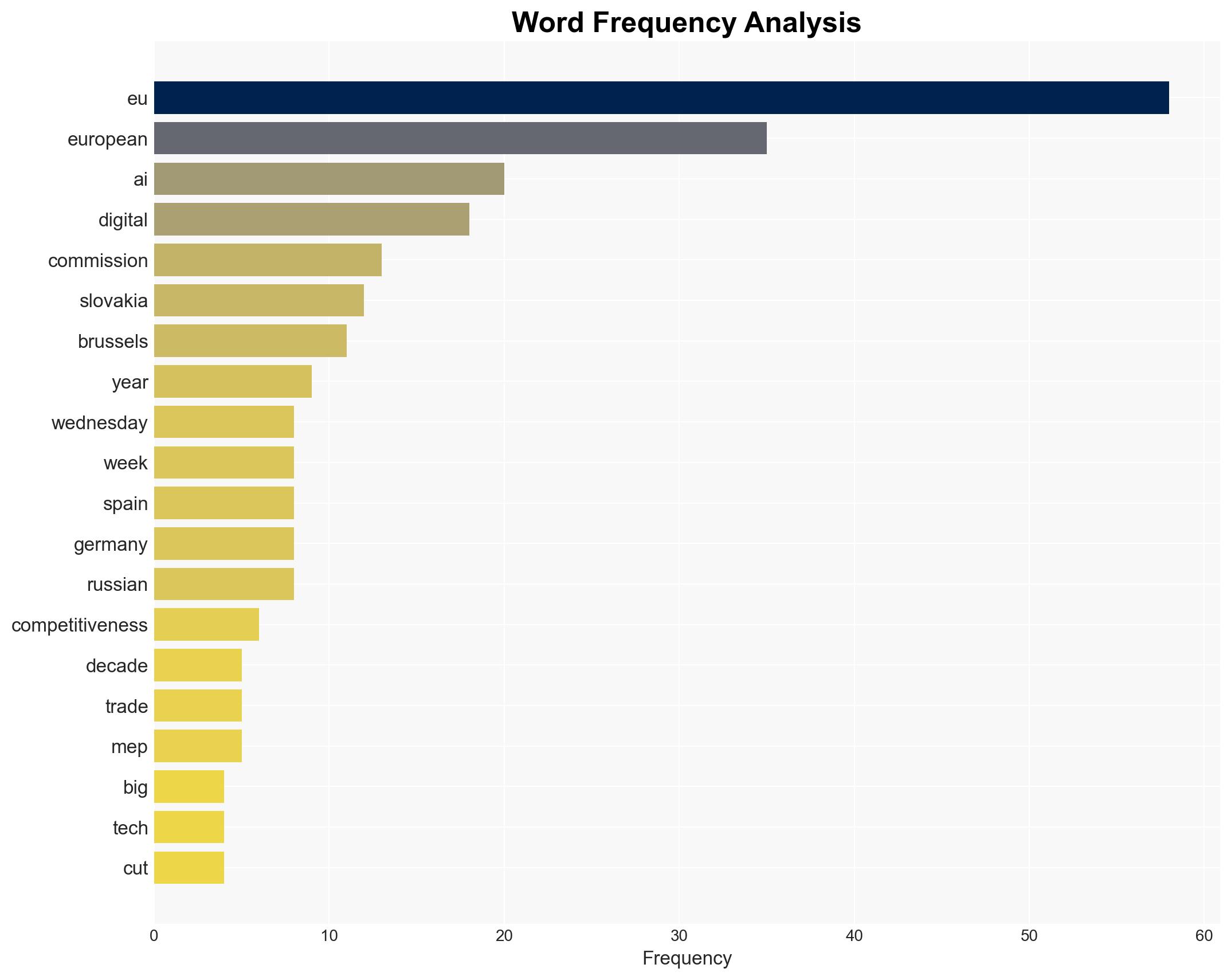

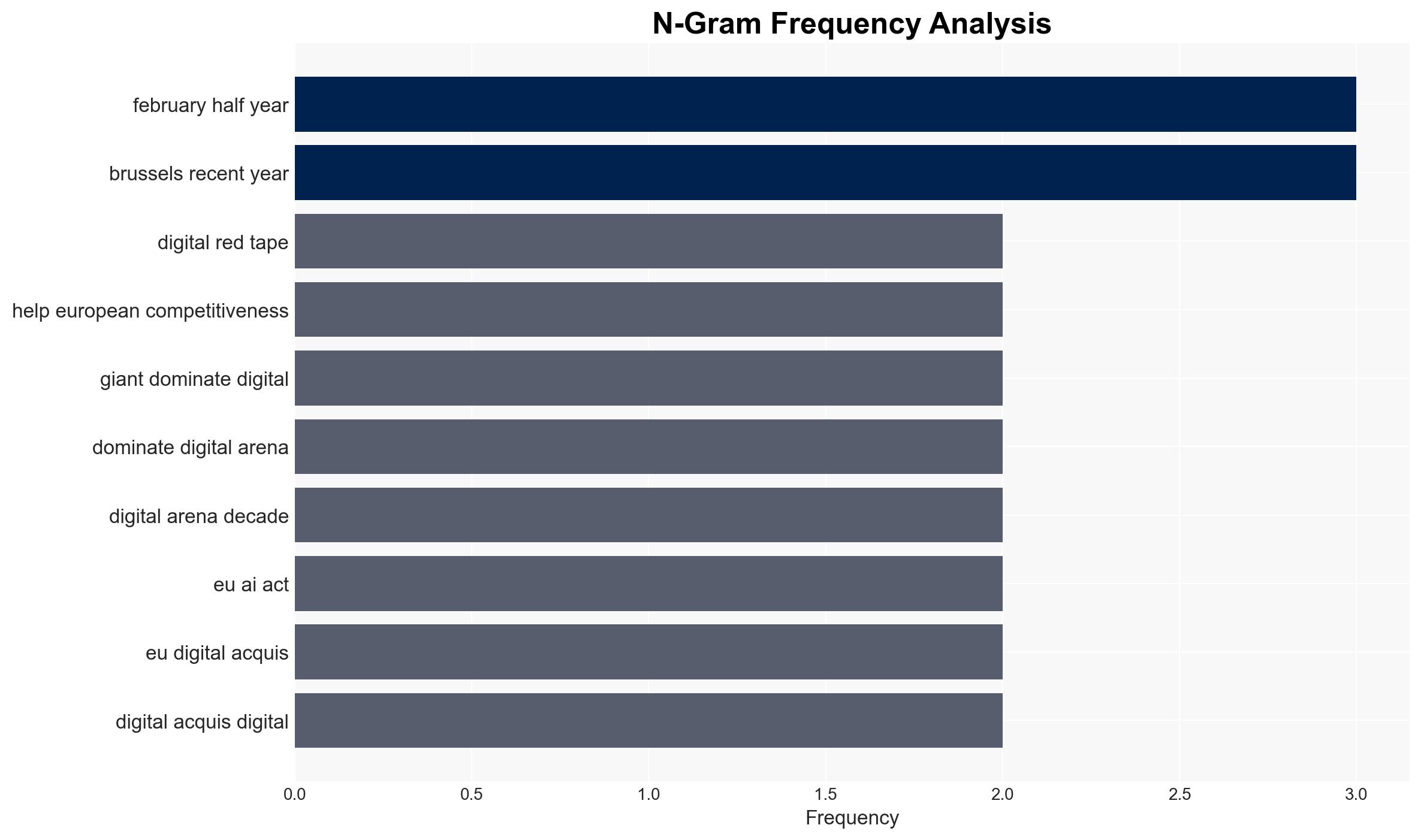

The European Union’s recent deregulatory measures aimed at reducing digital red tape may inadvertently strengthen Big Tech’s dominance rather than fostering European competitiveness. The most supported hypothesis is that these regulatory changes will not significantly enhance European innovation but rather benefit established tech giants. Confidence Level: Moderate. Recommended action includes a careful reassessment of the deregulatory impacts and strategic engagement with tech firms to ensure a fair competitive environment.

2. Competing Hypotheses

Hypothesis 1: The EU’s deregulatory measures will enhance European competitiveness by reducing barriers for homegrown innovation and allowing smaller firms to scale more effectively.

Hypothesis 2: The deregulatory measures will primarily benefit Big Tech companies, as they have the resources to quickly adapt and exploit the new regulatory environment, potentially stifling smaller competitors.

The second hypothesis is more likely given the historical context of Big Tech’s lobbying power and ability to navigate regulatory landscapes to their advantage. Additionally, the complexity and scale of AI and data-driven innovations favor established players with significant resources.

3. Key Assumptions and Red Flags

Assumptions include the belief that deregulation will automatically lead to increased competitiveness and innovation. A red flag is the significant lobbying by Big Tech, which may indicate attempts to shape regulations in their favor. The potential for regulatory capture is a concern, as is the assumption that smaller firms can compete on equal footing without additional support mechanisms.

4. Implications and Strategic Risks

The primary risk is the entrenchment of Big Tech’s dominance, which could lead to reduced competition and innovation within the EU. Politically, this may result in increased scrutiny and backlash against the EU’s regulatory approach. Economically, smaller firms may struggle to compete, leading to reduced diversity in the digital market. Informationally, there is a risk of public perception issues if deregulation is seen as prioritizing corporate interests over consumer rights.

5. Recommendations and Outlook

- Conduct a comprehensive impact assessment of the deregulatory measures on both large and small firms.

- Engage with stakeholders, including smaller tech firms, to ensure their needs and challenges are addressed.

- Monitor Big Tech’s adaptation to the new regulations to identify potential anti-competitive behaviors.

- Best-case scenario: A balanced regulatory environment that fosters innovation and competition.

- Worst-case scenario: Increased dominance of Big Tech, stifling smaller competitors and reducing market diversity.

- Most-likely scenario: Incremental benefits to smaller firms overshadowed by the advantages gained by Big Tech.

6. Key Individuals and Entities

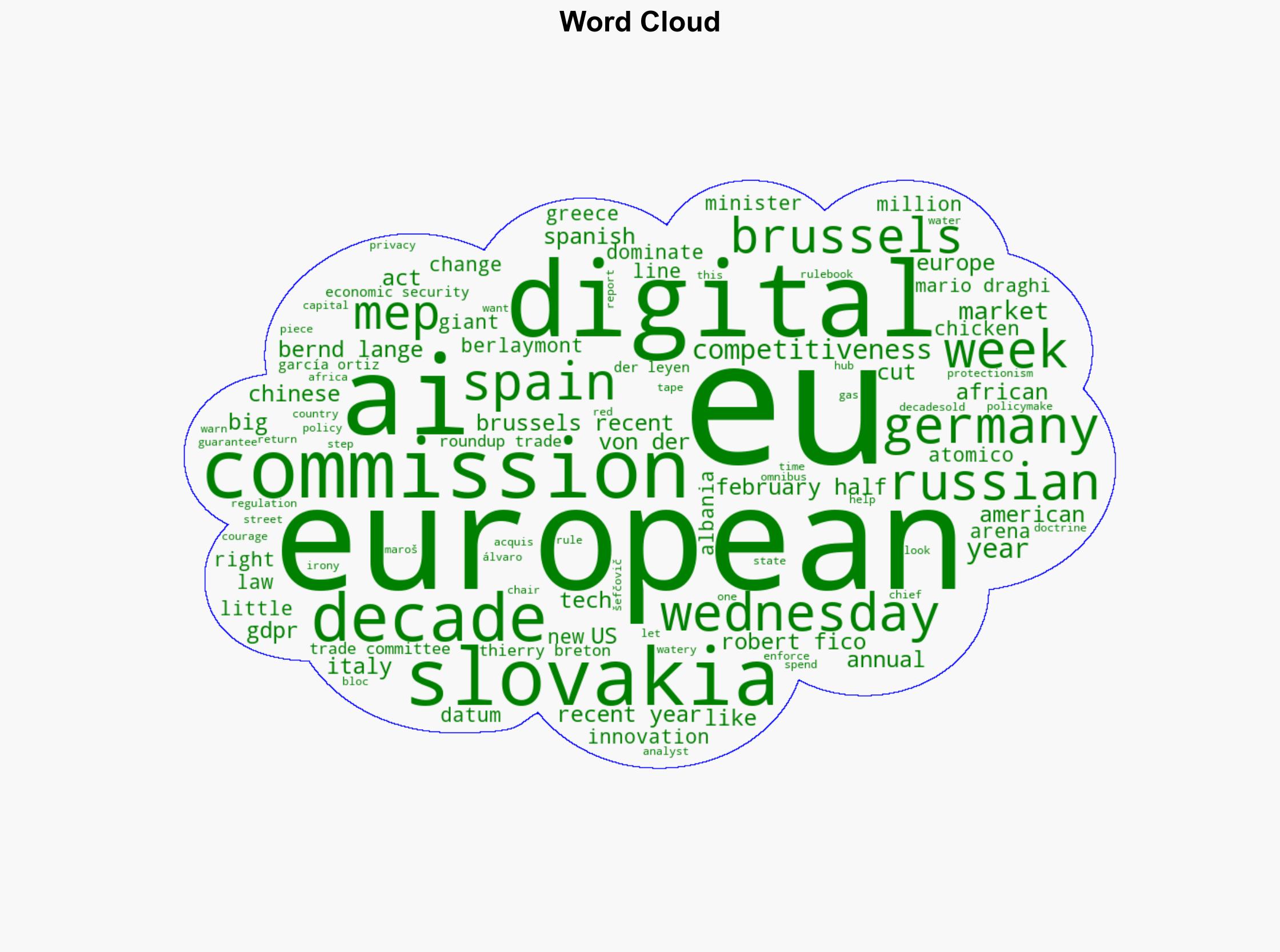

Thierry Breton (EU Digital Chief), Mario Draghi (referenced in context), Bernd Lange (EP Trade Committee Chair), Maroš Šefčovič (Trade Chief).

7. Thematic Tags

Cybersecurity, Digital Regulation, European Union, Big Tech, Innovation, Competitiveness

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us