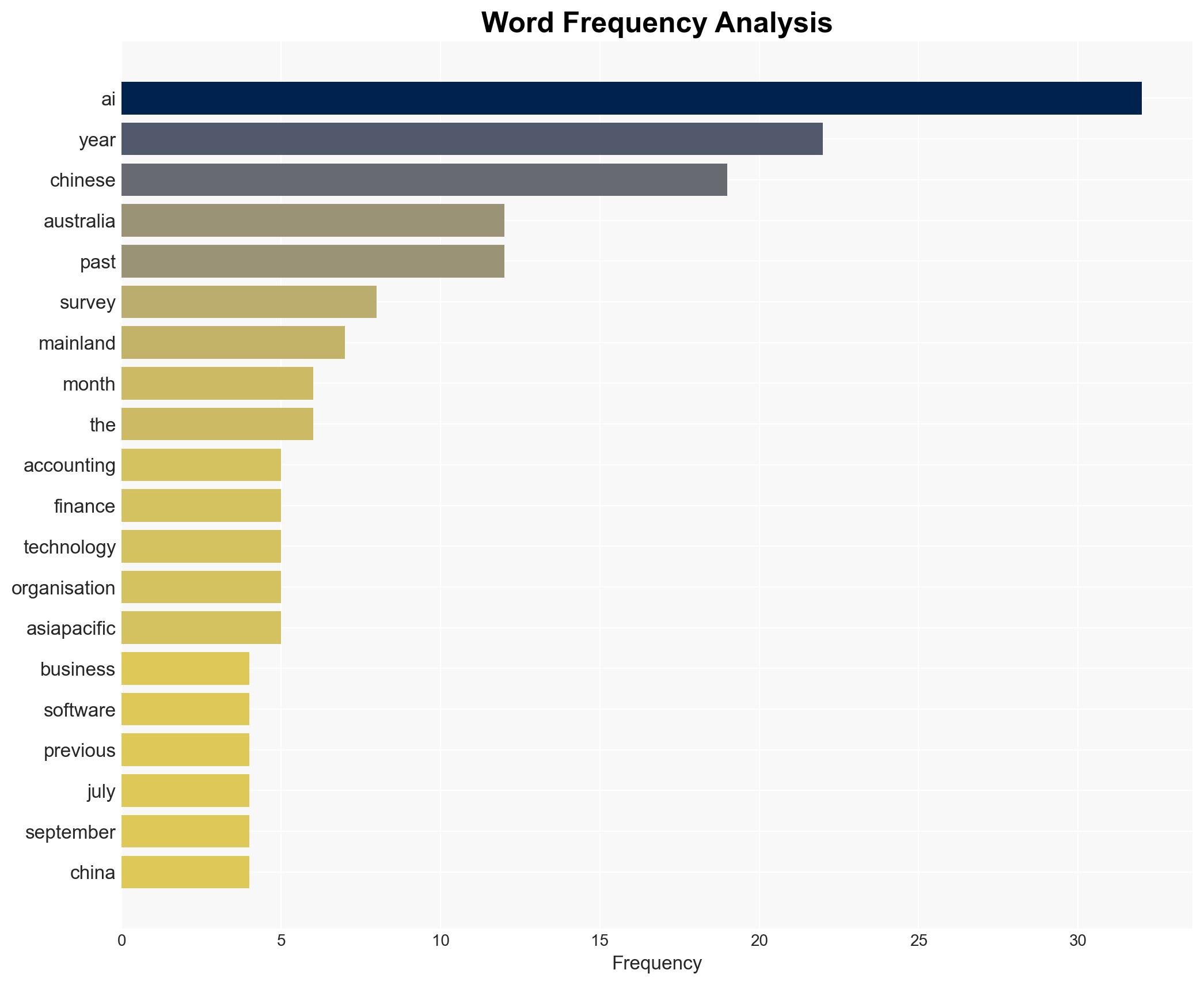

AI drives accounting transformation in China CPA Australia survey

Published on: 2025-11-21

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: AI Drives Accounting Transformation in China

1. BLUF (Bottom Line Up Front)

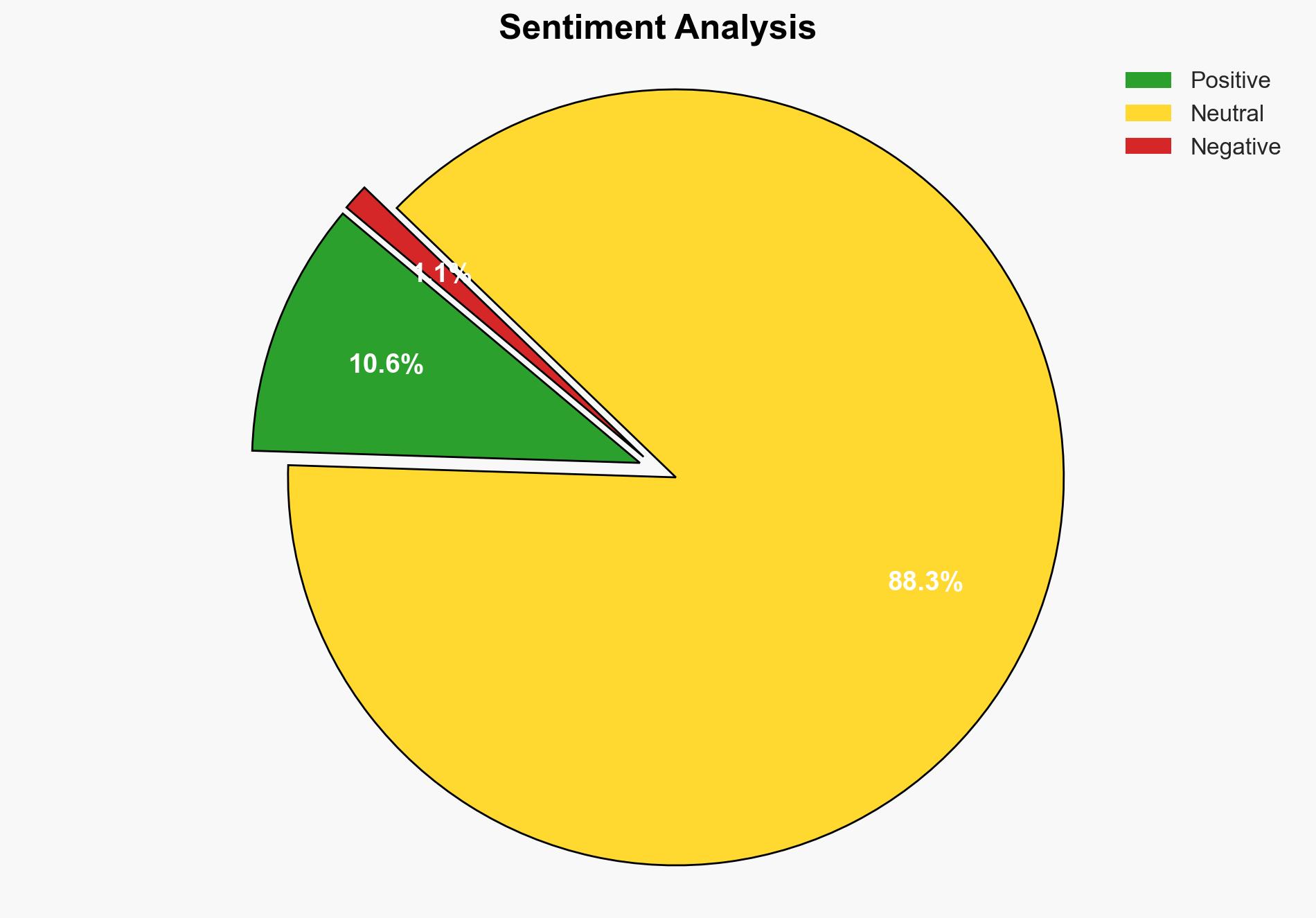

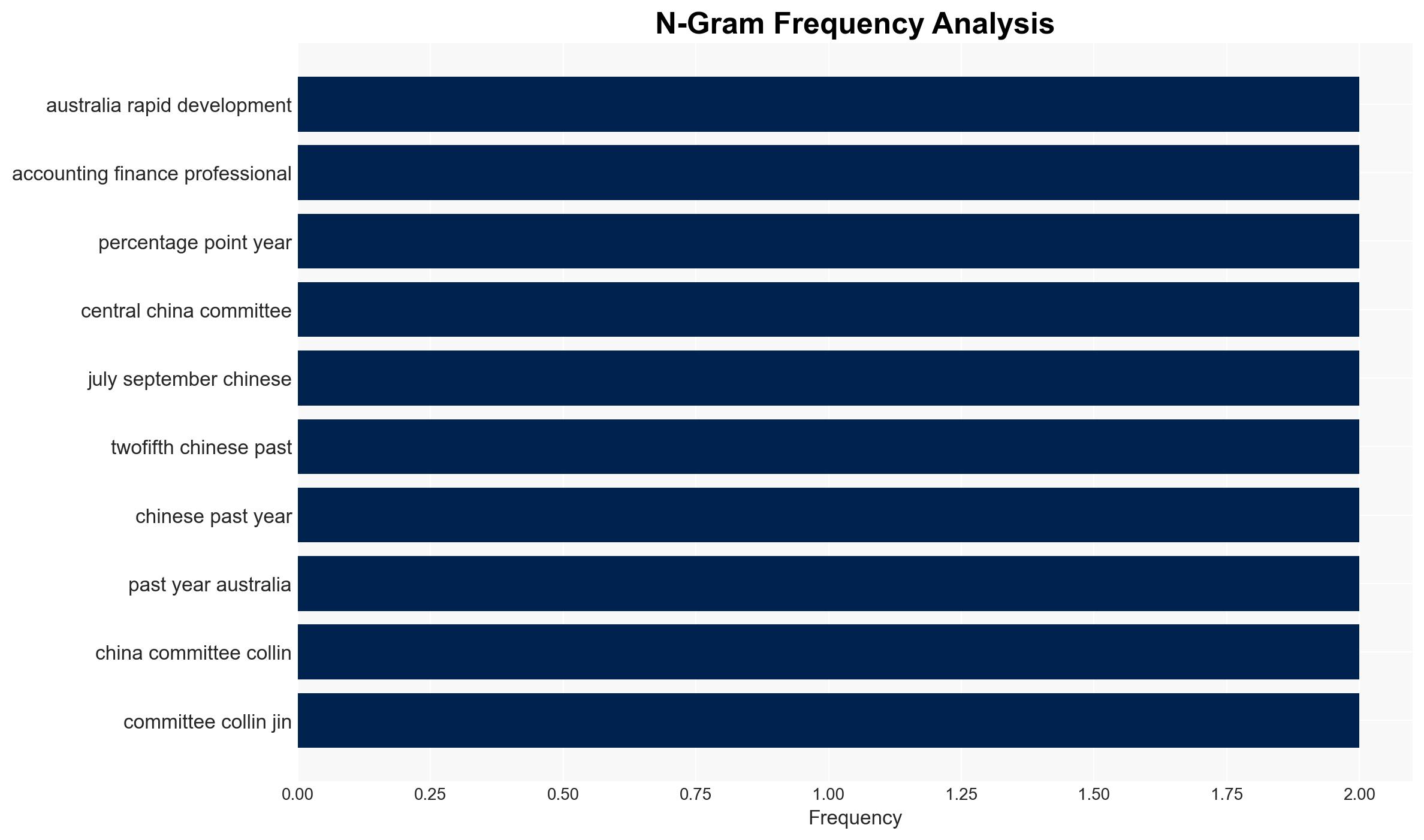

The rapid adoption of AI in China’s accounting and finance sector is transforming talent demands and operational efficiencies. The most supported hypothesis is that AI integration will continue to grow, enhancing productivity and innovation, but challenges such as low ROI and resource constraints for SMEs remain. Confidence Level: Moderate. Recommended action includes fostering AI literacy and addressing cybersecurity vulnerabilities to maximize AI benefits.

2. Competing Hypotheses

Hypothesis 1: AI adoption in China’s accounting sector will lead to significant efficiency gains and innovation, driving economic growth and competitive advantage.

Hypothesis 2: Despite AI’s potential, the sector will face significant challenges such as low ROI, resource constraints, and cybersecurity threats, limiting the transformative impact.

Hypothesis 1 is more likely given the high adoption rates and positive feedback from industry professionals. However, the concerns about ROI and resource constraints, particularly for SMEs, lend some credence to Hypothesis 2.

3. Key Assumptions and Red Flags

Assumptions: AI tools will continue to improve in functionality and accessibility. The Chinese government will support AI integration in business sectors.

Red Flags: Over-reliance on AI without adequate human oversight could lead to errors. The rapid pace of AI adoption may outstrip the ability of firms to manage cybersecurity risks effectively.

4. Implications and Strategic Risks

The integration of AI could lead to economic growth and increased competitiveness for Chinese firms. However, there are risks of increased cyber vulnerabilities and potential job displacement in routine accounting roles. Politically, this could lead to tensions if AI adoption exacerbates economic disparities or if foreign entities perceive Chinese AI advancements as a competitive threat.

5. Recommendations and Outlook

- Actionable Steps: Enhance AI literacy among accounting professionals, invest in cybersecurity measures, and develop policies to support SMEs in AI adoption.

- Best Scenario: AI leads to significant productivity gains and innovation, positioning China as a leader in AI-driven business solutions.

- Worst Scenario: Cybersecurity breaches and low ROI hinder AI adoption, leading to economic stagnation and job losses.

- Most-likely Scenario: Gradual improvement in AI integration with ongoing challenges in cybersecurity and ROI management.

6. Key Individuals and Entities

Collin Jin, President of CPA Australia’s East and Central China Committee, is a key figure in promoting AI adoption in the accounting sector.

7. Thematic Tags

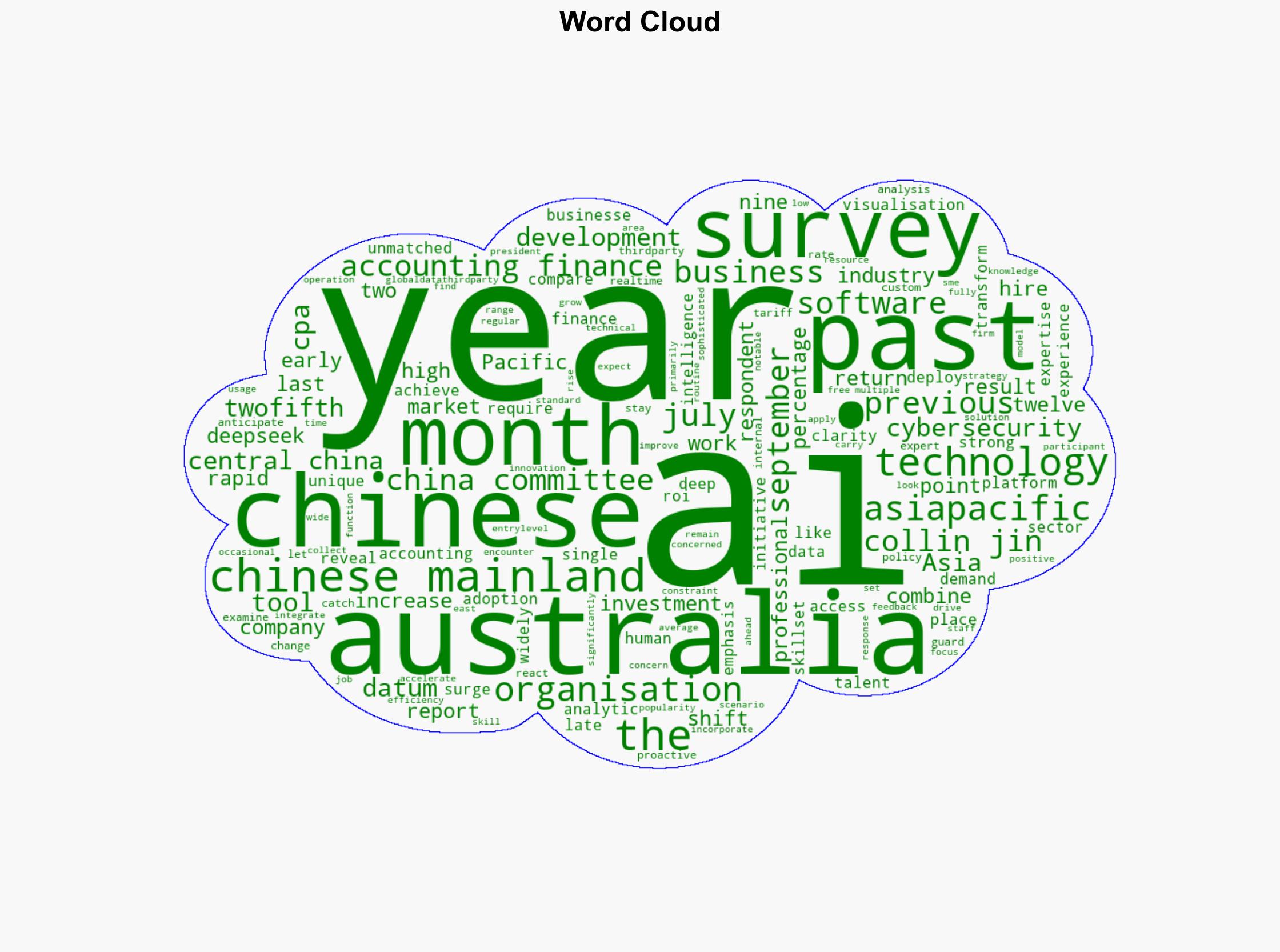

Cybersecurity, AI Adoption, Economic Growth, Talent Transformation, SME Challenges

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Forecast futures under uncertainty via probabilistic logic.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us