Where Does Ethereum Whale Accumulation Stand As Price Dips Below 3000

Published on: 2025-11-21

AI-powered OSINT brief from verified open sources. Automated NLP signal extraction with human verification. See our Methodology and Why WorldWideWatchers.

Intelligence Report: Ethereum Whale Accumulation and Market Dynamics

1. BLUF (Bottom Line Up Front)

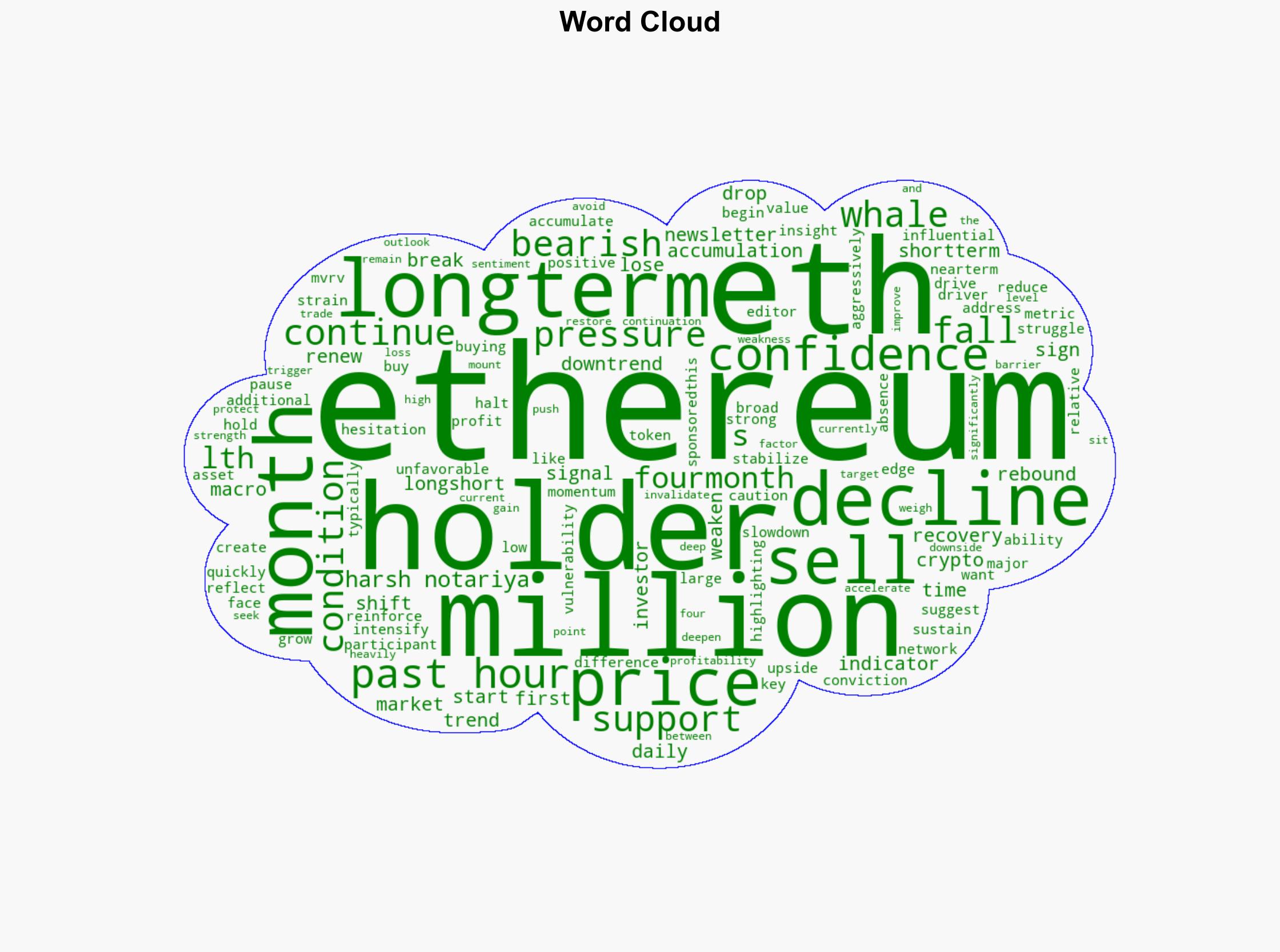

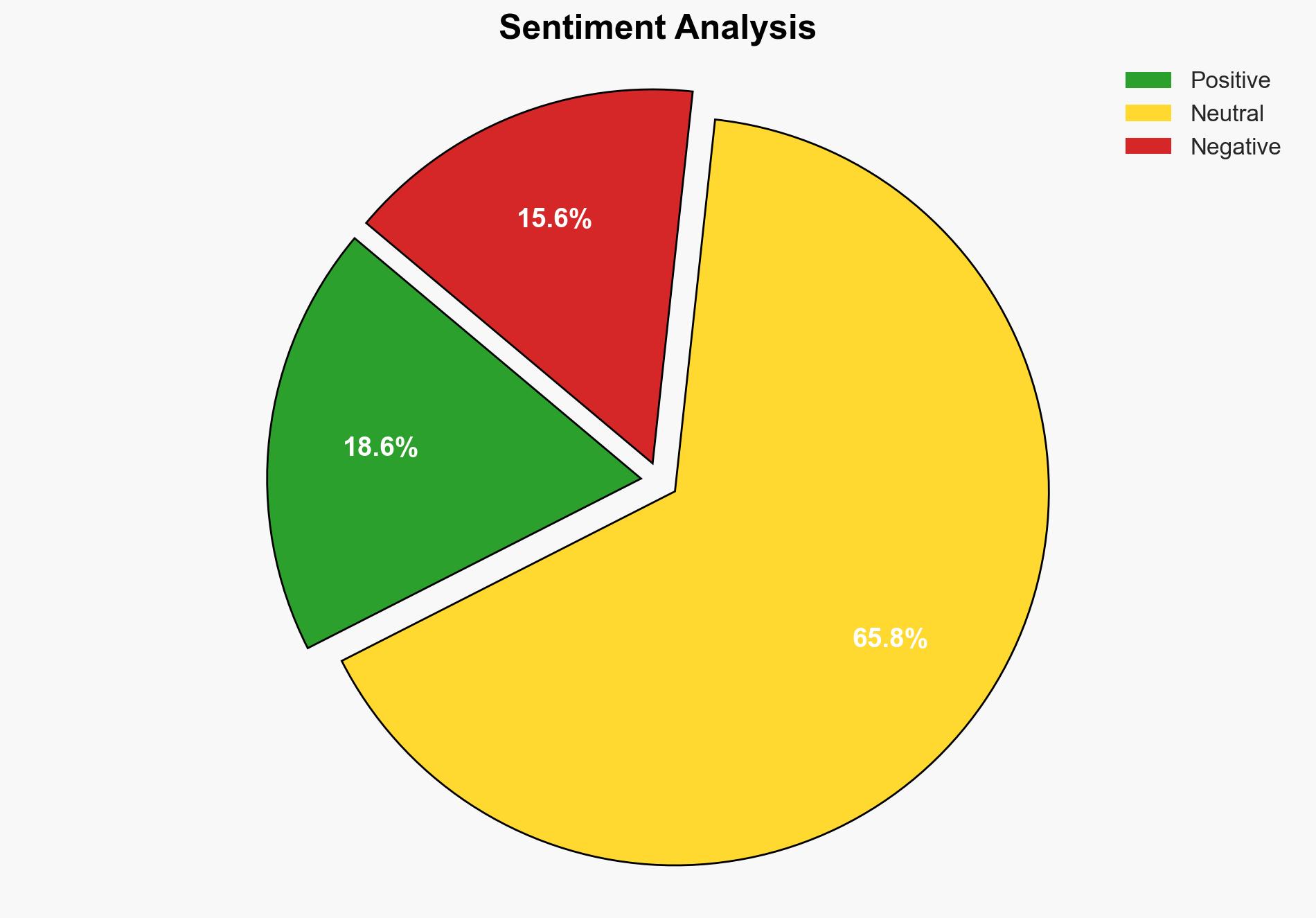

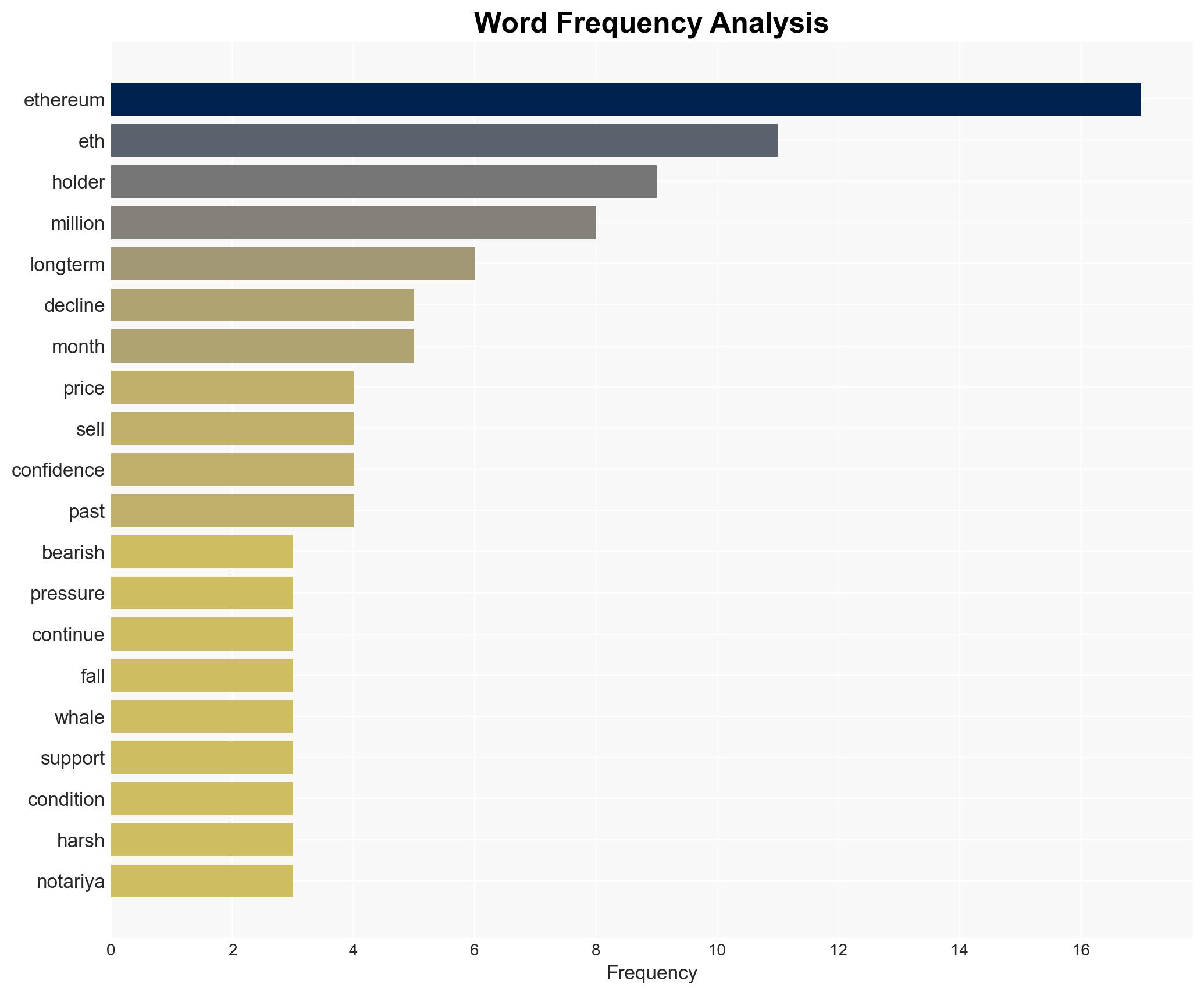

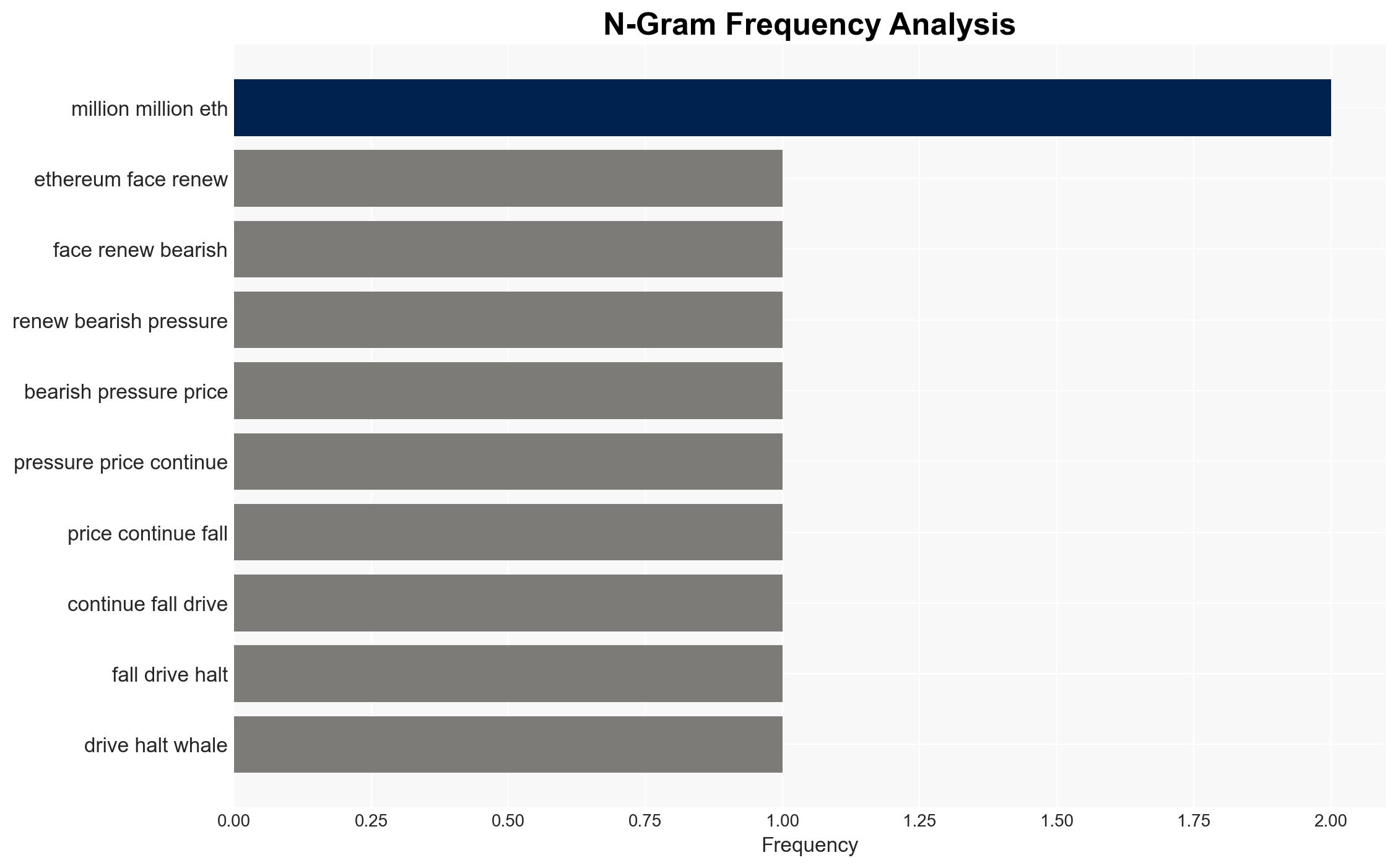

The most supported hypothesis is that Ethereum’s current price decline and reduced whale accumulation are primarily driven by bearish macroeconomic conditions and declining investor confidence. This situation is likely to persist in the short term, with a moderate confidence level. Strategic recommendations include monitoring macroeconomic indicators and whale activity for signs of recovery or further decline.

2. Competing Hypotheses

Hypothesis 1: The decline in Ethereum’s price and whale accumulation is primarily due to unfavorable macroeconomic conditions and declining investor confidence, leading to a temporary market correction.

Hypothesis 2: The decline is a result of strategic manipulation by large holders to drive prices lower for future accumulation at a discount.

Hypothesis 1 is more likely due to the broader market conditions and the absence of clear indicators of coordinated manipulation. The macroeconomic environment, including inflation concerns and regulatory uncertainties, supports this hypothesis.

3. Key Assumptions and Red Flags

Assumptions: It is assumed that macroeconomic conditions are the primary driver of current market trends. Additionally, it is assumed that whale behavior is a significant indicator of market sentiment.

Red Flags: Potential bias in interpreting whale activity as purely market-driven without considering possible strategic manipulation. Lack of direct evidence of manipulation is a gap in analysis.

4. Implications and Strategic Risks

The continuation of bearish trends could lead to increased sell-offs by long-term holders, exacerbating the downtrend. This could impact Ethereum’s market position and investor confidence, potentially leading to broader market instability. Cybersecurity threats and misinformation campaigns could exploit this volatility, further destabilizing the market.

5. Recommendations and Outlook

- Actionable Steps: Monitor macroeconomic indicators and whale activity closely. Develop strategies to mitigate potential sell-offs by long-term holders.

- Best Scenario: Market conditions improve, leading to renewed whale accumulation and price recovery.

- Worst Scenario: Continued decline triggers widespread sell-offs, leading to significant market destabilization.

- Most-likely Scenario: Short-term bearish trends persist, with gradual stabilization as macroeconomic conditions improve.

6. Key Individuals and Entities

Harsh Notariya, editor of a daily crypto newsletter, provides insights into market trends and sentiment.

7. Thematic Tags

Cybersecurity, Macroeconomic Conditions, Cryptocurrency Market Dynamics

Structured Analytic Techniques Applied

- Adversarial Threat Simulation: Model and simulate actions of cyber adversaries to anticipate vulnerabilities and improve resilience.

- Indicators Development: Detect and monitor behavioral or technical anomalies across systems for early threat detection.

- Bayesian Scenario Modeling: Quantify uncertainty and predict cyberattack pathways using probabilistic inference.

- Network Influence Mapping: Map influence relationships to assess actor impact.

Explore more:

Cybersecurity Briefs ·

Daily Summary ·

Support us